Welcome to the June edition of the Graphite Miners News.

June saw very depressed flake graphite and spherical graphite prices. The longer-term picture looks much better for graphite, with demand forecast to surge this decade.

It was a busy month of news with many of the juniors making good progress.

Graphite price news

During the past 30 days, the China graphite flake-194 EXW spot price was down 1.51%. The China graphite flake +195 EXW spot price was down 1.01%. Note that 94-97% is considered best suited for use in batteries; it is then upgraded to 99.9% purity to make “spherical” graphite used in Li-ion batteries. The spherical graphite 99.95% min EXW China price was down 3.18% the past 30 days.

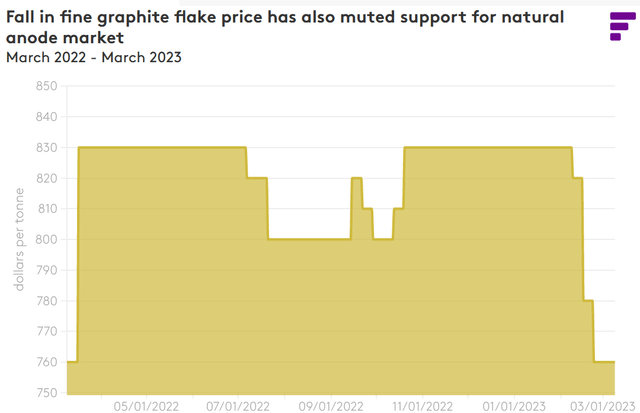

Fastmarkets’ price assessment for graphite flake, 94% C, -100 mesh, fob China, was $750-770/t on March 2, 2023 (down ~6% since March) (source)

Fastmarkets

Note: You can read about the different types of graphite and their uses here.

Graphite demand and supply forecast charts

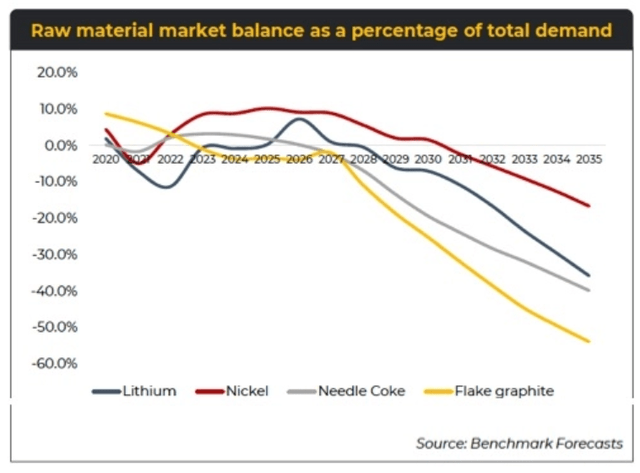

BMI graphite-market-balance benchmarkweek-2022 (source)

BMI

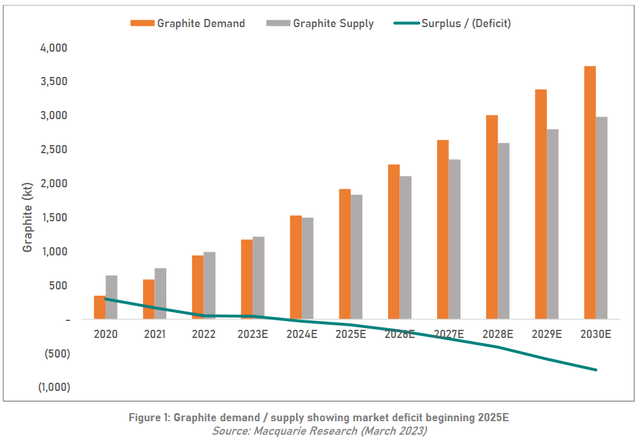

Macquarie Research (March 2023) forecasts flake graphite deficits starting in 2025 and growing larger to 2030 (source)

Sovereign Metals courtesy Macquarie Research

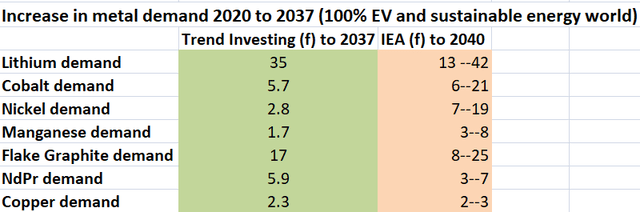

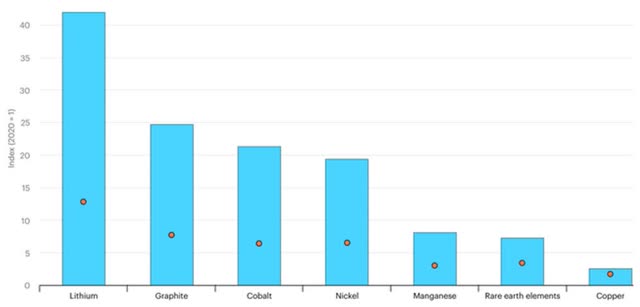

Trend Investing v IEA demand forecast for EV metals (Trend Investing) (IEA)

Trend Investing & the IEA

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 – Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, And Copper 2x to 3x

IEA

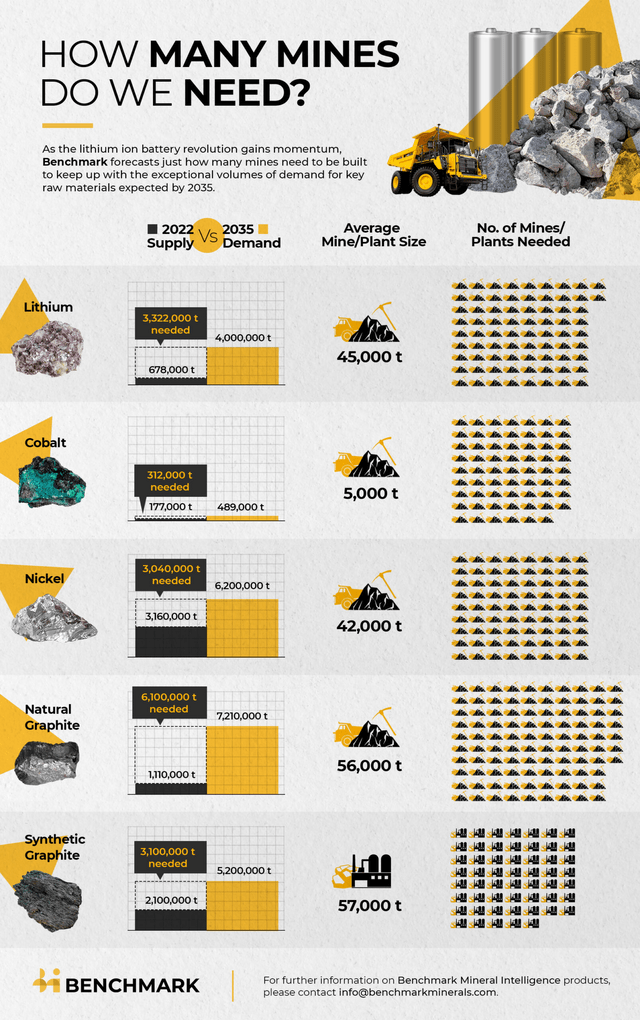

2022 – BMI forecasts we need 330+ new EV metal mines from 2022 to 2035 to meet surging demand – 97 new 56,000tpa natural flake graphite mines

BMI

Graphite market news

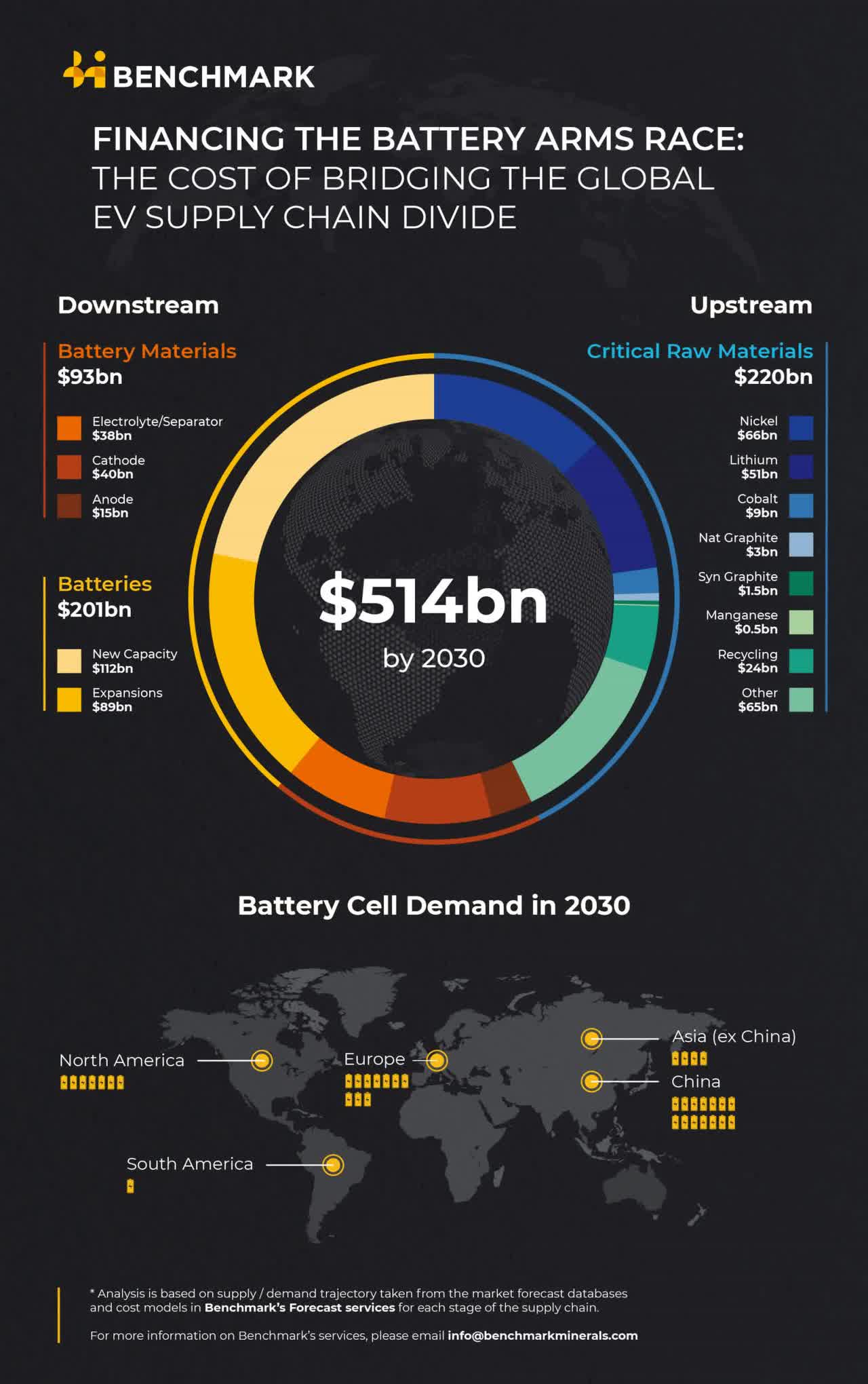

On June 19 Benchmark Mineral Intelligence reported:

Financing the battery arms race: The $514 billion cost of bridging the global EV supply chain divide…..Producing the critical raw materials will require $220 billion (43% of the total), with nickel and lithium accounting for over half of that. Manufacturing the additional 2.7 TWh of batteries needed by 2030 will require $201 billion and the midstream production of battery materials will take the remaining $93 billion…..Natural and synthetic graphite are forecast by Benchmark to have a combined supply gap of 3.6 million tonnes, but the relatively lower capital requirements for graphite mines and synthetic graphite production facilities results in an investment need of $4.3 billion.

Benchmark breakdown of the supply chain estimated costs needed to reach 2030 battery cell demand estimates – Natural graphite will require $3b, synthetic graphite $1.5b.(source)

Benchmark Mineral Intelligence

On June 20, Fastmarkets reported:

Spherical natural graphite prices plunge to 11-year lows on more competition from synthetic graphite. The price for spherical natural graphite in China has fallen to its lowest level in June 2023 since Fastmarkets began tracking it in 2012…….In the most recent calculation on June 8, Fastmarkets assessed the price of graphite, spherical, 99.95% C, 15 microns, fob China, at $2,000-2,200 per tonne, down by more than 42% year on year compared with $3,500-3,800 per tonne on June 9, 2022……The rapid increase in graphitization capacity during the second half of 2022 meant that graphitization costs tumbled……The sharp reduction in graphitization costs prompted a significant rise in the output of synthetic graphite in 2022, up by 62% in the second half of the year versus the first half.

On June 21 Reuters reported:

Analysis-Auto firms race to secure non-Chinese graphite for EVs as shortages loom. Automakers, including Tesla and Mercedes, are rushing to lock in graphite supply from outside dominant producer China, as demand for electric vehicle (EV) batteries outpaces other uses for the mineral for the first time due to soaring EV sales. Auto firms have been slow to plan for graphite shortages, focusing mainly on better-known battery materials lithium and cobalt, even though graphite is the largest battery component by weight…..Now, car makers are knocking at the doors of new producers, such as Madagascar and Mozambique, as this year EVs are forecast to account for more than 50% of the natural graphite market for the first time, according to consultancy Project Blue. Shortages of material produced outside of China will be even more acute as legislation in the United States and Europe aims to cut reliance on China for critical minerals…..Graphite shortages are expected to rise in coming years, with a global supply deficit of 777,000 tonnes expected by 2030, Project Blue projections showed…..About $12 billion of investment is needed by 2030 in graphite and 97 new mines required by 2035 to meet demand, Benchmark Mineral Intelligence [BMI] said in a report. China produces 61% of global natural graphite and 98% of the final processed material to make battery anodes, BMI said.

Graphite miners news

Graphite producers

We have not covered the following graphite producers as they are not typically accessible to most Western investors. They include – Aoyu Graphite Group, BTR New Energy Materials, Qingdao Black Dragon, National de Grafite, Shanshan Technology, and LuiMao Graphite.

Note: AMG Advanced Metallurgical Group NV [AMS:AMG] [GR:ADG] (OTCPK:AMVMF) is also a “diversified producer”, producing graphite, vanadium, and lithium. SGL Carbon (OTCPK:SGLFF) is a synthetic graphite producer and Novonix [ASX:NVX] (OTCQX:NVNXF) is commercializing their synthetic graphite product. Graphex Group Limited [HK:6128] (GRFX) makes spherical graphite.

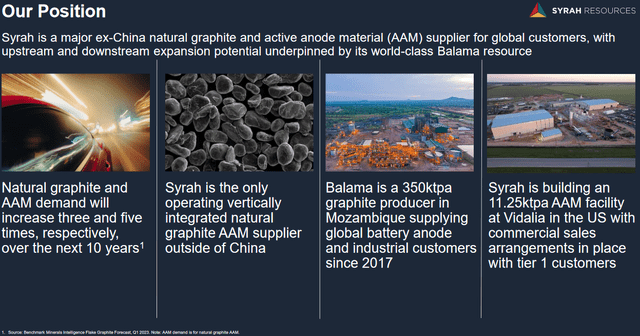

Syrah Resources Limited [ASX:SYR][GR:3S7](SYAAF)(SRHYY)

Syrah Resources Limited owns the Balama graphite mine in Mozambique. Syrah is also working to become a vertically integrated producer of natural graphite Active Anode Material (“AAM”) at their Vidalia facility, Louisiana, USA.

No significant news for the month.

You can view the latest investor presentation here or the recent May 2023 AGM presentation here.

Catalysts:

- September 2023 quarter – First Stage 11.25ktpa AAM Vidalia facility targeted to start production.

Natural graphite and AAM demand will increase three and five times, respectively, over the next 10 years (source)

Syrah Resources presentation courtesy BMI Q1, 2023

Ceylon Graphite [TSXV:CYL] [GR:CCY] (OTCQB:CYLYF)

Ceylon Graphite has ‘Vein graphite’ production out of one mine in Sri Lanka with 121 square kilometers of tenements.

No news for the month.

Mineral Commodities Ltd. (“MRC”) [ASX:MRC]

Skaland Graphite is 90% owned by MRC. Skaland is the highest grade flake graphite operation in the world and largest producing mine in Europe; with immediate European graphite production of up to 10,000 tonnes per annum with regulatory approval to increase to 16,000. MRC plans to demerge its Norwegian graphite assets into a newly incorporated Norway company branded as Ascent Graphite.

On June 15 Mineral Commodities Ltd. announced:

MRC signs participation and heritage engagement agreement for Munglinup…..The Agreement is one of the key precursors to obtaining environmental authorization and a mining right for the Project. The Agreement includes standard commercial terms, warranties and undertakings for contracts of this nature and includes a royalty payable to ENTAC of 0.5% of the gross proceeds derived from the sale or other disposal of graphite concentrate extracted from the Project each year, commencing on the production commencement date.

Tirupati Graphite [LSE:TGR] (OTCQX:TGRHF)

No significant news for the month.

Northern Graphite [TSXV:NGC][FRA:ONG] (OTCQB:NGPHF)

Northern Graphite purchased from Imerys the Lac des Iles producing graphite mine in Quebec and the Okanjande graphite deposit/Okorusu processing plant in Namibia. They also own the Bissett Creek graphite project located 100km east of North Bay, Ontario, Canada and close to major roads and infrastructure. The Company has completed an NI 43-101 Bankable final Feasibility Study and received its major environmental permit.

On May 31 Northern Graphite announced: “Northern Graphite announces first quarter 2023 results.” Highlights include:

Operational Highlights for the first quarter include:

- “Mine-to-Market Strategy: The Company announced its mine-to-market strategy which consists of developing one of the world’s largest battery anode material (“BAM”) facilities in Baie-Comeau, Québec with 200,000 tonnes per year (“tpy”) of capacity. The Company also announced the signing of an agreement to acquire a 33.33% ownership interest and the majority of voting rights (50.1%) in NeoGraf Solutions, LLC (“NeoGraf”), a U.S.-based company focused on the manufacturing of specialty value added products made from natural graphite.

- Mining and Development Projects:

- The Company’s Lac des Iles (“LDI”) mine in Québec produced 2,966 tonnes of graphite concentrate with a recovery rate of 91.6%;

- Following the exercise of its option to acquire 100% of the Mousseau West graphite project in Québec in the fourth quarter of 2022, in March 2023, the Company increased size of the project by an additional 101.6 hectares to a total of 590.5 hectares;

- Following the decision to relocate the Okorusu plant directly to the Okanjande mine site in Namibia, the Company is completing an updated PEA which it expects to release this quarter. It includes plans for a 31,000 tpy processing plant that will be ready for production in late 2024.”

Financial Highlights for the first quarter include:

- “Revenue of $4.0 million generated from 1,813 tonnes of graphite concentrate sold at an average realized sales price of $2,202/tonne (USD$1,628/tonne) (1).

- Cash costs of $1,592 (USD$1,171) per tonne of graphite concentrate sold (1).

- Income from mine operations of $452,000.

- An operating loss of $2.6 million was recorded.

- A net loss of $4.2 million ($0.03 per share) was recorded.

- Cash and equivalents of $2.0 million as at March 31, 2023.

- Working capital of $20.4 million as at March 31, 2023.

- 4,652,500 warrants with a strike price of $0.45 were exercised for gross proceeds of $2,093,000.

- On April 27, 2023 the Company closed a non-brokered private placement financing of 3,000,000 units of Northern issued on a charity flow-through basis at a price of $0.75 per unit for proceeds of $2,250,000. Each unit consists of one common share and one-half of one common share purchase warrant, with each whole warrant entitling the holder to purchase one common share at an exercise price of $0.75 for a period of two years.”

On June 22 Northern Graphite announced:

Northern Graphite clarifies Namibian export ban on unprocessed critical minerals…..”We have consulted with the Ministry of Mines and Energy of Namibia, and we have been assured that this ban only applies to unprocessed ore and as such should have no bearing on our plans to mine and process graphite bearing resources into concentrate at Okanjande,” said Northern Graphite Chief Executive Officer Hugues Jacquemin.

You can view the latest investor presentation here and the Trend Investing article on Northern Graphite here or a Trend Investing CEO interview here.

Graphite developers

NextSource Materials Inc. [TSX:NEXT] [GR:1JW] (OTCQB:NSRCF)

NextSource Materials Inc. is a mine development company based in Toronto, Canada, that’s developing its 100%-owned, Feasibility-Stage Molo Graphite Project in Madagascar. The Company also has the Green Giant Vanadium Project on the same property. The Molo mine is fully-funded and scheduled to commission in Q1 2023.

On June 5 NextSource Materials Inc. announced:

NextSource Materials Files amended and restated Unaudited Condensed Interim Financial Statements and MD&A…..”

On June 22 NextSource Materials Inc. announced:

NextSource Materials announces first production of SuperFlake® Graphite at Molo Mine in Madagascar. President and CEO, Craig Scherba, commented: “……..As we ramp up the production stage of operations, the Company is in the enviable position of transitioning into a significant and sustainable global producer of high-quality graphite and anode material just as demand for their use in lithium-ion batteries is growing exponentially.”

Investors can view the latest company presentation here or the latest Trend Investing article here.

Talga Group [ASX:TLG] [GR:TGX] (TLGRF)

Talga Group is a technology minerals company enabling stronger, lighter and more functional materials for the multi-billion dollar global coatings, battery, construction and carbon composites markets using graphene and graphite. Talga 100% owned graphite deposits are in Sweden, proprietary process test facility is in Germany.

On June 18 Market Screener reported: “Talga Group secures AU$239 million debt funding for Swedish Anode Project; Shares rise 11%.”

On June 21 Market Screener reported: “Talga Group secures environmental permit for Swedish Battery Anode Facility.”

You can view the latest investor presentation here.

Westwater Resources (NYSE:WWR)

Westwater Resources Inc. is developing an advanced battery graphite business in Alabama. The Coosa Graphite Plant (2023 production start) plans to source natural graphite initially from non-China suppliers and then from the USA from 2028.

On June 7, Westwater Resources announced:

Westwater Resources executes Letter of Intent with Dainen Material, a Japanese Anode Supplier to leading Japanese Manufacturers. Westwater to source CSPG from its Kellyton advanced graphite processing plant…..

You can view the latest investor presentation here.

Magnis Energy Technologies Ltd [ASX:MNS] (OTCQX:MNSEF)

Magnis is an Australian based company that has rapidly moved into battery technology and is planning to become one of the world’s largest manufacturers of lithium-ion battery cells. Magnis has a world class graphite deposit in Tanzania known as the Nachu Graphite Project.

On June 2, Magnis Energy Technologies Ltd. announced: “iM3NY cell certification update.”

On June 8, Magnis Energy Technologies Ltd. announced: “Exceptional Performance Achieved by Nachu Anode Materials Minus Purification.” Highlights include:

- “Anode Active Material (AAM) samples from Nachu graphite feedstock utilising US pilot equipment were produced for customer testing.

- First Cycle Efficiency (FCE) of >94.4% with a reversible capacity of >355 mAh/g.

- Purity at or above 99.97% without any harsh chemical, acid or very high-temperature thermal purification.

- Additional Tier-1 customer discussions and qualification programs progress.

- Several sites shortlisted for US AAM facility.”

On June 13, Magnis Energy Technologies Ltd. announced:

$25 million facility completed…..The Magnis Board does not intend to draw down the additional $25 million tranche available under the facility at the present time.

On June 14, Magnis Energy Technologies Ltd. announced:

Magnis CEO resigns. Magnis Energy Technologies Ltd (“Magnis”, or the “Company”) (ASX: MNS; OTCQX: MNSEF; FSE: U1P) wishes to advise that its CEO David Taylor has tendered his resignation from Magnis. David’s notice period will commence today and end on 1 December 2023.

On June 15, Magnis Energy Technologies Ltd. announced: “iM3NY Batteries Receive Certification.” Highlights include:

- “Batteries produced by iM3NY have officially received UN/DOT38.3 certification.

- UN38.3 certification is an internationally recognized standard established by the United Nations for the transportation of lithium-ion cells.

- iM3NY cells are now permitted to be transported within the United States and internationally.

- All seven tests were completed successfully with all cells used in the testing process compliant.”

Gratomic Inc. [TSXV:GRAT] [GR:CB82 ] (OTCQX:CBULF)

Gratomic’s Aukam Graphite Project is located in Namibia, Africa. The Project is undergoing “operational readiness.” Gratomic also 100% own the Capim Grosso Graphite Project in Brazil. Gratomic is also collaborating with Forge Nano to develop a second facility for graphite micronization and spheronization.

On June 16, Gratomic Inc. announced:

Gratomic signs commercial partnership and sales agreement for up to 7,260 tonnes per annum…..of Aukam Vein Graphite.

Black Rock Mining [ASX:BKT] (OTCPK:BKTRF)

On May 29, Black Rock Mining announced: “Black Rock signs binding offtake and US$10m prepayment agreements with POSCO.” Highlights include:

- “Binding agreements signed with Strategic Alliance Partner, POSCO, including: US$10m prepayment agreement, repayable via delivery of product. Offtake agreement for 100% of planned life of mine graphite fines (-#100) for Module 1 production.

- Prepayment component to be used as part of construction financing.

- The Company continues to progress debt financing with credit-approved term sheets anticipated in Q2 CY23.”

On June 13, Black Rock Mining announced: “Black Rock completes A$10.0m placement to institutional and sophisticated investors.” Highlights include:

- “Black Rock raises A$10.0 million at A$0.115 per share in a strongly supported Placement to new and existing institutional and sophisticated investors.

- Cornerstone support for the Placement received from large US-based fund.

- Funds will be used to support general working capital to complete the debt process and project level partner process.”

Nouveau Monde Graphite [TSXV:NOU] (OTCQX:NMGRF) (NYSE:NMG) and Mason Graphite [TSXV:LLG] [GR:M01] (OTCQX:MGPHF)

Nouveau Monde Graphite (“NMG”) own the Matawinie Graphite Project, located in the municipality of Saint-Michel-des-Saints, approximately 150 km north of Montreal, Canada. NMG (51%) and Mason Graphite (49%) have agreed to JV (subject to approvals) on the Lac Guéret Project.

No significant news for the month.

You can view the latest investor presentation here.

Greenwing Resources Limited [ASX:GW1] (OTCPK:BSSMF)

No graphite related news for the month.

You can view the latest company presentation here.

Triton Minerals [ASX:TON][GR:1TG] (OTCPK:TTMNF)

Triton Minerals Ltd. engages in the acquisition, exploration and development of areas that are highly prospective for gold, graphite and other minerals. The company was founded on March 28, 2006 and is headquartered in West Perth, Australia. Triton has two large graphite projects in Mozambique, not far from Syrah Resources Balama project.

On May 1, Triton Minerals announced:

A$5m placement to Shandong Yulong completed. As previously announced in September 2022, major Chinese listed commodities trading and resources company, Shandong Yulong Gold Co Ltd, conditionally agreed to invest A$5.0m in Triton. All conditions precedent for the A$5.0 million investment have been satisfied and accordingly the A$5.0 million has now been received by Triton and the placement securities issued…..

You can view the latest investor presentation here and the latest article on Trend Investing here.

SRG Mining Inc. [TSXV:SRG] [GR:18Y] (OTCPK:SRGMF) [Formerly SRG Graphite Inc.]

SRG is focused on developing the Lola graphite deposit, which is located in the Republic of Guinea, West Africa. The Lola Graphite occurrence has a prospective surface outline of 3.22 km2 of continuous graphitic gneiss, one of the largest graphitic surface areas in the world. SRG owns 100% of the Lola Graphite Project.

No significant news for the month.

You can view the latest investor presentation here.

Leading Edge Materials [TSXV:LEM] (OTCQB:LEMIF)

Leading Edge Materials Corp. is a Canadian company focused on becoming a sustainable supplier of a range of critical materials. Leading Edge Materials’ flagship asset is the Woxna Graphite Project and processing plant in central Sweden. The company also owns the Norra Karr REE project, and the 51% of the Bihor Sud Nickel-Cobalt exploration stage project in Romania.

On June 21 Leading Edge Materials announced: “Leading Edge Materials reports quarterly results to April 30, 2023.” Highlights include:

During the three months ended April 30, 2023:

- “On March 1, 2023, the Company announced it identified extensive Co-Ni-mineralization 50 meters above the previously reported Gallery 7 at its Bihor Sud project in Romania.”

Subsequent to April 30, 2023:

- “On June 1, 2023, the Company announced in-situ assay results at over 30% Nickel and 4.7% Cobalt at Bihor Sud. Additionally, surface trench assay results indicate a zone of Pb-Zn-Ag mineralization.”

Investors can view the latest company presentation here.

Renascor Resources [ASX:RNU]

Renascor Resources Ltd. is an Australian exploration company, which focuses on the discovery and development of economically viable deposits containing uranium, gold, copper, and associated minerals. Its projects include graphite, copper, precious metals, and uranium.

No news for the month.

You can view the latest investor presentation here.

EcoGraf Limited [ASX:EGR] [FSE:FMK] (ECGFF)

On May 31 EcoGraf Limited announced:

POSCO signs cooperation agreement. Strategic long-term partnership for EcoGraf Vertically Integrated Battery Anode Material Developments…..

You can view the latest investor presentation here.

Lomiko Metals Inc. [TSXV:LMR] (OTCQB:LMRMF)

Lomiko has two projects in Canada – La Loutre graphite Project (flagship) (100% interest) and the Bourier lithium Project (70% earn in interest).

On May 29 Lomiko Metals Inc. announced:

Lomiko announces the filing of the Technical Report for the Mineral Resources Estimate of the La Loutre Natural Flake Graphite Property and announces adjustment on Resource Tonnage and Grade…..

On June 1 Lomiko Metals Inc. announced:

Lomiko announces closing of the acquisition of the Carmin Natural Flake Graphite Property in Southern Quebec……

On June 16 Lomiko Metals Inc. announced:

Lomiko announces private placement of units and flow-through units and participation in Laval University Study, Quebec and UK Canada Trade Mission……

Focus Graphite [TSXV:FMS][GR:FKC] (OTCQB:FCSMF)

No news for the month.

Metals Australia [ASX:MLS]

No graphite related news for the month.

NGX Limited (100% owned subsidiary of Sovereign Metals [ASX:SVM] [GR:SVM][LSE:SVML])

On June 8, Sovereign Metals announced:

Kasiya graphite shows excellent suitability for use in lithium-ion batteries…..Key outcomes were: Near perfect crystallinity – an indicator of battery anode performance Above benchmark >99.95% carbon purity achieved No critical impurities or deleterious elements commonly found in other natural graphite sources….

On June 20 Sovereign Metals announced: “Graphite bulk sample operations commenced.” Highlights include:

- “Bulk sample program commenced to produce larger volumes of natural graphite from Kasiya. Samples to be used for downstream testwork and product qualification for the lithium-ion battery sector.

- Initial four tonnes of flake graphite pre-concentrate produced at the Company’s laboratory in Malawi ready for despatch to world leading laboratory SGS Lakefield…….

- Initial characterisation testwork on Kasiya’s graphite has already indicated excellent suitability for use in lithium-ion batteries.

- Bulk sample program in line with Sovereign’s graphite marketing strategy to establish Kasiya as a major supplier of two critical minerals – natural flake graphite and natural rutile.

- Active marketing of Kasiya’s graphite to end users to follow; Sovereign has already secured rutile offtake MOUs with major blue chip partners including Japan’s Mitsui and US-listed Chemours.

- Multiple government initiatives across the G7 and other world economies recently announced focusing on securing graphite supply alongside other critical minerals.”

You can view the latest investor presentation here.

Sarytogan Graphite [ASX:SGA]

Sarytogan Graphite has an Indicated and Inferred Mineral Resource of 229Mt @ 28.9% TGC in Central Kazakhstan.

On June 6 Sarytogan Graphite announced:

Metallurgical update…..Alternative thermal purification flowsheet also under development to allow the Pre-Feasibility Study (PFS) to consider two main flowsheets. Overall schedule on-track to deliver spheroidized-graphite battery-testing results this year.

On June 26 Sarytogan Graphite announced: “EM anomalies identified at Kenesar.” Highlights include:

- “TDEM Survey identifies Electro-Magnetic (EM) anomalies consistent with graphitic rich layers within the graphitic schist under shallow cover at Kenesar.

- Shallow low-cost drilling will now commence at Kenesar to penetrate the shallow cover and sample the graphitic schist basement rocks.

- Pre-Feasibility Study activities also progressing at namesake Sarytogan Graphite Project.”

Evion Group NL [ASX:EVG] – (Formerly BlackEarth Minerals [ASX:BEM])

No significant news for the month.

Albany Graphite Corp. (100% owned subsidiary of Zentek Ltd. [TSXV:ZEN] (ZTEK))

On May 30 Zentek Ltd. announced:

Zentek and Pattern Energy to collaborate on Icephobic Technology for Wind Turbine Industry…..

On June 22 Zentek Ltd. announced:

Zentek provides update on ZenARMOR™ Corrosion Protection Technology….in corrosion protection paints. This is an area that has taken on heightened importance due to the high cost of corrosion. This award confirms the Government of Canada’s commitment to working with innovative domestic companies to help address this challenge,” commented Greg Fenton, Zentek CEO. “Importantly, we see this as a potential precursor to commercialize our technology not only within the Canadian Government, but with other interested parties, as well.”

Other graphite juniors

Armadale Capital [AIM:ACP], DNI Metals [CSE:DNI] (OTC:DMNKF), Eagle Graphite [TSXV:EGA] [GR:NJGP] (OTC:APMFF), Elcora Advanced Materials Corp. [TSXV:ERA] (OTCPK:ECORF), Electric Royalties [TSXV:ELEC], Evolution Energy Minerals [ASX:EV1] (OTCPK:EVMIF), Graphite One Resources Inc. [TSXV:GPH] [GR:2JC] (OTCQX:GPHOF), Green Battery Minerals Inc. [TSXV:GEM] (OTCQB:GBMIF), Infinity Stone Ventures [CSE:GEMS] (OTCQB:GEMSF), International Graphite [ASX:IG6], New Energy Metals Corp. [ASX:NXE], Volt Resources [ASX:VRC] [GR:R8L], South Star Battery Metals [TSXV:STS] (OTCQB:STSBF), Walkabout Resources Ltd [ASX:WKT].

Synthetic Graphite companies

- SGL Carbon (OTCPK:SGLFF)

- Novonix Ltd [ASX:NVX](OTCQX:NVNXF).

Graphene companies

- Archer Materials [ASX:AXE]

- Black Swan Graphene Inc. [TSXV:SWAN]

- Elcora Advanced Materials Corp. [TSXV:ERA](OTCPK:ECORF)

- First Graphene [ASX:FGR] (OTCQB:FGPHF)

- Graphene Manufacturing Group Ltd [TSXV:GMG]

- NanoXplore Inc. [TSXV:GRA] (OTCQX:NNXPF)

- Strategic Elements Ltd [ASX:SOR] (OTCPK:SORHF)

- Zentek Ltd. [TSXV:ZEN] (ZTEK).

Conclusion

June saw flake graphite prices lower and spherical graphite prices lower.

Highlights for the month were:

- Financing the battery arms race: The $514 billion cost of bridging the global EV supply chain divide. Natural graphite will require $3b, synthetic graphite $1.5b.

- Spherical natural graphite prices plunge to 11-year lows on more competition from synthetic graphite.

- Reuters – Analysis-Auto firms race to secure non-Chinese graphite for EVs as shortages loom. Project Blue forecasts that graphite shortages are expected to rise in coming years, with a global supply deficit of 777,000 tonnes expected by 2030.

- Northern Graphite reports an operating loss of $2.6 million in Q1, 2023.

- NextSource Materials announces first production of SuperFlake® Graphite at Molo Mine in Madagascar.

- Talga Group secures AU$239 million debt funding for Swedish Anode Project.

- Westwater Resources executes Letter of Intent with Dainen Material, a Japanese Anode Supplier to leading Japanese Manufacturers.

- Magnis Energy Technologies iM3NY batteries receive certification.

- Gratomic signs commercial partnership and sales agreement for up to 7,260tpa of Aukam Vein Graphite .

- Black Rock signs binding offtake and US$10m prepayment agreements with POSCO.

- POSCO signs cooperation agreement with EcoGraf for vertically integrated battery anode material development.

- Lomiko announces closing of the acquisition of the Carmin Natural Flake Graphite Property in Southern Quebec.

- Sovereign Metals Kasiya graphite shows excellent suitability for use in lithium-ion batteries.

- Sarytogan Graphite on-track to deliver spheroidized-graphite battery-testing results this year.

As usual, all comments are welcome.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here