Investment thesis

Our current investment thesis for Guess (NYSE:GES) is that although interest has declined, the business has done well to keep revenue flat and make some gains in the last few years. Margins are strong and geographical diversification is supporting the relevancy of the company’s brand. Management forecasts look dire in the coming quarter, which could extend beyond Q1. This makes investing today difficult to justify.

Company description

Guess is a company that designs, licenses, and distributes apparel and accessories for men, women, and children. Its product portfolio includes jeans, pants, skirts, shirts, jackets, activewear, knitwear, and intimate apparel. The products are sold under various brand names.

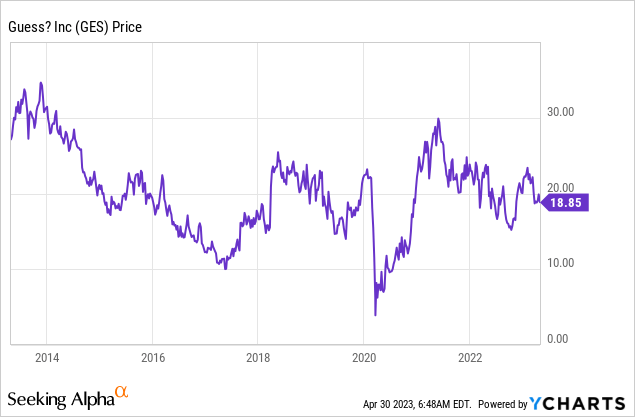

Share price

Guess’ share price has declined across the last 10 years, driven in large part by the difficult time apparel brands have had as the industry has been disrupted by several factors.

Financial analysis

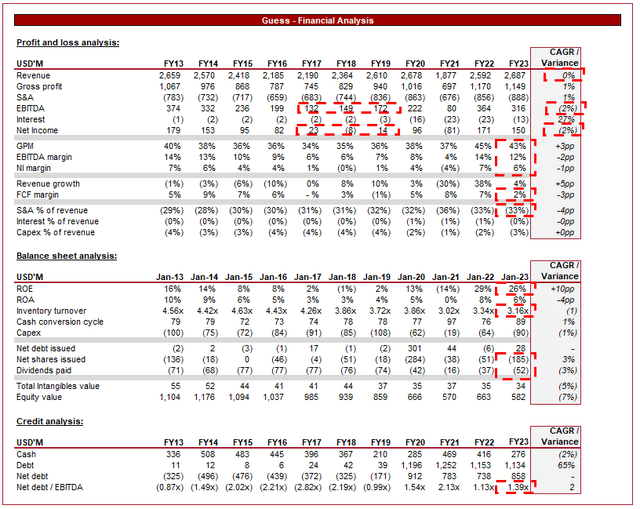

Guess Financial performance (Tikr Terminal)

Presented above is Guess’ financial performance for the last decade.

Revenue

Guess has experienced a lost decade, with no revenue growth in the last 10 years. It has been a difficult period for the business, as it has for many retailers, as consumer trends change and the industry is disrupted.

The largest disruption has been the rise of e-commerce, which has revolutionized the fashion industry, with online shopping becoming the preferred method of purchase for many consumers. With the convenience and accessibility of online shopping, traditional brick-and-mortar retailers have been pressured to adapt. The issue is that the “gatekeepers” have now changed. Traditionally, consumers would physically go to locations where brands congregated, such as a Mall or Department store. This meant footfall was key. Now the internet is driving growth, with new-age brands using social media to rapidly grow.

The other driver of disruption has been Fast fashion. Established brands, such as Zara and H & M (OTCPK:HNNMY), as well as several new companies have been producing large volumes of low-cost clothing to keep up with rapidly changing fashion trends. They can pump out new designs rapidly, allowing the money-conscious consumer to remain culturally relevant. This has punished many of the traditional players in the market, including Guess, who have been unable to innovate at the same speed or cost.

The backdrop of these two key disruptors has been Social media, which is now an essential tool for fashion brands to engage with their customers and promote their products. Guess has a strong social media presence and has utilized celebrity collaborations to keep its brand somewhat relevant.

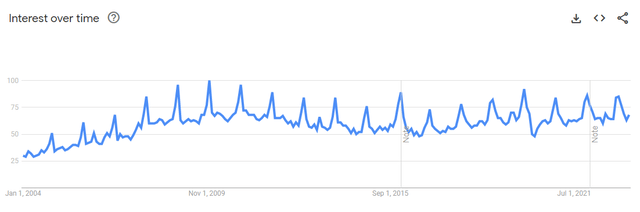

The issue is that Guess has struggled to grow its relevancy during this period, likely due to the lack of agility a large Corporate has relative to brands that are closer to consumers culturally. The most successful brands are usually those who have relationships with those that are influencing trends and those directly involved in the culture. Looking at Google Trends, Guess has seen a noticeable change in trajectory from its peak.

Interest over time (Google Trends)

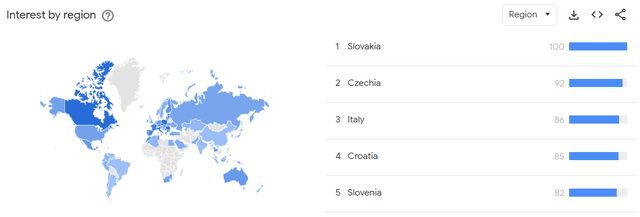

Further, looking at geography, the company’s main interest is coming from Europe currently. Importantly, North American interest remains high and the business has good diversity globally.

Geographical trends (Google)

From a financial perspective, this is positive as it means a diversification of revenue. It allows the business to improve interest in new markets, reducing the risk that a weakening of performance in one market can impact the group as a whole.

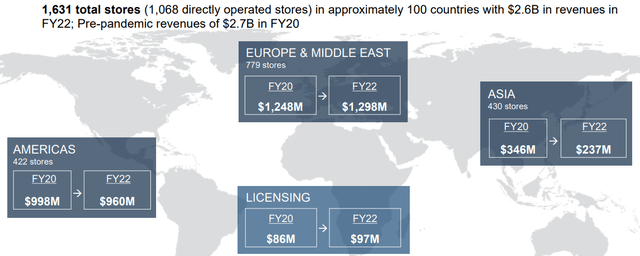

Looking below, NA experienced a $39m decline into FY22, compared to Asia which grew over $100m. Further, both licensing and Europe experienced an increase also, although not to the same degree.

Revenue diversification (Guess)

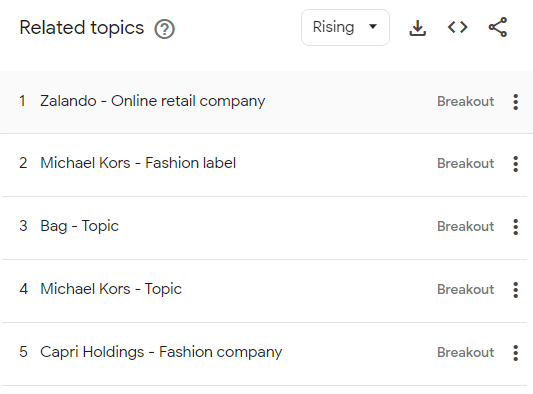

Further, the highest related topic is Zalando (OTCPK:ZLDSF), which is an e-commerce retailer. The issue with this is that margins are tighter going through retailers, which suggests the company is struggling with bringing consumers to its site.

Related topics (Google)

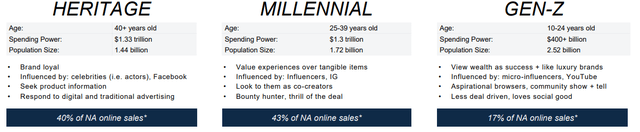

This is likely a reflection of Guess’ current target market, which is the older cohort and thus individuals who are more likely to shop in stores rather than online.

Customers (Guess)

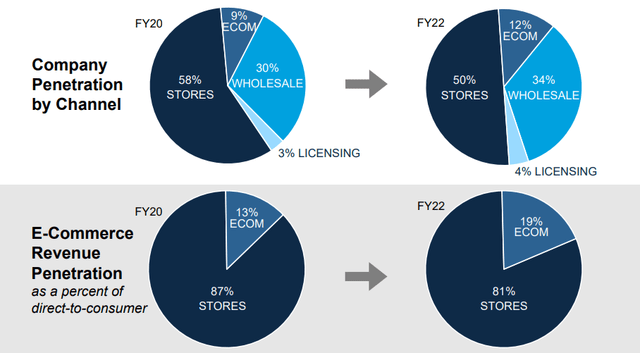

Due to the nature of how Guess is structured, with a large number of stores, the business looks committed to a brick-and-mortar approach. Despite an acceleration of digital activity, 81% of sales continue to be through store locations. This is not a bad thing, especially if it is DTC as margins are superior with store locations, but the growth is not here.

Channel (Guess)

Consumers are becoming increasingly aware of the environmental impact of the fashion industry and are demanding more sustainable and ethical practices from brands. This is materially impacting their spending habits, meaning companies must take note and adapt accordingly. Although Guess has made some inroads, they are currently poorly considered. Goodonyou is a business that rates retailers based on sustainability, giving Guess a “Not good enough”.

Sustainability rating (Goodonyou)

This has the potential to be an area to exploit but comes at a financial cost to businesses currently (Both material and labor). As a result of this, reluctance from Management is expected given it does not create certainty of benefits.

Economic considerations

We are seeing heightened inflation globally with rates increased as a monetary response. These factors have been eating away at consumers’ discretionary income, with a greater proportion of income committed to living costs. During such a cycle, we generally see a decline in discretionary spending, at least from those outside of the high-earning bracket, as non-essential costs are cut. This is an issue for Guess as retailers are usually quite severely hit, as it is quite easy for a consumer to forego apparel spending without materially impacting their life.

Our macroeconomic outlook is for things to continue as they are for much of the year, as inflation continues its slow decline to a sustainable level. This will likely mean a tough year for Guess, which could come in below FY23.

Margin

Guess’ current margins are quite attractive in our view. Unlike many of its competitors, the business has not foregone margins as a means of keeping growth positive. This is a trend that has been seen with the rise of e-commerce and fast fashion, as competition drives down prices.

Our only concern here is that margins may slip if conditions continue to be difficult, as greater discounting is used. The business has shown that EBITDA-M can fall as low as 4-9%, during a period of very low profitability.

Q4 results

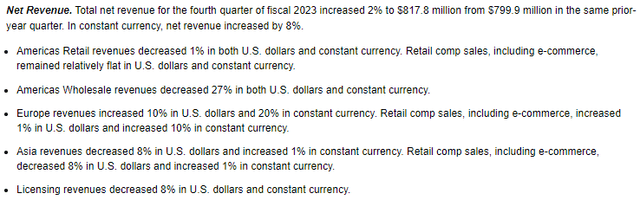

Q4 (Guess)

Guess had a soft quarter, with positive currency swings benefiting the business. America, Asia, and Licensing all experienced a decline, likely due to softening demand relative to the prior period.

The standout performance was Europe, a segment that is increasingly looking like a stronghold for the business. This is a reflection of expansion into the region, as comparable sales increased only 1%.

Our view is that Q1 will possibly be more of the same, but likely much worse in line with the current trajectory. We are expecting to see a decline of 5-10% in total sales.

Balance sheet

Guess’ inventory turnover has declined marginally in the most recent period while being on a general downward trajectory for the last decade. Management has done well to keep this flat, although our view is that a 4x level should be the target.

Further, the company is reasonably financed, with a ND/EBITDA ratio of 1.4x. This is primarily leases also. This gives the business flexibility while also reducing any downside risk.

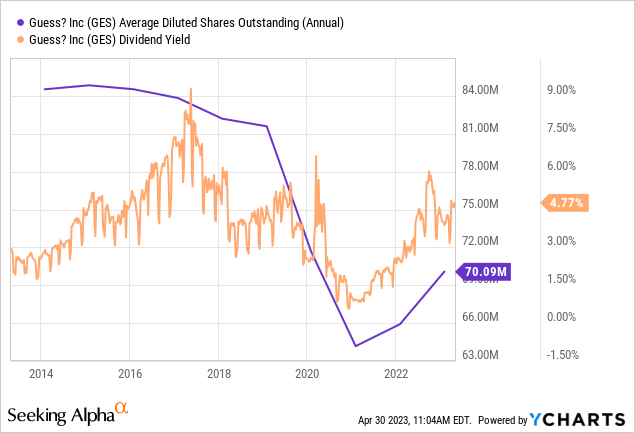

This allows the business to distribute healthily to investors, through both buybacks and dividends.

With economic conditions impacting demand, we could see distributions fall in the next year, however. In FY23, the company generated FCF of $80m, while paying $52m in dividends and repurchasing $187m in shares. This is not sustainable unless debt is issued.

Outlook

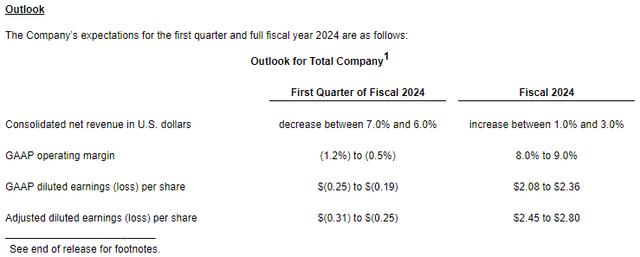

Outlook (Guess)

Presented above is Management’s forecast for the coming year. The expectation is for the business to become loss-making in Q1, followed by a profitable year and growth.

Loss-making is slightly surprising, suggesting demand is declining rapidly, with negative pricing action in response. With a large portion of costs fixed given its brick-and-mortar nature, the business is highly susceptible.

The ability to achieve growth in FY24 looks optimistic based on the current outlook. Further, given Management is quick to suggest negative OPM, it is possible that the business seriously suffers in FY24. Management is essentially banking on demand recovering from current levels.

Valuation

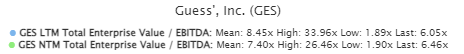

Valuation (TIkr Terminal)

Guess is currently trading at a discount to its historical average EBITDA multiple and in line with the ’10-’18 period. This suggests the business has not made any material improvement relative to where it was before Covid.

This assessment looks harsh. Online penetration is improving, margins have ticked up, and geographical expansion looks strong. The problem we see with buying today is that the NTM looks difficult for the business. Markets will not take well to the company losing money in the next quarter or two.

Key risks with our thesis

The risks to our current thesis are:

- (Downside) Larger loss than expected in Q1, resulting in markets changing their view on FY24. Currently, there is still hope for growth in FY24 but if this is to change, the price will react.

- (Downside) A larger than expected margin deterioration in the medium term, as a result of the current conditions.

- (Upside) Guess is one of a few retailers we have seen guiding losses in Q1. If this is avoided, the company would achieve an impressive beat, with the share price potentially responding positively.

Final thoughts

Guess has the potential to be a great business. Interest has wavered in the last decade, growth has been non-existent… and yet the business is not dead. Margins remain good, revenue in the last 5 years has been good, and low debt means the company’s downside risk is mitigated.

The problems are with the short term, which is concerning based on outlook. We could see value in the coming 5 years but currently, the valuation looks appropriate based on near-side struggles offsetting improved trading.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here