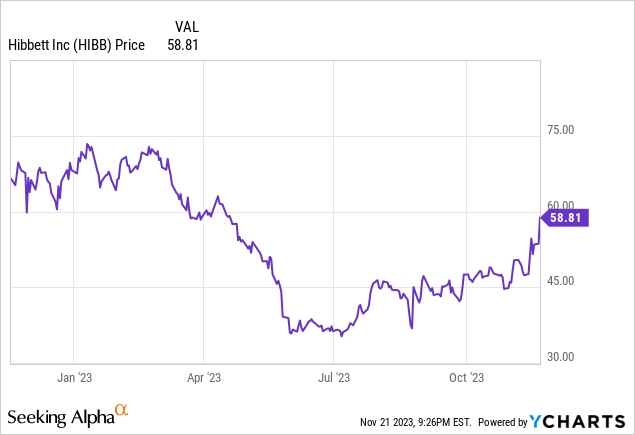

I last covered Hibbett, Inc. (NASDAQ:HIBB) in July 2022, rating the stock a BUY at $45.54. Since then, Hibbett is up 32% compared to the S&P 500’s return of 18%. Not bad. But the stock peaked at $75 back in January, and has given up a good portion of those gains.

Hibbett recently reported Q3 2024 earnings, so I thought it’d be a good time to revisit the thesis. On a day when most of the market was down, Hibbett popped 10% post earnings.

Let’s dive into what drove the optimism, and to learn why I’m downgrading from BUY to HOLD.

Q3 2024 Earnings Recap

Hibbett reported Q3 2024 earnings on November 21 and Wall Street liked the print, sending shares up nearly 10% for the day. After listening to the call, I attributed the positive reaction to 3 key factors.

First, Hibbett walloped Analysts’ consensus EPS estimate for the quarter, delivering $2.05 vs $1.17 expected. That equates to a beat of $0.88 or 75%. Additionally, revenue came in at $432 million, $15.3 million above consensus and representing a 4% beat.

Second, Hibbett reiterated its full year 2024 guidance for revenue, and raised its EPS outlook by 10% from $7.38 to $8.15 (at midpoint). The beat & raise was largely a result of the company’s improved operating margin. Hibbett has been on a multi-year effort to cut fat out of its business, which is showing up in the bottom line.

Lastly, Hibbett launched a new partnership with Nike referred to as Connected Partnership. I believe this new partnership helped to calm investors’ fears Nike may pull its products off Hibbett’s shelves like it did Foot Locker (FL) in February 2022. This has been one of the greatest risks facing Hibbett.

Here’s an excerpt from Hibbett CEO Mike Longo from the Q3 2024 earnings release:

At the end of the quarter, we were pleased to announce the launch of our Connected Partnership, an initiative that connects the Hibbett and Nike loyalty programs. This further reinforces our valued partnership with Nike and confirms the strength of our relationship. This transformative partnership will support our loyalty member customers across all retail channels, providing exclusive shopping experiences, personalized content, and early access to Nike and Jordan member products.

Potential Reversion To The Mean

All in all, Hibbett put together an excellent quarter and is poised to deliver on full year 2024 expectations. Even so, I am downgrading my rating from BUY to HOLD, which is largely a reflection of Hibbett’s growth prospects and current share price near $59 which I believe is fairly valued.

It’s no secret Hibbett greatly benefited from demand pull forward during the Covid pandemic. From 2019-2023, revenue compounded at nearly 14%, which is 4x its 3.5% growth rate pre-Covid (2014-2019).

Hibbett did a great job executing in that environment, growing its ecommerce channel and opening new stores. But my prediction is a reversion to the mean in top line revenue growth of 3-5% annually. Analysts are expecting revenue to be flat YoY in 2024 and up 4.5% in 2025.

Shrinking Competitive Advantage

Hibbett’s competitive advantage is its target demographic of mostly rural, low-to-median income communities. But as I look at the competitive landscape with DICK’S Sporting Goods (DKS), Academy Sports & Outdoor (ASO), Sportsman’s Warehouse, etc…, and contemplate Hibbett’s ability to keep share, I worry.

Also, one has to consider the risk Amazon (AMZN), Walmart (WMT), and other big box retailers present as their direct-to-consumer footprints continue to expand. How much longer will “hard to reach” customers be hard to reach? No one really knows.

I like Hibbett, especially that it supports rural communities, and believe it to be a sound company. But the further into the future I look, the less optimistic I am about its prospects.

Bull Case Hinges On Buybacks

I’d be bullish on Hibbett if shares were sitting at $40 or less, but they’re not. The reason I’m more bearish is because I believe net income and FCF will also revert to the mean, and compound in the 3-5% range.

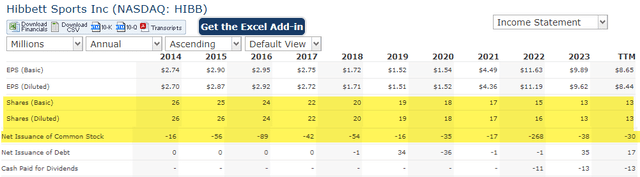

In my opinion, the bull case hinges on share buybacks which would serve to bolster EPS. Fortunately, Hibbett has a long history of reducing total number of shares outstanding via buybacks, having repurchased 50% of shares over the past 10 years.

HIBB Shares Outstanding (quickfs.com)

With low float (12.6 million shares) and relatively cheap valuation from a P/E perspective, it doesn’t take a lot of capital to drive a lot of EPS. But there’s no guarantee Hibbett continues this practice.

Valuation

If you couple my estimated 3-5% organic EPS growth with 3-5% growth from share repurchases and dividends, that sums to 6-10% annually. My crystal ball would look something like this:

HIBB Valuation (Author’s data)

The forecast assumes a 3.5% revenue CAGR, net margins of 5.8% (5YR avg is 5.4%), a 2.5% reduction in annual shares outstanding, a 10% annual increase in dividends, and P/E expansion to 9x (its 5YR forward avg).

There are a lot of assumptions in this estimate. But from a starting price of $59, shares would CAGR around 9-10%. For me, I’m not convinced investing in Hibbett would achieve better results than investing in the S&P 500. Thus, if I was a shareholder, I’d HOLD.

Conclusion

Famed investor Charlie Munger has a great quote which I think applies well to Hibbett.

A great business at a fair price is superior to a fair business at a great price.

Hibbett almost always looks cheap from a P/E or market multiple perspective. But for the long-term, I think Hibbett is a fair business at a great price. At $60, it’s just not cheap enough for me to contemplate taking up a position.

If you’re looking for a stock with market-beating potential, I’d pass on Hibbett at current levels.

Read the full article here