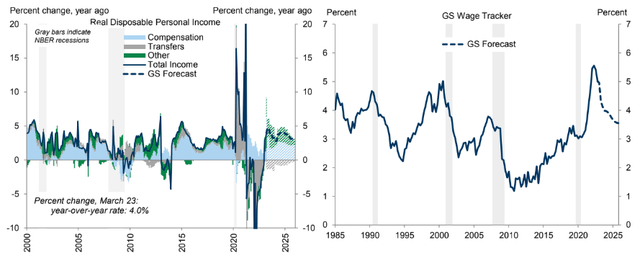

It might not feel like it, but real income growth has accelerated to a very hot +7.8% annualized growth pace over the last three months, according to Goldman Sachs.

With travel spending continuing to be stout, I have a buy rating on Vail Resorts (NYSE:MTN). I assert the bears have gotten over their skis.

Real Income Growth Should Help Consumers In 2023

Goldman Sachs

According to Bank of America Global Research, MTN owns and/or operates several ski resorts, including Vail, Beaver Creek, Breckenridge, Keystone, Heavenly, Northstar-at-Tahoe, Kirkwood, Canyons, Park City, Afton Alps, Mt. Brighton, Wilmot, Perisher, Whistler, and Stowe. Vail also owns several resorts in the Midwest and Northeast, acquired through its acquisition of Peak Resorts. In addition, Vail Resorts owns the RockResorts lodging brand and the Grand Teton Lodge Company. It operates through three segments: Mountain, Lodging, and Real Estate.

The Colorado-based $9.7 billion market cap Leisure Facilities industry company within the Consumer Discretionary sector trades at a high 29.4 trailing 12-month GAAP price-to-earnings ratio and pays a high 3.2% dividend yield, according to The Wall Street Journal.

Back in March, Vail reported a big EPS miss, though sales modestly topped estimates. Its guidance was weak; FY23 EBITDA is now expected to verify in the $831-$859 million range versus the previous $893-$947 million range. A tough late-winter environment in the Northeast was the culprit. Those temporary negative factors don’t detract from the firm’s exposure to higher-end consumers who are faring better than those at the low end. Also, its evolution to a recurring revenue business helps give clarity to future earnings. Not surprising to me was the Board’s announcement that it was increasing the firm’s share buyback plan while increasing the dividend.

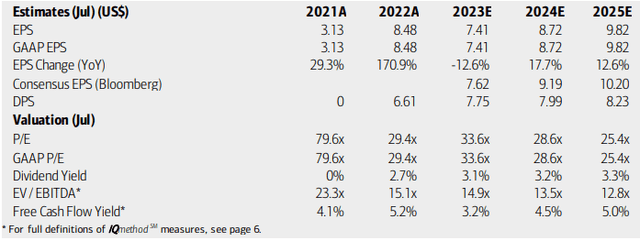

On valuation, analysts at BofA see earnings dropping sharply this year, but then recovering at a robust clip in 2024. Per-share profits are then seen as jumping at a double-digit rate in 2025. The Bloomberg consensus forecast is even more optimistic versus what BofA sees. Dividends, meanwhile, are expected to grow steadily over the coming quarters. If we assume a 14% normalized EPS growth rate and next 12-month EPS of $8.50 (since we are already into MTN’s Q4), then the stock’s PEG ratio is only about 2.0 (a 28.4 forward operating P/E on the $241 share price).

Vail Resorts: Earnings, Valuation, Dividend Forecasts

BofA Global Research

What’s more, the company’s EV/EBITDA ratio is actually about in-line with the market average, which is cheap considering the robust earnings growth outlook. With solidly positive free cash flow, I have a buy rating on the stock and assert its fair value should be closer to $275 if we apply a 16x EV/EBITDA ratio (which is at a discount to its 18.4 five-year average).

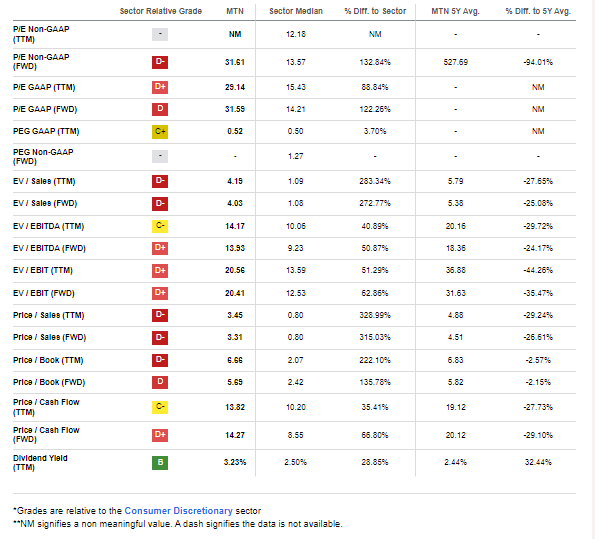

MTN: Cheap On An EV/EBITDA Basis

Seeking Alpha

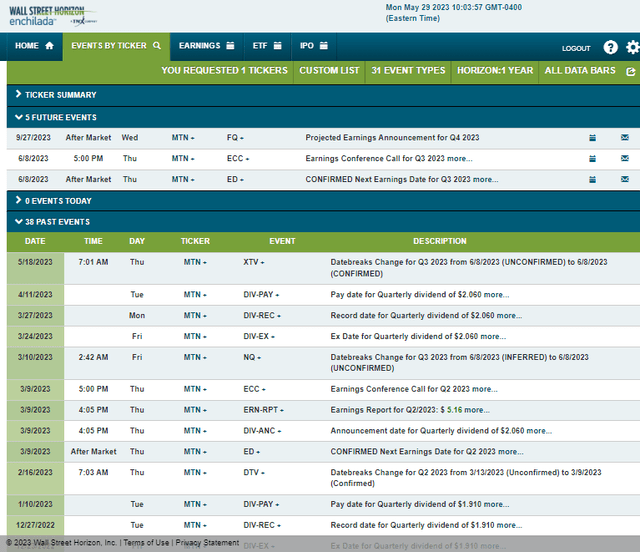

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q3 2023 earnings date of Thursday, June 8 AMC with a conference call immediately after results cross the wires. You can listen live here.

Corporate Event Risk Calendar

Wall Street Horizon

The Options Angle

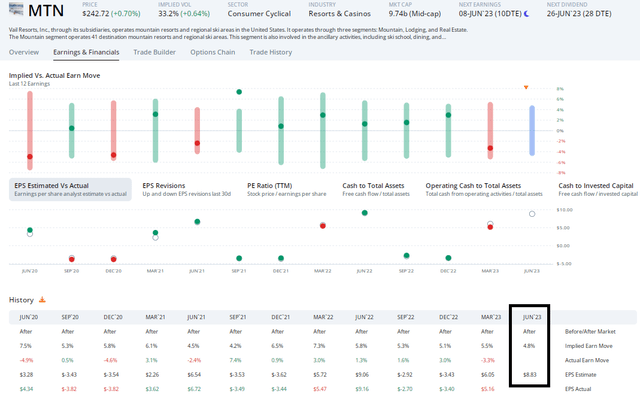

Digging into the upcoming earnings report, data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $8.83 which would be a 3.6% decline from $9.16 of per-share profits earned in the same quarter a year ago. The company has topped analysts’ earnings expectations in just 8 of the last 12 events, but the stock has traded higher post-earnings in 6 of the previous 7 instances. So, there are bullish trends in my view.

Options traders, meanwhile, have priced in a 4.8% earnings-related stock price swing when analyzing the at-the-money straddle expiring soonest after next Thursday’s report. Given a series of small moves post-reporting, I would not get aggressively long options at that price.

MTN: Not Expecting High Earnings-Related Stock Price Volatility

ORATS

The Technical Take

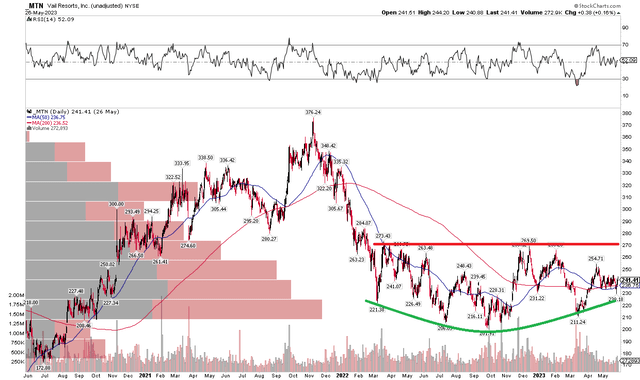

With shares undervalued ahead of Q3 earnings, I see optimistic trends on the chart. Notice in the graph below that MTN is putting in a bearish to bullish reversal pattern. The so-called “rounded bottom” feature has resistance near $270, which is about my fair value target. But should that level break, then the bulls could take the stock to $340 based on the pattern.

With the long-term 200-day moving average inflecting positive before long, that should help support the bullish thesis. For now, long with a stop under the March low appears as a favorable risk-reward play.

MTN: Bullish Rounded Bottom

Stockcharts.com

The Bottom Line

I have a buy rating on MTN. The stock’s strong growth profile warrants a valuation premium, and the chart is working on a bullish rounded bottom pattern.

Read the full article here