Introduction

The hospitality sector has undoubtedly been one of the most, if not the most, severely impacted sectors by the pandemic. With travel restrictions, lockdowns, and reduced consumer spending over the past couple of years, hotels faced significant challenges. I have covered several hospitality REITs previously, such as Apple Hospitality REIT (NYSE: APLE), Summit Hotel Properties (NYSE: INN) and Park Hotels & Resorts (NYSE: PK) and evaluated their attractiveness to investors at various points.

While Apple Hospitality REIT and Summit Hotel Properties primarily focus on select-service hotels, the subject of this article, Host Hotels & Resorts (NASDAQ:HST), shares more similarities with Park Hotels & Resorts. Host Hotels & Resorts is focused on luxury and upper upscale hotels, which cater to a higher-end clientele and offer premium services and amenities. In this article, I will evaluate the company to determine if it is an attractive investment.

The Business

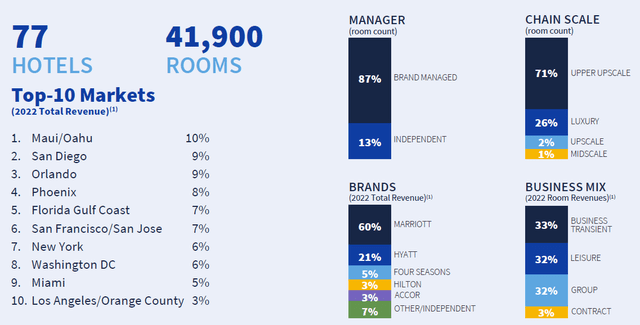

Host Hotels & Resorts has a market capitalization of over $12 billion, making it by far the largest publicly traded lodging REIT. The company’s portfolio comprises 77 hotels, encompassing a total of 41,900. While the bulk of these hotels are located in the United States, the company does have a small international presence, with 5 hotels (comprising 1,499 rooms) situated in Brazil and Canada.

The company is focused on luxury and upper upscale hotels, with 97% of its available rooms falling within this category and the majority of its hotels operated under the Marriott and Hyatt brands. The hotels are also geographically diversified. The company has a well-distributed presence across multiple locations, with no single market accounting for more than 10% of its revenue. This helps mitigate any risks associated with economic fluctuations or disruptions in any single area, thereby providing stability to the company’s portfolio.

HST May 2023 Investor Presentation

Q1 2023 Earnings & Outlook

The company announced its earnings for Q1 2023 last month, reporting impressive results. The company saw a substantial increase in revenue, from $1.07 billion in Q1 2022 to the current $1.38 billion, an increase of 28.6%. The company’s earnings per share (EPS) also saw significant improvement, more than doubling from $0.16/share in Q1 2022 to $0.40/share. The company’s adjusted funds from operations (AFFO), a key metric used to determine the capacity of REITs to pay dividends, came in at $0.55/share. This was an impressive increase of 41% compared to the $0.39/share reported in the same period last year.

Moving to the more granular details, the company’s revenue per available room (RevPAR) increased by 31% compared to Q1 2022, surpassing the initial guidance by 4%. The company’s earnings before interest, taxes, depreciation and amortization (EBITDA) for the quarter were $439 million, exceeding the 2022 and 2019 figures by 44% and 18% respectively. The company also achieved an EBITDA margin of 32.5%, surpassing margins in 2022 and 2019. In fact, the impressive performance for the quarter marked the fourth consecutive quarter that the company has achieved RevPAR, EBITDA and EBITDA margins ahead of the 2019 levels (i.e. before the pandemic), highlighting the company’s resilience and continued recovery from the pandemic.

Looking ahead, the strong performance saw the company revise its FY 2023 RevPAR guidance upwards to between 7.5% and 10.5%, with the midpoint of 9.0% nearly double the 5% projected in the previous quarter. Additionally, AFFO for the year is expected to range between $1.84/share and $1.95/share, up from the initial guidance of $1.60/share and $1.83/share. To provide some perspective, the FY 2022 AFFO came in at $1.79/share.

Balance Sheet

Maintaining a strong and flexible capital structure is a key strategic focus for the company, which will allow it to navigate various economic cycles. Notably, the company is the only investment-grade credit rated lodging REIT, which underscores its commitment to financial stability.

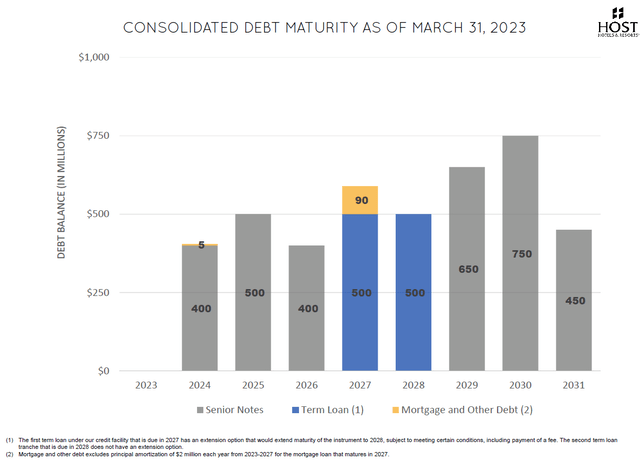

As of Q1 2023, the company has a total debt of approximately $4.2 billion, with a weighted average interest rate of 4.5% and a weighted average maturity of 5 years. Additionally, 76% of its debt is fixed-rate debt, mitigating potential risks associated with fluctuations in interest rates. One key feature to highlight is the company’s debt schedule – the company does not face any significant debt maturities until Q2 2024, and it has a fairly equal distribution over the years. This reduces the risk of any liquidity constrains, and provides the company with a significant runway to allocate its capital.

The company has a total liquidity of $2.3 billion, which includes a $1.5 billion credit facility. This robust liquidity position provides the company with financial flexibility, ensuring it can meet its operational and investment needs while also having a cushion for any unforeseen circumstances or opportunities.

HST Q1 2023 Supplemental Financial Information

Dividend

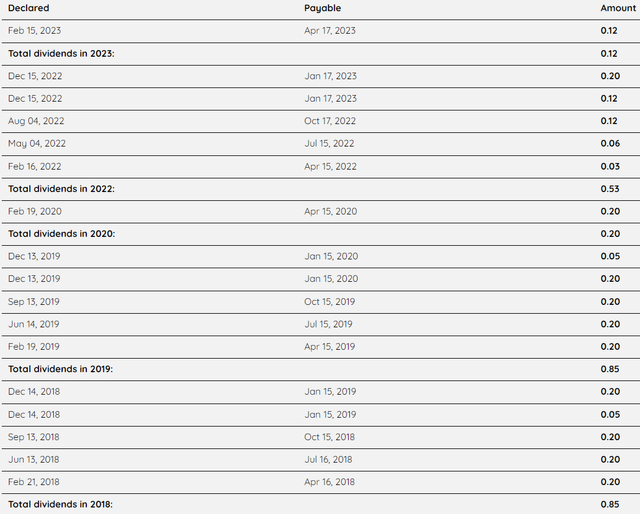

Similar to many hospitality REITs, Host Hotels & Resorts’ dividend payments were affected by the pandemic. Prior to the pandemic, the company had been consistently paying a quarterly dividend of $0.20/share, along with a special year-end dividend of $0.05/share, since 2016. However, due to the challenging circumstances brought about by the pandemic, the company suspended its dividends for 7 consecutive quarters, from Q2 2020 to Q4 2021, in order to preserve its liquidity.

The company resumed its dividend payments in Q1 2022, albeit at a reduced level of $0.03/share. Over the next 2 quarters, the company increased its dividends, culminating in a special dividend of $0.20/share at the end of the year. For Q1 2023, the company maintained its dividend for a third consecutive quarter at $0.12/share. While no specific guidance was provided for future dividends, the CFO mentioned during the earnings call that the company expects to be able to maintain its quarterly dividend.

Assuming the quarterly dividend of $0.12/share is maintained, this gives the company an annualized dividend of $0.48/share, resulting in a forward dividend yield of 2.73% based on the latest share price of $17.60. Assuming the FY 2023 AFFO comes in at the lower end of guidance, at $1.84/share, the company has a dividend payout ratio of 26%. This is a very low amount, and indicates the company is able to cover its dividend payout more than three times over.

All things considered, I would find it more probable than not that the company will increase its dividends later this year.

HST Investor Relations

Share Price and Valuation

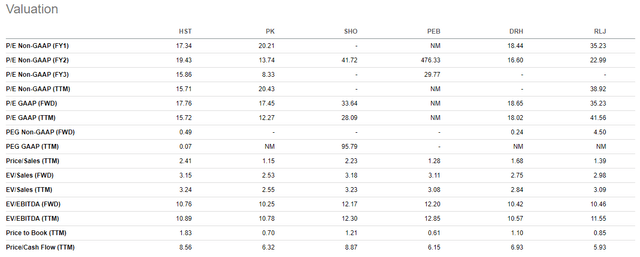

A look at the company’s valuation metrics compared to other industry peers – Park Hotels & Resorts, Sunstone Hotel Investors (NYSE: SHO), Pebblebrook Hotel Trust (NYSE: PEB), DiamondRock Hospitality Co (NYSE: DRH) and RLJ Lodging Trust (NYSE: RLJ) – shows that the company isn’t the cheapest share out there.

The company has a forward price-to-adjusted funds from operations (P/AFFO) ratio of 12.00, which is somewhat in the middle of its peers – Park Hotels & Resorts (10.99), Sunstone Hotel Investors (15.38), Pebblebrook Hotel Trust (12.00), DiamondRock Hospitality Co (11.13) and RLJ Lodging Trust (7.92).

Seeking Alpha

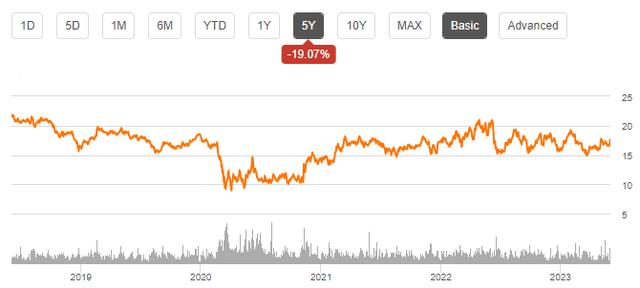

Additionally, when comparing the company’s share price against its historical share price, it is worth noting that the company is currently trading at a level similar to its pre-pandemic levels, a further sign that the company isn’t trading at a depressed valuation.

Seeking Alpha

Conclusion

Host Hotels & Resorts has continued its impressive recovery from the depths of the pandemic. The company has a strong balance sheet, with a well-managed debt schedule and ample liquidity, highlighting the company’s financial stability and flexibility. While its dividend yield, at 2.73%, is not the highest out there, the company’s ability to comfortably cover its dividends not only ensures that the dividend is safe, but it also highlights the possibility for further dividend increases. Although the company is not trading at a valuation that may be the cheapest in the market, I view the company as a buy for its stable dividends.

Read the full article here