Strategy

Launched by BlackRock, Inc., and managed by BlackRock Fund Advisors, the iShares U.S. Broker-Dealers & Securities Exchanges ETF (NYSEARCA:IAI) invests in stocks of companies operating in the United States financial services industry. IAI primarily focuses on a specific sub-sector of the industry, mainly investment service providers and financial exchanges. These include broker-dealers and trading firms, excluding investment management firms. The fund invests in growth and value stocks of companies across diverse market capitalizations and aims to track the performance of the Dow Jones U.S. Select Investment Services Index using a representative sampling technique. IAI was launched in 2006 and has a total of $418 million in assets under management. The fund is rebalanced on a quarterly basis.

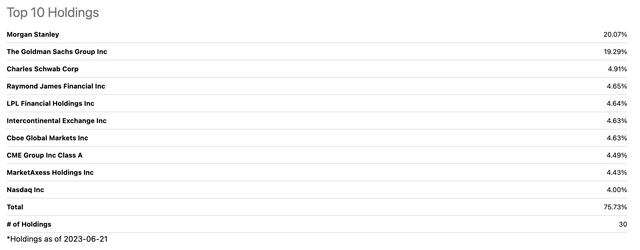

Holding Analysis

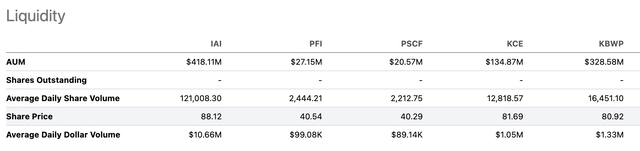

As mentioned earlier, IAI primarily focuses on security brokers, dealers, and securities or commodities exchanges. With this niche focus, the fund only invests in a total of 30 individual holdings. The fund offers exposure to a very specific type of financial firm, and its weighting is heavily skewed towards two firms, namely Morgan Stanley and Goldman Sachs. Both of these holdings constitute 20% and 19%, respectively. The rest of the top 10 holdings include other notable firms, such as Charles Schwab (SCHW) and Raymond James Financial (RJF). The weightings of the latter eight holdings all constitute between 4% and 5% of the portfolio. Overall, the top 10 holdings represent over 75% of the entire fund. Moreover, the fund strongly leans towards large-cap firms, with 75% allocated to large-caps and 20% allocated to mid-caps. Small and micro-caps represent the remaining 5%.

Seeking Alpha etfdb.com

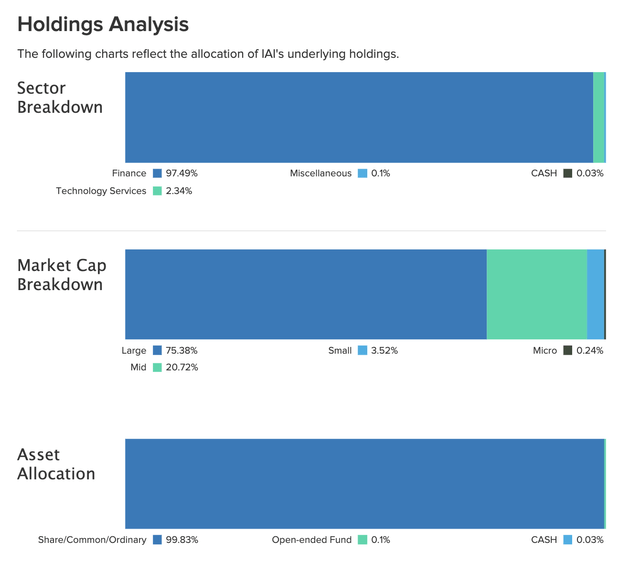

Performance Analysis

IAI has historically performed very similarly to the S&P 500 in terms of its total return. While the fund has mostly trailed the S&P 500 in the past five years, IAI has closely followed every peak and trough that the broader index experienced. Moreover, IAI has demonstrated a level of volatility roughly comparable to the broader index. However, the only instance in the past five years where IAI significantly deviated from the performance of the S&P 500 was at the beginning of 2023. This was likely caused by the bank failures of Silicon Valley Bank and Signature Bank, which precipitated a minor crisis in the banking and financial services sector as a whole. Currently, IAI is up 45% in the past five years, while the S&P 500 is up 72%.

Seeking Alpha

Potential of GS and MS

IAI allocates 40% of its portfolio to two stocks, Goldman Sachs (GS) and Morgan Stanley (MS). These two stocks carry the bulk of the fund’s performance, and they seem to be the primary drivers of growth for the fund. Both of these stocks have demonstrated strong and steady growth in the long run despite cyclical recessions. In the past five years, Goldman Sachs and Morgan Stanley are both up 43% and 76% in price, respectively. These stocks reported the strongest growth from 2020 to 2022, but from 2023 onwards, their growth has remained relatively stagnant as a result of macroeconomic headwinds and recessionary concerns. Unlike many prominent industries like tech and healthcare that experienced a slowdown during this time, Goldman Sachs and Morgan Stanley did not experience a significant drop in their price during this time, which is a testament to their stability during times of economic uncertainty.

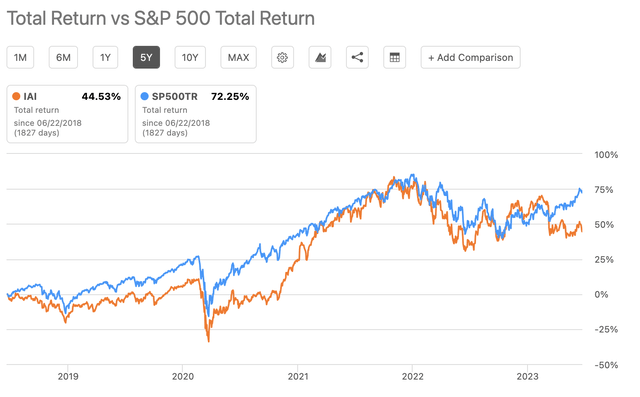

Attractive Liquidity and Dividends

Moreover, with an AUM of $418 million, IAI is one of the largest and most popular funds in its peer group. The fund has an average daily share volume of over 120,000, which is significantly higher than that of its peers, as shown below. With an AUM of $329 million, KBWP is the closest peer to IAI in terms of AUM, but its average daily share volume is several times smaller than that of IAI.

Seeking Alpha

IAI also offers reasonably attractive dividends. The fund currently has a dividend yield of 2.12% with a four-year average yield of 1.71%, which is very comparable to its peers. The fund’s dividend rate of $1.87 is also the largest among its peers. However, what stands out the most to me is the fund’s dividend growth rate in the long term. The fund’s three-year and five-year CAGRs are both 17.50% and 19.19%, respectively, which is substantially higher than all of its peers. Moreover, the fund has experienced nine consecutive years of dividend growth and has consistently paid out dividends for 16 years, whereas the median for all ETFs is only two years. The fund’s dividends and dividend growth provide a certain level of stability for investors who may not entirely rely on consistent capital appreciation.

Seeking Alpha

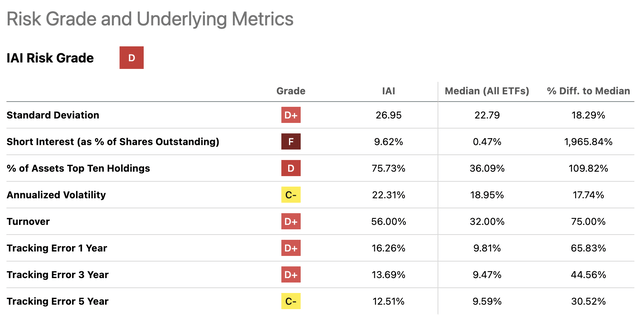

High Concentration Risk and Turnover

Seeking Alpha assigns IAI a risk grade of D, and many of its underlying metrics fall within the F to C- range as well. This may be due to the fund’s high concentration risk, as it allocates over 75% of its portfolio to the top 10 holdings. Furthermore, the fund has an extremely high turnover rate of 56%, which is slightly less than double that of the median of all ETFs. This implies that the fund could possibly be using a more active management approach, where the fund’s managers might be consistently trading securities within the fund to maximize its performance against the broader market. This strategy is logical given the recent collapse of several banks, which could encourage the fund’s managers to decrease their holdings in riskier banks and safeguard against the possible downfall of other banks.

Seeking Alpha

Interest Rates Hikes On Brokerages

The Federal Reserve’s interest rate hikes should present favorable opportunities for the brokerage industry. Brokerages often experience heightened trading activity when the economy improves in higher interest rate environments. While this can also lead to increased market volatility as higher interest rates impact the cost of borrowing and subsequently companies’ cash flows, IAI does not necessarily report an annualized volatility of 22%, which is not exceptionally high compared to the median of all ETFs at 19%. While the Fed announced an interest rate pause in June, it is likely that interest rates will continue to rise in the upcoming months. While the economy has come a long way, reducing the inflation rate by over half since its peak of 9.1% in June 2022, Federal Reserve Chair Jerome Powell announced that interest rates would still increase at a more moderate pace.

Conclusion

Overall, IAI invests in U.S. financial services firms, with a heavy focus on broker-dealers and securities exchanges. Most notably, two holdings, Morgan Stanley and Goldman Sachs, dominate this fund’s portfolio with a collective weighting of over 40%. These two stocks have performed exceptionally well in the past few years, representing the primary drivers of growth for the fund. While IAI has demonstrated slow growth throughout the past five years, its performance has remained stable, demonstrating resilience in 2022 despite facing significant macroeconomic challenges. Moreover, the fund offers attractive dividends, and its consistent dividend payouts and dividend growth rate add another layer of stability to the fund. Ultimately, in light of a rising interest rate environment and anticipated further hikes, I rate IAI a Buy.

Read the full article here