Often the reaction to an event is more important than the event itself. This is the manner in which I view Hindenburg Research’s short report on Carl Icahn’s MLP and why I have waited close to two months to put an article out on it.

The initial price reaction was a move lower, then a bounce and a sideways trade range. Most of the sentiment that I’ve heard is actually bullish as retail investors seem to be using the drop in the unit price as a buying opportunity rather than selling this lower. Along with this, I don’t find Icahn Enterprises’ (NASDAQ:IEP) response to be convincing.

What this tells me is that the market seems to be ignoring many of the negative aspects of this report and are instead buying as a yield play. I think that the overly positive sentiment will likely dissipate over time as the units will get more diluted or the distributions will get cut completely causing a dividend trap. Either way, the picture seems gloomy unless the performance is stellar over the next few years.

My Independent Take On IEP Prior To Hindenburg’s Report

Before jumping into Hindenburg’s report, I’d like to go over my view independent of what Hindenburg put out.

Prior to Hindenburg’s report coming out, I was somewhat familiar with IEP, but I didn’t know about many of the nuanced issues such as Carl Icahn’s margin loan.

I had an overall bearish take on IEP but didn’t have as high of a conviction as I have now.

The main thing that stood out to me when I looked at IEP prior to Hindenburg’s report is the high yield. When one sees a yield like that they have to ask themselves why there would be such a high-yield investment vehicle with such a well-known investor. On top of that unless Carl Icahn’s portfolio companies were providing enough dividends there was always the question of how IEP can continue to pay out a high yield. In fact, other contributors like DT Analysis on Seeking Alpha had pointed to this issue before, so it wasn’t as if no one knew about how IEP was diluting to pay distributions.

The reason I and likely many others weren’t as bearish as were currently are is the following three reasons:

1. Betting on the GOAT, not the portfolio companies

2. No price action-reaction to issues

3. Hard to forecast future performance

The first point is that buying into IEP isn’t a bet on the conglomerate itself, but is rather a bet on the celebrity investor Carl Icahn. For example, if you ask someone why they might buy into Berkshire Hathaway (BRK.A), their answer is likely that they think that Buffett and Munger are great investors and it is a vehicle to bet on them. Similarly, many use IEP as a vehicle to bet on Carl Icahn, who is seen as the GOAT(greatest of all time) activist investor. Because of this even if a fundamental analysis of IEP showed up bearish, investors would still buy IEP as it isn’t a bet on the fundamentals of the companies they own, but rather is a bet on Carl Icahn. Because of this even if we knew about the structural issue at play it was hard to short IEP as most market participants weren’t looking at it from a purely fundamental viewpoint.

The second big issue is the price action. For years IEP traded in a sideways trade range even with the dilution that was happening. This can be seen in the chart below:

IEP Price Return (Seeking Alpha)

Source

As can be seen on the above chart from 2020 till just two months back IEP traded sideways in a tight narrow range, which is at the 25% drawdown line. This means that even with all the dilution that was happening the price action didn’t budge. In hindsight, this is likely because Carl Icahn was taking distributions through new units, so he was able to support the price. So if you shorted in 2020 with the thesis that IEP was diluting too much to pay a yield even though they were unprofitable you would’ve had three years of negative returns as the price didn’t move lower and the carrying cost of shorting IEP was high due to the high yield. This is one of the reasons why I previously didn’t like the idea of shorting IEP even though I was bearish.

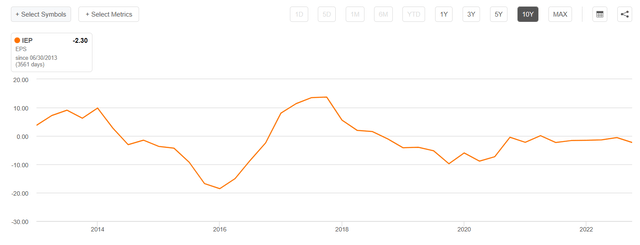

The third reason why I previously wasn’t as bearish or with the high conviction that I now am is that performance was hard to forecast. Below is a chart showing EPS over the last 10 years:

IEP EPS (Seeking Alpha )

Source

As can be seen above for most of the last decade IEP had a negative EPS. Early on this was due to the drop in prices of many of the commodity-related stocks they own due to the commodity bear market from 2014-2016, but after 2018 the underperformance was due to bets that Icahn made against the market which didn’t work out well due to a multi-year bull market after 2018(with the brief exception of March 2020). This has caused bad performance in recent years.

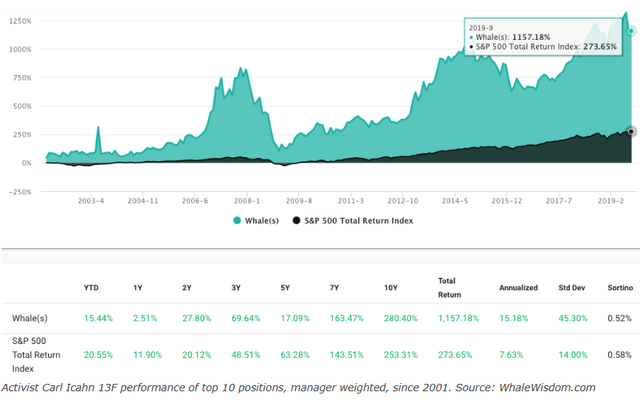

With that said though, over the decades Icahn has generated alpha especially through his activist investing. Whale Wisdom Alpha backtested the 13Fs of Icahn Enterprises and determined that Icahn made a 15%+ CAGR since 2001.

IEP Returns Relative to SPX Total Returns (Whale Wisdom Alpha)

Source

Above is Icahn’s performance compared with the S&P 500 total return.

This is why I say that performance is hard to forecast since Icahn has performed well over the long run, but over the last decade has run into a rough patch. By shorting IEP one is taking the risk that Icahn will once again start to outperform the market in which case it could become a massive headwind to shorts, as the market might ignore the issues at hand like trading above NAV due to good portfolio performance.

The above reasons are why I was bearish prior to Hindenburg’s report, but still cautious as I understood that various issues like trading above NAV or an unsustainable dividend might be ignored by the market for a long period of time, as it already was for the previous three years.

Now though, I’m a high-conviction bear, whereas before I was bearish but with more caution. One of the big things that the Hindenburg report did was that it let the cat out of the bag for shareholders who weren’t aware of the model that IEP was run with. Even for those who did know about many of the issues, the report by Hindenburg allowed them to say the quiet part out loud without the kind of backlash they might have previously faced. For example, well-known investors like Bill Ackman are now calling out Carl Icahn, comparing IEP to what happened to Archegos. Along with this, the price action has decidedly broken bearish after three years of sideways trading and the market is pricing in no distributions. For all these reasons I think that the release of Hindenburg’s report is the straw that broke the camel’s back, in that, I and other market participants were already aware of many of the issues, but now that a well-known activist short-seller is coming out to say this it provides a lot more credibility and credence to the bearish thesis and forces Carl Icahn to take these issues more seriously as investors put more pressure on him.

Hindenburg’s Accusations

Hindenburg’s report is very long, so I’ll sum up the main points and discuss the nuances and whether I agree with them.

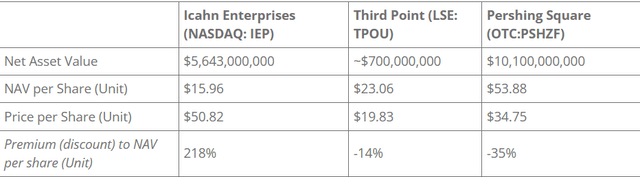

Our research has found that IEP units are inflated by 75%+ due to 3 key reasons: (1) IEP trades at a 218% premium to its last reported net asset value (NAV), vastly higher than all comparables (2) we’ve uncovered clear evidence of inflated valuation marks for IEP’s less liquid and private assets (3) the company has suffered additional performance losses year to date following its last disclosure.

I absolutely agree with the first point about NAV premium as this is actually the biggest issue for unitholders. The NAV of IEP is around $15 while the units trade at a far higher value. Normally units in an MLP trade at or below NAV. The argument for an MLP like this trading above NAV is that Carl Icahn is a famous manager, so investors will pay up for his MLP units. While on one hand this might be true there are two issues here at play. The first is that the fund simply hasn’t performed well over the last decade when looking at its underlying businesses’ earnings and growth in valuation or lack thereof. The second is a simple mathematical issue, which is that if a fund was trading for above NAV then the fund manager should issue new units at a premium to then buy into more of their portfolio companies’ stocks, which is an absolute no-brainer as it’s a pure arbitrage; this hasn’t happened with the IEP public float.

While it is true that there have been units issued as Carl Icahn takes his distributions through units rather than cash, there hasn’t been a mass dilution of the publicly traded float(units not owned by Carl Icahn); the public float is what really matters as that is what sets the price per unit in the market. In fact, there has actually recently been a $500 million stock buyback program in place over the last two months. With units trading this much above NAV, there is no reason to do a buyback program. Moreover, with Carl Icahn taking his distributions through units, it does bring up the question of why he would take units that are overpriced compared to NAV rather than take cash distributions. My view and also that of Hindenburg is that if Icahn doesn’t take distributions through units, the market price for his units will crash and likely trigger a margin call.

Along with these two reasons for not trading at a premium, there is an argument that these units should trade at a discount. The first argument is that there is a key-man risk when investing in an MLP that is solely controlled by one individual that could make the wrong capital allocation decisions. The second is that funds have fees, which aren’t usually justified as most active managers underperform the market, so units should be going for a discount to account for these fees rather than a premium; the big key thing to take into account regarding fees is that it seems, at least according to Icahn Enterprises, that they don’t have any fees.

To be clear, Mr. Icahn receives no fees, salary or any other compensation from IEP.

This did beg a different question for me, which is why would anyone run a fund if they get no compensation for it? It is likely that Carl Icahn’s main incentive for this fund is that he can use his investors’ capital to exert greater influence over management teams, which might not be possible with just his own capital.

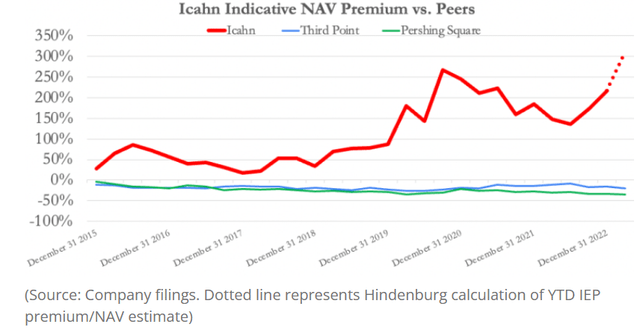

In comparison to other funds, Hindenburg does say trading at a premium is not the norm:

Most closed-end holding companies trade around or at a discount to their NAVs. For comparison, vehicles run by other star managers, like Dan Loeb’s Third Point and Bill Ackman’s Pershing Square, trade at discounts of 14% and 35% to NAV, respectively.

We further compared IEP to all 526 U.S.-based closed end funds (CEFS) in Bloomberg’s database. Icahn Enterprises’ premium to NAV was higher than all of them and more than double the next highest we found.

Hindenburg Research

Hindenburg Research

Source

In my view, the answer to the premium is the high yield, which I find to be unsustainable. In my view, a distribution is sustainable if the companies that an MLP owns are paying out large dividends. In this case though, the distributions that IEP is paying out are nowhere close to the dividends it receives from its portfolio companies.

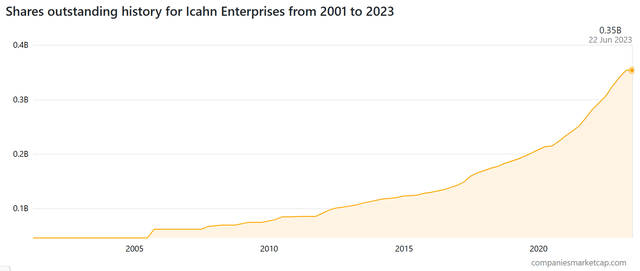

companiesmarketcap.com

Source

Above is the outstanding unit count for IEP. As can be seen, the units are exponentially growing, as this is the only way for the firm to consistently pay its unitholders a consistent yield.

These two issues of trading well above the NAV and paying out unsustainable distributions are the biggest issues, although I would encourage everyone to read the Hindenburg Research report for various other issues they see such as Carl Icahn’s personal margin loans against IEP units, how NAV is being calculated etc.

The Reaction

The most interesting area of this was the reaction or lack thereof. I’ve provided a Seeking Alpha link to the full response. I largely found it to be a word salad without anything actionable. For example, if Icahn Enterprises truly felt that the report was untruthful then they could sue Hindenburg Research for commercial defamation and libel, and the SEC could’ve gone after Hindenburg Research for Short and Distort, which is the opposite of a pump and dump, where shares are shorted and bad news is put out to crash the underlying asset price. No action like this was taken by Icahn Enterprises or any regulatory agency. What was also noticeable was that it took 8 days for Icahn Enterprises to respond, which I believe goes to show that they were caught flat-footed.

There are even some parts of IEP’s response that agree with Hindenburg, such as the following where Icahn Enterprises admits that their portfolio hasn’t been performing well due to bets against the market:

In more recent years the performance of our investment segment has been lower than our historical averages. A key detractor has been our bearish view of the market, causing us to have a large net short position. We recently have taken steps to reduce the short positions in our hedge book and concentrate for the most part on activism, which has served us so well in the past. We believe our existing portfolio has considerable upside potential over the coming years

All in all, in my view the belated response from Icahn Enterprises doesn’t provide much pushback against the claims made by Hindenburg.

Another aspect is the market reaction. After the unit price went lower it had a large retracement higher and the sentiment among many retail investors seems to be that this is a great bargain to be able to invest alongside a celebrity investor and make a high yield, while they are seemly unphased by the chance that the distributions get cut or that there is even further dilution.

What Does The Market Maker Know That We Don’t?

When looking through potential trade ideas on IEP I looked at the options market. What I noticed really surprised me at first, but then I figured market makers already knew that distributions are very likely to get cut so this isn’t all out of the ordinary.

What I saw was that the ATM calls and ATM puts on a far-dated expiration were priced the same. What we would expect to see is that the puts would be priced higher than the calls due to the distributions that are expected to be paid. Instead, market makers have priced this as if IEP won’t pay any distributions over the next two years.

I view this as “smart money” knowing that a distribution cut is coming. This also brings a very interesting arbitrage trade if the expectation of a distribution cut by the options market is wrong.

How To Trade This

The clear view here is that IEP is likely to go lower due to trading well above NAV, constant dilution, and the likelihood of a distribution cut. Because of this, the clearest way to express this would be to short IEP units directly.

The biggest downside of directly shorting is the deep negative carry due to the high distribution yield and cost of borrowing the units to sell short. The current cost of borrowing to short is 10% on interactive brokers. On top of this IEP has a trailing yield of 29%. Since short sellers have to pay both distributions and the borrowing cost, this all adds up to 39%, which is a very high carrying cost to short, which is why I prefer other alternatives which are highlighted below.

Since the options market is already pricing in a cut, an alternative that would work better would be to sell a call and buy a put for a net zero premium being paid out; this is essentially a short forward contract on the unit price without the worry of the negative carry of shorting.

Long Sum Of The Parts & Short IEP Units

Another way to play this is to arbitrage the difference between the assets held in the MLP and the unit price itself.

This would involve buying all the stocks that Icahn Enterprises owns in proportion to its percentage of the NAV and shorting the units.

The stocks and a few other positions like warrants that IEP owns can be found on the 13-F. Keep in mind that some of these positions are illiquid assets or OTC and there is also debt on the holding company, so a perfect arbitrage isn’t possible.

Long Bonds & Short Units

Another way to express a bearish view is long bonds and short units. In this trade in the worst case downside scenario, both get wiped out. The real risk in this kind of trade is that the units make a higher return than the yield to maturity on the bonds.

Currently, the 2026 bonds are yielding 10.2%. Other bonds with different maturities are yielding 9%-10%. If one’s view is that the unit prices will not rise by more than 10.2% then this is a good trade. Whilst my view is that the price of the units will go down I still think that the bonds will be paid back with little chance of default, so this offers a great long/short trade on both sides.

Risk-Free Collar

Likely the best trade from the risk/reward perspective is a long collar. Under this trade the 100 units can be bought; a call sold and a put bought, at the same expiration and same strike price.

For example, if IEP is at $25, then a hundred units are bought; a call is sold a year out at a $25 strike for $6; a put is bought a year out at a $25 strike for $6.

What this trade does is it removes any price swings from impacting the price by leaving it at a value of $25, and it can be costless if the put is bought for the same price the call is sold.

Then if the units continue to provide distributions then those can be collected with no risk.

The main issue with this trade is liquidity. Most of the far-out options are trading with wide bid-ask spreads so even though the mid-price for the puts and calls is equal it’s hard to get filled in a manner where it is a true risk-free trade due to the spreads that have to be paid.

Takeaway

The biggest takeaway is that IEP continues to be valued above its NAV, which as I said makes no sense from a basic arithmetic perspective, as when a unit trades above NAV it’s best for the manager to dilute it till it gets to NAV to get cash which can be deployed in their portfolio. On top of this, the options market is telling us that the distributions won’t continue, and if they do then more dilution is likely.

Overall in my view, IEP will go a lot lower and this write-up highlighted many potential trades to take advantage of it.

Read the full article here