Following our recent update on the EU Semiconductor sector with a follow-up note on STMicroelectronics (STM), today, we are back to analyze Infineon Technologies AG (OTCQX:IFNNY)(OTCQX:IFNNF). Following a sector de-rating, the company rallied >10% post-Q2 Fiscal Year 2024 results. This was due to a long-awaited cut to Infineon’s outlook and evidence that we have reached the trough of the cycle. As a reminder, our long-standing buy rating was supported by MACRO and MICRO upside. In detail, we emphasized 1) improved fundamentals with support from IoT, 2) a Volume Recovery In H2 2024, and an underperformance compared to the PHLX Semiconductor index.

Q2 Earnings Results

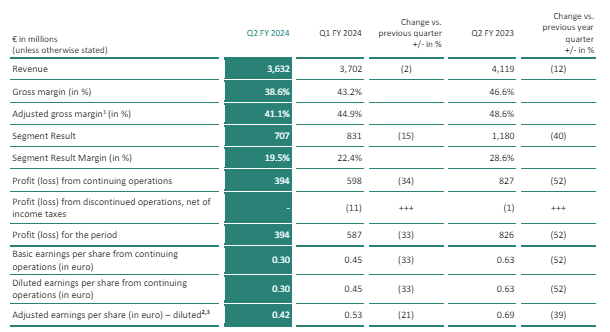

On 07/05/2024, Infineon Technologies AG released its Q2 results. Looking at the recent earnings, the company delivered (Fig 2):

- Top line sales of €3.63 billion, signing a 2% decrease on a quarterly basis and a 12% decrease vs. last year’s results;

- An adjusted gross margin of 41.1% compared to 44.9% achieved in Q2 2023. This was mainly due to Green Industrial Power and Power & Sensor Systems’ lower sales and then decremental utilization rate;

- A better Free Cash Flow generation, which signed positive results of €82 million.

Infineon Technologies Q2 Financials in a Snap

Source: Infineon Technologies Q2 press release – Fig 1

In a nutshell, the company delivered a solid Q2 and reduced its Fiscal Year 2024 guidance. This was expected. Here at the Lab, after having analyzed STM, we believe the sector is derisked. In our view, there is a positive upside to price in.

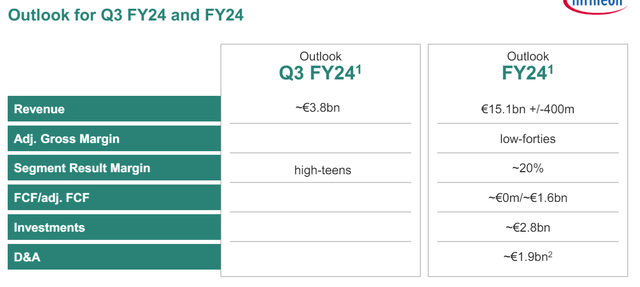

The company now guides sales up by 5% quarterly (Fig 2). Infineon margins will likely remain under pressure, but the company’s order backlog stabilizes, leaving solid visibility of a healthy growth rate in 2025. We also expect a margin expansion into the following year. Looking at this year, the auto revenue represents 50% of the total company’s sales, and we reset our expectation to a low-mid-single digit growth rate. This implies significant destocking activities and EV growth expectation of +10/15%. Here at the Lab, we have a solid knowledge of the automotive segment, and there is a view of a “soft” downcycle in the automotive demand. Still, Infineon might be surprised by the market share gains.

Infineon Technologies guidance

Source: Infineon Technologies Q2 results presentation – Fig 2

Optimistic Takes and Earnings Changes

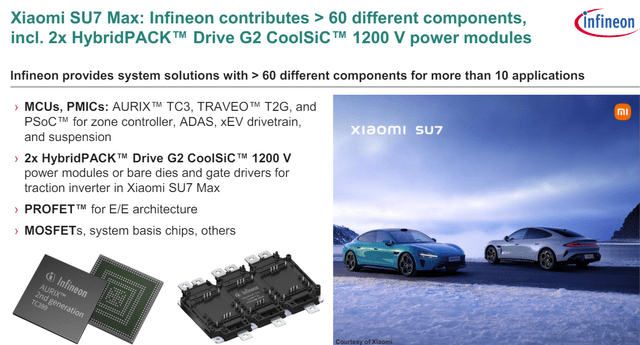

That said, looking at the presentation, we believe the more interesting points in this release are around win progress and AI server design. In addition, a new win from Chinese Auto and a sizeable ‘Step Up’ in the cost-saving program cannot go unnoticed.

Starting with the latter, the company’s management decided to move on with a new cost-cutting. There is an expectation to improve the group segment result between €500 million and €1 billion. According to our calculation, at the midpoint of the guidance, this would imply a 5% higher core operating profit margin expansion. Here at the Lab, we believe this saving program will be materially released in steps. Therefore, we project structural and incremental EBIT margin gains in a visible three-year period. In addition, we positively view the management’s latest decision to optimize the company’s footprint and further work on the company’s cost base to gain gross margin.

On the AI server, we see supportive news reporting that Infineon has won designs with all three major processor companies with its power supply portfolio. Therefore, our projection anticipates a promising evolution in the Infineon power supply segment. This is not related only to 2024; however, we are more constructive to a growth inflection beyond 2025. We anticipate the company will be able to reach €1 billion in Al server sales in our three-year visible period.

Regarding Chinese Automotive, the company confirmed its leadership position and provided more details on Xiaomi’s popular EV. This is a solid demonstration of the company’s leadership in SiC and MCU and a proof of force over local competition. A stable backlog also supports this evidence. Therefore, the company is in a unique position in the Auto segment.

Infineon Technologies win

Looking ahead, the company slightly lowered its adjusted gross margin expenditure, incorporating €800 million of idle costs. This is mainly due to higher fab underutilization. Regarding technical guidance, Infineon expects a lower CAPEX from €2.9 billion to €2.8 billion. The company will complete the first Phase of the Kulim site in Malaysia. In our last adjustment, we lowered 2024 sales and margin to €16.3 billion and €3.8 billion, respectively. This implied an NTM EPS of €2.21. On a long-term assumption, we remain confident about mid-term structural growth drivers. On segments, Automotive is supported by 2025 EU emission targets, EV development, and reaccelerating momentum for plug-ins. In the Green Industrial Power division, we expect an acceleration in silicon carbide. In Connected Secure Systems, the company views IoT demand and smart card products positively, thanks to attractive structural growth trends.

Compared to our last estimates, and taking into account the latest outlook, we arrived at €15.2 billion in sales with a core operating profit of €3.1 billion. We cut our 2024 EPS from €2.21 to €2.03.

Valuation

We see promising guidance and a stronger competitive position. According to the CEO, IoT and communication have reached a plateau but have yet to see a substantial recovery. Artificial Intelligence remains a growth area, with the company commenting that it has won designs with all three major AI processor companies. There is a roadmap to a triple-digit million-euro market.

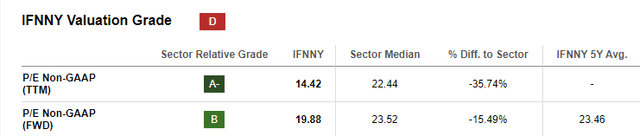

Taking advantage of Seeking Alpha valuation data and continuing to apply a P/E of 20x, in line with the company’s five-year historical average, we derive a 12-month valuation of €40.7 per share. Despite the Q2 results post-rally, the company’s valuation remains attractive. This company has a limited financial position and a solid earnings projection for the next visible period. As we reported in the STM follow-up, US semis peers are currently trading on forward estimates of 25x P/E multiple. This is not justified. An operating profit margin above 20% with a RoIC ten double digits above the WACC deserves a 20x P/E. Our buy rating is confirmed.

Infineon Technologies SA Data Valuation

Risks

Downside risks include 1) exposure to the automotive industry, 2) fluctuations in the semiconductor cycle, 3) fab utilization rate, 4) exchange rate volatility with a strong USD positive for the business, and 5) disruptions risks for new products and this implied potential failure in R&D. This year, there is a negligible free cash flow expectation. In addition, we should also report further client destocking activities due to higher inventory and lower cost optimization rates.

Conclusion

Here at the Lab, we reiterate our buy rating. A backlog normalization, market share win, AI upside, and new cost-cutting support this. Compared to STM, the guidance review was more limited, and we believe the outlook is de-risks. We are not surprised to see a flattish performance at the stock price level on a YTD basis. Still, there is a valuation discrepancy compared to the PHLX Semiconductor index performance.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here