If you take your money out of the bank, where do you put it? This is a common rhetorical question implying the futility of questioning traditional banks. But increasingly there are literal answers that could doom some banks. Here’s one.

AAPL

Apple Inc. (NASDAQ:AAPL) picked the right partners and the right features to set a new standard for depositors. They are working with Mastercard Incorporated (MA) as their global payment network, so this new card is already usable around the globe. Their savings accounts are provided by The Goldman Sachs Group, Inc. (GS), a systemically important bank that will survive forever or at least as long as the United States survives. When interest rates were low, it might not have been worth the bother to switch from one account to another for some trivial net benefit. But today, it is different. You can get it all – much higher yield, greater safety, and at least as much convenient functionality.

Their savings account currently offers a 4.15% APY, over 10x the national average. You can automatically deposit daily cash into this savings account. There are zero annual, late, or other fees. You get 1% cash back anywhere without Apple Pay, 2% cash back with Apple Pay, and 3% cash back from Apple, Uber (UBER), Nike (NKE) stores in the U.S., Walgreens (WBA), T-Mobile (TMUS), Exxon (XOM) and others.

In terms of safety, The Goldman Sachs Bank USA is a member of FDIC, with deposits federally insured up to a quarter of a million dollar balance. In practice, it is unlikely that anyone would lose any money deposited with a globally systemic bank such as Goldman. Short of nuclear war or a crisis of that magnitude, you can expect all of your money to be safe here. That is true of only a small handful of banks.

Historically, there could have been some inconvenience associated with a product that offers an upside of over 4% and virtually no downside. One might have had to handle sweeping cash manually or tradeoff yield versus the practicality of an account that you could use for everyday consumption. But this one is so flexible that it can be used as your primary transactional account. In short, it can replace your bank. Businesses might not be as fast as retail depositors to switch to Apple, but they will want much higher yields than most traditional banks have been offering, and they have greater resources to sweep to money markets or Treasury products. Both will demand rates over 4% as they should.

Will ServisFirst be the next to crash?

Many banks will be unable to survive this kind of competition in the current interest rate environment. Want me to name names? ServisFirst Bancshares, Inc. (SFBS) is down over 30% so far this year but is worth at most half of what it costs today. Their problem starts with their deposits. A year ago their deposits cost them 0.21%, which rose to 0.47% then 1.18% and now 1.94% but will continue to rise. They have a 100% loan to deposit ratio, so they have to pay up to keep deposits. Their net interest margin shrunk from 3.52% to 3.15% last quarter and is going lower. They can only grow with borrowings and high cost deposits. They trade at two times their tangible book value. They should trade at one times at most.

ServisFirst was founded in 2005 and raced to accumulate $15 billion in assets. They are very exposed to commercial lending and construction loans. Their non-interest bearing deposits were down 14% quarter over quarter and should continue to rapidly decline. Borrowings are 11% of assets. At 1.28%, they are inadequately reserved, especially if the economy stumbles and real estate is hit.

Another…

When this banking crisis is over, investors will look back and ask why First Financial Bankshares, Inc. (FFIN) ever traded for over three times tangible book value and eighteen times earnings. They made an all-in bet on residential mortgage-backed securities. If that goes bad, then look out below. It isn’t necessarily a $0 but is probably worth no more than $5-10 per share today. Management is promotional and optimistic. We both expect a 50% move from here but differ on the direction. Their earnings are eroding too fast for it to make sense valuing it on an earnings multiple. It should trade based on its book value. Careful examination of that book results in a valuation in the single digits.

Caveats

While Apple and Goldman are potent partners, there are some limitations to their prospects as dinosaur killers. Their self-description at first appears frictionless, but there is plenty of small print that limits the appeal. The current account offering is capped at $250k. High net worth clients and corporations need to be able to deposit far more. Apple places further restrictions on ACH transfers. Apple Cash transfers are capped at $10k and $20k every seven days. 1% of accounts have 56% of deposits, and that 1% can’t use something with these somewhat childish caps. The other 44% could be Apple customers today, but 56% of deposit balances will require more lenient caps. This is a mass-market product that I highlight because it shows where everyone’s minimum standards should be, not because it is a fit for everyone.

Hundreds of billions of dollars will continue to flow out of banks such as ServisFirst and into too big to fail banks such as Goldman, Bank of America Corporation (BAC), and Wells Fargo & Company (WFC). But these won’t be the only survivors. At the other end of the size spectrum, small community banks with a large number of small insured accounts are also valuable. Many depositors in such banks have $10,000-20,000 checking accounts, get direct deposits, pay their mortgage and car payments, and use their debit cards at ATM machines. These much be non-interest bearing or low interest, but such depositors are not that rate sensitive. So the money won’t all flow to the largest banks. But a lot of it will and when it does, bank stocks such as SFBS that have been cut in half already will be cut in half again.

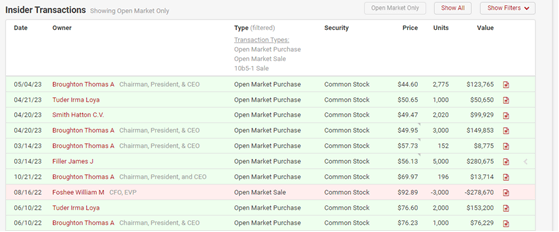

A final caveat: while my strong view is that SFBS is massively overvalued and could be a risky place to keep deposits, management has been buying:

Edgar

Conclusion

Apple reveals what depositors can get. If ServisFirst’s costs of deposits rise substantially, their value will continue to fall. Shares are worth closer to their $24-25 per share tangible book value. Their share prices have been cut in half but need to be cut in half again to reflect deposit flight and the higher cost of remaining deposits. First Financial is my second candidate for the next potential bank run.

TL; DR

Depositors should demand at least 4% yields and can get it from Apple, Treasury Direct, and elsewhere. Some traditional banks such as ServisFirst and First Financial still have a long way to fall if depositors do.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here