Despite a share price gain of 40% in the last twelve months, iShares U.S. Home Construction ETF (BATS:ITB) could be a smart investment option because the long-lasting favorable market dynamics supports its portfolio companies. Nearly 66% of its portfolio is composed of well-established companies from the homebuilding industry while the rest of the portfolio is made up of building products and improvement companies. The well-established companies in the homebuilding industry continue to thrive as robust demand compared to sluggish supply helps them make solid revenue, profit and cash flow growth quarter over quarter. The demand and supply dynamics are unlikely to change in the short to mid-term due to tight investing conditions. Therefore, I initiate ITB’s coverage with a buy rating, with expectations for robust gains in 2024 and beyond.

The Homebuilding Industry is Likely to Thrive

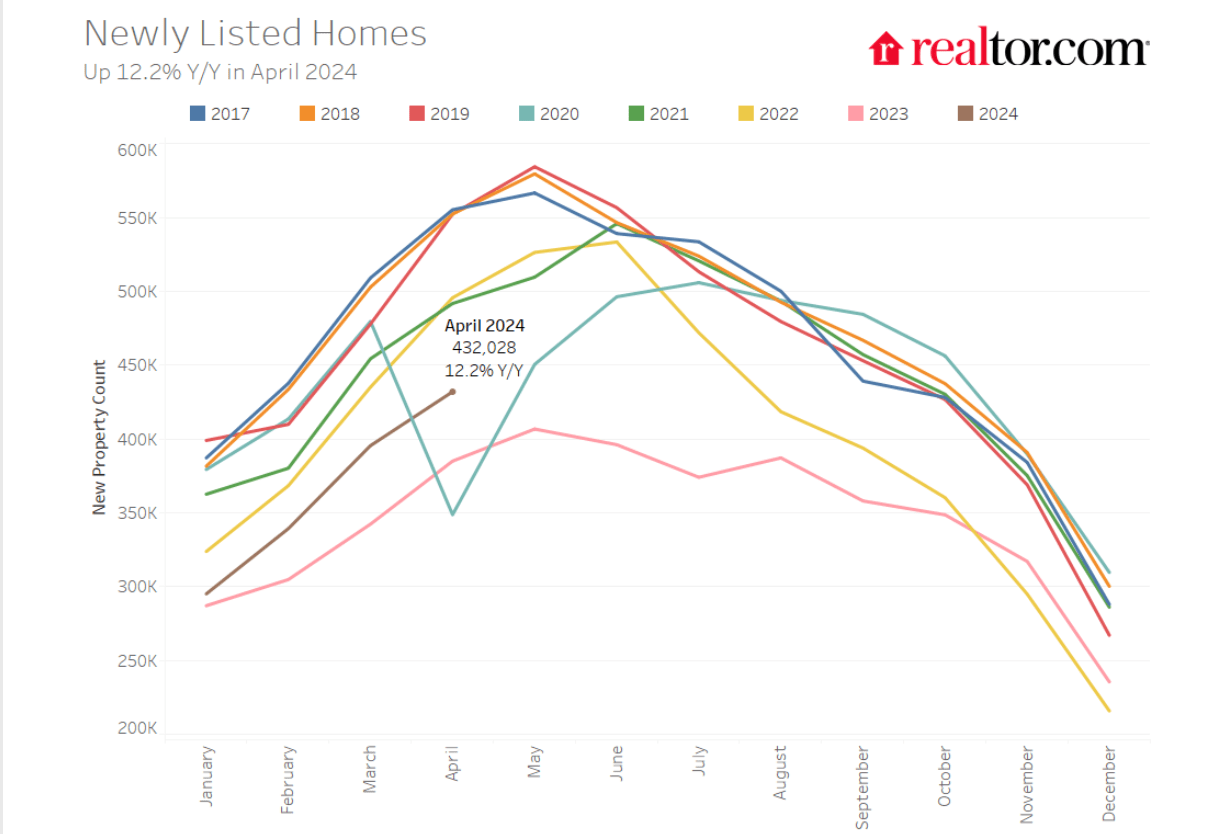

Newly listed homes (realtor.com)

Although an average month of supply recovered from a record low in late 2021 to an average supply of nearly 3.5 months at the end of April 2024, it is still down massively from an average supply of 5 to 6 months to attain equilibrium. Despite a spring season and year over year growth, newly listed homes are down substantially from 2021, 2022 and pre-covid levels. There are numerous reasons for sluggish supply, including high mortgage rates, economic volatility and rising costs. Meanwhile, existing homeowners are still holding up their plans to sell their property due to fear of losing locked-in low rates. As the Fed is likely to hold rates at a higher level for a longer and then gradually decrease them to achieve their objective of sustaining inflation around 2%, the supply-side dynamics are unlikely to change instantly.

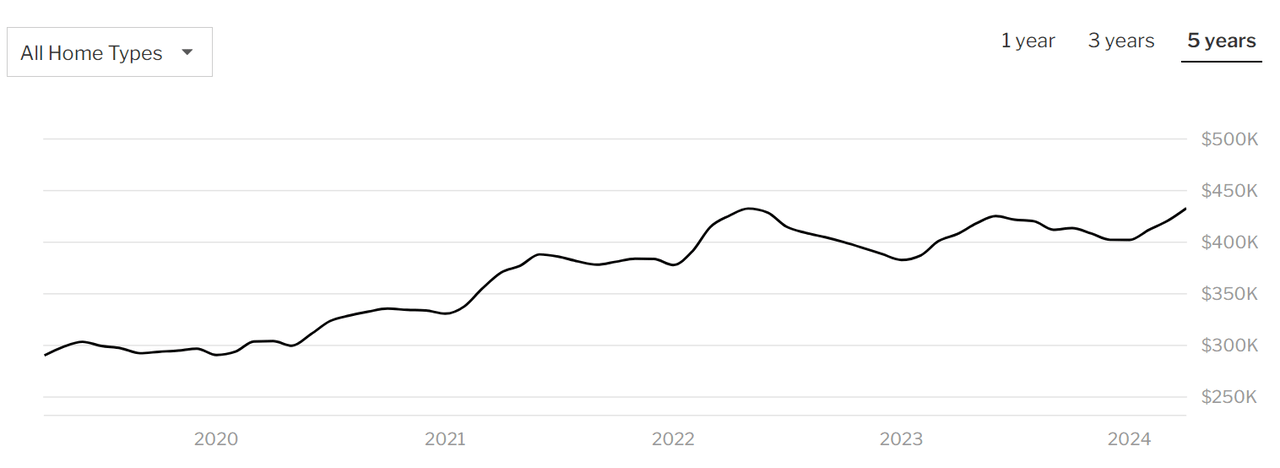

Home prices (redfin.com)

On the other hand, the demand has been outpacing supply significantly despite higher rates and economic uncertainty, which is resulting in a sharp increase in prices. There are a number of reasons for higher demand, including urbanization, increasing migration to the US and a large group of millennials. In addition, the demand from Generation Z is also likely to bolster in the coming years. Overall, the homebuilding market is unlikely to reach an equilibrium sooner given robust demand and headwinds for new and existing homes.

Homebuilding Companies are Benefiting from Favorable Market Dynamics

As demand is outpacing supply and investors and real estate companies are struggling to invest due to high rates and uncertainty, well-established homebuilding companies continue to make billions of dollars in profits and cash flows. For instance, D.R. Horton (DHI), a homebuilding company and the largest stock holding of ITB’s portfolio, reported earnings per share of $3.52 for the second quarter of 2024, beating the consensus estimate of $3.05 by a large percentage and increasing 24% year over year. Its second quarter revenue of $9.11 billion grew 14% from the year-ago period. Moreover, it’s 46% sequential and 14% year over year net sales orders growth also reflects solid demand.

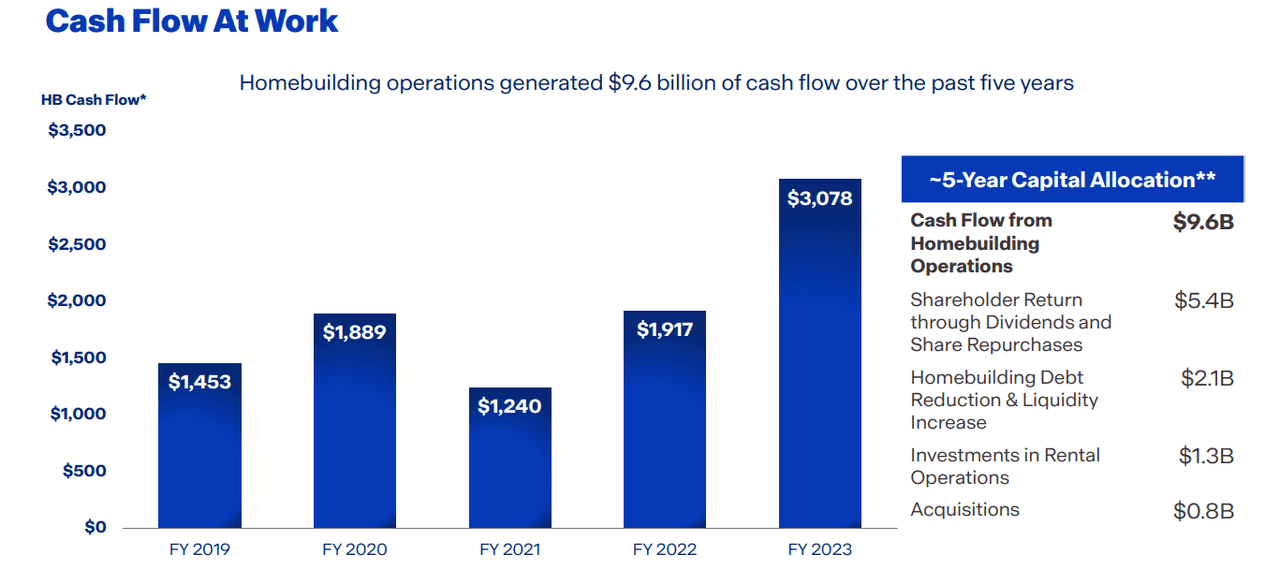

D.R. Horton cash flows (Seeking Alpha)

It returned more than $5.4 billion to shareholders through a combination of dividends and share buybacks. Despite that, the company is sitting on $5 billion in cash on hand, with an expectation for a $3.5 billion increase by the end of 2024. It also has billions of dollars in available undrawn credit facilities. It recently launched a massive $5 billion share repurchase program to return more cash to investors, a strategy which I believe will fuel its share price and earnings per share growth in the quarters ahead. What’s more interesting about homebuilding companies is their low valuations. Although D.R. Horton’s shares outperformed the S&P 500 in the last twelve months, they still appear undervalued. This is because its solid share price gains are fully backed by a robust financial growth outlook. Its shares are currently trading around 9.8 times trailing and 10.17 times forward earnings, down significantly from the broader market index of 24 and 20 times, respectively.

LEN share price (Seeking Alpha)

Lennar Corporation (LEN), the second largest homebuilding company in ITB’s portfolio, continues to impress investors with whopping profits and a rosy outlook. In the March quarter, its earnings per share of $2.57 increased from $2.06 in the year-ago period. Its home sales grew 28% while deliveries increased 23% year-over-year. Lennar now anticipates delivery of 80,000 homes in 2024 due to high demand compared with prior estimates of 73,087.

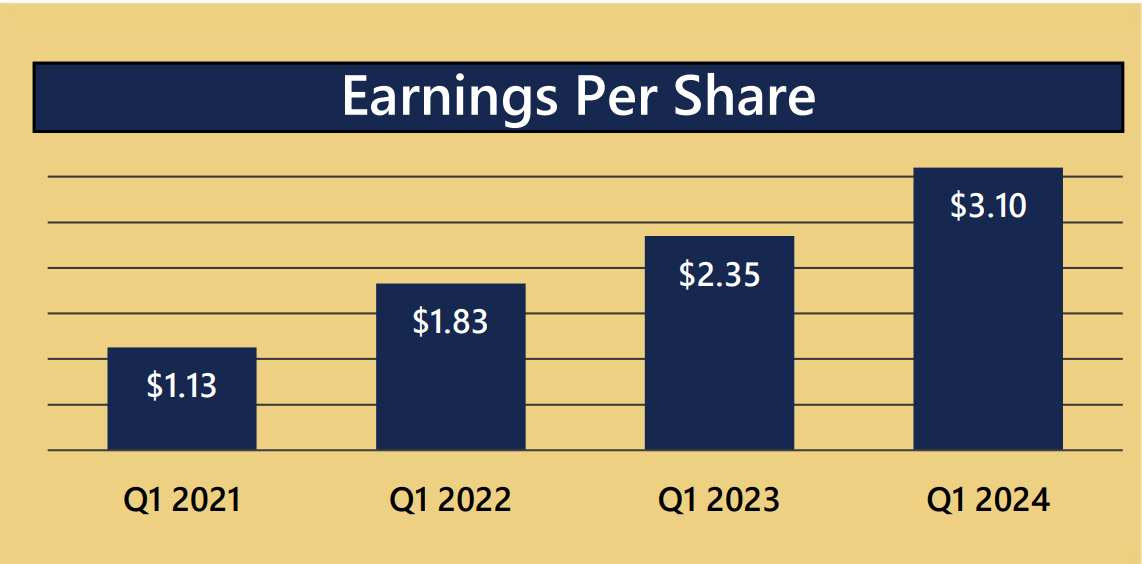

PulteGroup earnings growth (earnings presentation)

Shares of ITB’s third largest stock holding PulteGroup (PHM) saw a whopping 71% increase in the last twelve months, thanks to strong home sales and substantial profits and massive cash flows. Its first-quarter earnings per share of $3.10 marked the quarterly record and topped the consensus estimate of $2.36. Its new sale orders soared 14% year over year, supported by higher gross orders and a lower cancellation rate. Its home sales gross margin of 29.6% was also one of the highest in the industry. In an earnings call, its CEO stated that PulteGroup is well-positioned to capitalize on shortage in the homebuilding industry. Here is what he stated:

“After more than a decade of underbuilding, it is estimated that our country has a structural shortage of several million homes,” added Marshall. “Given PulteGroup’s broad operating platform and deep product portfolio, along with the powerful incentive programs we can offer to help improve the overall affordability equation, we are well positioned to expand our market share while helping to provide much needed new housing stock.”

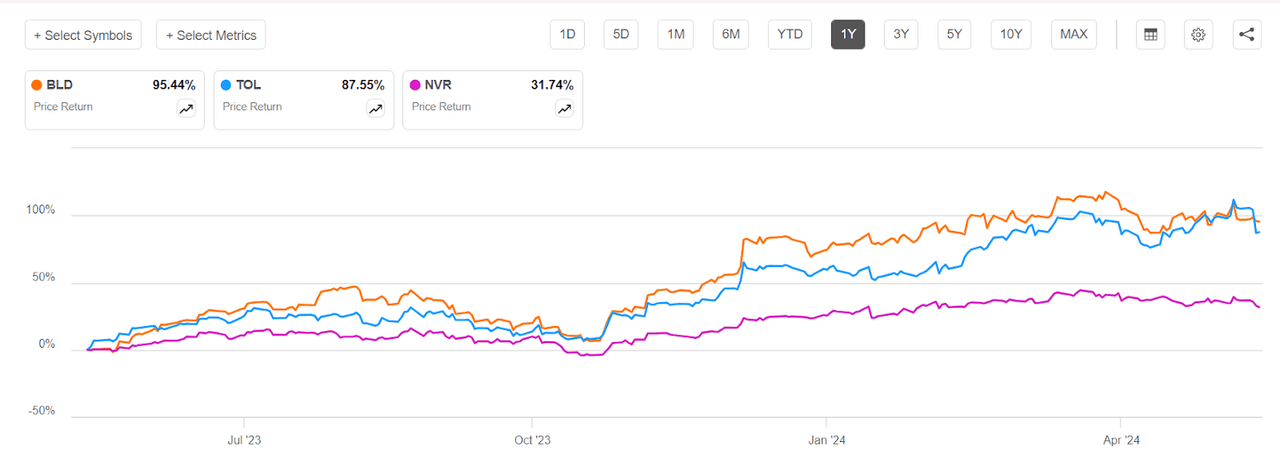

BLD, TOL and NVR share price performance (Seeking Alpha)

The rest of ITB’s top 10 stock holdings from the homebuilding industry also generated spectacular returns for shareholders through share price gains, dividends and share buybacks. Toll Brothers (TOL) and TopBuild Corp (BLD) are among the biggest gainers, with share price gains of 87% and 95%, respectively. However, despite massive gains, their shares are trading within their historical valuation range due to solid financial growth. For instance, Toll Brothers posted second-quarter earnings per share of $4.55 compared to $2.25 in the previous quarter and raised its 2024 deliveries guidance to 10.4K-10.8K units from prior guidance of 10K-10.5K. On the other hand, TopBuild generated 11% earnings growth in the March quarter, raised its 2024 outlook and announced a $1 billion buyback program.

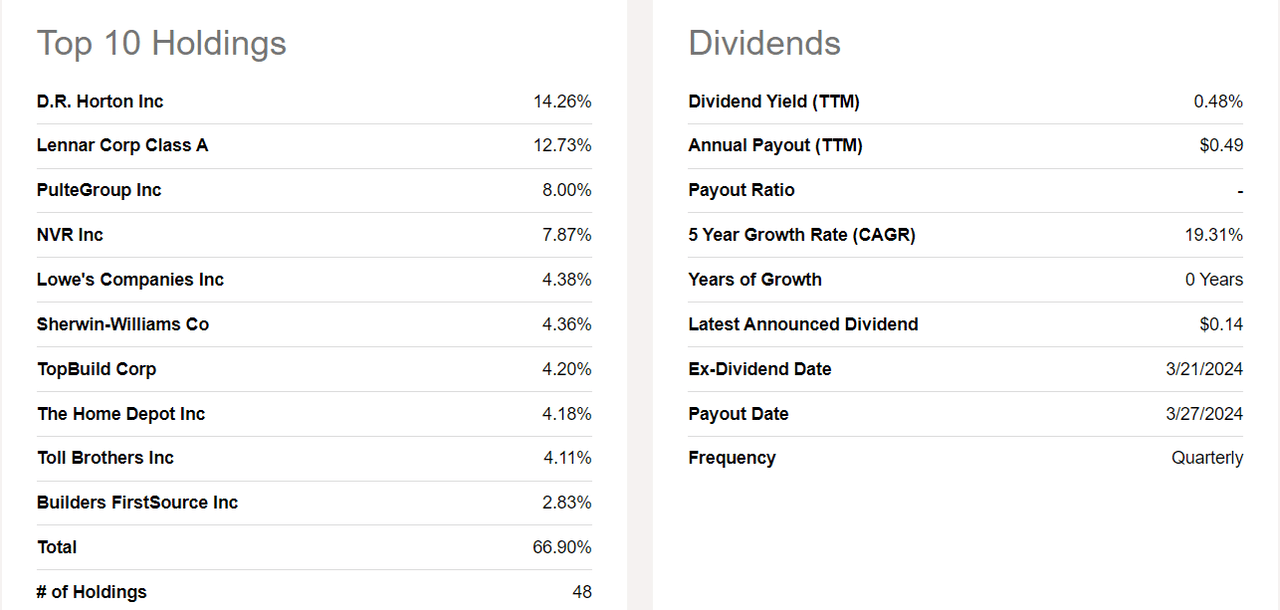

ITB’s Portfolio Holdings and Characteristics

ITB Portfolio holdings and other characteristics (Seeking Alpha)

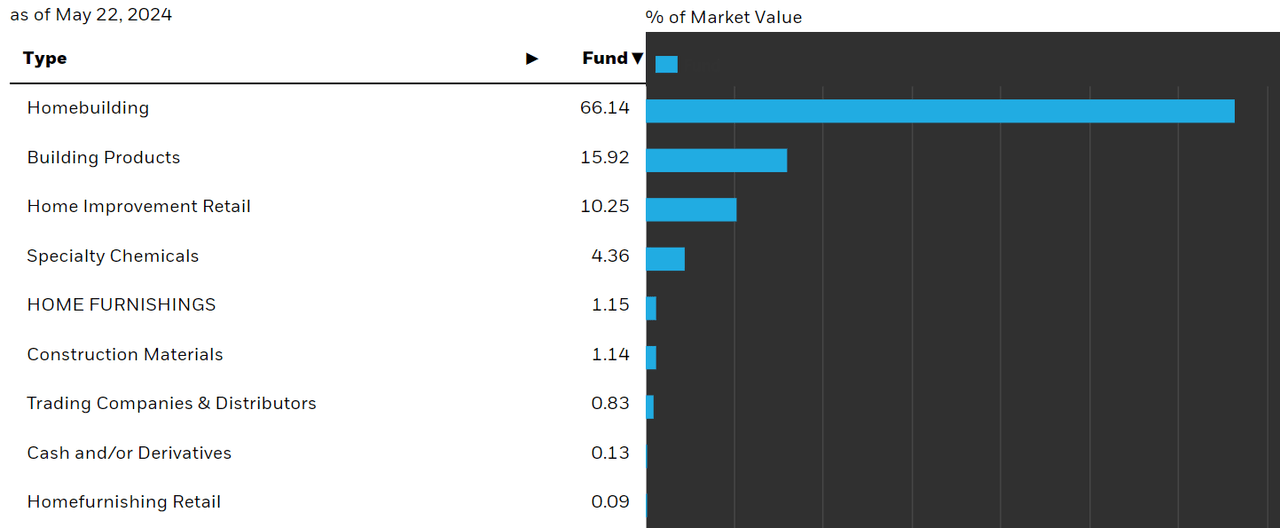

ITB’s portfolio is composed of 48 stocks, with homebuilding stocks accounting for 66% of the overall portfolio. In addition, 6 out of its top 10 holdings belong to the homebuilding industry. Therefore, the ETF’s performance mainly depends on homebuilding stocks, which are thriving as I discussed above. Besides that, its portfolio includes 16% of stocks from the building products industry and 10% from home improvement and 4% from specialty chemicals.

Industry diversification (ishares.com)

However, unlike homebuilding companies, building products and home improvement industries are struggling to generate healthy growth. This is because of sluggish investments from real estate and private investors. Moving forward, the stability in economic trends and potential rate cuts later in 2024, will drive the demand for building and home improvement products. Investor confidence in their future fundamentals is also reflected in their strong share price gains in the last twelve months. ITB’s top building products holdings include Builders FirstSource (BLDR), Lennox International (LII) and Owens Corning (OC). Shares of Builders FirstSource rallied nearly 47% in the last twelve months while Lennox International share price saw a growth of nearly 80%.

Besides portfolio diversification, there are a number of other characteristics that make ITB an interesting play. For instance, despite higher valuations of building products and home improvement holdings, the ETF’s overall price to earnings of 13.60x makes it an interesting option in an overvalued broader stock market. Its lower valuations are attributed to its significant stake in homebuilding companies, which are generating substantial revenue and earnings growth to back their share price upside momentum.

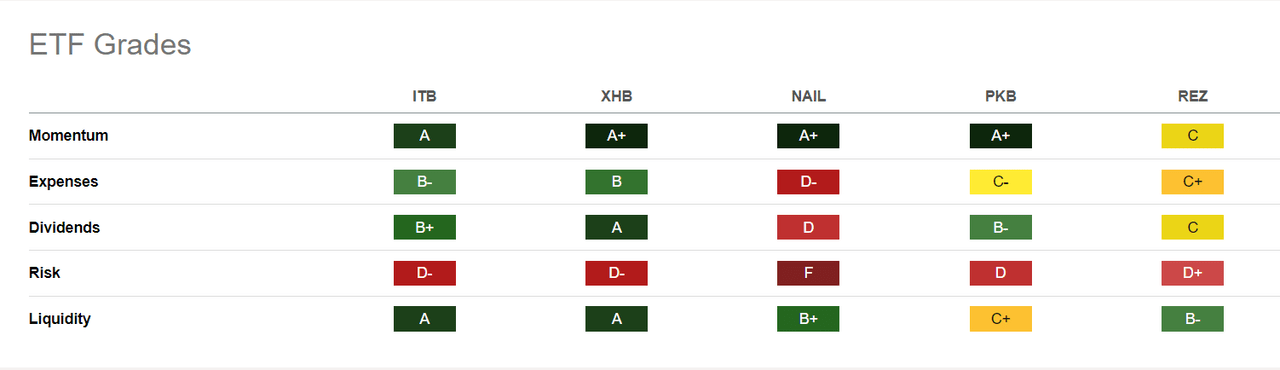

Quant rating (Seeking Alpha)

The ETF also earned a buy rating with a quant score of 4.27. It received higher grades on momentum, liquidity and dividends. Excluding Direxion Daily Homebuilders & Supplies Bull 3X Shares ETF (NAIL), its risk factor is in line with the peers’ average. The risk factor of construction ETFs generally remains high because of their unique industry dynamics and correlation with economic and interest rate policies. Although its beta of 1.37 is high, the fundamental risk with homebuilding companies isn’t significant because of solid demand.

ITB is ranked second in its sub-asset class based on quant ranking, down slightly from top-performing SPDR® S&P Homebuilders ETF (XHB). However, I prefer ITB because of its significant exposure to homebuilding companies. On the other hand, XHB’s 52% of portfolio is concentrated in the building products industry while 48% is made up of homebuilding stocks. Moreover, ITB offers higher liquidity and dividend growth than its peers. Although its expense ratio of 0.40% is slightly higher from XHB’s 35%, it is in line with the industry average.

In Conclusion

Investing in iShares U.S. Home Construction ETF appears like a perfect strategy because of favorable market dynamics for its portfolio holdings. Homebuilding companies are likely to experience robust demand while their massive cash flows would enable them to make more homes and return significant cash to shareholders. Attractive valuations with solid fundamental outlook make them an attractive investment option for investors who missed the recent run.

Read the full article here