Strategy

Launched by BlackRock, Inc. and managed by BlackRock Fund Advisors, the iShares U.S. Financial Services ETF (NYSEARCA:IYG) invests in stocks of companies operating across the US financial services industry. Sub-sectors within this heavily concentrated industry include banks, asset managers, investment banks, consumer finance, specialty finance, investment services, and mortgage finance, among others. IYG invests in growth and value stocks across diverse market capitalizations and seeks to track the performance of the Dow Jones U.S. Financial Services Index by using a representative sampling technique. The index is reconstituted annually and is subject to quarterly reviews.

Holding Analysis

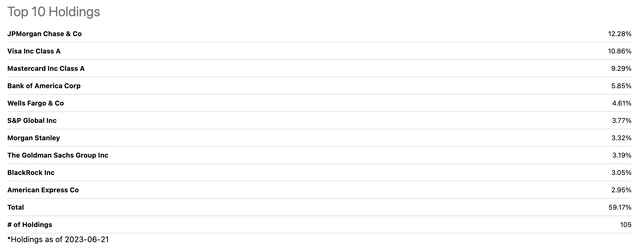

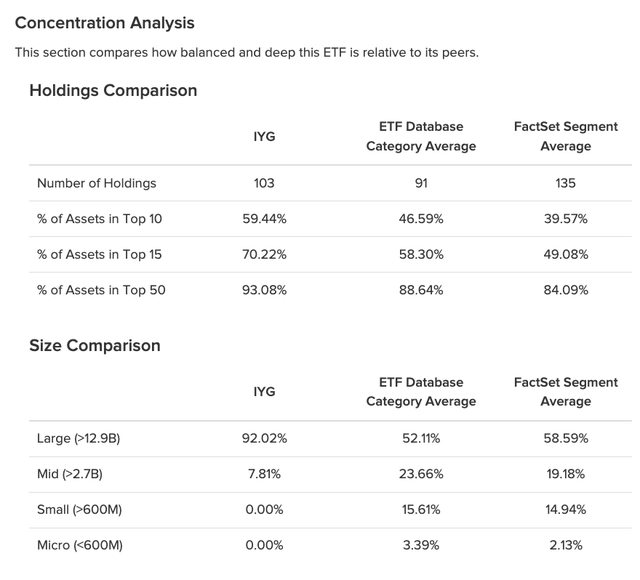

IYG’s portfolio consists of a total of 105 holdings and focuses almost exclusively on large-cap companies across a wide range of sectors within the financial services industry. The fund invests 100% in the US and uses a market-cap weighting strategy to select and weight its holdings. This strategy has led the fund to allocate a substantial weight to its top 10 holdings, nearly 60%. Within the top 10 holdings, the top 3, JPMorgan Chase (JPM), Visa (V), and Mastercard (MA), hold significantly larger weights than the rest of the top 10. These holdings are weighted 12%, 11%, and 9%, respectively, whereas the weights of the rest of the top 10 holdings range between 3% and 5%. Furthermore, IYG allocates 92% of its portfolio to large-cap companies and the remaining 8% to mid-caps.

Seeking Alpha etfdb.com

Systemic Banking Should Remain Stable

Although the failure of Silicon Valley Bank and others may have caused a shock in the US banking and financial services industry, there is no evidence of a systemic banking crisis. Instead, TS Lombard advises investors to treat the collapse of these banks as an opportunity to buy large-cap US bank stocks. Silicon Valley Bank, Signature Bank, and First Republic Bank failed due to aggressive tightening of monetary policy and consistent interest rate hikes. However, larger banks are not at risk from rising interest rates as they typically have a wider variety of services and business sectors that can help protect them from rising interest rates and other market fluctuations. Larger banks also have better access to capital markets, where they have various vehicles to manage their funding.

Moreover, following the fallout of the banks mentioned above, JPMorgan deposits increased by $50 billion. The collapse of Silicon Valley Bank presented JP Morgan with a significant opportunity to win over the VC firms and startups that were originally SVB’s clients. As a result, the banking giant saw a large number of new account openings and deposits. JP Morgan’s CEO, Jamie Dimon, announced that the risk associated with the entire banking sector from SVB’s collapse has been contained and that the issue will not spread to other banks. He also believes that the banking crisis is over.

Interest Rates Continue to Rise

Increases in interest rates by the Federal Reserve should create advantageous opportunities for the financial services industry. When interest rates rise, banks and financial services firms are better positioned to earn more from a greater spread between the interest they pay to their customers and the profits they make from investing. Even though the Federal Reserve decided to hold interest rates steady in June, it’s likely that they’ll continue to climb in the following months. The economy has made significant strides, cutting the inflation rate by more than half from its peak of 9.1% in June 2022. However, the Chair of the Federal Reserve, Jerome Powell, declared that interest rates will continue to rise, albeit at a more moderate pace.

Furthermore, larger banks have lower exposure to commercial real estate loans. Many of these loans are at a great risk of defaulting and expiring, which presents a significant challenge for banks that hold these loans. That being said, smaller banks hold 4.4 times more exposure to these loans than larger banks. Fortunately, IYG’s portfolio contains 92% large-cap stocks and can effectively mitigate this risk.

Favorable Dividends Compared To Peers

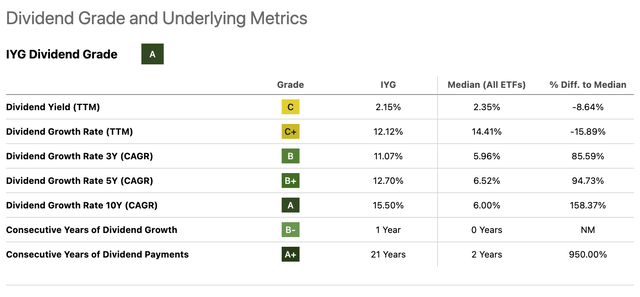

IYG also benefits from an attractive dividend yield. The fund currently has a dividend yield of 2.15%, and this figure compares favorably to the rest of its peers, which have yields within the 2-3% range. Despite this, the fund’s actual dividend rate is $3.27, which is significantly higher than that of the rest of its peers. VFH has the second-highest dividend rate in the group at $1.94, and this is still substantially lower than that of IYG. The fund also has a relatively stable dividend growth rate for the long term. Its CAGRs for 3, 5, and 10 years are currently 11.07%, 12.70%, and 15.50%, respectively. All of these values are more than double that of the median of all ETFs. Most notably, the fund has consistently paid out dividends for 21 years, whereas the median for all ETFs is only 2 years.

Seeking Alpha Seeking Alpha

Weaknesses

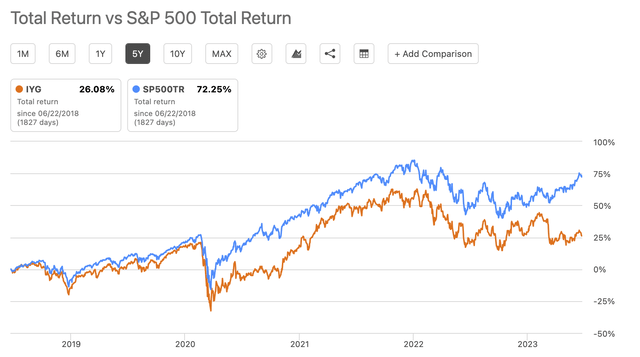

If we look at IYG’s performance in the past 5 years, it is clear that the fund has historically underperformed the S&P 500 in terms of total return. It seems as though IYG was closely following the return of the S&P 500 up until the beginning of 2020 when the pandemic caused a crash in both the S&P 500 and IYG. However, the fund crashed harder than the S&P 500, which caused a large gap in the years following their rebound. As of the past few months, the gap has only become wider. This can mostly be attributed to the banking crisis in March as a result of the fallout of several banks in the US. As of today, IYG’s total return over the past 5 years is only 26%, which is a fraction of the S&P 500’s total return of 72%.

Seeking Alpha

Threats

While the banking crisis may not pose a large threat to large banks in the US, there has been a significant decrease in US bank deposits in the last few months. US banks saw total deposits decline by 2.5% in the first quarter of 2023, and industry-wide profits were relatively lower after the two large bank failures. Moreover, the FDIC announced that there was a whopping $472 billion in deposit outflow in the first quarter of 2023, which is the largest they’ve recorded since 1984. Furthermore, the graph below shows that deposits from all commercial banks were already seeing a steady decline throughout 2022 and into 2023, but it experienced a steep drop in March as a result of the bank failures. While larger banks may be less affected than smaller banks, it still stands as a testament to the overall decline in consumer confidence in the US banking and financial services industries.

FRED

Conclusion

Overall, IYG is a solid choice to capitalize on the recent bank failures, as the fund is heavily weighted towards large-cap banks like JPMorgan Chase and others. These companies typically mitigate risks associated with the banking crisis, and it seems to me that the banking industry should remain relatively stable, at least for large-caps. Not to mention that the financial services industry, as a whole, stands to benefit from a high interest rate environment as well as potential future hikes. Although IYG has historically underperformed the S&P 500, the fund has offered favorable dividends as well as consistent dividend growth. Ultimately, I am bullish on large-cap financial services firms, and I rate IYG a Buy.

Read the full article here