The Janus Henderson AAA CLO ETF (NYSEARCA:JAAA) is a novel ETF offering retail investors access to AAA-rated CLO debt tranches that were once reserved for institutional investors. For investors looking for modest yields from highly rated assets, the JAAA ETF is a solid choice. Just be mindful that in a credit downgrade cycle, total returns could be less than distribution yields as NAV gets marked down when investments are downgraded.

Fund Overview

The Janus Henderson AAA CLO ETF is an ETF that allows retail investors to access the high quality AAA-debt tranches of CLOs that are typically the domain of institutional investors.

The JAAA ETF has $2.7 billion in assets and charges a net expense ratio of 0.22% after fee waivers.

What Are CLOs

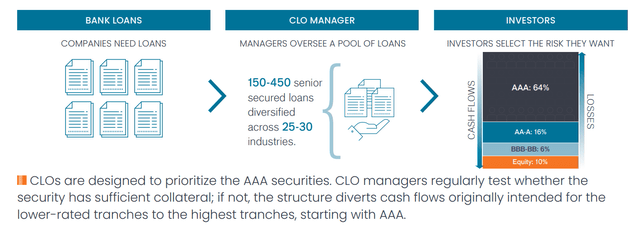

A Collateralized Loan Obligation (“CLO”) is a collection of bank loans that have been packaged, securitized, and tranched (Figure 1). The securitization and tranching allows AAA-rated securities to be synthetically created from underlying loans that may not be AAA themselves.

Figure 1 – CLO overview (janushenderson.com)

The CLO debt tranches (AAA to BB in figure 1 above), are protected from losses by structural enhancements such as overcollateralization and interest diversion. What this means is that cashflows collected from the pool of loans are used to pay interest to the most senior tranches first (AAA downwards in the capital structure), while credit losses, if they occur, are applied to the most junior tranches first (Equity upwards).

The creation of the CLO asset class has dramatically increased the universe of highly rated securities that risk-adverse institutional investors like banks and insurers can invest in, while risk-seeking investors like CLO Equity funds (Oxford Lane Capital for example) can choose to bet on the riskier equity tranches.

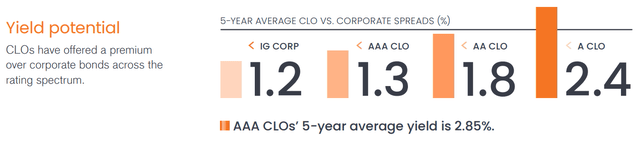

The main benefit of CLOs is that CLO debt tranches offer a yield premium over similarly rated corporate bonds (Figure 2). In an era of zero interest rates, any incremental yield pick-up is greatly desired by investors.

Figure 2 – Main attraction of CLOs is yield pickup (janushenderson.com)

CLO Performed Well Through Trial By Fire

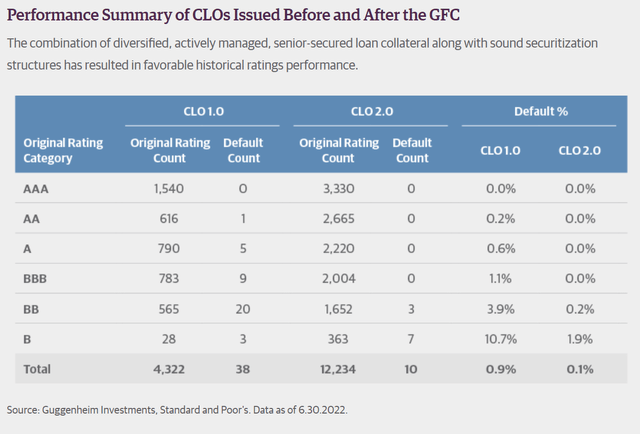

CLO debt tranches have historically delivered strong performance through the combination of diversified, actively managed, senior-secured loan collateral along with the structural enhancements mentioned above.

According to Standard & Poor’s, CLO 1.0s (those issued before the Great Financial Crisis) produced very few lifetime defaults. Out of 1,540 issues originally rated AAA, there were 0 instances of default, while out of 4,322 rated tranches, there were only 38 defaults, or 0.9% (Figure 3).

Figure 3 – CLO performance through time (guggenheiminvestments.com)

Since the Great Financial Crisis (“GFC”), additional structural enhancements (more overcollateralization; exclusion of subordinated bonds and other structured credit investments; shortening of the trading period of the portfolio) have led to even better performance, with only 10 rated tranches out of 12,234 tranches defaulting, or 0.1%, to June 30, 2022.

However, investors should note that the post-GFC period has generally been characterized by central banks injecting trillions of liquidity into the global financial system, so business cycles may have been distorted.

JAAA Portfolio Holdings

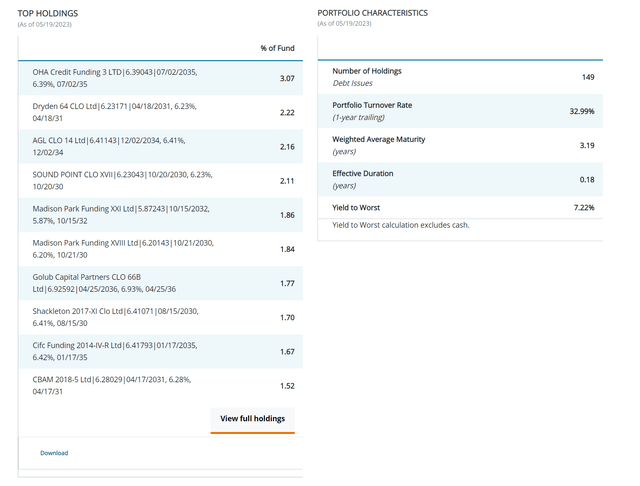

Figure 4 shows some highlights of JAAA’s portfolio. Overall, the JAAA ETF holds 149 investments with a weighted average maturity of 3.2 years and effective duration of 0.2 years (this is because CLOs are floating rate instruments).

Figure 4 – JAAA holdings summary (janushenderson.com)

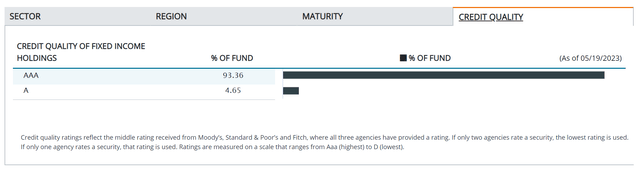

The JAAA ETF, as the name implies, invests almost exclusively in AAA-rated CLO tranches (Figure 5).

Figure 5 – JAAA credit quality allocation (janushenderson.com)

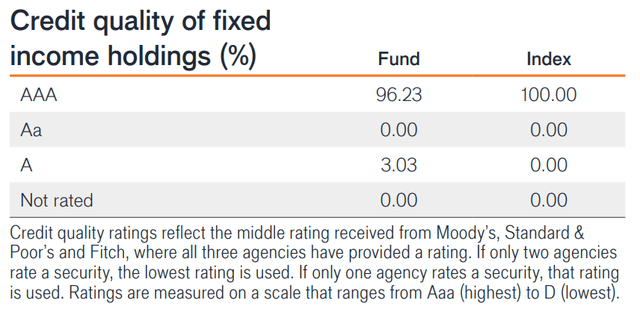

However, it is interesting to note that the fund holds 4.7% of investments rated Single-A as of May 19, 2023. This is an increase from 3.0% from the March 31, 2023 factsheet, perhaps indicating some AAA rated investments have been downgraded by the credit agencies to Single-A in the past 2 months (Figure 6).

Figure 6 – JAAA credit quality allocation as of March 31, 2023 (JAAA factsheet)

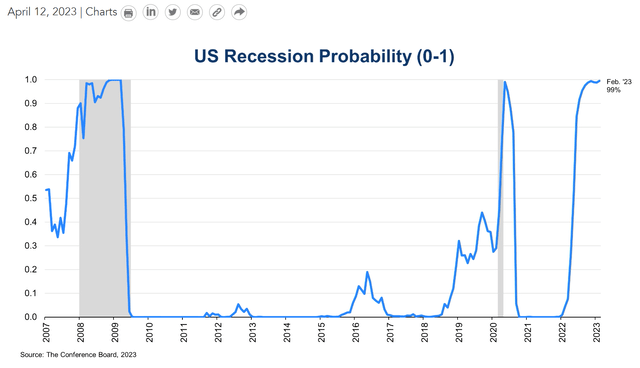

While credit quality in JAAA’s portfolio is still strong, as A-rated securities are expected to pay their financial obligations, the deterioration of JAAA’s portfolio within such a short period of time does highlight potential risks on the horizon if the U.S. economy falls into a widely expected recession (Figure 7).

Figure 7 – High probability of U.S. recession (Conference Board)

Returns Have Been Consistent But Modest

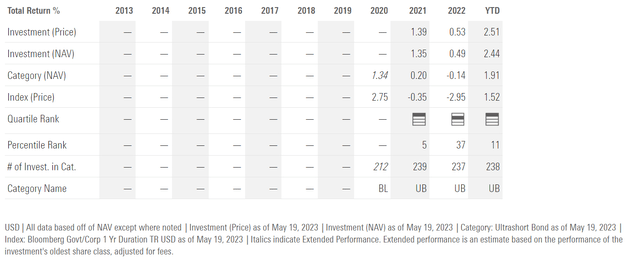

Overall, the JAAA ETF has delivered consistent, if modest total returns, with 1.4% in 2021, 0.5% in 2022, and 2.4% so far in 2023 (Figure 8).

Figure 8 – JAAA annual returns (morningstar.com)

Distribution Increases May Start To Slow Down

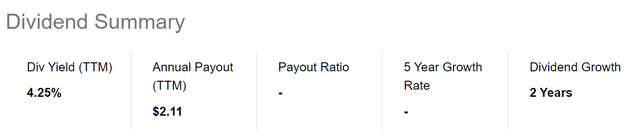

The main attraction of JAAA is its relatively high monthly distribution yield from ‘AAA-rated’ assets. The JAAA ETF has paid a trailing 12 month distribution of $2.11 / share or 4.3% yield (Figure 9).

Figure 9 – JAAA trailing distribution (Seeking Alpha)

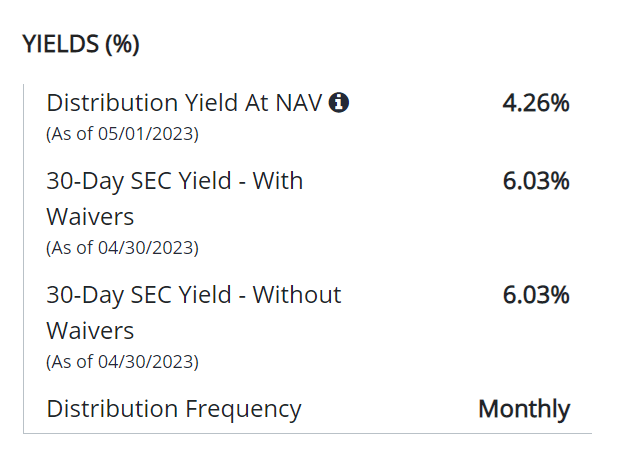

Currently, the fund has a 30-Day SEC yield of 6.0% and the latest monthly distribution annualizes to 6.1% (Figure 10)

Figure 10 – JAAA’s current distribution annualizes to 6.1% (janushenderson.com)

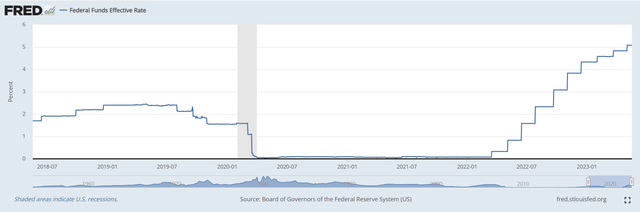

As the Federal Reserve raised short-term interest rates by 500 bps in the past year, floating rate funds like the JAAA ETF have kept pace, increasing their distribution rates (Figure 11).

Figure 11 – Fed Funds rates (St. Louis Fed)

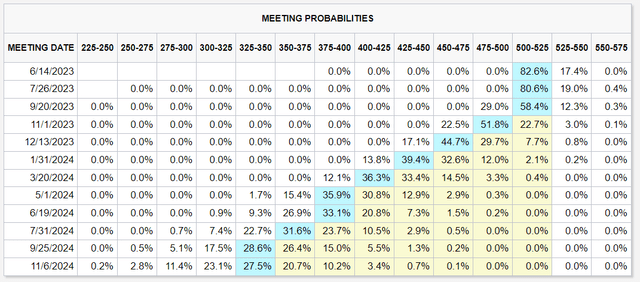

However, as the Fed has indicated it may pause interest rate hikes and/or proceed at a much slower pace in the coming months, the rate of distribution increases for floating rate funds is expected to slow down as well. Currently, the market believes May was the last Fed Funds increase of the current cycle, as traders have only assigned a less than 20% chance of further rate increases at the upcoming FOMC meetings (Figure 12).

Figure 12 – Traders expect no more rate increases (CME)

JAAA vs. USFR

For yield starved conservative investors in an era of Zero-Interest-Rate-Policy (“ZIRP”), high-yielding investment funds like the JAAA ETF was a godsend, as it allowed investors to earn modest yields from ‘AAA’ assets when bank deposits and money market yields were effectively zero.

However, with the Fed’s increase in short-term interest rates to over 5%, there are now alternatives for investors to consider that does not involve the credit risk of holding synthetic AAA-rated assets.

To be clear, I am not doubting the when-issued AAA-rating of CLO assets; however, as we can see from Figure 6 above, when economic conditions deteriorate, credit downgrades of AAA tranches do occur, which could affect the NAV of the JAAA ETF.

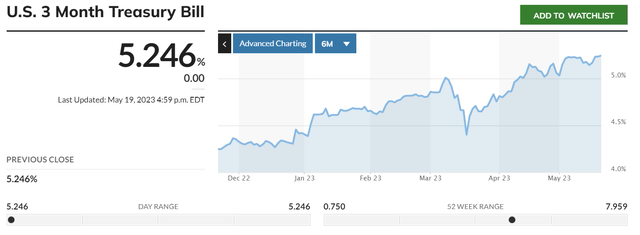

In fact, one can argue that with 3-Month treasury yields at 5.2% currently, the additional credit risk from the JAAA ETF may not be worth it, especially if the U.S. economy falls into recession and more downgrades occur (Figure 13).

Figure 13 – 3 Month treasuries yielding 5.2% (marketwatch.com)

One alternative to the JAAA ETF that I currently hold in my personal portfolio is the WisdomTree Floating Rate Treasury Fund (USFR) that invests in floating rate treasury bonds paying interest based on 3-Month treasury yields. The USFR ETF currently has a 30-Day SEC yield of 5.1% and has an annualized yield of 4.9%. I wrote about the USFR ETF here.

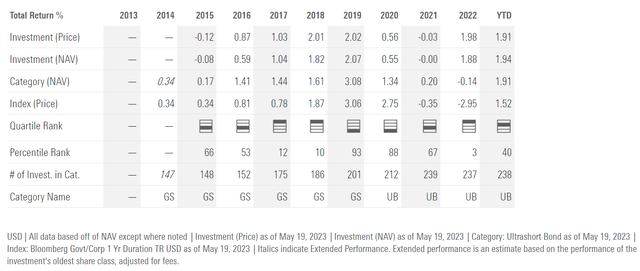

In 2022, the USFR ETF actually had a higher total return compared to JAAA, presumably because USFR has zero credit risk (this fact is debatable given current debt ceiling concerns, but that is a different discussion for another day) (Figure 14).

Figure 14 – USFR annual returns (morningstar.com)

Conclusion

The JAAA ETF is a novel ETF offering retail investors access to AAA-rated CLO debt tranches that were once the domain of institutional investors. When interest rates were held at the zero bound, JAAA offered retail investors a modest yield from highly rated assets. However, as short-term interest rates are now above 5%, that incremental yield pickup may not be worth it for the additional credit risk.

Overall, for investors looking for modest yields from highly rated assets, the JAAA ETF is a solid choice. Just be mindful that in a credit downgrade cycle, total returns could be less than distribution yields as NAV gets marked down when investments are downgraded.

Read the full article here