JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI) remains an attractive investment option for passive income investors with a long-term investment horizon.

The exchange-traded fund has managed to achieve 10%-plus annual returns since its inception and remains an attractive choice in an environment with or without inflation.

One of the most attractive features of the JPMorgan Equity Premium Income ETF is that the exchange-traded fund is well-diversified across a number of cyclical and non-cyclical industries and that it offers passive income investors a monthly distribution. JEPI presently yields 9% and it is a core holding in my passive income portfolio.

My Rating History

In my February article entitled JEPI: Beat Inflation With This 11% Yielding Monthly-Paying ETF I laid out my thinking about the exchange-traded fund, specifically as it related to owning JEPI in a high-inflation environment.

With that being said, though, the ETF’s strong distribution history, defensive orientation and high NAV yield make the JEPI an attractive investment even in a low-interest environment.

The ETF’s Investment Strategy, Diversification, Income And Distribution Potential

The JPMorgan Equity Premium Income ETF is one of the most popular, actively-managed exchange-traded funds in the United States with $30 billion in assets under management.

The ETF invests primarily in equity securities in the large-cap segment, but also generates incremental income from selling options. The purpose of the exchange-traded fund is to produce recurring income from option premiums and stock dividends that are used to pay investors a high distribution that is paid monthly. The JPMorgan Equity Premium Income ETF paid a total distribution of $4.98 in the last twelve months which implies a yield on net asset value of 9.2%.

At its core, the JPMorgan Equity Premium Income ETF is well-diversified across a number of industries, both of cyclical and non-cyclical nature.

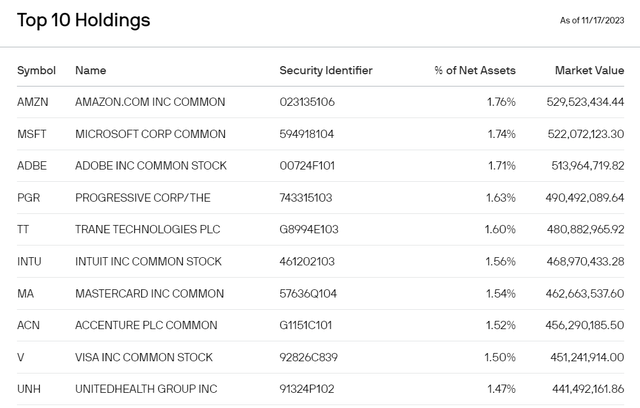

The ETF’s portfolio, to name only a few, includes companies such as Amazon.com Inc. (AMZN), which was also the ETF’s largest portfolio holding, Microsoft Corporation (MSFT), and software company Adobe Inc. (ADBE).

Other top ten names include well-known financial companies like Mastercard Incorporated (MA) and Visa Inc. (V) and insurance company UnitedHealth Group Inc. (UNH). Most of the ETF’s constituents are well-known S&P 500 companies, have defensive business models or are business with moats and considerable earnings potential.

Top 10 Holdings (JPMorgan Equity Premium Income ETF)

Reasonable Fee Structure

I have said it before and I am saying it again: When it comes to investing in funds/ETFs that have active managers, the amount of fees investors pay for management have a huge impact on their realized returns. The higher the fees for the active manager, the lower the return for investors.

Thus, investment funds including ETFs with low expense ratios have a competitive advantage and a strong selling point compared to more expensive funds. The JPMorgan Equity Premium Income ETF has an expense ratio of just 0.35%.

Attractive Long Term Investment Returns For Markets Of A Different Variety

Consistency of returns is a benchmark that any high quality exchange-traded fund must meet in order to appeal to passive income investors. Ideally, such an exchange-traded fund is well-diversified and has a chance of earning reasonable annual returns in market characterized by either low or high interest rates and sluggish or booming economic growth.

With respect to the JPMorgan Equity Premium Income ETF, the exchange-traded fund has delivered attractive double-digit returns since its inception: The ETF returned 10.87% annually since its inception and 9.89% in the last three years. The performance period included the after effects of the Covid-19 pandemic as well as low and high interest rate periods.

Cumulative Returns (JPMorgan Equity Premium Income ETF)

3 Reasons For Passive Income Investors To Buy 9%-Yielding JEPI

There are obviously other reasons to buy an exchange-traded fund than just a high yield, in this case of 9%. The 9% yield is a strong reason to buy the ETF, but not the only one.

Another reason for passive income investors to own JEPI is that the ETF deploys an option writing strategy (it writes out-of-the-money S&P 500 Index call options) which helps the ETF capture additional income with improves JEPI’s overall cash return potential compared to exchange-traded funds that merely pass through dividends from their underlying equity holdings.

A third reason is, in my view, high-yield passive income instruments like the JPMorgan Equity Premium Income ETF should remain attractive investments even in an environment in which inflation recedes. Business development companies, for instance, have portfolios that are geared heavily towards floating-rate securities. Once the central bank stops hiking rates, these companies are set for net investment income headwinds and potentially lower dividends. I don’t expect similar headwinds from the JPMorgan Equity Premium Income ETF as it consists primarily of defensive equity holdings.

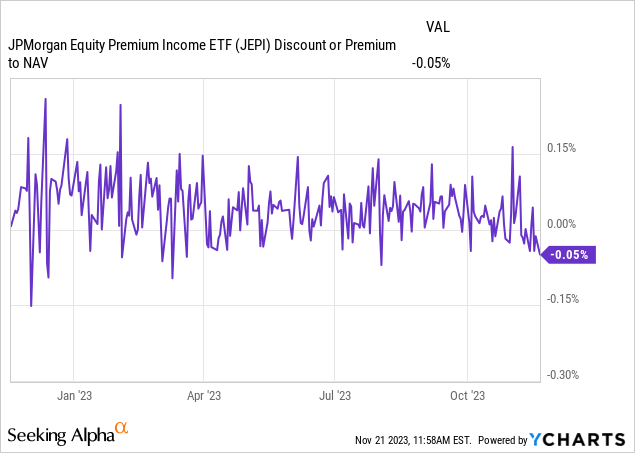

JEPI Trades At Net Asset Value

As an exchange-traded fund, the JPMorgan Equity Premium Income ETF trades at marginal premiums or discounts to net asset value. Presently, there is a discount of 0.05% in the market relative to JEPI’s underlying NAV.

Why JEPI Could Experience Headwinds

The JPMorgan Equity Premium Income ETF has considerable equity exposure and is therefore dependent on the overall performance of the stock market.

Should the U.S. economy wither and slide into a recession, the JPMorgan Equity Premium Income ETF should be expected to rack up a poor performance, but likely only in the short-term.

In the long-term, JPMorgan Equity Premium Income ETF has a solid chance, due to its broad diversification and defensive equity orientation, to participate in the broad growth of the U.S. economy.

My Conclusion

The JPMorgan Equity Premium Income ETF is an attractive addition to a passive income-centered investment portfolio that focuses primarily on equity investments.

I have doubled down on the JPMorgan Equity Premium Income ETF last week, but missed the real lows at the end of October. I think that the ETF’s 9% yield, the attractive long-term return history, its diversification across industries and particularly the monthly distribution frequency are pros that passive income investors will appreciate.

Read the full article here