Overview

I vividly remember being in college and trying to learn how to trade options to create some extra income for myself as a broke college student. I would completely disregard whatever lecture hall I was in because my focus was on the list of YouTube videos I have queued up on how to efficiently deploy option strategies on my tiny portfolio at the time. Times have changed since then and we are currently in one of the best time in modern history to be an investor that prioritizes income. There are so many different income based funds out there now that offer diverse exposure, sizeable yields, include option strategies, and are managed by top tier firms.

JPMorgan’s Nasdaq Equity Premium Income ETF (NASDAQ:JEPQ) is one of these new option based funds that offer the opportunity to collect high income on a monthly basis. The ETF has an objective to generate income through the combination of selling options but also investing in large cap US-based companies. They collect income to be distributed through the use of option premiums and dividends collected from holdings. The strategy here aims to deliver similar returns that are on par with the Nasdaq 100 and to do so with less volatility.

JEPQ is a newer fund with an inception date in mid 2022. The annual expenses for the fund are actually quite reasonable at only 0.35% considering that the fund has a market cap of $13.6B. The current dividend yield sits around 8.8% and distributions are paid out to shareholders on a monthly basis. I believe this fund to be a valuable asset to any dividend enthusiast’s portfolio as you are able to capture instant diversification, get world class management from JPMorgan (JPM), collect distributions on a monthly basis, and still capture upside price appreciation as the fund’s holdings leans more heavily towards tech.

Strategy & Catalyst

Taking a look at the top holdings reveals a diverse batch of holdings across all industries. However, the fund leans more towards tech since it aims to mimic the make up of the Nasdaq. I compiled the top ten holdings and sorted from largest weight below. By holding JEPQ, you are getting exposure to some of the largest and highest quality companies in the world.

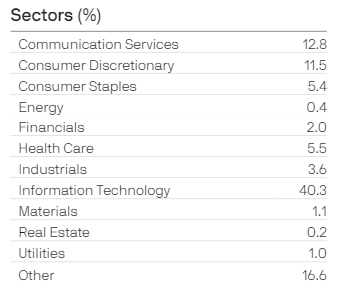

According to the most updated fact sheet, the exposure sits across many different industries. We can see that technology makes up the largest portion of the fund, accounting for 40%. This is followed by consumer services at 12.8% and consumer discretionary at 11.5% of the overall portfolio.

JEPQ Fact Sheet

While having a diversified set of exposure is nice, the main benefits of this fund are a result of the option writing strategy. Funds that rely on option writing to generate income are most useful during times of high volatility and market uncertainty. These option inclusions are sometimes referred to as a covered call strategy. JEPQ collects a premium for the options it writes and during periods of high volatility, the premiums tend to be higher due to uncertainty. The average investor typically views uncertainty as ‘risky’, therefore making the cost of these options higher, which is why JEPQ is able to rake in more income.

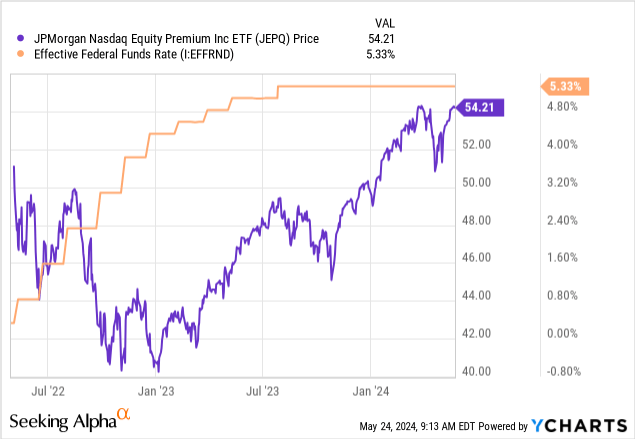

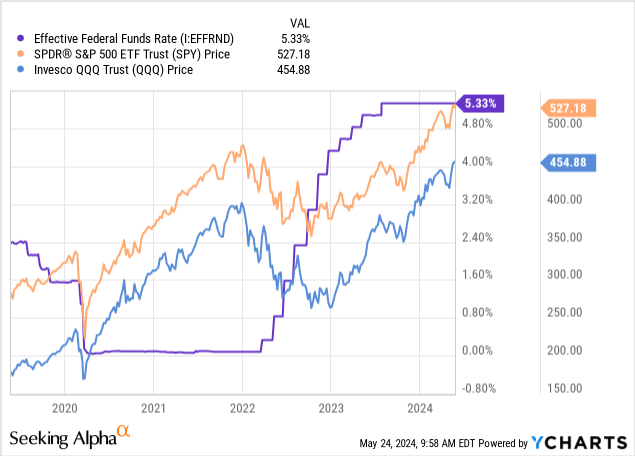

Just to paint a visual of this concept, take a look at how JEPQ performed during a time of rapid interest rate hikes. I’ve covered a ton of business development companies and Closed End Funds in the past quarter that have all reacted negatively to the rising rates. The market perceives this prolonged period of rates as risker as defaults tend to increase, higher costs to service debt slows growth, and borrowing activity slows.

The market sees this as risky but JEPQ has been able to navigate and offset this with their option writing strategy. It’s no coincidence that JEPQ’s dividend yield reached the highest levels ever around the same time that interest rates peaked near the middle of 2023. At that time, the dividend yield of JEPQ sat well above the 12% range. I anticipate a lot more uncertainty to take place over the next 12 months that will continue to contribute to JEPQ’s success.

We first have to consider the ongoing market reactions to talks of interest rate cuts from the Fed. The Fed has decided to keep rates unchanged over the last few meetings as they await more economic data to roll in around inflation and job numbers. As inflation remains higher than expected, we sit in a higher rate environment for longer than usual. While different firms such as Morgan Stanley, believe that rate cuts can happen as soon as September, I think that they may get delayed to 2025. This is because we have the elections in the US starting around November. The combination of these two events will likely cause elevated levels of volatility and uncertainty which are prime conditions for JEPQ to continue providing higher levels of income.

Risk Profile

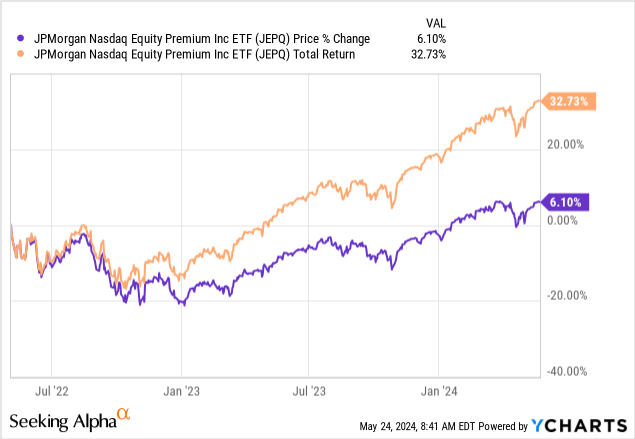

When it comes to these covered call ETF strategies, there are some risks involved. One of the main risks is that you may underperform the greater Nasdaq index in times of strong bull runs. This is because JEPQ uses 5% out of the money calls which essentially caps the upside to 5%. A call option is considered out of the money when the strike price is above the current market price of the underlying asset of the option and in this case, the strike price is strategically set 5% above the current market price. This 5% gap is where JEPQ earns the premium for the option but if the price of the underlying asset goes above this 5% buffer, no additional upside is captured within JEPQ itself.

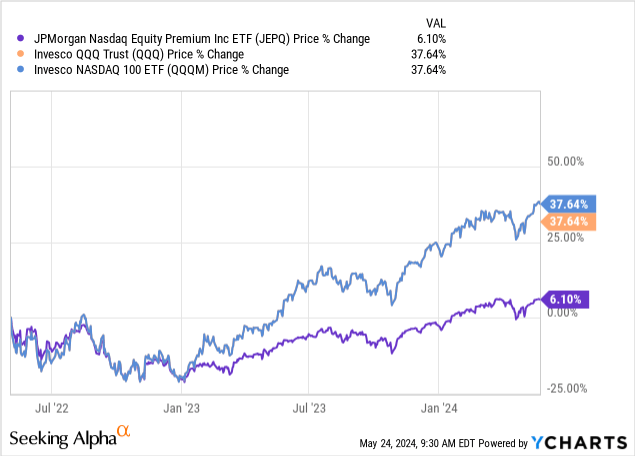

A good demonstration of this would be to compare the price performance of JEPQ against greater indexes like Invesco QQQ Trust (QQQ) or the Nasdaq 100 ETF (QQQM). We can see that JEPQ’s price only moved up in 6% during this time frame, which significantly undercuts the performance of these alternative approaches. Therefore, you have to be willing to understand that you are very likely to be giving up the upside capital appreciation here in order to prioritize the income aspect of JEPQ. If you are looking for capital appreciation, you may need to settle for much less of a yield by choosing one of these more traditional ETFs.

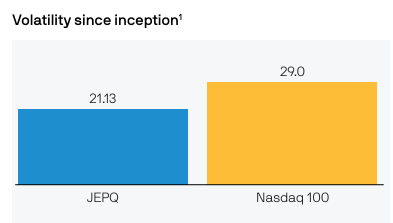

The benefit to offset a lot of this risk is that JEPQ offers a lower level of volatility to the greater Nasdaq 100. Taking a look at the visual provided in their latest supplemental, we can see that the JEPQ has maintained a lower level of volatility since inception. By being able to distribute income without the duration of credit risk, they are able to mitigate this volatility risk.

JEPQ Supplemental

Since the upside is capped, you essentially get a partial stake of the upside movement but you experience the full wrath of potential downward movements. This can lead to an erosion of capital over time if we sat in unfavorable conditions for a long period of time. While JEPQ uses out of the money calls to offset the risk of erosion a bit, it still remains a long term concern that does not currently have enough long term data to really gauge how this might play out for JEPQ.

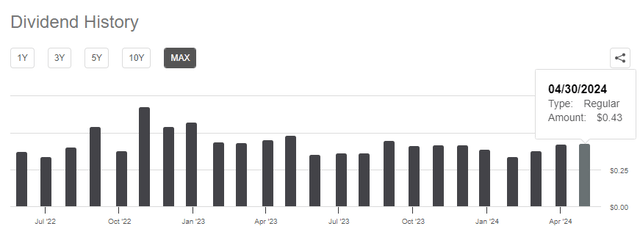

Dividend

As of the latest declared monthly dividend of $0.4311 per share, the current dividend yield sits at 8.8%. The yield has frequently traded in the double digit range in the recent past but has now come down to the targeted level around 8% to 9%. If you are looking for a consistent and growing stream of income similar to a classic dividend growth stock, then you better look elsewhere because the distributions from JEPQ can be varied depending on performance. Taking a quick glance at the history below, we can see that the distributions change month to month.

Seeking Alpha

As volatility increases, we will likely see distributions increase from the option writing. However, prolonged periods of lower volatility can significantly reduce the payouts. It’s no coincidence that the dividend yield spiked to the highest levels as soon as interest rates started rapidly rising towards the midpoint of 2022 through 2023. Now that the ripple effects of those rate increases have settled, distributions have come down a bit. However, with the elections upcoming and talks of future rate cuts on the horizon, we may see the distributions start to increase once again.

Something to keep in mind here is that the distributions received from JEPQ are classified as ‘ordinary dividends’. This means that they are taxed at higher rates compared to dividends that are classified as ‘qualified dividends’. You may be able to offset this by prioritizing this sort of asset in a tax advantaged account.

Outlook

Even though I’ve already established that there’s a potential for higher volatility due to elections and the ongoing talks surrounded interest rates, I do think that the market will be heading higher over the next year. Interest rates will eventually have to start getting reduced and when it does, this opens the door to a lot of upward mobility. As the portfolio of JEPQ remains highly diversified, I believe that we will maintain a high level of income while also seeing price appreciation. We’ve already seen the way that near-zero rates had previously boosted the valuations across the market throughout 2020 and 2021.

When interest rates start getting reduced, we will see increase borrowing levels that will fuel growth across many of the industries that JEPQ has exposure to. For example, technology companies depend on access to cheaper debt to fuel difference growth initiatives and fund research and development of new innovations. The same is true for consumer based companies that may have seen inflated raw material costs due to rising rates, which have shrunk their operating and profit margins. The lowering of interest rates will be a breath of fresh air that has the ability to serve as a catalyst across most sectors.

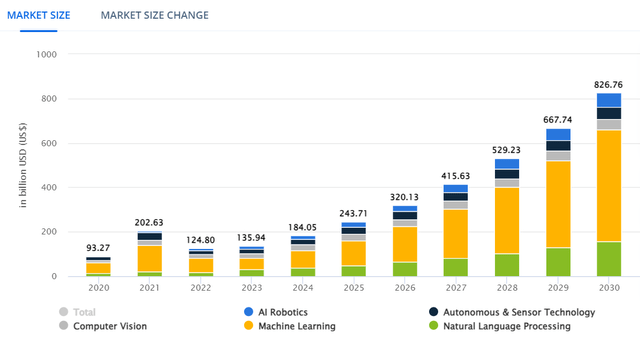

Additionally, the boom of the AI sector will continue growing as demand for innovation in the space increases. The AI market is currently valued around $184B in 2024 but this is projected to increase up to $826.7B by the end of 2030. This is including different aspects of AI as well, ranging from simple generative AI chat tools that we are accustomed to, through things like robotics, machine learning, autonomous sensors, and language processing.

Statista

Takeaway

In conclusion, JEPQ is a great way to gain exposure to both a diversified tech focused ETF while collecting a high dividend yield from the markets uncertainty and increased volatility. While the dividend yield currently sits around 8.8%, the distributions may vary month to month based on performance, success of the option writing strategy, and overall market sentiment. While covered call ETFs does have some risks to consider, I believe that JEPQ’s construction and strategy will be able to efficiently capitalize on what I believe to be potential catalysts. This includes ongoing talks surrounding interest rate cuts as well as the election causing additional spikes in volatility.

Read the full article here