The bifurcation of the world’s nuclear powers has changed the worldwide financial landscape. For decades, the U.S. dollar has been the world’s reserve currency. While the dollar remains the most liquid foreign exchange instrument that is freely convertible, tensions between Washington, DC, and Beijing, the ongoing war in Ukraine on Europe’s doorstep, and political divisions within the United States have weighed on the dollar’s value.

Fiat currency values derive from the full faith and credit of governments that issue legal tender. The fiat currency system allows governments to control the money supply; the rise of cryptocurrencies directly challenges that power. Meanwhile, gold is the world’s oldest and most consistent means of exchange. Central banks, governments, monetary authorities, and supranational financial institutions validate gold’s role in the financial system. They hold the precious metal as a reserve asset, classifying gold as a foreign exchange reserve. Over the past years, governments have been net buyers of gold, adding to strategic reserves. China and Russia, the leading gold-producing countries, have vacuumed domestic output to build reserves as a direct challenge to the U.S. dollar’s dominance. Gold is sitting near a record high, and the bull market that began at the turn of this century shows no signs of slowing down. Gold’s steady ascent is a commentary on the decline of fiat money. A rising gold price and uncertainty over the stock and other asset markets fuel gains in gold mining and exploration companies.

Investors looking for safety and capital appreciation have flocked to gold and gold mining companies. Meanwhile, new highs in gold and the potential of a spike higher may only exacerbate the market’s appetite for gold exploration companies, offering leverage to the precious metal’s price. Gold exploration and junior mining companies invest millions in their quest for gold discoveries, and when they find gold-rich veins, their stocks can soar. Moreover, rising interest in gold investments creates a herd of buyers, creating a self-fulfilling prophecy for the junior gold miners.

The Direxion Daily Junior Gold Miners Index Bull 2X Shares ETF (NYSEARCA:JNUG) product is a short-term junior gold mining vehicle that turbocharges the performance of the diversified VanEck Junior Gold Miners ETF (GDXJ) on the up and downside.

New highs in June gold

June COMEX gold futures rallied after the May FOMC meeting and 25 basis point rate hike that took the Fed Funds Rate to the central bank’s 5.125% target for 2023.

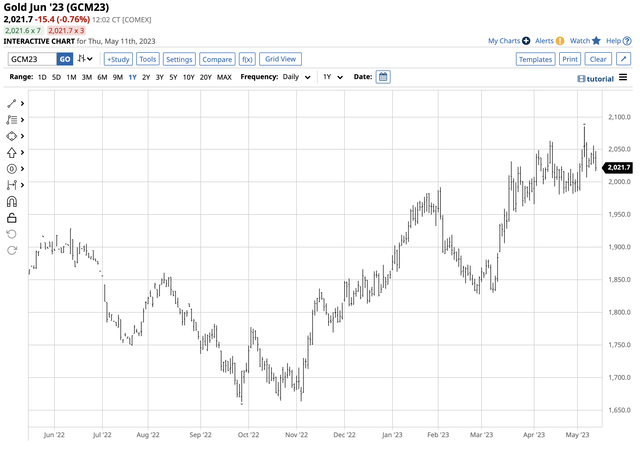

One-Year Chart of COMEX June Gold Futures (Barchart)

The chart shows the rally that took COMEX June gold futures to a $2,085.40 high on May 4, which was above the previous record continuous contract $2,072 peak. Meanwhile, the continuous COMEX gold futures contract rose to $2,072 per ounce in early May 2023, creating a double top in the futures.

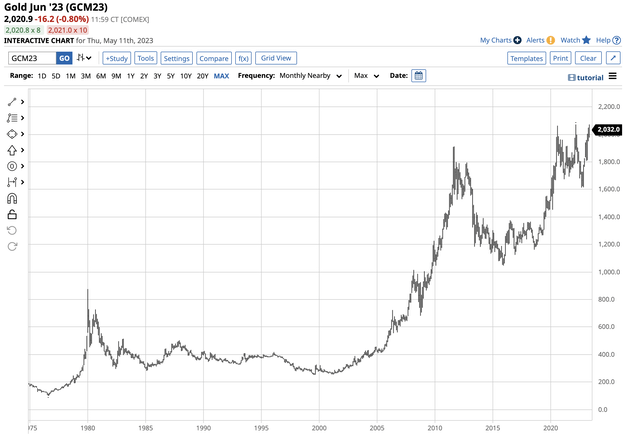

Long-Term Chart of COMEX Gold Futures (Barchart)

A correction followed the double-top formation, pushing gold lower, but the June contract remained above the $2,000 level on May 11, with the price at $2,020 per ounce.

The long-term trend is higher

The bull market in gold is not a recent development. In 1999, gold reached $252.50 per ounce as the U.K. auctioned off half its reserves, which became a significant bottom. Since then, every substantial correction in the gold market has led to new highs and has been a golden buying opportunity.

Long-Term Chart of COMEX Gold Futures (Barchart)

The chart shows the pattern of higher lows and higher highs, with gold reaching a new record peak in 2008, 2011, 2020, and 2022 and threatening to trade to a new high in 2023.

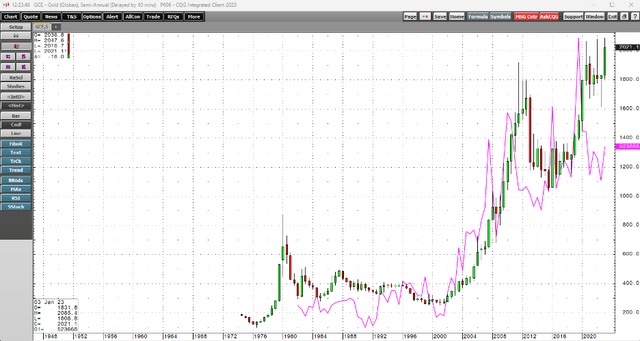

Semi-Annual Gold Futures Chart (CQG)

The semi-annual chart shows the bullish path of gold futures since the turn of this century. The open interest metric, the total number of open long and short positions in the COMEX gold futures contracts, has increased with the price. Rising open interest tends to validate a futures market’s bullish trend, indicating increased participation.

Junior gold mining shares can deliver significant returns

Junior gold mining companies explore for the metal worldwide. Junior mining companies expend millions of investment dollars in the quest for gold deposits. While the senior miners extract the metal from the earth’s crust, the junior miners are more likely to find the deposits that become tomorrow’s fruitful mining properties.

Exploration is a highly leveraged venture, as many prospective gold deposits are duds. However, the returns can be explosive when modern-day prospectors strike a golden vein with significant potential.

Gold exploration is a function of the metal’s price. As gold rallies, the demand for new metal deposits increases. Moreover, a higher gold price makes mining gold with higher production expenses possible. If the total cost of extracting the metal is lower than the market price, the results are golden. Therefore, exploration activity at the $2,000 per ounce level is considerably higher than at the $1,000 level. Junior gold mining companies exploring for the precious metal can deliver significant returns during bull markets. Meanwhile, investors looking for gold exposure tend to flock to junior mining companies with low per-share prices during bullish trends, exacerbating the upside potential.

JNUG – leverage and eliminating idiosyncratic risks come at a price

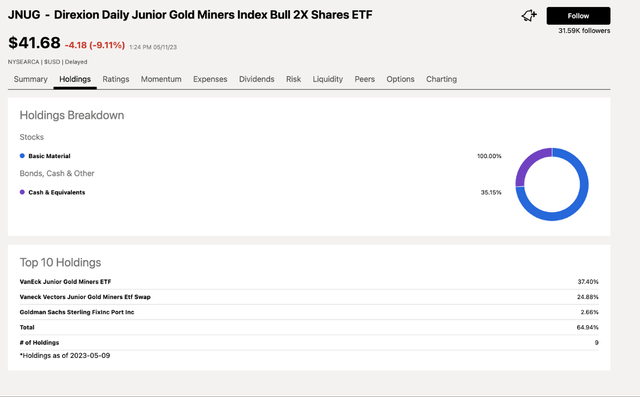

The top holdings of the Direxion Daily Junior Gold Miners Index Bull 2X Shares ETF product include:

Top Holdings of the JNUG ETF Product (Seeking Alpha)

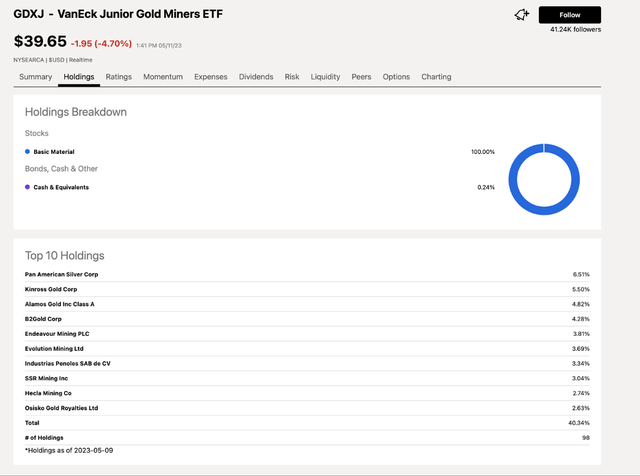

Since the JNUG ETF owns VanEck Junior Gold Miners ETF and leveraged derivatives on the ETF, GDXJ’s top holdings include:

Top Holdings of the GDXJ ETF Product (Seeking Alpha)

GDXJ holds a diverse portfolio of leading junior gold mining companies involved in exploration and production. While the senior miners have economies of scale for extracting gold, the junior miner’s exploration activities can yield the most leveraged returns. GDXJ mitigates the risk of investing in single-name junior gold mining companies exposed to management, specific property, and geopolitical risks in certain countries. The portfolio approach minimizes idiosyncratic risks in the junior gold mining sector.

An example of the potential for explosive returns is the price action from March through August 2020, when nearby COMEX gold futures rose 42% from $1,452.10 to $2,063 per ounce. Over the same period, GDXJ moved 238% higher from $19.52 to $65.95 per share.

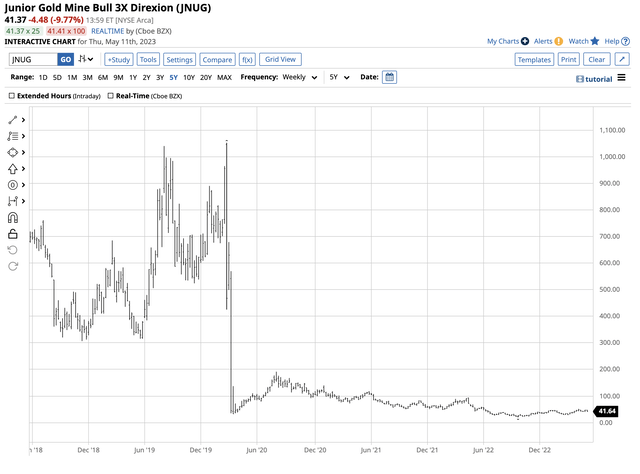

Chart of the JNUG ETF Product (Barchart)

Over the period when gold rallied 42%, and GDXJ moved 238% higher, JNUG moved 476% higher from $33.20 to $191.17 per share. The outperformance occurred because of JNUG’s derivative structure and the buying herd during the higher spike in the gold market. Meanwhile, the chart also highlights the danger in JNUG. Leverage comes at a price, time decay. The leveraged derivatives have outperformed during rallies, but if gold prices and junior gold mining stocks decline or remain stable, JNUG will underperform. The bottom line is the risk of a leveraged product is commensurate with the potential rewards. Therefore, timing is crucial for success with JNUG and other leveraged ETF/ETN products.

The reasons for an explosive gold move

The following factors favor a continuation of higher gold prices:

- Inflation remains elevated, and even though the recent CPI and PPI readings show a decline in the economic condition, inflation remains at the highest level in years and above the Fed Funds Rate.

- The Fed has reached its 2023- 5.125% Fed Fund target, making a pause in interest rate hikes likely. Stable rates may support gold.

- The potential for a BRICS currency as an alternative to the U.S. dollar challenges the U.S. currency’s dominance as the world’s reserve currency. A weaker dollar on the global financial landscape supports gold, the world’s oldest means of exchange.

- Central banks continue to buy gold hand-over-fist to add to reserves. Central bank gold holdings as an integral part of foreign currency reserves validate gold’s role worldwide financial system.

- Investors worldwide are nervous as the bifurcation of the world’s nuclear powers and the war in Ukraine has changed the geopolitical landscape. Gold has traditionally been a safe harbor during times of geopolitical turmoil.

- The U.S. debt at over $31.7 trillion and rising by over $1.6 annually, with the Fed Funds Rate at 5.125%, is shaking confidence in the world’s wealthiest country. Moreover, increasing the debt ceiling is the leading hot-button issue between Congress and the Biden administration, with the threat of a U.S. debt default handing over the markets.

These reasons and more support gold as an investment alternative in the current environment. Any surprises in the economic or geopolitical landscapes could ignite a significant rally in the gold market, which only recently rose to a new record nominal price.

Meanwhile, timing is critical when considering JNUG, the leveraged junior mining ETF product. Over the past years, buying gold, gold mining shares, and JNUG during price corrections has been the optimal approach, and I expect that to continue.

Trading or investing with JNUG requires time and price stops because of the leverage and an understanding of the risks involved. Accepting small losses in the quest for oversized profits is a logical approach to the leveraged junior mining ETF product.

Read the full article here