Introduction

It hasn’t been easy for Kemper Corporation (NYSE:KMPR) this year, in Q1 the results showed a significant net loss of $80.1 million. Margins are poor for the company even in a higher interest environment which should be benefiting them. Seeing as they are an insurance company with operations in the United States I think investors are right to be disappointed in the recent results from the company.

The results were below the company’s expectations and the blame was put on elevated catastrophe losses. It seems that if KMPR isn’t successful in handling these losses, which are part of being an insurance company then the risk presented here is far too high. Time will tell if increased interest earnings can bring margins back on track. KMPR has been able to achieve a positive net margin before, and if they get back to that then the current valuation could make sense. But neglecting that fact, there is still the uncertainty of continued poor results and then you aren’t invested in a company with a resilient business model. I am skeptical about future reports from KMPR and will be rating them a sell now actually. There seem to be better insurance companies out there to invest in instead.

Company Structure

Kemper hasn’t been an insurance company for that long when compared to other giants in the space, it was founded back in 1990 and has grown into an over $3 billion valuation. As for the structure of the company it has divided its operations into three different segments right now. These are as follows, Specialty Property & Casualty Insurance, Preferred Property & Casualty Insurance, and lastly Life & Health Insurance.

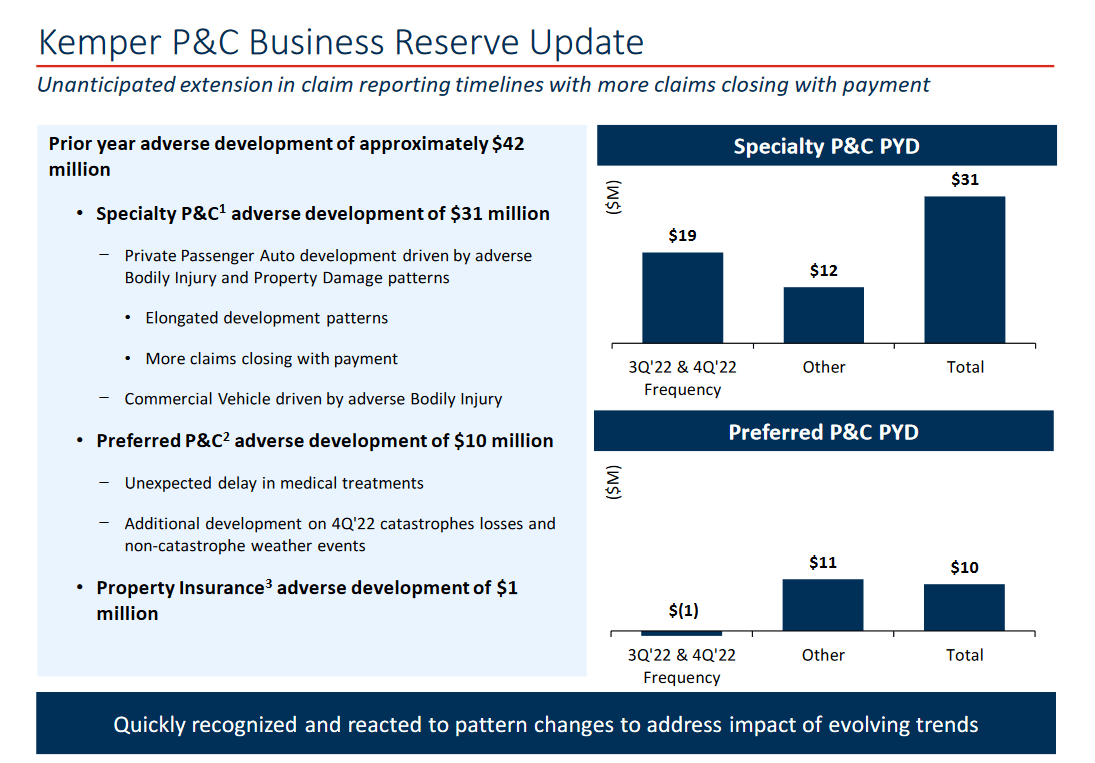

Business Overview (Earnings Presentation)

In terms of the largest segment in KMPR Life & Health Insurance was the only profitable part of the business last quarter, getting $13.2 in operating income. This is a very decent improvement from the prior year of $11.6 million. But this segment can’t be the sole driver for growth and profits in the business. The other two insurance segments need to perform very well too.

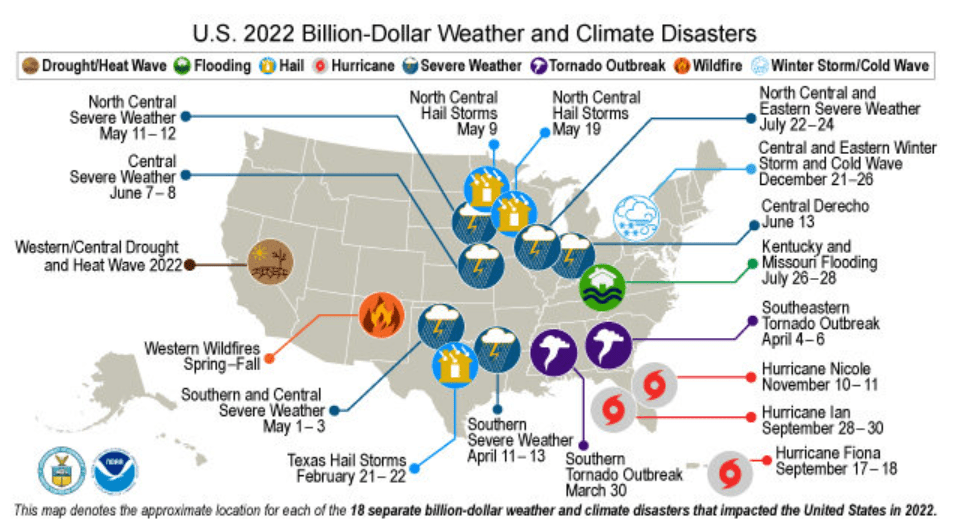

Disasters (climate.gov)

But what is setting hurdles in KMPR’s growth path is the fact we are seeing more natural disasters and weather-related accidents. In 2022 there were a large number of natural disasters and weather-related incidents that resulted in over $1 billion in damages. For insurance companies, this is introducing a lot of risk in the common quarters and even years.

Fundamentals

Without solid fundamentals, an investment case quickly disappears. That seems to be the case with KMPR right now. The company has quite honestly horrible margins, which of course has been affected by the recent surge of catastrophic losses the company was faced with.

Net margins are negative and cash flows are negative, a big shift from the positive $1.7 billion generated in 2022. With such a lack of consistency, a much lower premium should be applied to the company.

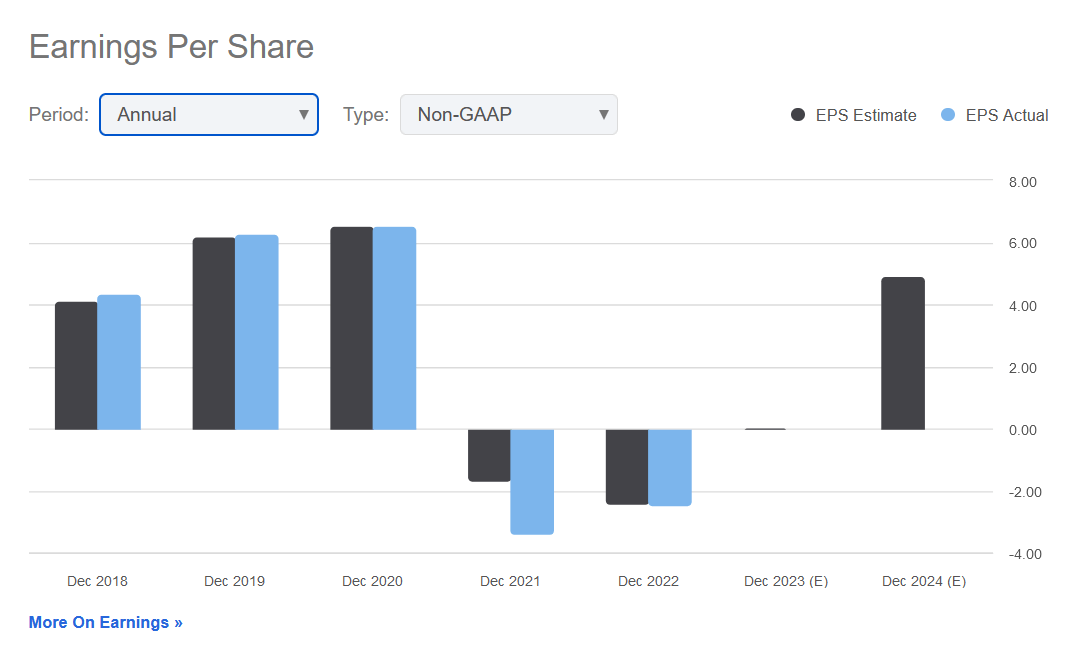

EPS History (Seeking Alpha)

Up until 2021, the results for the company were very good. But afterward, they have taken a deep dive and now sit in the negatives. It seems that 2023 will be a consolidation year with a largely flat bottom line. Seeing the difficulties the company had in Q1 though, if Q2 produces similarly poor results then 2023 will most likely result in a negative EPS. In the picture above thought the EPS estimates sit at $4.92, which would value the company at a p/e under 10. That still isn’t low enough given the risks I have discussed.

Earnings Transcript

From the last earnings call that KMPR posted some important comments from the CEO Joe Lacher shed some light on the management’s views on the performance.

-

“We experienced many of the same issues that our peers have voiced during this earnings season. Our first quarter results were below our expectations, but we see this as a temporary setback. The entire team remains highly focused on returning the business to profitability and achieving our financial targets. We are aggressively pursuing opportunities to improve results and position the company to deliver long-term shareholder value”.

-

“The first quarter revealed several unanticipated trend changes. These caused us to modestly update our first half of 2023 guidance. We see this again as a temporary setback. We’re reiterating our prior guidance of a return to underwriting profitability in the second half of 2023 and achieving our financial targets in 2024 of an ROE greater than 10%”.

These comments suggest that the coming quarters for 2023 will show improvements as the market stabilizes and having a more strict cost structure and overview of operational expenses would be efficient measures to have these targets come true.

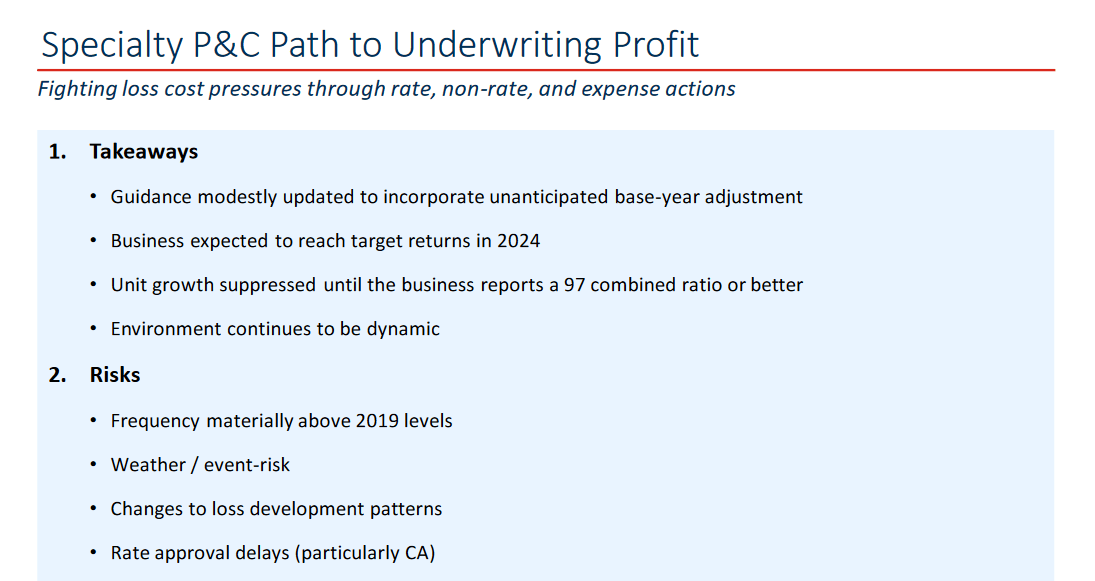

Underwriting (Earnings Presentation)

However, they also need to make substantial improvements in the underwriting part of the business. The guidance provided is that underwriting will net a combined ratio below 100% in the second half of 2023. In Q2 2023 the prediction is for it to be 103 – 107%. That means there is still a lot of work for KMPR to do here.

Risk Associated

Insurance companies face significant risks related to natural disasters and their associated costs, which can have a profound impact on their financial stability and overall business operations. One of the primary risks is the occurrence of catastrophic losses resulting from natural calamities such as hurricanes, earthquakes, wildfires, and floods. The unpredictable nature of these events makes it challenging for insurers to accurately predict the extent of their liabilities, leading to potential financial strain.

Investor Takeaway

2023 has been a difficult year for KMPR and it seems Q2 will produce similar poor results. I think there are far too many risks associated with the company right now as they have handled the catastrophe losses poorly, resulting in a net loss of $80 million. There are better insurance companies out there with decent valuations as opposed to what KMPR is at right now. I am pessimistic about coming quarters and rate KMPR as a sell now.

Read the full article here