The last year or so has been dismal for Korean stocks; while the YTD rally has recovered some of the losses, the Kospi index remains >30% off its 2021 highs. The factors that led to this underperformance look set to reverse, however, as we enter a (relatively) weaker USD/neutral monetary policy regime and China returns to growth mode (vs. the strong USD, high rates, and weak China backdrop). Given the sensitivity of Korean corporate earnings to the trade balance, equities should be the first port of call for global investors to re-rate as fears of a global recession abate. And with the virtuous cycle reversing into 2023 amid a weaker dollar and an expanding China, the exporter-heavy Korea Fund (NYSE:KF) portfolio should lead the rebound.

From here, all eyes will be on the Bank of Korea’s (i.e., the Korean central bank or the ‘BoK’) rate decision next week. Given the potential macro headwinds and decelerating inflation trend domestically, an accommodative policy stance is likely on the cards, keeping valuations well-supported. A pending inclusion into the FTSE World Government Bond Index (WGBI), which would entail significant passive inflows into Korean bonds, presents an additional near-term technical catalyst as well. At a wider than usual high-teens % NAV discount, KF is a compelling vehicle to play the Korea recovery.

Morningstar

Fund Overview – A Competitively Priced but Concentrated Korean Investment Vehicle

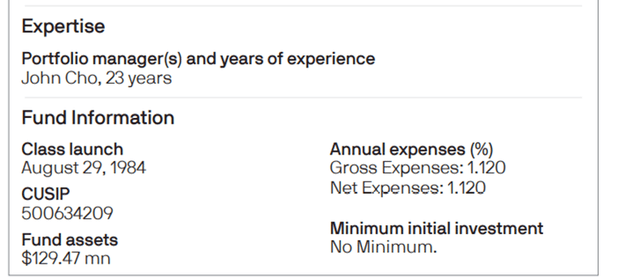

The actively managed, US-listed Korea fund seeks to deliver long-term capital appreciation relative to its benchmark MSCI Korea 25/50 Index primarily through investments in securities listed on the Korea Stock Exchange. The fund is managed by JPMorgan (JPM) Korea country specialist John Cho, who has been in the role since 2011 and works out of Hong Kong as part of the Emerging Markets and Asia Pacific Equities team. The fund leverages a high-conviction, value-focused approach to identifying investment opportunities, though growth and quality are also factors in the fund’s stock selection process. Per the latest factsheet, the fund held $129m of net assets at the time of writing and charged a competitive ~1.1% expense ratio (mainly management fees). A summary of key facts about the fund is listed in the graphic below:

JPMorgan

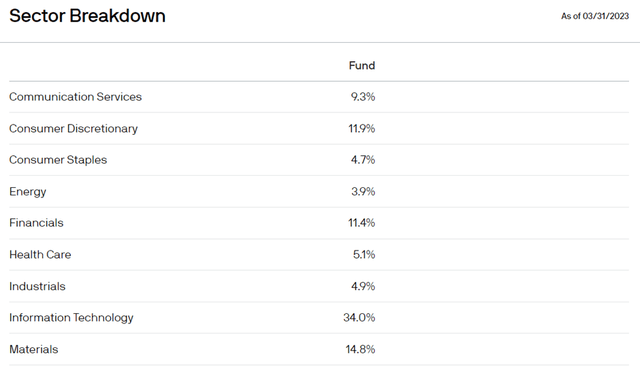

As highlighted by the fund’s latest holdings disclosure, KF is fairly concentrated from a sector standpoint. Information Technology is the largest allocation at 34.0%, followed by Materials at 14.8% and Consumer Discretionary at 11.9%. Other sectors with portfolio contributions exceeding the 5% threshold include Financials (11.4%) and Communication Services (9.3%). In total, the top five sectors make up ~81% of the overall fund.

JPMorgan

The KF fund’s single-stock allocation reflects the concentrated tech exposure – the largest holdings by far are semiconductor/mobile giant Samsung Electronics (OTCPK:SSNLF) at 23.4% and SK Hynix (OTC:HXSCF) at 6.9%. The fund’s other major tech holding is NAVER Corp (OTCPK:NHNCF) at 3.6%. The large Materials exposure comes from two key holdings, LG Chemical (OTCPK:LGCLF) at 6.6% and POSCO Holdings (PKX) at 3.9%. The fund’s financials allocation, on the other hand, is spread across a wider range of holdings, led by KB Financial Group (KB) at 4.1%. All in all, the top ten holdings accounted for 59.3% of the overall 98-stock portfolio, with the concentration levels and portfolio composition closely tracking its benchmark MSCI Korea 25/50 Index.

JPMorgan

Fund Performance – Outpacing the Benchmark but the NAV Discount Remains Wide

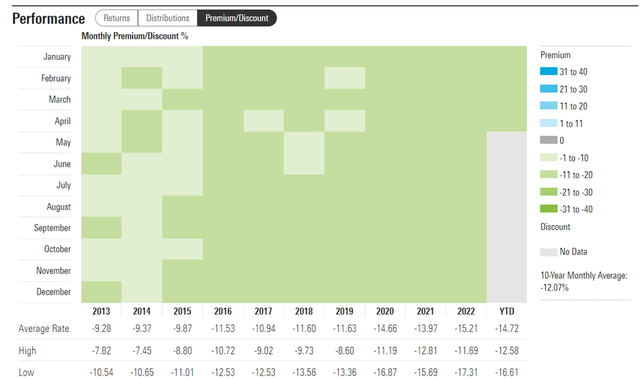

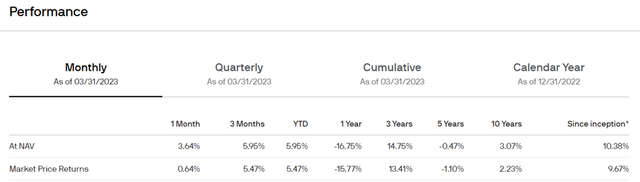

On a YTD basis, the fund has risen by 6.4% in market price terms, trailing passive Korea ETFs like the iShares MSCI South Korea ETF (EWY), which has returned 11.9% this year. Over longer timelines, however, the fund has modestly outperformed its key comparable EWY and its benchmark index. In NAV terms, the fund has annualized at a solid +10.4% since inception in 1984, while the last decade has seen the fund compound at +3.1% vs. the EWY’s +2.1% and +2.4% for the MSCI Korea 25/50 Index. In market price terms, however, the fund’s outperformance fades due to the persistent NAV discount – the fund’s +2.2% annualized return over the last ten years is broadly in line with the EWY and slightly below its benchmark.

JPMorgan

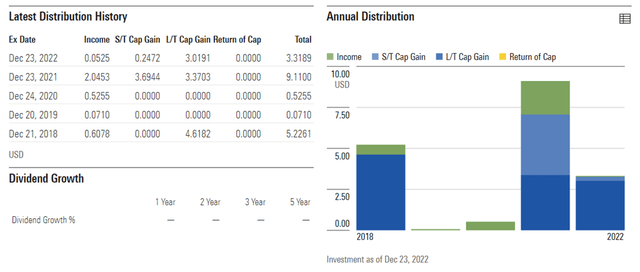

At first glance, distributions seem strong at a total yield of ~15% on a trailing basis. But most of last year’s distribution came out of realized short and long-term capital gains, leaving the yield from recurring income at <1%. Last year was a challenging year for the tech/exporter-heavy KF portfolio, though, so 2023 income distributions should come in much higher. While a reversion to historical levels would imply a 1-2% yield, distributions tend to be inconsistent; thus, this fund isn’t a great fit for income investors. In the meantime, the fund trades at a wider than usual high-teens % NAV discount (vs. low to mid-teens % average in 2021/2022), likely due to downbeat investor sentiment on the fund’s prospects. While there isn’t a clear catalyst for the NAV discount to narrow anytime soon, the performance-linked buyback (up to 25% of outstanding shares) does offer some downside protection.

Morningstar

Fundamental and Technical Tailwinds on the Horizon

As an economy highly leveraged to global trade activity, South Korea has been forced into a negative feedback loop triggered by the strong USD/higher rate environment overseas last year. Things are reversing this year, however, as the combination of less hawkish policy, a stronger won, and post-reopening Chinese growth has already driven a narrowing of last year’s record trade deficit (see chart below from Trading Economics). In line with the Korean economy’s reliance on exports, an outsized % of Korean corporates are also dependent on trade, so an eventual recovery in China and other emerging market economies bodes well for the near-term earnings outlook. In the meantime, a transitory inventory glut is weighing on chip prices, though policy support (mainly via tax cuts) and server/artificial intelligence demand tailwinds should keep tech exports strong through H2.

TradingEconomics

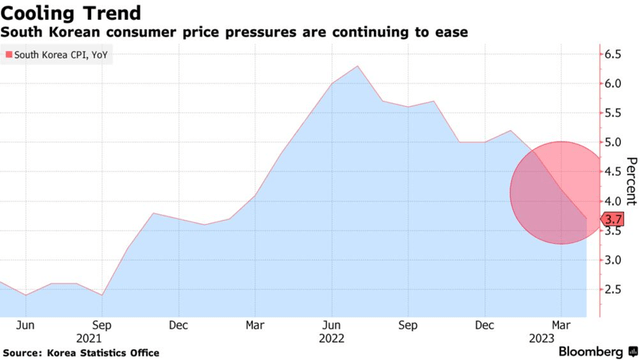

Additionally, lower FX-driven import costs have also led to decelerating inflationary pressures, supporting the case for a BoK pivot later this year. Either way, the fundamental setup is compelling for KF’s exporter-heavy portfolio, and investors stand to reap the benefits both ways (valuation re-rating and earnings growth). Also worth monitoring will be the pending inclusion of Korean bonds into the FTSE Russell WGBI next year; significantly increased passive inflows post-inclusion (albeit over a staggered 18–24-month period) presents a technical tailwind for equity valuations via lower risk-free yields.

Bloomberg

Conclusion

The Fed is finally pulling back on its tightening cycle, and that bodes well for economies like Korea, which remain heavily leveraged to trade activity. 2023 has already started off on the right foot, with the combined effect of a weakening USD and a return to growth in China driving Korean equities higher YTD. Highly cyclical funds like KF, which fell out of favor amid the record trade deficit last year, should be among the leading beneficiaries of the current environment. At the current high-teens % NAV discount, investors stand to win both ways – via a re-rating of the fund itself and of the underlying export-focused holdings, many of which continue to trade at a discount to their book value. A more dovish BoK next week (in light of the external headwinds and fading inflationary pressures) presents an upside catalyst, along with passive inflows from an eventual WGBI inclusion for Korean bonds (likely early next year).

Read the full article here