Kinsale Capital Group (NYSE:KNSL) is an American property and casualty insurance company with an exclusive orientation toward the E&S market. The firm services all 50 states in addition to US territories.

Activities in this segment and these geographies have enabled $896.77mn in TTM revenues alongside a net income of $183.12mn, a net margin of 20.42%.

Introduction

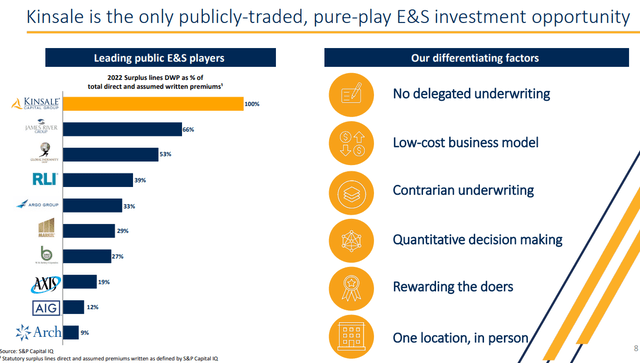

Kinsale’s current strategy is fivefold; the company maintains a focus on small-account E&S consumers; it maintains a highly vertically integrated process to maintain expertise and capture maximum value; the firm has thus developed proprietary technology with cost-advantages built-in; employing a highly quantitative approach; and return utmost excess capital to investors while growing market share.

Kinsale Q1 Presentation

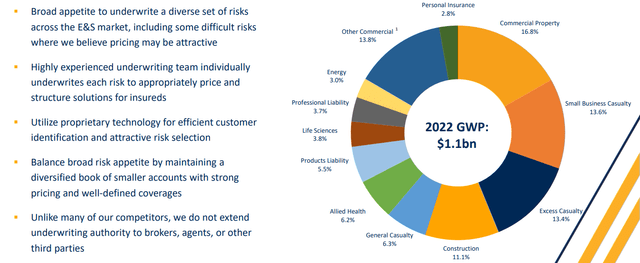

The company is therefore able to operate in insurance regions wherein extremely niche and specialized underwriting and risk assessment tools must be employed. This allows access and sale generation that others may not adequately be able to compete for. Additionally, this strategy can aid in developing a broadly diversified and lower-risk portfolio.

Kinsale Q1 Presentation

Valuation & Financials

General Overview

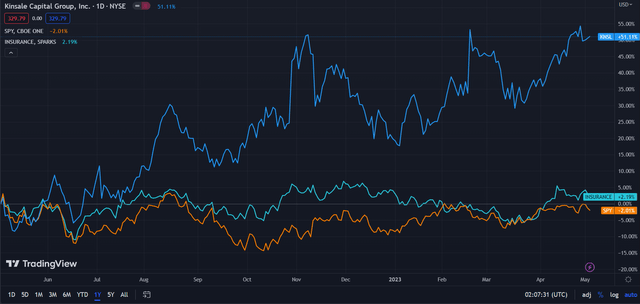

Over the past year, Kinsale (+51.11%) has experienced significantly superior price action to both TradingView’s Insurance tracking index (+2.19%) as well as the general market, represented by SPY (-2.01%).

Kinsale (Dark Blue) vs Market & Industry (TradingView)

Despite this rally, I still believe that Kinsale has growth ahead, as would be consistent with its long-term price performance and is well-positioned to capture continuous growth in its industry niche.

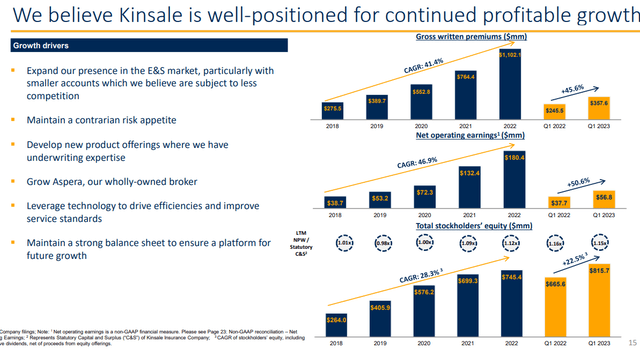

Kinsale Financial and Operational Growth (Kinsale Q1 Presentation)

Comparable Companies

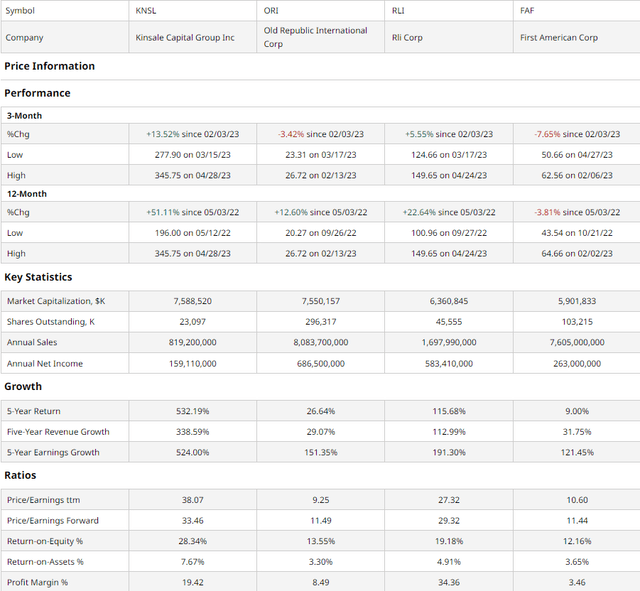

Although, as the only sufficiently large E&S pure play, Kinsale has no direct competitors, it can be adequately compared with peers across the insurance industry. This includes Old Republic International (ORI), which is a general commercial insurance business; RLI Corp. (RLI) is a specialty insurance company, which offers business and personal products; and First American Financial (FAF) offers title, specialty, and settlement services, with a focus on real estate.

barchart.com

As demonstrated above, Kinsale has demonstrated materially superior performance to peers, with the second-best company’s 12-month return approaching +22.64%, 28.47% lower than Kinsale’s growth. Said growth is highly warranted; Kinsale’s 524% earnings growth over the past 5 years is peerless.

And the fact that the firm’s earnings grow at a much higher rate than its revenues illustrates tangible margin expansion alongside given scale growth. Said growth is both a response to the 10.3% CAGR of the E&S market from 2011-2021 alongside Kinsale’s unique contribution to this growth, with Kinsale able to service previously inaccessible markets with its higher propensity for specialization.

Valuation

According to my discounted cash flow analysis, Kinsale is undervalued by 16% at its base case, with its fair value being $394.12, up from its current price of $329.79.

With my DCF model, I calculated a discount rate of 8%, owing to a low debt/equity and therefore low cost of capital. Additionally, I took a more conservative approach, projecting net margins at 20% and growing at 2% per year, although Kinsale’s net margins for the trailing three years were 21.67%, 19.41%, and 23.86% respectively.

Furthermore, the growth drivers of the DCF were primarily derived from overall E&S market growth along with the additional net income- thus cash flows- which will be derived from continued margin growth.

I chose not to conduct a relative valuation using AlphaSpread’s relative valuation tool due to its inherent focus on multiples, which do not adequately reflect the company’s aggressive margin and scale expansion and neglect Kinsale’s unique position in the E&S market.

Whole Business Orientation Leverages E&S Trends for Growth

As previously discussed, Kinsale has taken a concerted approach to both being an E&S pure play while unlocking as much potential value as possible within the market. The vertical integration of the firm- a large contributor to widening margins- means the company does not delegate underwriting, is able to take a one-to-one approach with clients, and ultimately provide both better service and quality.

Kinsale Q1 Presentation

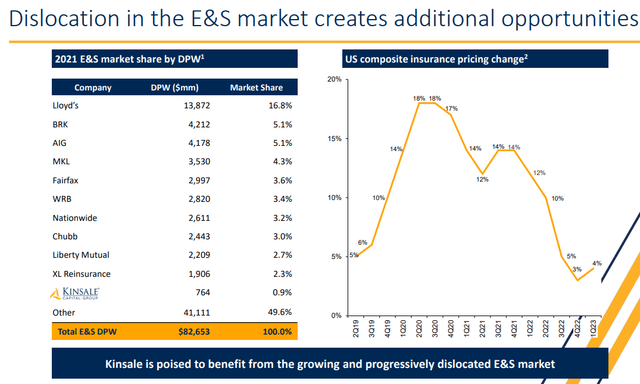

More so than just Kinsale’s approach, the macro situation of the E&S market is highly favourable as well; a high degree of fragmentation in the market enables market share growth and pricing power for more specialized firms such as Kinsale. Moreover, market dislocation due to stressors such as interest rate increases can harm larger competitors more so than firms like Kinsale, enabling Kinsale to further expand their footprint.

Kinsale Q1 Presentation

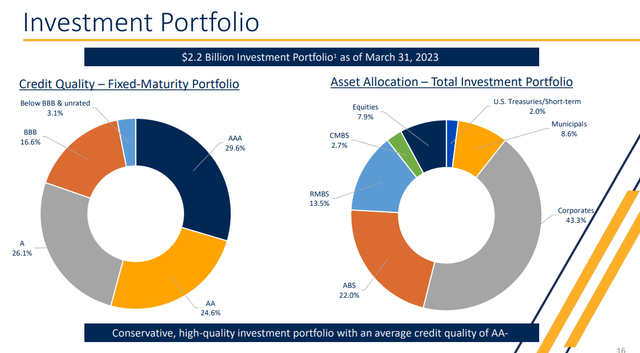

And the firm’s well-disciplined capital deployment justifies even further value; the insurer continues to vertically expand to drive organic growth, such as through Aspera, Kinsale’s wholly owned insurance broker, continues to invest in technology as a core competency to boost access and reduce costs, and maintains a stable portfolio to enable financial security, no matter the headwinds.

Kinsale Q1 Presentation

Wall Street Consensus

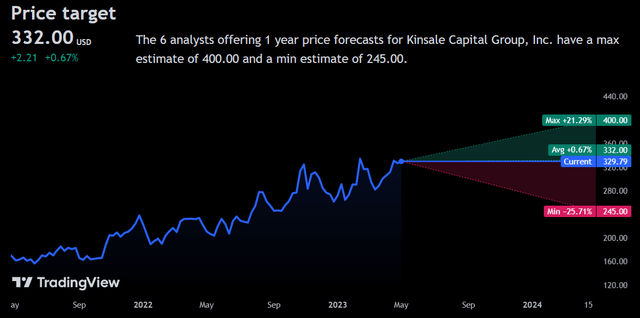

Contrary to my belief, while the overall outlook on the firm is positive, analysts generally support a neutral or hold rating, projecting an average 1Y price increase of 0.67% to a price of $332.00.

TradingView

Similarly, in the worst case, analysts project a minimum price decline of 25.71%, to a price of $245.00.

However, I believe this is an overreaction from analysts, bearish on Kinsale’s prospects due to large and consistent rallies over the past few years, which have led to poorer multiples for the firm.

Risks & Challenges

Dependency on the E&S Market

Since Kinsale fundamentally stylizes itself as an E&S pure play, reduced appetite or demand in the E&S market can lead to sudden and effective reductions in scale and margins for the firm. This can have materially negative impacts on the firms underlying value proposition and intrinsic value.

Risk Assessment Uncertainty

Again, the niche operation of Kinsale in the E&S market, particularly the small-account market, means Kinsale must develop its own risk assessment models based on its own novel techniques. Failure to adequately assess risk- not an unlikely proposition- can lead to losses and material reductions in profitability.

Inability to Cover Potential Losses

Although the firm maintains a diversified balance sheet, its scale may not be sufficient to cover a sudden decline in E&S demand or a high level of losses in the industry. Though a more unlikely risk, it presents an existential threat to the organization.

Conclusion

In the short term, I expect Kinsale to continue to lead the E&S market and access novel revenue streams.

In the long term, I project Kinsale’s continued focus on vertical expansion and E&S market share expansion to convert to positive share price action.

Read the full article here