Thesis

KKR & Co. (NYSE:KKR) is a premier global investment firm that appears well positioned to capitalize on the decline in earnings multiples. Despite the recent selloffs and underperformance, I believe KKR’s long-term prospects remain promising. The company has a strong track record of navigating through market cycles and generating superior and consistent returns coming out of recessions. I also believe investors should look beyond the temporary setbacks and recognize the long-term potential for KKR to deliver an annual returns of 20% or more according to my discounted cash flow (DCF) model, thus KKR presents an enticing investment opportunity and I rate KKR stock a Buy.

Background Information

KKR Share Price History (TradingView)

- KKR’s share price has fell significantly from its all-time high in 2021

- The company has suffered $2.5 billion in capital allocation-based income

- Global economic conditions have worsened since 2022

- Rising interest rate has caused an increase in cost of capital, leading to a contraction in earnings multiple

- This has affected the unrealized gain in KKR’s carried interest

Federal Funds Effective Rate (FRED)

Thesis Explainer

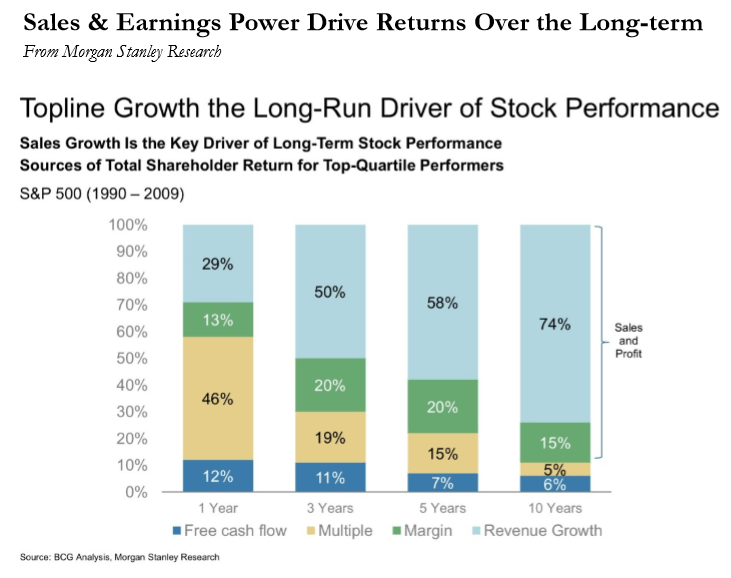

However, I believe the underperformance is likely to be short-term in nature. According to Morgan Stanley Research and Boston Consulting Group Analysis, the long-term drivers of stock performance are primarily sales and profit, as shown in the chart below. If you look at the short-term driver, however, 46% is influenced by earnings multiples. Likewise, I believe KKR’s portfolio has experienced a decline in earnings multiple, but it should have very limited impact on its long-term performance and ability to generate return. In fact, the multiple only accounts for 5% of value over a 10-year period.

What drives stock performance? (Morgan Stanley)

There was in fact a very good quote by Jeff Bezos:

If everything you do needs to work on a three-year time horizon, then you’re competing against a lot of people. But if you’re willing to invest on a seven-year time horizon, you’re now competing against a fraction of those people… Just by lengthening the time horizon, you can engage in endeavors that you could never otherwise pursue.

Jeff Bezos emphasized the importance of having a long-term perspective view and likewise, he was very successful with Amazon due to his long-term view and forward thinking. I think we can apply a similar approach when valuing KKR. Even though short-term return may seem volatile, due to high earnings multiple fluctuations during challenging global economic conditions, KKR has shown strong performance track record coming out of a recession and long-term record to generate alpha above market returns. I will explain below in great detail on why I think the drawback in 2023 presents a great entry point for investors.

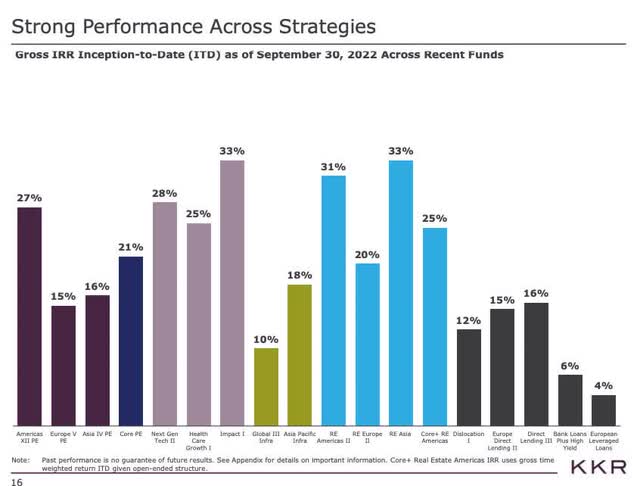

KKR’s Performance Across Strategies (KKR’s Investor Relations)

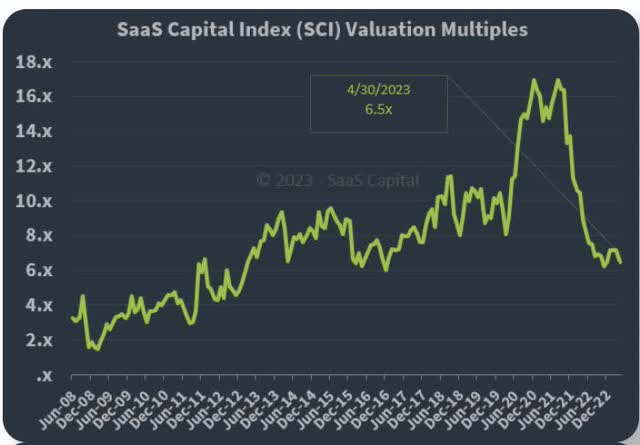

By focusing on the long-term outlook, we need to understand that short-term fluctuations in multiples do not overshadow the potential for value creation. When we look at KKR’s performance across its various strategies, a significant majority of its private equity (PE) funds have consistently achieved an internal rate of return (IRR) exceeding 20% over an extended period – that is almost twice as what S&P have returned! This remarkable track record underscores the strength of the private market, and the outperformance despite the 2008 financial crisis. Considering the current market, the PE model remains highly attractive, and it fact, I would argue that it should be even more appealing than before. With lower multiples (as shown in the chart below) we have seen in over 6 years, KKR’s substantial dry powder of $106 billion provides them with a unique opportunity to capitalize on short-term declines in multiples. By strategically deploying this capital, KKR can generate higher IRRs by acquiring assets at more favorable valuations. KKR’s first quarter 2023 earnings call:

We feel really excited about the investing environment that we are currently in, so we remain incredibly well positioned to build the portfolio for the future. And looking what our teams have done more recently, we continue to be pretty creative of putting that capital to work.

SaaS Valuation Multiple Index ( SaaS Capital)

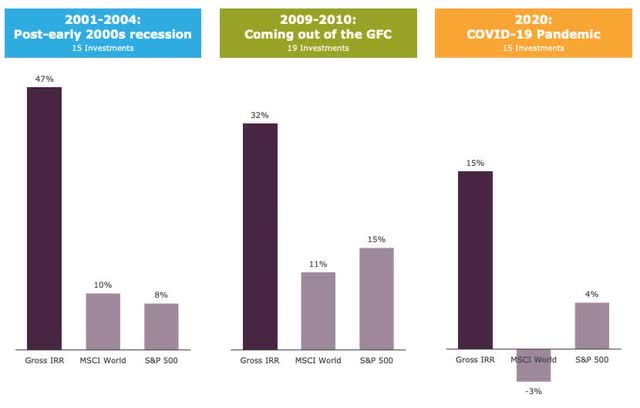

KKR’s historical performance also proves my argument. During the dot-com bubble from 2001 to 2004, KKR’s management has successfully navigated the crisis and achieved an exceptional 47% IRR, outperforming both in MSCI World and the S&P 500 index. Similarly, during the 2008 financial crisis, KKR emerged strongly, outperforming the market and making a record number of successful investments. If we also take a look at the SaaS valuation multiple chart during the same period. It was during this time that KKR capitalized on the low valuation multiples, leading to stunning returns that outperformed the S&P 500 index and MSCI World by a remarkable three-fold margin. These examples highlight KKR’s ability to seize opportunities during challenging market conditions and generate exceptional returns for its investors.

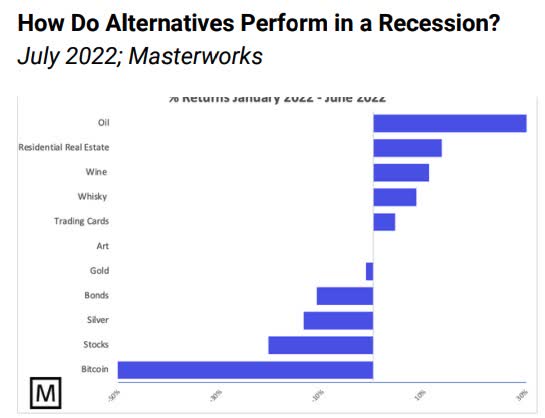

KKR’s Performance After Recession (Investor Relations) How Do Alternatives Perform in a Recession? (Masterworks)

Company Information

KKR & Co. (also known as Kohlberg Kravis Roberts) founded in 1976 is a leading global alternative asset management firm that primary focuses on private equity, real estate, infrastructure and credit strategies.

KKR’s Management Fee Profile (Investor Relations)

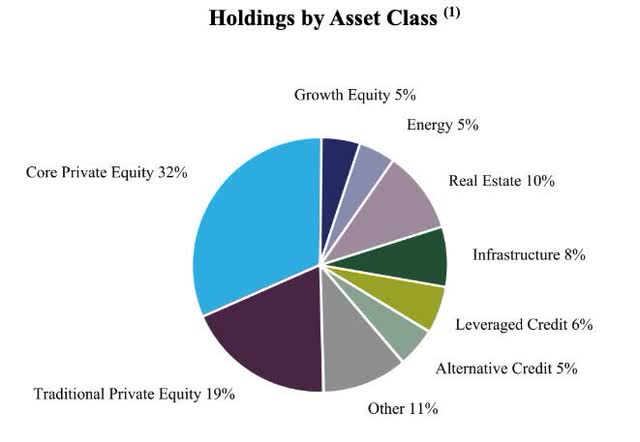

KKR’s Holding by Asset Class (10-K filings)

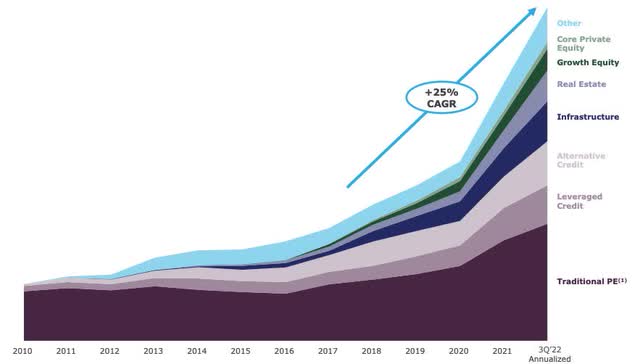

As of today, KKR has over $510 billion of assets under management (AUM), which is up 6% year-over-year, with $416 billion of Fee Pay Assets Under Management as of first quarter 2023.

KKR generate its revenue through 4 different segments. Asset Management Fees is revenue generated by KKR through providing investment management services to its clients. These fees are typically calculated as a percentage of the fee-paying AUM and commonly range between 1.0% to 1.3%. Next, Capital Allocation-Based Income are the income generated from carried interest, which represents a percentage of profits generated above a certain level of hurdle rate by the investment funds managed by the firm. Insurance Income includes net premiums, policy fees, and other forms of income related to insurance operations within KKR. Lastly, Insurance Investment Income are earnings from investments held within its insurance business balance sheet.

Competitive Position

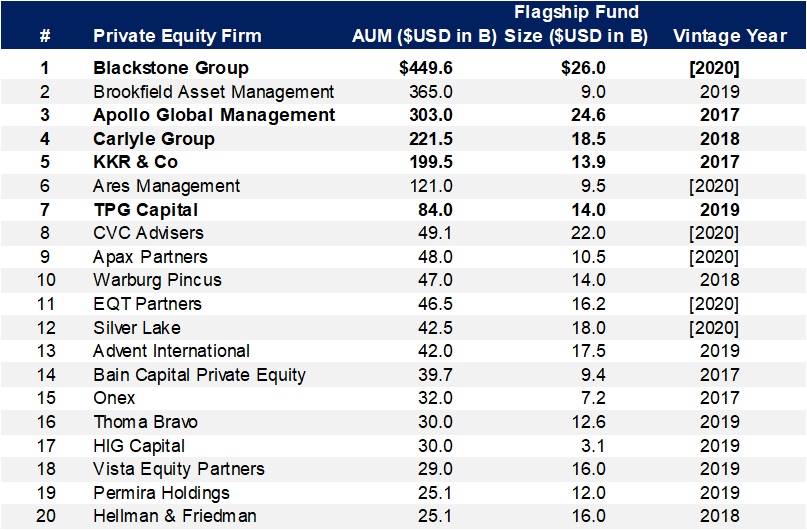

In terms of the competitive advantages of KKR, I would rate it as “narrow” moat. Although private equity business does not have high barriers of entry, but I do think KKR have some distinct advantages compared to its competitors.

Strong Brand Reputation: KKR is one of the world oldest and the most prominent alternative asset managers. As described by Morningstar Investment Research:

“KKR has, in our view, built a solid position in the industry, using its reputation, broad product portfolio, investment performance track record, and cadre of dedicated professionals to not only raise capital but to maintain its reputation as one of the go-to firms for institutional and high-net-worth investors looking for exposure to alternative assets.”

I would also want to add on that KKR is also one of the most prestigious private equity firm, the firm’s strong industry reputation and excellence attracts top-tier talents, allowing KKR to assemble a strong deal team who will drive and deliver superior investment return (IRR). As well, KKR’s strong brand reputation will also enable them to secure more deals and gain access to larger and better investment opportunities.

Private Equity Firm by AUM (Peak Frameworks)

Consistent Strong Performance: KKR’s impressive track record of consistent strong performance stands as a testament to its investment expertise. The firm has demonstrated its ability to deliver attractive returns to investors, solidifying its reputation as a trusted partner capable of generating long-term value. This proven performance track record enhances KKR’s appeal, instilling confidence in both existing and prospective investors who seek reliable and successful investment opportunities. By consistently outperforming the market and delivering on its promises, KKR has established itself as a top choice for those institutional investors.

Income Statement Analysis

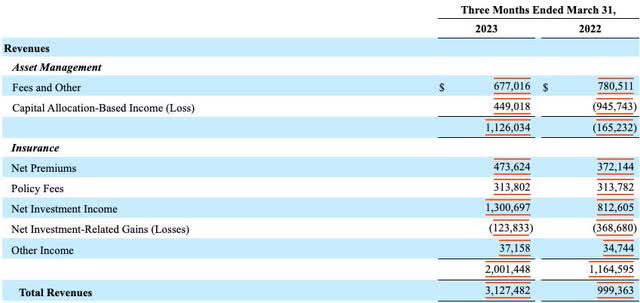

Here are some of the highlight in KKR’s first quarter earnings release:

- Fees and other for the three month period decreased primarily as a result of low transaction volume, however, it was offset by the consistent 10% increase in the management fees with accounts for 67% of total fees and other income.

- Capital allocation-based income was positive primary due to the appreciation of Americas Fund XII, Global Infrastructure Investors III, and Asian Pacific Infrastructure Investors.

- For the insurance segment, the net investment income increased due to growth in portfolio yields because of rising interest rate as well as the growth in assets from Global Atlantic.

Overall, I would say that KKR had a very solid first quarter in terms of revenue growth in the strong recurring asset management fees, and net investment income from insurance segment.

KKR’s Q123 Income Statement (Investor Relations)

Valuation

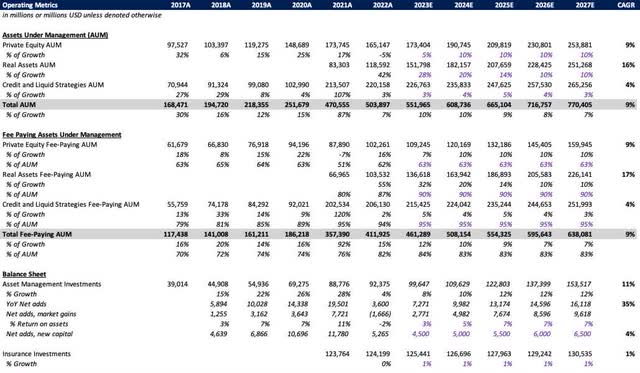

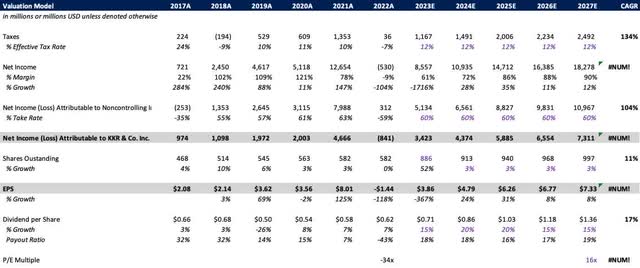

Based on my 5-year discounted cash flow (DCF) model analysis, I have projected that KKR’s total AUM will have a high single-digit growth rate. This projection accounts for a deceleration growth rate compared to previous years, primarily influenced by the worsened global economic condition posed by the rising interest rates which has negatively affected capital raising activities. I believe the high interest rate will stay with us in the foreseeable future. In terms of fee-paying assets under management, I have assumed that KKR’s private equity division will comprise approximately 63% of Private Equity (AUM) based on historical averages. Real assets are expected to be significantly higher at around 90% as percentage of assets under management (AUM), while credit and other liquid strategies maintain an average of 95% based on the last three years. Taking these factors into consideration, the combined fee-paying assets under management are estimated to achieve a blended rate of 84% as percentage of total assets under management.

KKR’s Operating Metrics (10-K, Author’s Projections)

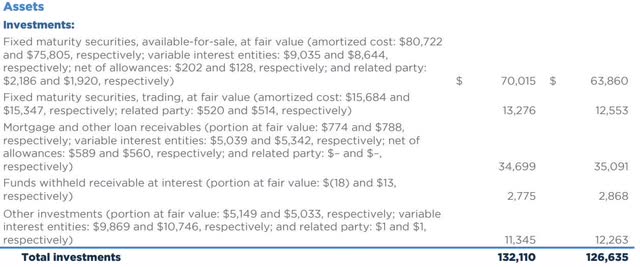

For the balance sheet, I have assumed that the asset management investments will grow at a rate of 11% which is consistent with the average market return. Additionally, I had projected an average return on assets of 6%, slightly below the historical average of 7%. For the insurance investments segment, I have assumed a 0% rate of return. Since their insurance portfolio is primarily consists of fixed income securities such as U.S. Treasury bonds, commercial mortgage-backed securities (CMBS), and other asset-backed securities (ABS), which are expected to mature at par.

KKR’s Balance Sheet Assumptions (10-K, Author’s Projections) Global Atlantic Q1 Balance Sheet (Investor Relations)

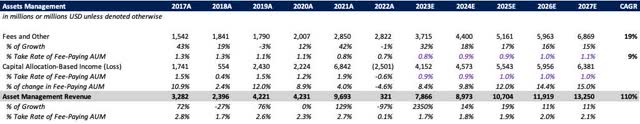

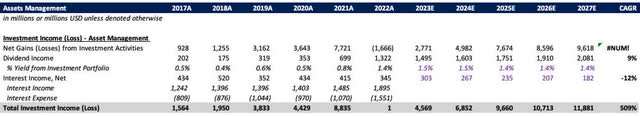

In the asset management segment, I assumed the asset management fee to increase to the historical average take rate of 1.1% as a percentage on fee-paying (AUM). The decline rate in 2022 was due to the decline of the performance portion of the fee, but I anticipate a return to normal levels in the medium to long term. Thus, this translate to a 19% compound annual growth rate (CAGR) for fee and other revenue. For performance allocation-based income, I have assumed a low-teens percentage of change in fee-paying (AUM). While this is lower than the historical average take rate of 1.5%, it still contributes to the overall revenue. Overall, I assumed asset management revenue to reach $13 billion by 2027, representing a 37.5% increase from 2021. Shifting to expenses, I have assumed an average of 27% of revenue for fee related compensation based on historical figures, with occupancy and related charges growing at a 5% (CAGR), while general, administrative, and other fees are assumed to grow at a 10% (CAGR). All in all, I have projected the operating earnings to reach the mid-50% range by 2027, representing a 9% (CAGR) increase from 2021. For the asset management investment income, I have assumed an average of 1.5% dividend yield and a 6% annual return in market gains, based on the historical data.

KKR’s Assets Management Revenue Build (10-K, Author’s Projections) KKR’s Assets Management Revenue Build (10-K, Author’s Projections) KKR’s Assets Management Investment Income Build (10-K, Author’s Projections)

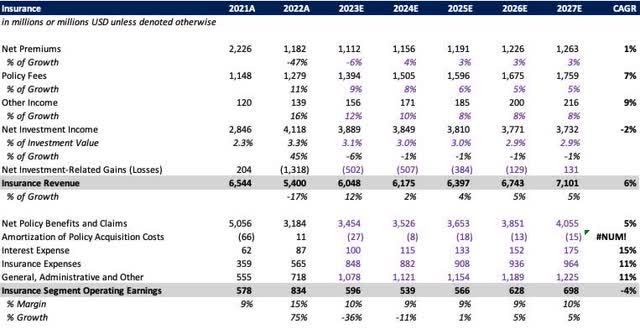

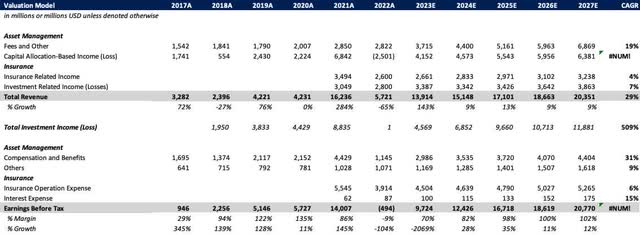

Now, for the insurance segment. I have assumed the net investment income to be around 3% of the insurance investment based on the historicals. Considering that a significant portion of their portfolio consists of treasury bonds and fixed income securities, I assumed the yield will remain relatively stable. For revenue, I assume a (CAGR) of 6% over the next five years for the insurance segment. Additionally, the operating income margin is assumed to remain content around 10%. Overall combing the two segments, the model assumed a CAGR of 29% for revenue. By 2027, the model estimates that investment income will reach $11.8 billion. Furthermore, earnings before taxes are assumed to grow at a CAGR of 7% from 2021, reaching $20.7 billion. I assumed a 12% effective tax rate, this translate to a net income of $18.3 billion in 2027 for KKR. I also assumed that 60% of the net income will be attributable to non-controlling interests, and a 3% annual share dilution rate.

KKR’s Insurance Segment Assumptions (10-K, Author’s Projections) KKR’s Consolidated Valuation Model (10-K, Author’s Projections) KKR’s Consolidated Valuation Model (10-K, Author’s Projections)

EPS Calculation:

Total Revenue + Total Investment Income (Loss) – Total Expense = Earnings Before Tax (EBT)

(EBT) – Taxes = Net Income – Non-controlling Interest = Net income (NI) Attributable to KKR & Co. Inc

(NI) / Shares Outstanding = Earnings per Share (EPS)

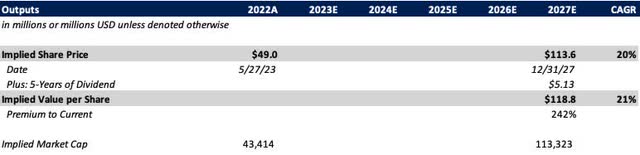

Based on these assumptions, the projected (EPS) for KKR is to be $7.33 per share in 2027. Additionally, I assumed a high double-digit dividend payout ratio, and an exit price to earnings multiple of 15.5x. In summary, based on the assumptions above, the projected share price for KKR by 2027 is $113.6 per share, representing a 5 year annual return of 20%. When factoring in the dividends, the implied value per share is $118.8, with an (IRR) of 21%. In conclusion, the valuation analysis suggest that KKR represents an quite attractive investment opportunity in the current market. The modeled share implied value per share demonstrate strong return potential, with a significant premium over the current price.

KKR’s Valuation Outputs (Author’s Projections)

Implied Value per Share Calculation:

Exit multiple x 2027E (EPS) = Implied share price

Implied share price + total 5-years of dividend = Implied value per share

Risks

-

Market Volatility and Economic Conditions: KKR’s business is significantly influenced by market conditions and economic cycles. During periods of market volatility or economic downturns, the performance of KKR’s investment portfolio may be negatively affected (as we seen today). Economic factors such as interest rate fluctuations, geopolitical uncertainties, and changes in consumer sentiment will impact the performance of KKR’s investments and the ability to generate favorable returns. Thus, impacting KKR’s performance based revenue and its ability to attract new investors.

-

Liquidity Risk: Private equity alongside other alternative assets are very illiquid. After the Global Atlantic acquisitions, KKR may be on the hook for significant cash obligation, and their commitments in the insurance industry will put pressure on its liquidity. KKR could be forced to sell its assets in unfavorable term or raise / issue significant debt or equity.

- Intense Competition: The asset management industry is highly competitive, and KKR faces competition from other well-established firms, such as BlackRock and Brookfield, among others. The industry have relatively low barriers to entry. Intense competition can lead to a challenging investment environment, as more firms enter into the bidding process, it may result in increased in acquisition price and put potential pressure on the internal rate of return (IRR), which could impact KKR’s ability to earn management fees and performance fees.

Conclusion

In conclusion, KKR stands out as an compelling investment opportunity in the current market landscape. Despite a recent decline in stock price by the challenging global economic conditions, rising interest rates, and a contraction in earnings multiples, however, I firmly believe that these losses are likely to be short-term in nature. KKR’s long-term performance will primarily driven by sales and profit, with multiples accounting for only a small portion of value over a 10-year period. Furthermore, KKR’s substantial dry powder of $106 billion positions the firm to capitalize on short-term declines in multiples. While risks exist, I do believe that KKR’s potential for growth and success outweighs its challenges. Therefore, based on the analysis and data presented, I rate KKR’s stock as a “buy” recommendation for investors looking to capitalize on the firm’s strengths and long-term growth potential.

Read the full article here