Investment Thesis

At a family gathering, I engaged in a conversation with my cousin about his gaming woes. He lamented that his X-Box’s limited memory forced him to remove beloved games to make way for new ones. Recently, he turned to Cloud Gaming, which bypasses downloads but compromises on graphic quality, resulting in a ‘pixilated’ and ‘laggy’ experience, especially for high-end games, which doesn’t do justice to his fiber optic internet cable.

This example mirrors a more pervasive issue in the tech industry: the growing need for enhanced data processing capabilities and more robust server infrastructure to support the increased demand for cloud services. In this context, Lam Research Corporation (NASDAQ:LRCX) stands out as a key player. As a leader in the semiconductor Wafer Fabrication Equipment ‘WFE’ market, their advanced technologies are crucial for addressing these emerging challenges. Beyond games, we need more chips to make ChatGPT faster and more powerful, Microsoft Office 365 less glitchy, and high-definition ‘HD’ 4K YouTube videos the global standard. The world is transforming fast, and LRCX offers an attractive vessel to capitalize on these trends.

Our buy rating is grounded on these long-term digitalization trends, offsetting short-term market volatility arising from the higher cost of living that suppressed demand for consumer electronics, and by extension, demand for memory WFE and related services, the primary market of LRCX. We believe that investors should expect a rebound in the memory semiconductor chip market as soon as 2024.

LRCX’s Edge

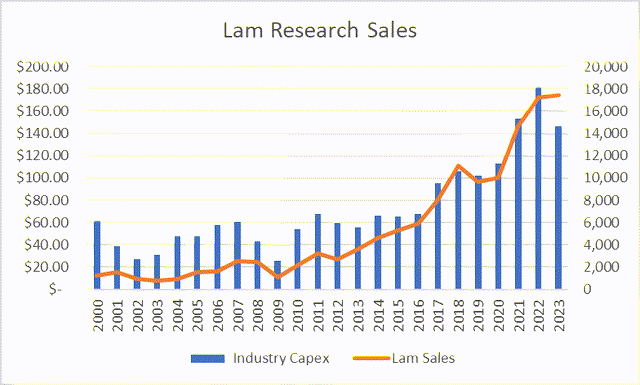

Creating statistical models to predict sales of multinationals often results in complex equations incorporating many elements, including regional economic conditions, new product rollout, competition, tech changes, and consumer preferences. This is not the case for Lam, whose sales are closely dependent on a single variable: the Global Semiconductor Capex. In fact, 97% of Lam’s sales changes are explained by this variable. This unique characteristic of Lam’s revenue reveals important (and appealing) company and market dynamics.

Author’s estimates based on data sourced from Statista

Lam collaborates closely with its customers (chip manufacturers) to design and enhance the semiconductor chip manufacturing process. This collaborative approach reduces the risks of making a strategic misstep that is detrimental to its market position, like the ones that Advanced Micro Devices, Inc. (AMD) and Intel Corporation (INTC) made that ultimately led to NVIDIA Corporation’s (NVDA) dominance while others play catch-up.

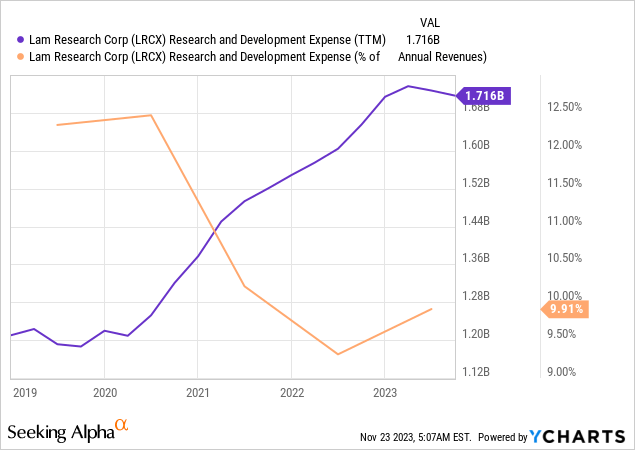

This touches on LRCX’s economies of scale and its ability to cough hundreds of millions of dollars on R&D collaboration projects with its customers. This financial power ensures its relevance and creates a barrier to entry. Smaller peers don’t have the financial resources to buy a seat in these R&D customer meetings that shape the industry. By R&D spending, LRCX is the third largest WFE provider after ASML Holding N.V. (ASML) and Applied Materials, Inc. (AMAT)

Despite the competition between WFEs, each has either built a niche focus on one of the four key fabrication processes or built a relationship with a set of semiconductor companies to derive sales. For example, KLA focuses on metrology and inspection, with its 295X series being the industry standard for Inline inspection. ASM International NV (OTCQX:ASMIY) established a leading position in Atomic Layer Deposition, with a 55% market share. ASML Holding N.V. (ASML) is the leader in Lithography. Lam has a strong position in memory wafer Etching.

Thus, buying LAM allows investors to gain exposure to secular semiconductor trends without worrying about strategic competitive positionings that have historically been a significant factor in the rise and fall of the more famous semiconductor design companies.

Financial Performance and Projections

In 2023, LRCX experienced a significant downturn, with over 30% year-over-year declines in the September and June quarters, underperforming its industry peers. While others in the WFE sector saw milder declines due to a temporary halt in semiconductor chip manufacturing capacity expansion to manage existing resources, LRCX’s struggles are primarily due to its heavy reliance on the highly volatile memory chips market. This market has been hit hard by reduced demand for consumer electronics, like mobile phones and TVs, a direct consequence of the rising cost of living.

In contrast, the logic and foundry segments have experienced a milder slowdown. Looking forward, a projected decline of around 26% (plus or minus 6%) is expected for the December quarter. However, after this correction, Lam’s performance will realign with the broader industry trajectory, where a recovery follows a temporary slowdown in 2024 – 2025.

LRCX’s underperformance is thus a result of its focus on the volatile memory chips market rather than a change in its market position. Thus, LRCX’s sales will stabilize sequentially, although investors should expect a YoY decline in the next two quarters ending March 2024 before the market rebounds.

Valuation Risk

LRCX is a bit costly but offers a better value than many of its peers, especially those lower in the semiconductor supply chain, making it an appealing prospect for those looking to capitalize on the expected rise in demand for semiconductors.

| Company | FWD PE Ratio |

| Applied Materials, Inc. (AMAT) | 19.4 |

| Lam Research Corporation (LRCX) | 20.5 |

| KLA Corporation (KLAC) | 21.3 |

| Tokyo Electron Limited (OTCPK:TOELF) | 27.2 |

| Advanced Micro Devices, Inc. (AMD) | 32.7 |

| ASM International NV (ASMIY) | 33.9 |

| NVIDIA Corporation (NVDA) | 40.6 |

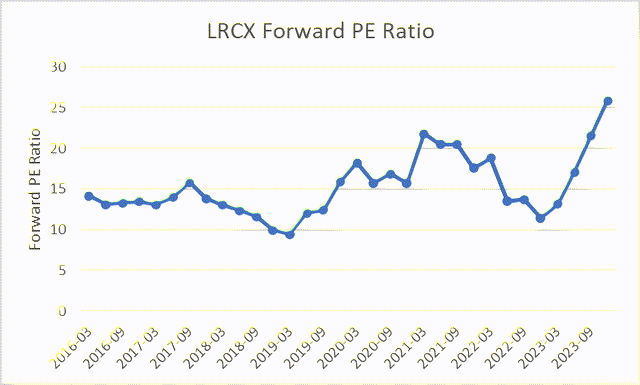

However, it is important to note that for a cyclical company, its current 20x PE ratio is not particularly cheap. Moreover, this ratio is at an 8-year high, suggesting cautious evaluation is warranted.

Our buy thesis is grounded on our belief that we are on the precipice of a fundamental change in the WFE market that extends beyond the cyclical sale of capital equipment to recurring revenue from services and spare parts. LRCX derives nearly a quarter of its revenue from services and products that depend on the installed base level rather than its customers’ capex decisions, offering a cushion against the market’s cyclicality.

GuruFocus

Share Buybacks and Dividends

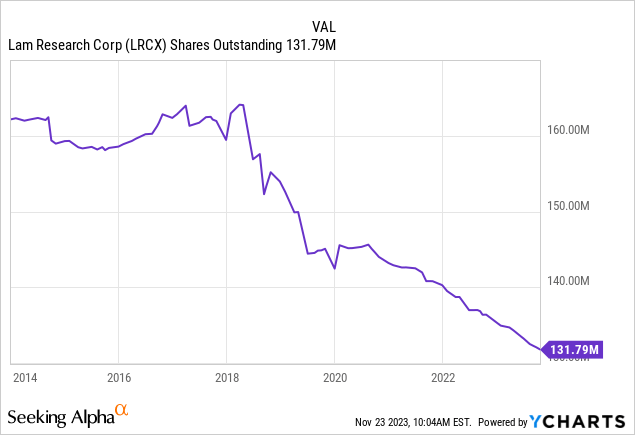

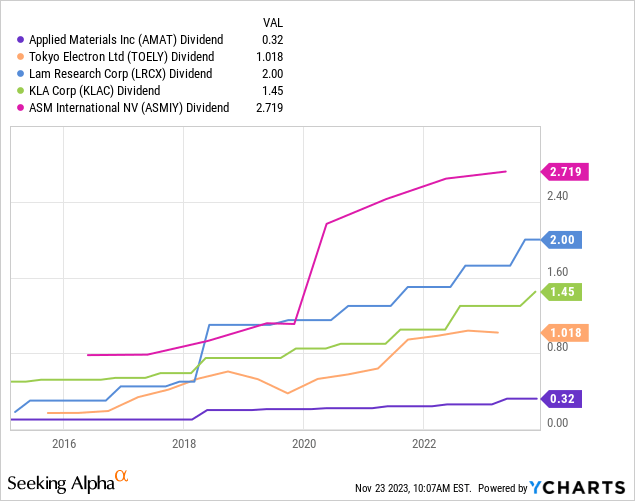

The WFE sector is cyclical, and growth isn’t consistent. Share buybacks and dividends are key to delivering value to shareholders amid volatility. LAM has demonstrated strong commitment to this strategy, reducing the number of shares outstanding by over 19% over the past decade and 16% in the last five years, indicating a solidified approach to stock repurchase.

Mirroring KLA’s policies, LAM has pursued a dividend growth policy, with the latest dividend hike in September marking the 9th consecutive year of dividend rises. This approach is uncommon in the cyclical WFE sector, yet both companies maintain it prudently, keeping payout ratios modest to buffer against market swings.

Summary

The investment thesis for LRCX centers around the company’s pivotal role in the semiconductor industry, a sector experiencing growing demand due to technological advancements and digitalization trends. The investment opportunity is, to a certain extent, inherent from the unique dynamics of the WFE sector, but also the company’s leading position, which allows it to profit as high-end chips seep through to more and more consumer electronics and business applications, replacing the crowded mature nodes semiconductor chips market. LRCX is one of the few companies capable of producing the fabrication equipment used to produce high-end semiconductor chips.

The company’s financial performance, although recently affected by market volatility, is posed for recovery. LRCX’s valuation presents a compelling opportunity compared to its peers. Adding to its standing is LRCX’s unique dividend growth policy, a rare characteristic in the cyclical WFE market. These dynamics render LRCX an attractive choice for investors seeking exposure to the semiconductor market’s growth while mitigating the risks associated with companies down the supply chain.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here