Hmmm. Maybe if I eat an extra bowl of alfalfa spouts I can get ahead. Actually, I’d rather just take a nap.

Introduction

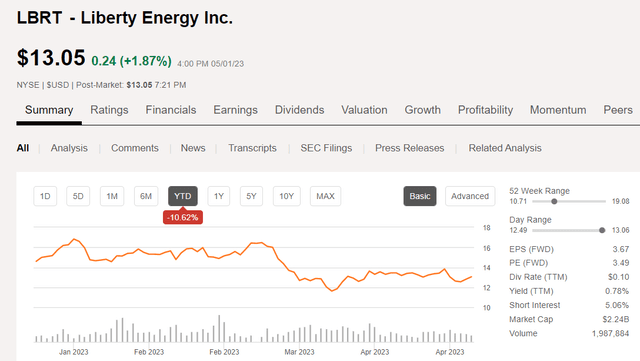

Liberty Energy Inc. (NYSE:LBRT) turned in a very solid quarter for Q1, beating on both the top and bottom lines and showing 60% growth YoY. The market was unprepared for this and had been taking down EPS estimates for the past several months. As investors we love good surprises, and that certainly was one, as LBRT stock has been mercilessly hammered in the intervening time.

Liberty Energy Price chart (Seeking Alpha)

I think Liberty Energy Inc. is a stock you want to own at current levels. It is the number two overall, and number one of the pure-play frackers. It has more going for it than just the business fundamentals we normally judge companies by.

It has its founder, Chris Wright, in the CEO seat, and if you believe management makes a difference, you are a fan of his. Wright is a visionary with a practical side. Wright is also the brainiac who essentially invented real-time frac modeling – something we take for granted now – with his first start up, Pinnacle Technologies, before he sold it to Halliburton, waited out his non-compete, and then founded Liberty. Wright is an enthusiastic and well-known supporter of a rational approach to energy delivery and frequently makes the round of financial chat shows, speaking about it in addition to running LBRT. I have published some of his writings here in the DDR, and he has taken recently to doing podcasts. Here’s a link to some of them, have a listen. Wright is an engaging and passionate advocate for sensible energy policies, and I think you will find listening in worthwhile.

On a fundamentals basis we find LBRT to be undervalued by the market, and expect this situation will correct soon. In this article, we will discuss some of the drivers that may make this happen.

The thesis for LBRT

This may shock you. Sit down, please. If we were to stop drilling today, a year from now we would be producing about 3.76 mm BOPD less. The decline rate of shale is commonly about 40% per year. Meaning, in about 2.5 years it’s time to call the cement truck, as you can’t sell salt water.

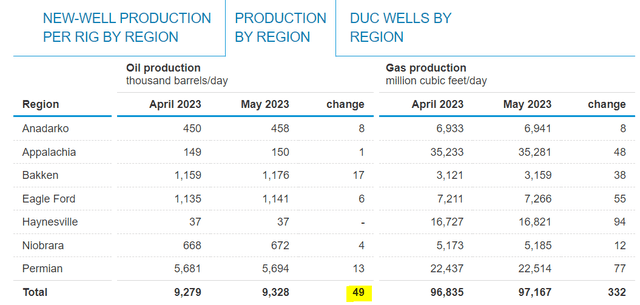

Quick math. Over the last 9 months, shale output has gone from 8.7 to 9.4 mm BOPD. Yay, we’re producing more 700K oil per day and life is going to be just ducky. But, and it’s a very big but, that’s only slightly higher than the monthly decline rate of ~330K BOPD per month. 700K BOPD over seven months working out to new production in excess of declines of only 58K BOPD per month. Don’t believe me? See what 600 rigs turning to the right are forecast to achieve between April and May, highlighted in yellow below.

EIA DPR new well production (EIA-DPR)

So you can see why I picked a sleepy hamster as the mascot for this article. If most drilling and completions are just replacing legacy production, we’d better keep drilling and fracking. And, that puts meat on LBRT’s table.

Liberty Energy Inc. is the second largest in terms of revenue and HHP, operating an estimated 44-45 fleets, with 39 under contract in Q-1. LBRT covers the full gamut of fracking with its acquisition of last mile sand logistics specialist, PropX in 2021. It is basic in sand with two mines that came along with the SLB deal to take over OneStim.

Fuel sources for frac spreads is a constant topic, as a Tier II diesel spread burns millions of gallons of diesel annually. The conversion of the diesels to Tier IV Dynamic Gas Blend-DGB, DigiPrime, and all-electric Digifrac units is well underway – at the 50% point now, and soon will comprise the bulk of LBRT’s fleet. Now Liberty has formed a vertically integrated subsidiary to supply fuels – CNG, RNG internally and potentially to other frac companies.

Liberty Power Inc-LPI, will use newly acquired Siren Energy’s CNG, technology to grow this business. CEO Wright describes it thusly:

To accelerate LPI’s expansion earlier this month, we announced the acquisition of Siren Energy, a Permian-focused, integrated natural gas compression and CNG delivery business. Siren brings its installed and expandable gas compression facilities at two Permian sites together with transportation, logistics, and well site pressure reduction services.

I am sure we will hear more about this business in quarters to come. It’s smart move by LBRT, sort of a “Midstream” solution to how to get reliable power to Tier IV DGB frac pumps, and I think it will quickly become accretive to the company. See what I mean about Wright being a visionary?

Q-1 and 2023 guidance commentary

Revenue came to $1.3 bn, flat sequentially but up 60% YoY. Adjusted EBITDA came to $330 mm, a 12% gain sequentially and over 3X YoY. The company returned $81 mm in capital to shareholders, consisting of $75 mm in stock buybacks and $9 mm in dividends. Net debt stood at $211 mm, and there was $21 mm cash on the books. Total liquidity stands at $300 mm including availability on their ABL. Over the past year, LBRT has reduced its share count by 4.5%.

CFO Michael Stock closed out his commentary with guidance for the year:

Looking ahead, we’re expecting modest sequential growth in the second quarter, expanding on the solid results, we achieved in the first quarter and reflecting stable pricing, normal, seasonality, and a solid base of customer demand. We’re not seeing softness in the gas markets significantly impacting our second quarter results.

Risks

Liberty Energy Inc. is a well-managed company with little debt and an industry leading position in the pure-play fracker segment. It has shown the capacity to make market concentrating acquisitions that are quickly accretive, and with the introduction of LPI is vertically integrating its fuel supply needs. This should drive down fuel costs and bring in revenue as its customer base expands. The main risk to the thesis lies in lower oil prices than the industry expects this year.

Another risk is additional ~15 frac spreads coming on the market in 2023. CEO Chris Wright made the point in the call that these will only partially offset the ~25 or so fleets that will be obsoleted this year-

Maybe people with band-aids hold on to half of that, 12, 13, 14 fleets of equipment exit and 13, 14 fleets of new equipment, arrive, that’s pretty much a flat supply this year.

Finally, we know the rig count is coming down, primarily in gas plays. CEO Wright noted that with LBRT’s primary exposure in oil dominant plays that the impact would be minimal:

Maybe 20% of total industry activity is in gas markets. There even if that pulled back by a third, that’s a 6% or 7% decline industry-wide in demand for frac fleets. So I would say the impact on us, probably not that meaningful.

Your takeaway

On April 27th, Liberty was the subject of a bullish article in Morningstar written by Katherine Olexa. She writes:

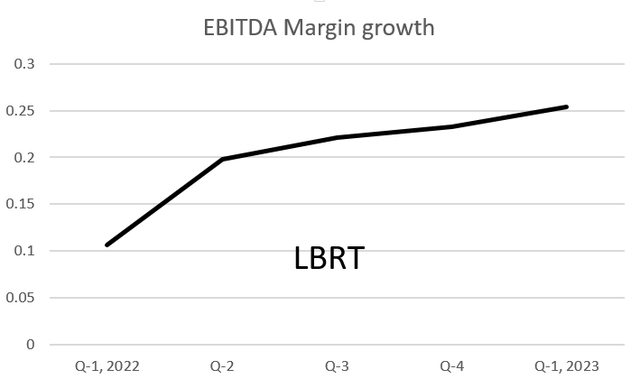

In our view, most of Liberty’s first-quarter performance is attributable to favorable pricing rather than active frac spread count. Estimates from Rystad Energy indicate Liberty operated 39 active rigs, four less than last quarter. Yet, first-quarter revenue increased 3% sequentially, implying service prices jumped 15% by our estimate. Pricing gains continue to boost profitability as well. For the third consecutive quarter, firmwide adjusted EBITDA margin increased 200 basis points to 26%, well above the firm’s pre-pandemic average in the high teens.

EBITDA Margin Growth (Seeking Alpha)

Ms. Olexa goes on to put a near-term price on Liberty share of $17. Other analysts are calling for a range of $14.50 to $28.00, with a median of $19.50.

Right now the company is trading at 1.8X Forward EV/EBITDA. Analysts have been raising their EPS estimates for Q-2, and are currently forecasting $0.96 per share. That would put earnings at $173 mm for Q-2, slightly ahead of Q-1’s $163 mm. With that in mind, we can nudge EBITDA for Q-2 to $350 mm run rate, put a 2X on it (181 mm X $17.00 = ~$3 bn market cap) and handily attains Ms. Olexa’s $17.00 price target. If we hang a 2.5X on LBRT shares, we get that median estimate of $19.50 per share.

For reference, smaller competitors, ProPetro Holding Corp. (PUMP) and NexTier Oilfield Solutions Inc. (NEX), are trading at 2.6X, and 2.43X respectively. None of these companies are overpriced in this market, but Liberty Energy Inc. is our pick.

However you calculate it, Liberty Energy Inc. is in a buy zone at the present time and risk tolerant investors should take a hard look at the company.

Read the full article here