Investment thesis

Lifetime Brands (NASDAQ:LCUT) is currently enduring a series of headwinds that are having a significant impact on the balance sheet, both from the current macroeconomic landscape and the nature of the industry in which the company operates. Weaker demand due to declining consumer purchasing power and high retail inventories have caused a significant drop in sales in 2022, and very high debt, together with increasing interest rates, are generating very significant interest expenses for the company. The company is currently struggling to generate cash from operations due to current headwinds and has relied on inventories to do so and keep deleveraging the balance sheet, which will be critical for the years to come, but cash from operations improved significantly during the past quarter. In this regard, time played against the company for the past year and could continue to do so if margins suffer another decline (even if slight), and that’s the main reason why the share price has experienced an abrupt fall in the share price, which has reached 75% since the highest peak of 2021. For this reason, the most important aspect for investors today is the survival of the company in the short and medium term as potential returns in the long term are very high.

Apart from the impact of high retail inventories and weaker demand on the company’s net sales, inflationary pressures and decreasing consumer purchasing power (and thus weakened pricing power for the company) are having a significant impact on the company’s cash generation capacity, but in this article, I will explain why investors’ pessimism represents a good opportunity as the company holds vast inventories to face current headwinds and even a potential recession.

A brief overview of the company

Lifetime Brands is a manufacturer and seller of branded kitchenwares, tablewares, housewares, and other products used in the home under its owned and licensed brands, and also through private labels. The company has its roots in 1945 and its market cap currently stands at ~$106 million, employing over 1,000 workers. Insiders own 14.13% of the shares outstanding, which means they are the main beneficiaries of the good performance of the share price.

Lifetime Brands logo (Lifetimebrands.gcs-web.com)

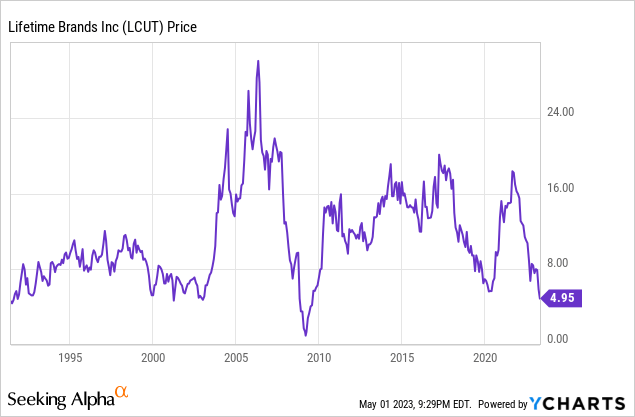

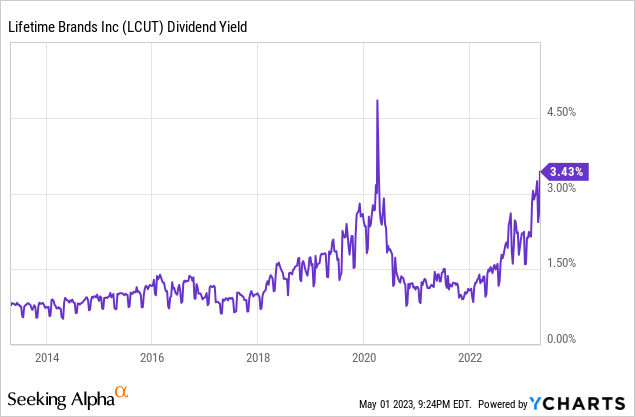

To understand the dynamics of investing in Lifetime Brands, it is very important to look at its long-term share price chart to realize that its business has been exposed to very abrupt changes over the years as its operations have been characterized by having a broad cyclical component. In this sense, the current fall in the share price has caused a spike in the dividend yield, which is at unusually high levels at 3.43%, but investors should invest with the idea of selling the shares once the company’s prospects improve and shareholder optimism returns as the risk of a significant decline in the share price significantly increases as it recovers.

Currently, shares are trading at 4.95, which represents a 75.16% decline from recent highs of $19.93 in August 2021. This fall in the share price is certainly very significant and reflects a very complicated outlook for the company, which is why it will be very important to evaluate the different aspects that come into play when assessing whether the company is prepared to overcome the current and potential headwinds. To begin, I am going to summarize the latest acquisitions of the company as these have allowed it to grow over the last few years.

Recent acquisitions

One of the main reasons why the company has shown growth rates in its sales over the years is that the management has adopted a strategy based on the acquisitions of other companies to include their operations in its business.

In September 2016, the company acquired the kitchen division of Focus Products Group, which manufactures a wide variety of kitchenware and bakeware products, for $8.8 million. A month later, in October 2016, the company acquired the Copco product line from Wilton Industries, which includes travel mugs, cups, tumblers and carafes, and other products for the kitchen, for $12.3 million.

In September 2017, the company acquired the business and assets of Fitz and Floyd, a manufacturer of tabletop products and decorative ceramic collections, for $9.1 million, and in March 2018, the company also acquired Filament Brands, a designer, marketer, and distributor of consumer and food service precision measurement products (including kitchen scales, thermometers, and timers), bath scales, wine accessories, kitchen tools, and hydration products, and select outdoor products to major retailers in the United States, Canada and select distributors throughout Europe and Asia, for $294 million. The acquired company manufactures products under its own brands but also supplies private labels.

After deleveraging its balance sheet a bit, in March 2022, the company acquired the business and certain assets of S’well, a global designer, wholesaler, and retailer of reusable, vacuum-insulated products, including bottles, bowls, food canisters, ice buckets, tumblers, and more, for ~$18 million.

Net sales, although currently weak, have shown an upward trend over the years

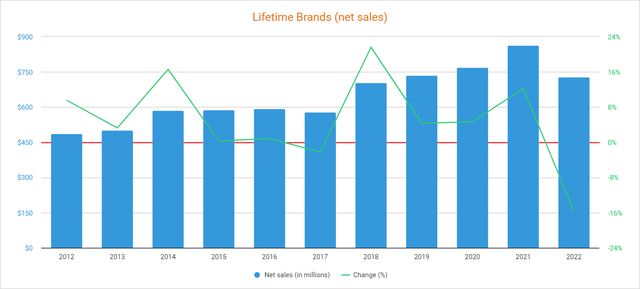

Thanks to the acquisitions carried out in recent years, the company has managed to successfully increase its sales in the past 10 years at a relatively acceptable pace, and when I say relatively acceptable I mean that the level of debt has increased so significantly in recent years that it is not easy to justify such moderate growth. Although it is true that 2021 was a good year thanks to a 12.19% increase in sales compared to 2020, net sales decreased by 15.67% in 2022 due to weaker demand as consumers are delaying their spending for non-essential items as inflation is impacting their purchasing power. Still, the company gained some market share in Europe throughout 2022, which reflects that the company is not performing all badly despite macroeconomic headwinds.

Lifetime Brands net sales (10-K filings)

More specifically, net sales declined by 6.61% year over year during the first quarter of 2022, by 18.93% during the second quarter, 16.99% during the third quarter, and 19.08% during the fourth quarter despite the acquisition of S’well in March 2022. Apart from a bad year for the industry due to weaker demand, the company’s customers have been rightsizing their inventories as they remain high, which resulted in fewer orders, and the management doesn’t expect a significant recovery in the foreseeable future more than some customer’s order normalization as their inventories empty. In this regard, net sales are expected to decline by 0.88% in 2023, but partially recover in 2024 by increasing by 6.79%.

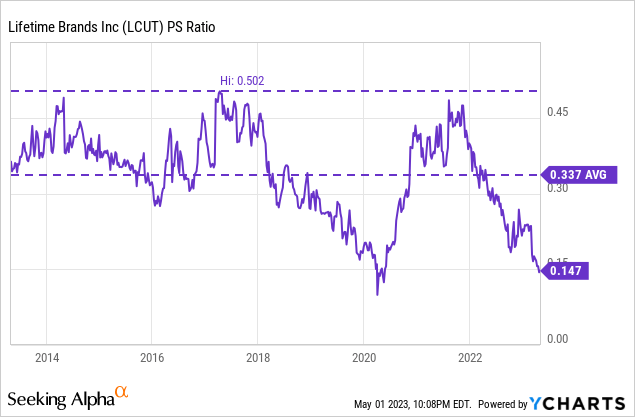

Using 2022 as a reference, 88% of the company’s total net sales are generated through operations within the United States, whereas 5% are generated in the United Kingdom, and 7% in the rest of the world, which means the company has some geographic diversification. Still, the profound decline in the share price coupled with a much softer decline in sales has caused a dramatic drop in the P/S ratio to 0.147, which means the company generates net sales of $6.80 for each dollar held in shares by investors, annually.

This ratio is 56.38% lower than the average of the past decade and represents a 70.72% decline from decade-highs of 0.502 reached in 2017. This reflects a clear pessimism among shareholders due to four main factors. In the first place, and as I have mentioned, due to the drop in sales as a consequence of a weakened industry and unusually high retail inventories. Secondly, due to the increase in debt derived from the acquisitions carried out in recent years, as well as increasing interest rates. Third, as a result of a contraction in margins as a result of declining volumes and inflationary pressures despite having shown a slight improvement in the last quarter. And finally, due to the growing concerns of a potential recession as a consequence of the recent interest rate hikes carried out to moderate high inflation rates around the world.

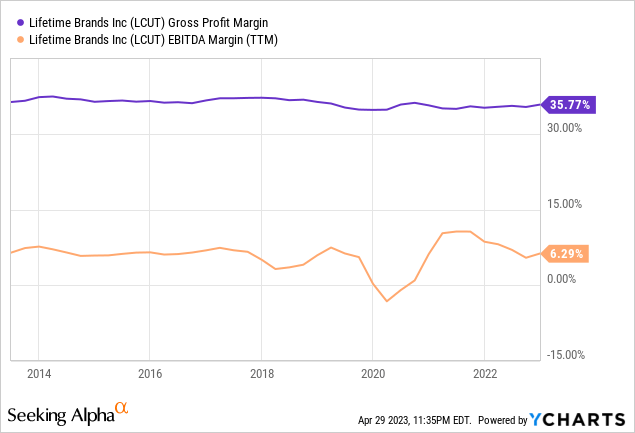

Margins are showing signs of improvement

The company has historically enjoyed healthy gross profit margins of over 30% and EBITDA margins of around 5%, but the coronavirus pandemic crisis caused a sharp decline in the EBITDA margin to negative territory in 2020. After recovering in 2021 as the world’s economies reopened after self-imposed restrictions derived from the coronavirus pandemic crisis, the EBITDA margin fell again in 2022 due to inflationary pressures, the war between Russia and Ukraine, higher storage costs due to unusually high inventories, and decreasing volumes at times of more expensive labor due to wage increases.

Nevertheless, the EBITDA margin partially recovered to 8.58% during the fourth quarter of 2022 as the company is taking cost management actions in order to offset decreased market demand as retailer’s inventories are still high, and the gross profit margin slightly improved to 35.9% thanks to lower freight costs and increased product prices. Still, the company generated an adjusted EBITDA of $19.7 million during the fourth quarter of 2022 vs. $30.9 million during the same quarter of 2021 (as for the whole year, the company generated $58.2 million adjusted EBITDA compared with $95.1 million in 2021), which means the 2021 boost seems to have come to an end. Nevertheless, the company recently eliminated all third-party distribution agents in major geographies in order to drive profitability in international operations. Also, it reduced distribution expenses by $4.6 million due to an ongoing labor efficiency program and also reduced discretionary expenses.

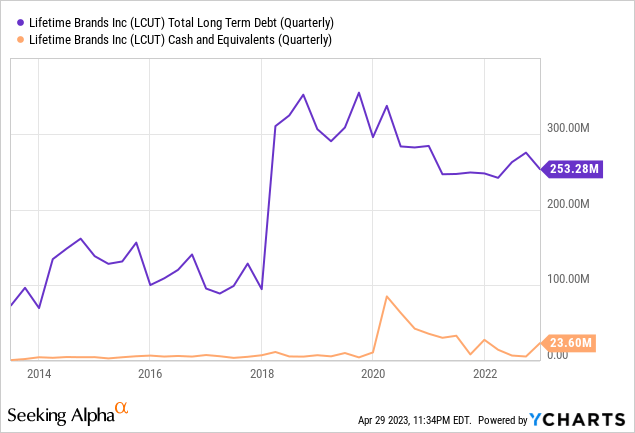

Long-term debt represents a major risk despite the recent partial deleverage

As a consequence of the Filament Brands acquisition in 2018, long-term debt increased by more than $200 million to over $300 million, but the company successfully paid down a significant portion of it to $253 million, albeit in exchange for significantly lower cash and equivalents. We must bear in mind that the company also spent $18 million on the S’well acquisition.

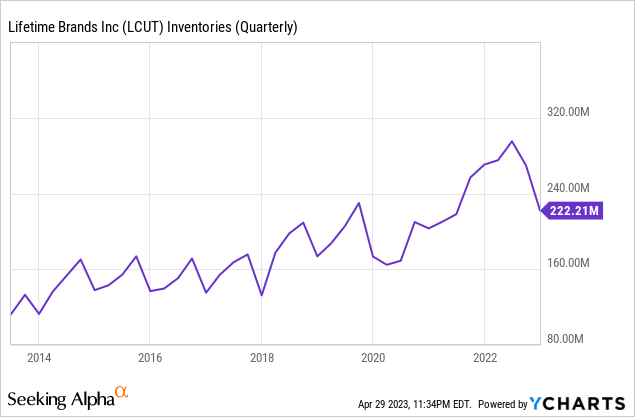

Still, inventories are still higher than usual at $222.21 million despite the fact that the company reduced them by $48 million in 2022, and the management expects to further reduce it throughout 2023 (although to a lesser extent), which should allow for strong cash from operations in the coming quarters with which to continue deleveraging the balance sheet.

In this regard, high inventories significantly reduce the risk that debt poses to the company, but still, interest expenses of $17.20 million in 2022 are a payment that the company should be able to cover through its own operations in the coming years, at least almost entirely, in order not to have to make use of said inventories without them being used to reducing the company’s debt pile. In addition, the company also has to cover a dividend payment of almost $4 million per year.

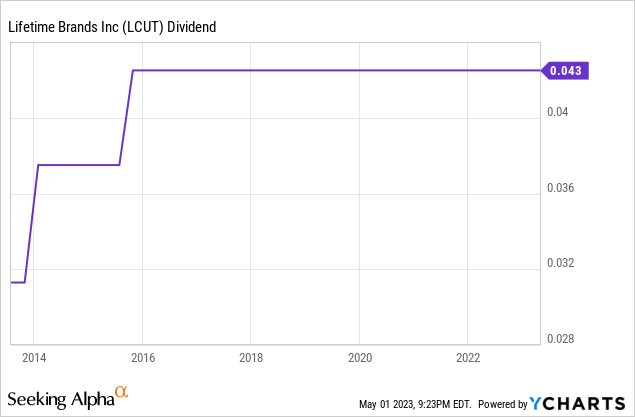

The dividend is currently at risk, but the potential dividend yield on cost is high in the long term

Certainly, dividend growth has been very limited in recent years and it remains frozen at $0.043 per share since 2016, as can be seen in the table below. This is because the company has devoted extensive efforts to expand through acquisitions and the interest expense has skyrocketed as a result.

Despite this, the recent share price decline has caused a very significant increase in the dividend yield, which currently stands at 3.43%, the highest level in recent years if we ignore the spike experienced during the worst days of the coronavirus in 2020. Therefore, the increase in interest expenses (and therefore a reduced past and future growth in the dividend) should not pose a significant problem for dividend investors, if the company successfully deleverages its balance sheet, despite short and medium-term limited potential (and risks) as the dividend yield on cost is significantly higher than usual. This is the price that dividend investors will have to pay in exchange for the current surge in the dividend yield on cost: lower upside potential and higher risks in the short to medium term.

In order to calculate the sustainability of the dividend over the last few years, in the following table I have calculated what percentage of the cash from operations has been allocated each year to the payment of the dividend and interest expenses. In this way, one can have an idea of the company’s ability to cover both expenses through actual operations.

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| Cash from operations (in millions) | $4.59 | $46.51 | $29.75 | $17.01 | $19.18 | $29.87 | $44.81 | $36.99 | $24.32 |

| Dividends paid (in millions) | $2.03 | $2.15 | $2.41 | $2.48 | $3.27 | $3.57 | $3.65 | $3.84 | $3.82 |

| Interest expense (in millions) | $6.42 | $5.75 | $4.80 | $4.29 | $18.00 | $20.38 | $17.28 | $15.52 | $17.20 |

| Cash payout ratio | 184.11% | 16.98% | 24.26% | 39.79% | 110.70% | 80.17% | 46.70% | 52.36% | 86.46% |

As can be seen in the table above, the company has maintained a very healthy cash payout ratio in recent years, which explains its ability to acquire companies and the very low dividend yield prior to the recent decline in the share price. Still, 2022 was a complex year for the company as cash from operations was just $24.32 million, which is significantly lower than cash generated in 2015, 2016, 2019, 2020, and 2021 despite a reduction of $48.3 million in inventories. Accounts receivable also declined by $33.9 million during the year, but accounts payable declined significantly more by $44.5 million. Furthermore, higher interest rates in the company’s variable rate debt caused a $1.2 million increase in interest expenses in 2022 to $17.20 million.

As for the fourth quarter of 2022, cash from operations was $44.4 million, and accounts receivable increased by $5.9 million while accounts payable declined by $4.9 million, but inventories declined by $47.5 million. In this regard, the company’s cash generation capacity improved significantly as the company posted a net income of $ 3.3 million for the quarter. Furthermore, interest expenses should continue to decline as they have in previous years as long-term debt declines.

Buybacks have been paused as a consequence of weaker cash from operations

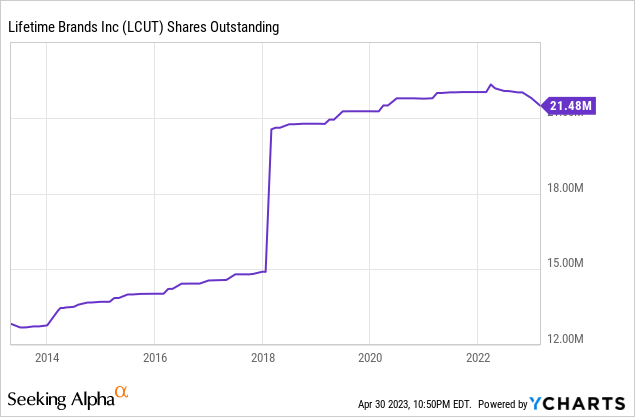

The company’s shares outstanding increased by 38% as a consequence of the Filament Brands acquisition in 2018, and with it did the interest expenses. The company announced a $20 million share repurchase program in March 2022, and the number of shares outstanding decreased by 2.43% in the past year to 21.48 million as a result of share buybacks of $6 million during the year.

Despite this, the program is currently on hold as margins remained depressed for the whole of 2022, although the management plans to buy back shares as the year goes on as cash from operations improved in the fourth quarter. Nevertheless, and in my opinion, there is a high risk of this share buyback program failing to be completed as the management could prefer to preserve cash amidst growing concerns of a potential recession in the short to medium term.

Risks worth mentioning

As we have seen throughout the article, the company’s risks are significantly high, and I would like to highlight them in this section.

- Currently, declining volumes (and therefore unabsorbed labor) and inflationary pressures are having a significant impact on the profit margins of the company, which has seen a significant decrease in cash from operations in 2022 when we consider the speed at which it is emptying the inventories. Although the fourth quarter showed a significant improvement and demand should stabilize once customers empty their inventories to lower levels, if inflationary pressures continue and consumer purchasing power does not pick up, the company could continue experiencing decreased sales in the coming quarters as its products are very easily postponed by consumers when their purchasing power is affected by macroeconomic factors.

- A potential recession would likely produce a significant impact on the company’s operations. As consumers delay their purchases of items sold by the company in times of economic struggle and uncertainty, volumes could suffer the most, which would lead to even more unabsorbed labor and pricing power.

- The company may have trouble selling its products at profitable prices as a result of high customer inventories.

- The dividend could be cut in order to preserve as much cash as possible to cover interest expenses and reduce current debt levels if the company does not recover its cash generation capacity soon and in a stable way as inventories will soon get to significantly lower levels.

- The share buyback program could remain on hold for much longer than the management planned, or even be suspended entirely due to the company’s dire need to reduce its long-term debt.

Conclusion

Certainly, the situation for Lifetime Brands is very complex at present and the risks are significant, but in my opinion, the current ~75% drop in share price since recent highs reached in 2021 is not fully justified as the situation is not as catastrophic as the share price can make one think. Debt is a real problem for the company’s viability, and margins have been significantly impacted by current inflationary pressures, increased labor costs, unabsorbed labor, and higher-than-usual storage costs due to high inventories, but cash from operations has shown a broad improvement in the fourth quarter despite a fast emptying of inventories. Furthermore, high inventories of $222.2 million represent not only very valuable resources to continue paying the debt pile, but also to face a potential recession as a consequence of the recent interest rate hikes.

For these two reasons (increasing cash from operations and high inventories), I consider that the recent fall in the share price represents a good opportunity to take advantage of this negative cycle of the company and thus acquire shares at reasonable prices in order to be able to sell the shares at significantly higher prices once the macroeconomic landscape improves and optimism returns to reign among investors.

Read the full article here