LiveRamp (NYSE: RAMP) is a data collaboration platform that helps businesses and their partners to securely share, organize, and activate their customer data to enhance their targeted advertising and marketing campaigns. It generates revenue primarily through platform subscription fees as well as revenue-sharing fees from its data marketplace platform.

In spite of the ongoing macro slowdown that has been pressuring advertising/ad spending, the business has been relatively resilient. It maintains double-digit growth, even as growth has declined from 16% – 30% pre- and during COVID-19 to +12% level as of FY 2023. The company also has a strong balance sheet, while operating cash flow / OCF has been positive since FY 2022.

As per the company guidance in Q4 2023, FY 2024 growth outlook will be temporarily a bit muted due to the ongoing lower ad spend environment due to the macro slowdown. However, I believe that the business should continue to benefit from a secular tailwind due to the broader shift to cookieless advertising and see growth reacceleration post-slowdown.

My modeled target price indicates that LiveRamp currently trades at a ~7% discount. Consequently, I am initiating my coverage with an overweight rating.

Catalyst

While I expect the ad spending headwinds to be temporary, LiveRamp has also been relatively resilient amid the industry slowdown. It even landed key upsell deals in Q4 to support its 13% revenue growth in FY 2023:

We had 5 customer upsells each with an incremental ACV of $1 million or more. 3 of these deals were with national retailers to support their growing retail media networks. The other 2 upsells were data collaboration use cases outside the retail sector, demonstrating that commerce networks are not limited to the retail CPG complex. We had an upsell with a global travel and hospitality customer and also a major automotive manufacturer. The auto upsell is an 8-figure multiyear deal to enable data collaboration between the corporate auto OEM, the dealerships and the regional advertising group.

With that in mind, there is a possibility that growth may accelerate above expectation in the second half of FY 2024 and reach a double-digit figure into FY 2025 once the slowdown starts to subside, as I expect it to.

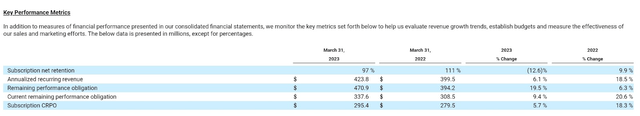

annual report RAMP

Despite the expectation of slowing growth in FY 2024, bookings have been solid for the entire FY 2023. RPO / Remaining Performance Obligation, which tracks the backlog of unrealized revenue from bookings, accelerated from 6.3% YoY a year ago to 19.5% YoY as of FY 2023. Effectively, it outpaced the +6% ARR growth in FY 2023, indicating that LiveRamp maintains a strong deal pipeline even during the slowdown. Given the multi-year nature of these contracts, LiveRamp will only partially realize some of those revenues in FY 2024.

Nonetheless, the trend suggests that LiveRamp’s offerings continue to be in demand despite the macro slowdown. In particular, the trend of a cookieless future has created a significant impact on not only the digital advertising industry but also the demand for LiveRamp’s offerings.

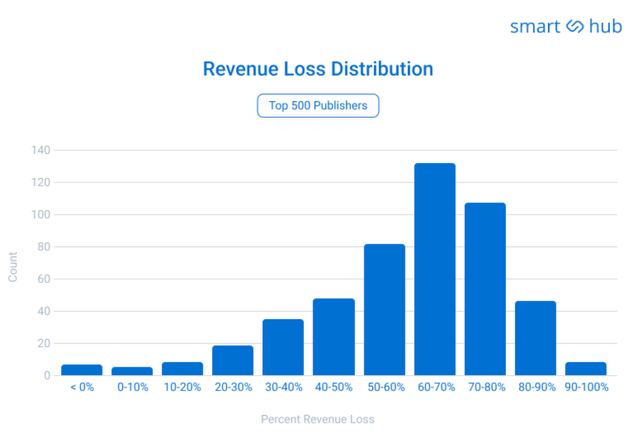

smarthub

A study conducted by Google (GOOGL) in 2019 indicates that the top 500 global ad publishers may expect on average a 52% decrease in ad revenue in a cookieless environment. Traditional advertising relies heavily on third-party cookies to track user behavior and target ads effectively. Things will change soon, driven by the rise in privacy concerns regarding the use of personal data. Google, for instance, expects to phase out third-party cookies in its popular web browser, Chrome, in 2024.

In a cookieless environment, first-party data becomes increasingly valuable. LiveRamp’s solution, for instance, helps create privacy-first identifiers that enable businesses to activate their first-party data to be used for audience targeting, measurement, and personalization across channels and devices.

As such, I continue to believe that this is the right time for LiveRamp to continue expanding its sales capacity and productivity to drive pipeline conversion. In the Q4 earnings call, we also learned of some interesting stats from the management regarding sales productivity that points to things going in the right direction – it appears that LiveRamp had 20% fewer ramped raps in FY 2023 than in FY 2022 on average, but expects to enter FY 2024 with 25% more ramped raps than in FY 2022. Furthermore, the number of new leads in the sales pipeline is also already 20% higher than the FY 2023’s average. Considering these facts and LiveRamp’s relatively strong execution during the slowdown, I think that it is realistic to project another double-digit bookings growth in FY 2024, despite the conservative revenue outlook.

Risk

Currently, I cannot identify any near-term key risk on LiveRamp aside from the possibility of a prolonged macro slowdown that may negatively affect LiveRamp’s subscription business, which is a key growth driver.

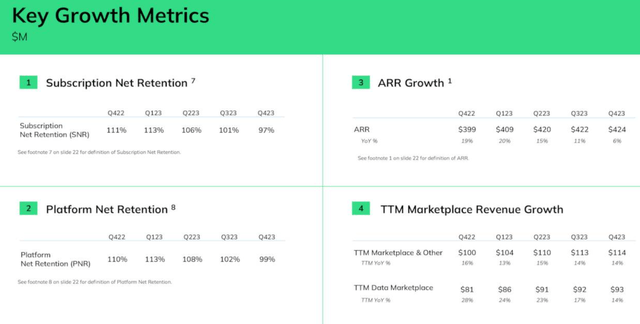

RAMP presentation

Despite the relatively steady marketplace growth, LiveRamp still generates +80% of its revenue from the platform subscription fees.

In Q4, subscription down-sell and churn activities were apparent, though the management suggested that it mostly came from the non-enterprise client segments. The management mentioned that SMBs made up less than 25% of the total revenue, though it does not disclose the classification of its clients by segments or deal size.

I think that the figure may probably be closer to 25% or even higher depending on the SMB definition, considering how quickly net retention dropped. It is important to note that Subscription Net Retention / SNR was 97% as of Q4, down by 1400 bps in just a year. As such, the potentially higher-than-expected SMB concentration may continue to drive higher down-sell and churn risks, especially during the macro slowdown.

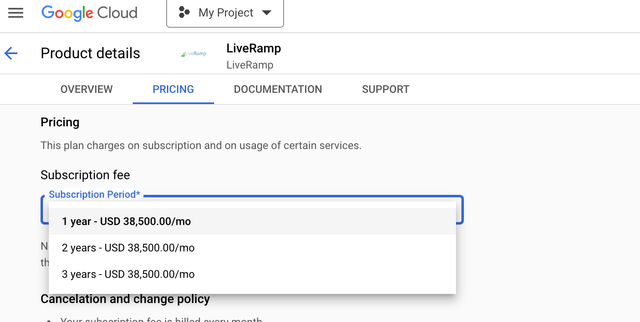

Google cloud site

Furthermore, while it is understood that LiveRamp’s relatively high subscription fee is probably not optimized for SMBs, the concern here is that we may still not see the bottom yet in Q4, and that the macro-driven weakness may extend into LiveRamp’s key client segment (enterprise) in the worst case scenario.

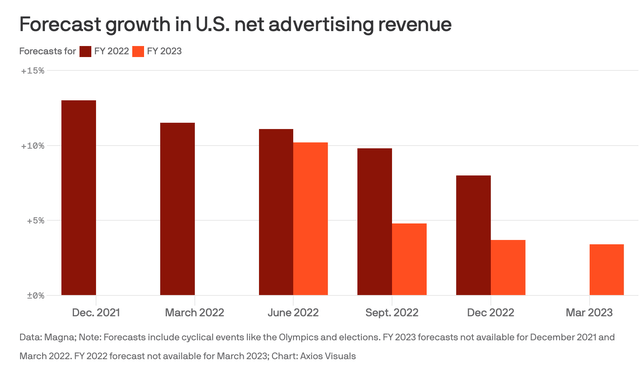

Axios

The most recent finding is also less encouraging. Based on the research from Magna, the growth forecast for the US net advertising revenue continues to be adjusted down. As of March’s forecast, the FY 2023 growth is expected to stand at 3.4%, already a 30 bps decline from the December forecast, suggesting that the media companies across all sizes will continue to face headwinds into FY 2024.

Valuation / Pricing

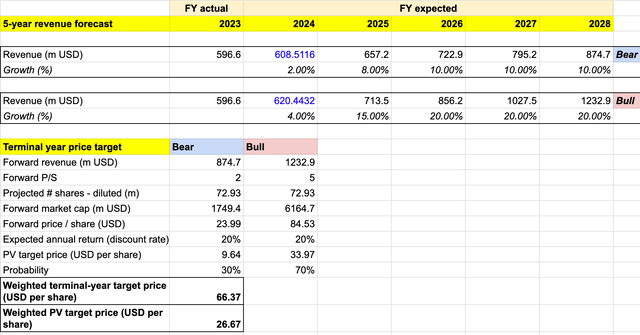

My target price for LiveRamp is driven by the following assumptions for the bull vs bear scenarios of the FY 2028 5-year revenue projection:

-

Bull scenario (70% probability) assumptions – LiveRamp to see 4% growth in FY 2024, in line with its high-end guidance. Growth will then reaccelerate to 15% in FY 2025 – a level last seen in 2021, where LiveRamp reported a +16% growth – driven by the strong bookings growth in FY 2024. Macro downturn starts to subside around the back half of FY 2024, and I expect LiveRamp to experience 15% growth in FY 2025, and then 20% revenue growth from FY 2026 onwards. I also assume that many other major browsers to follow in Google’s footsteps in deprecating third-party cookies to continue driving the secular growth opportunities from the major shift into cookieless advertising.

-

Bear scenario (30% probability) assumptions – LiveRamp to see 2% growth in FY 2024, in line with its low-end guidance. I expect growth to accelerate at a slower pace due to the continuing macro slowdown throughout the rest of FY 2024 and starts to see bookings growth picking up in FY 2025, though given its pricing, some new competitors start to enter the space and take some of the LiveRamp’s market share. I assume LiveRamp to be a 10% grower in FY 2028 at best.

I assign LiveRamp a P/S of 5x under the bull scenario, which I benchmark against LiveRamp’s 2021 – 2022 performance pre-slowdown, where P/S traded between 2x to 8x on average and annual revenue growth was +16% to +19%. With a projected FY 2028 revenue growth of 20%, I would then fairly expect a P/S figure that is slightly above the midpoint of 2x – 8x, considering the size of the business, which will be +$6 billion in terms of market cap. On the other hand, I assign LiveRamp a P/S of 2x under the bear scenario, a lower figure than LiveRamp’s current P/S of ~2.7x.

author’s own analysis

Consolidating all the information above into my model, I arrived at an FY 2028 weighted target price of +$66 per share. Discounting that target price with a 20% discount rate, I reached a Present Value/PV weighted target price of ~$27 per share. The 20% discount rate represents the expected annual return for holding LiveRamp.

The ~$27 per share is the highest price point at which investors can purchase the stock to realize a projected 20% annual return should my FY 2028 target price of +$66 be achieved. At ~$25 per share today, the stock trades at a ~7% discount to my target price, suggesting that it is undervalued.

Conclusion

Despite the ongoing macroeconomic slowdown impacting ad spending, LiveRamp has shown resilience with double-digit growth in FY 2023. The company has also maintained a strong balance sheet and positive operating cash flow since FY 2022. I expect the macro headwinds to be temporary, and while the FY 2024 growth outlook will be slightly muted, LiveRamp stands to benefit from the broader secular shift to cookieless advertising, which is expected to drive growth acceleration in the future. Based on my analysis, LiveRamp’s current stock price appears to be at a ~7% discount to the target price. I give RAMP stock an overweight rating.

Read the full article here