The Light At The End Of The Tunnel?

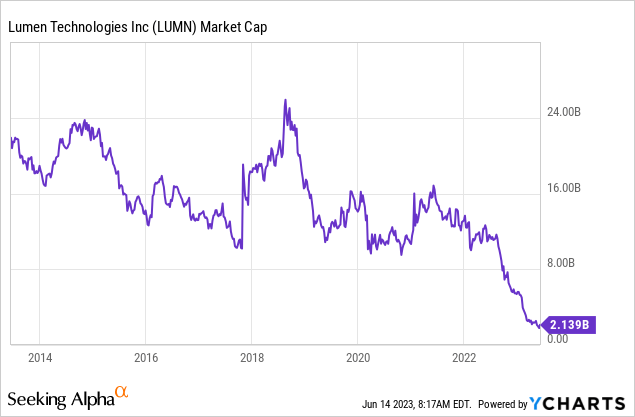

On our last coverage of Lumen Technologies Inc. (NYSE:LUMN), we did not think that there was any reason to expect an upside in the share price. While the stock was beaten down, material challenges remained ahead. Specifically we said,

The only hope here for survival is a liquidation, which is the exact opposite of what the new CEO was brought in to do. We hope that the optimistic projections from bulls on net asset value were remotely in the ballpark and that creates the best hope of salvaging something for equity holders. Despite the long standing suffering here, we unfortunately don’t have much good news for the shareholders.

Source: We Need A 180 Degree Course Reversal.

While the stock has lagged the broader markets, it is rapidly making up lost ground and rallying strongly off the lows. We look at the Q1-2023 results, the updated guidance, and tell you where we stand.

Lumen Technologies Q1 2023 Results

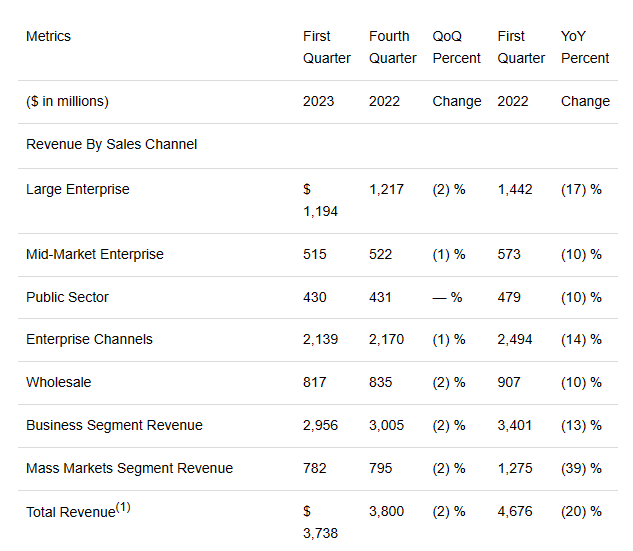

The company was able to post the smallest of revenue beats, but there was not much to cheer from the overall numbers. Revenues were down 20% year-over-year, with all categories declining by double digits in percentage terms vs Q1-2022.

LUMN Q1-2023 Press Release

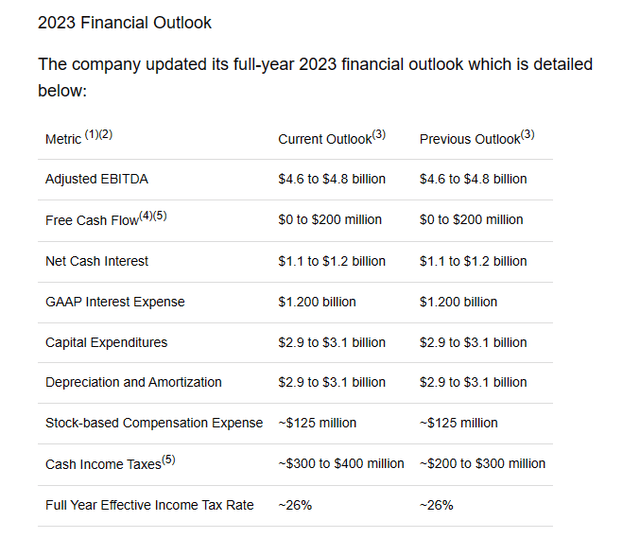

Investors also got to see that all categories were broadly down even compared to Q4 2022. Telecommunication companies have substantial leverage on the way up and on the way down. The drop in revenues meant that adjusted EBITDA got crushed by 36% year-over-year and the adjusted EBITDA margin dropped to 33%. The good news was that the company did not lower its outlook any further outside the greater forecast for cash taxes.

LUMN Q1-2023 Press Release

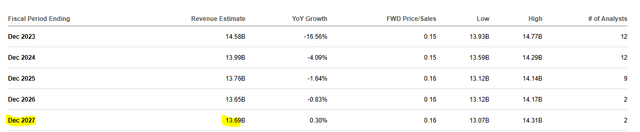

The bad news is that investors are unlikely to see any relief on these chronically declining metrics even in 2024.

Seeking Alpha

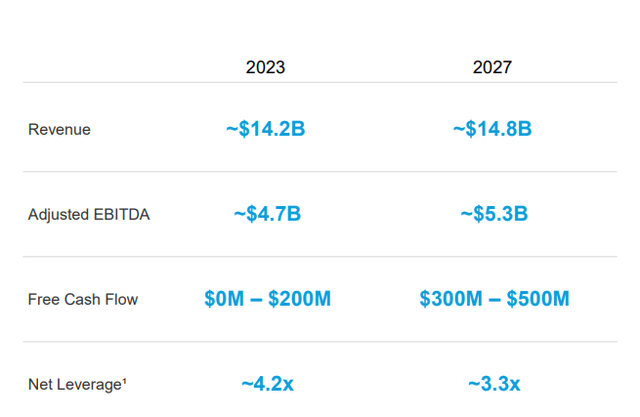

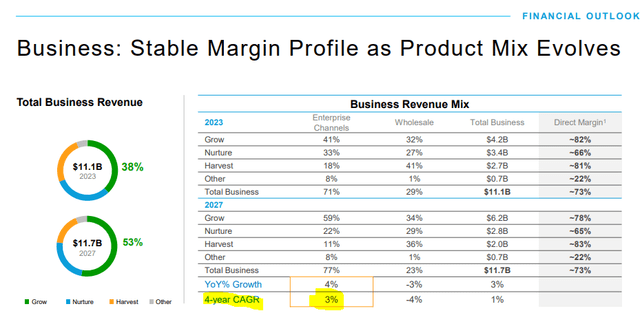

Revenues are expected to drop another 4%, and we guarantee that no analyst has built a recession into their model. Even in their investor day presentation, LUMN forecasted 4% growth vs. 2023 revenues directly in 2027.

LUMN June 5, 2023 Presentation

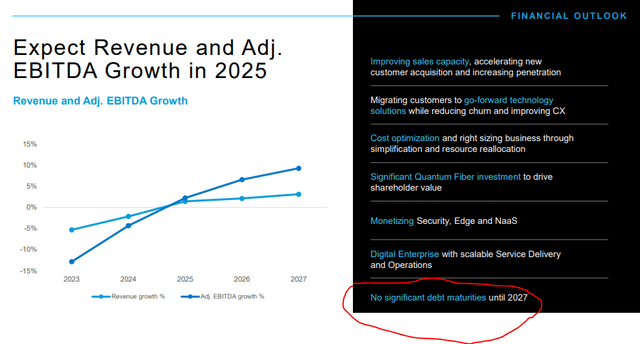

Ok, perhaps that slide was intended to show the great total cumulative progress to be achieved. LUMN does expect revenue trends and EBITDA trends to reverse starting in 2025.

LUMN June 5, 2023 Presentation

While those revenues numbers are really tepid for the general population of companies, investors will be delighted if LUMN can come anywhere in the ballpark of $11.7 billion in 2027.

LUMN June 5, 2023 Presentation

Our Take

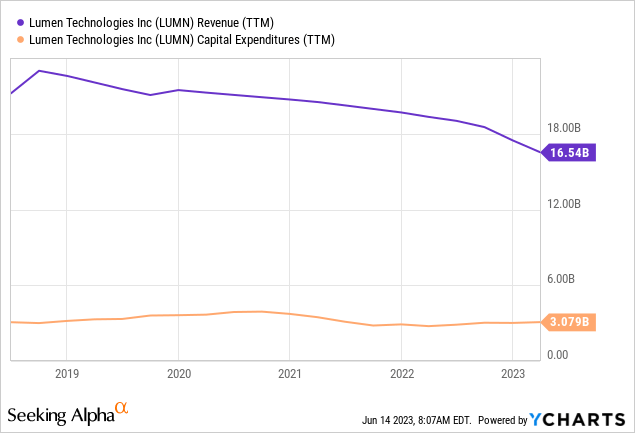

Whenever there is a secular decline in an industry (landlines in this case), it is very hard to reverse things on a dime. In fact, it is very hard to reverse despite spending more than 300 million “dimes” every single year.

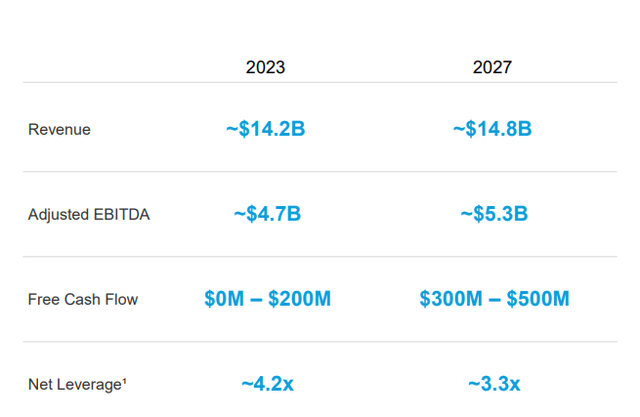

Assuming LUMN achieves its objectives, it will have lost 30% of its revenue base between 2018 and 2027 while spending about $40 billion in capex over this timeframe. Inflation adjusted that is a loss of 50% of its revenues. Sure there have been asset sales but the capex has been huge even deducting those out. Even that projected end result looks incredibly bad on a standalone (not accounting for the trajectory itself) basis. The company expects:

LUMN June 5, 2023 Presentation

The company would produce just $400 million of free cash flow at that point, which means that it will still be running incredibly high $3.0 billion of capex. It will also still have $17.5 billion of debt. The only reason you could get excited over this result is the current market capitalization of the common equity.

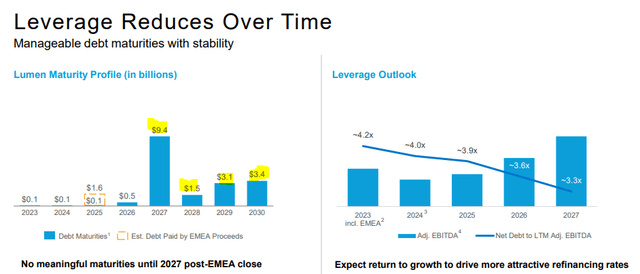

On the current market capitalization, the potential $400 million represents 20% free cash flow yield. But we would not expect to see any of that free cash flow being returned to investors. There is a debt wall between 2027 and 2030, and we would expect only deleveraging to be a priority here.

LUMN June 5, 2023 Presentation

Macro Concerns

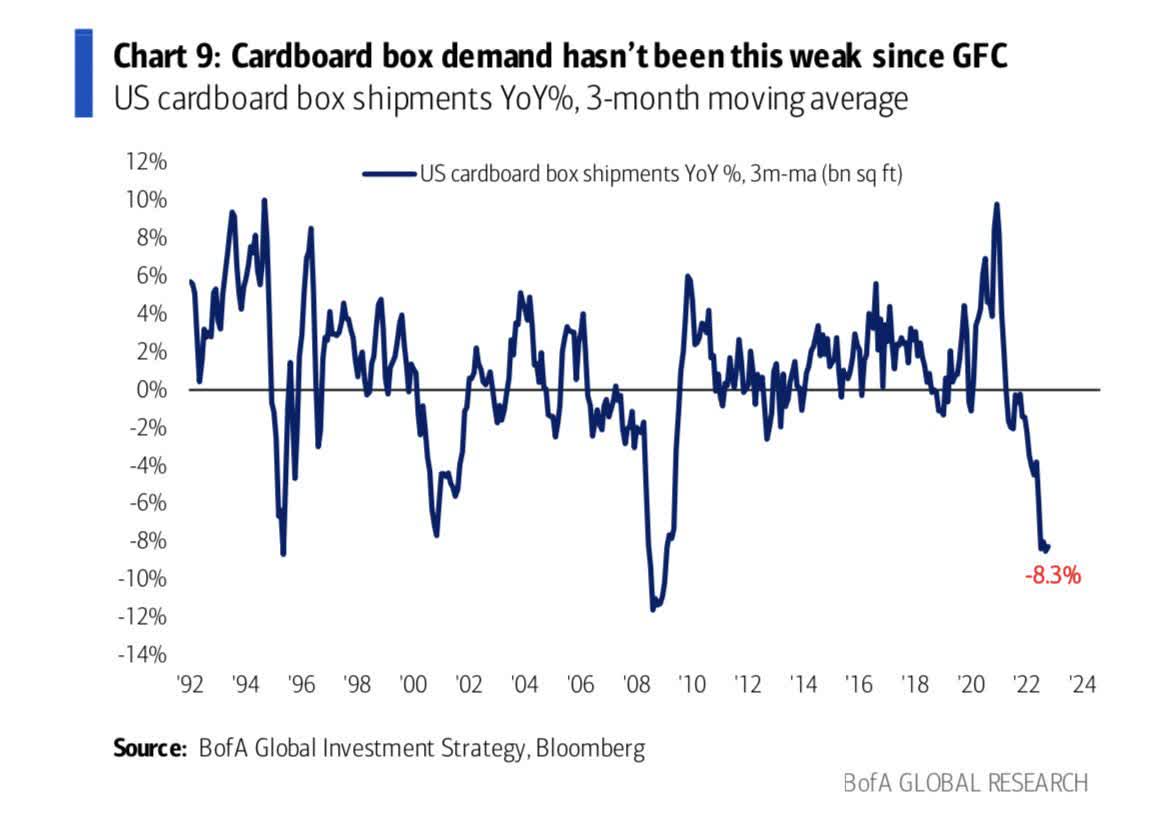

While we are generally skeptical of companies that chronically disappoint like LUMN has, the bigger issue is where the economy goes in the next 12 months. Many metrics, such as the one shown next, suggest that we are already within a recession.

Bank Of America

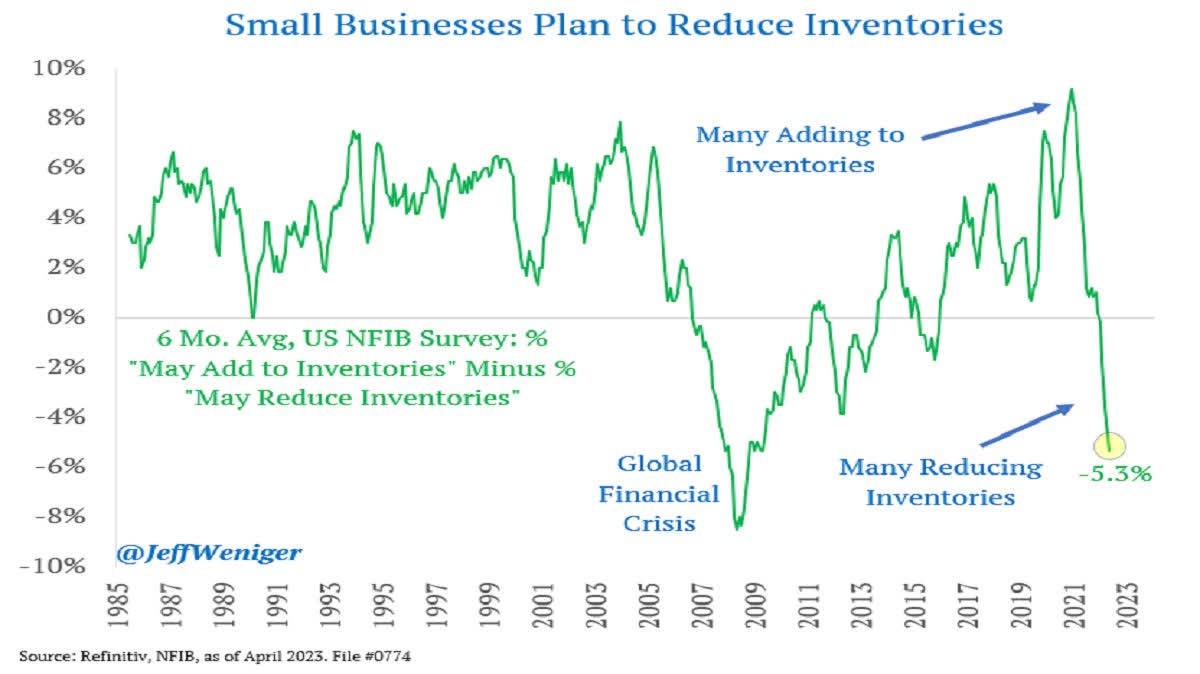

Cardboard box demand is an even stronger indicator today than it was during the global financial crisis thanks to proliferation of e-commerce. Small Business plans to reduce inventories will also generally correlate with forward capex plans. That indicator is cliff diving as well.

Jeff Weniger-Twitter

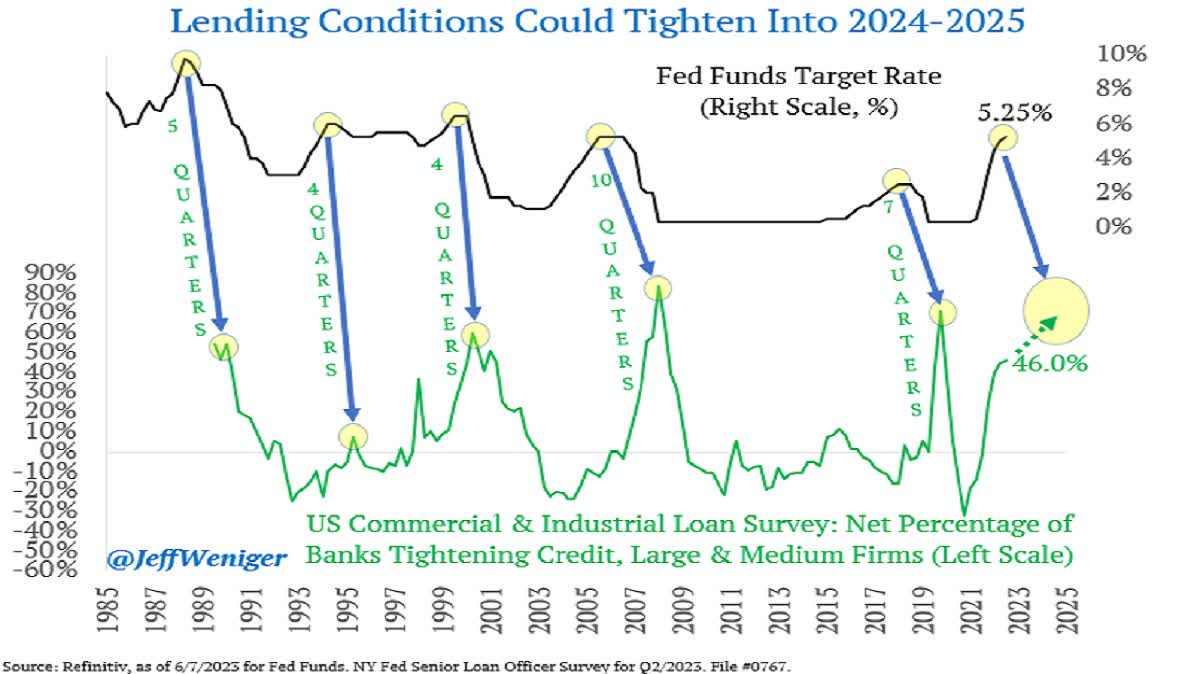

Credit conditions tend to tighten for 4-6 quarters after a peak Federal Reserve rate is reached.

Jeff Weniger-Twitter

We apparently have not even reached the peak yet, as expectations are for at least 1 more rate hike. Can LUMN even hit its modest 2023-2027 numbers in this climate? We don’t see it. Analysts don’t see it, either, despite not modeling a recession.

Seeking Alpha

Sure, if were in the same situation with this company coming out of a recession or capex downturn, we might have seen a chance for the company to beat medium-term expectations. As things stand, all you can get is a good short squeeze. With 13% shares short, even that squeeze is likely to peter out before $3.00 is reached.

Verdict

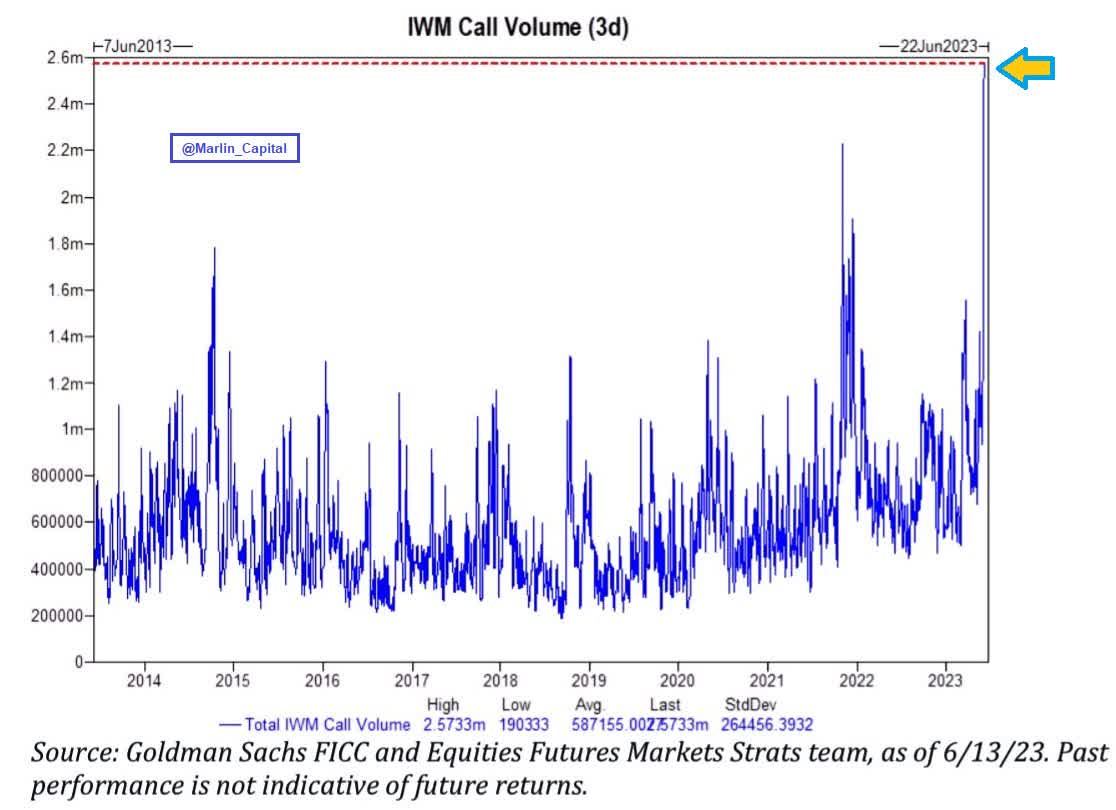

It has been about two years since we saw such unbridled madness in the markets. 2021 was all about chasing SPAC plays and anything associated with “reopening.” We did not expect to be back here on the hopes of a “pause” and mouse trap of “AI.” Just yesterday, the three day call volume in iShares Russell 2000 ETF (IWM) was about 20% higher than its previous peak and 160% over its longer-term average.

Goldman Sachs

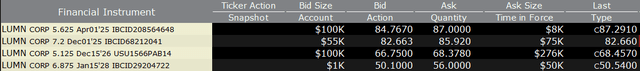

It is easy to lose track in this euphoria what should go up and what is being pulled up unnecessarily. LUMN definitely fits the latter in our opinion. It has no business going up other than to relieve an oversold state. If you cared to speculate here on a positive outcome, the bonds offer pretty stunning yields for less risk. The Jan 15 2028 bonds offer a stunning 26% yield to maturity on the bid price.

Interactive Brokers June 14, 2023

The near term April 2025s offer 15% plus. Century Tel Bonds which have priority in asset coverage are still yielding over 11% for about 2 years out.

Interactive Brokers June 14, 2023

Rating agencies expect full recovery on these even in the case of a default. So these are areas for a calculated gamble. The Lumen Technologies common stock remains a no-touch situation, as it is trading a 20% free cash flow yield based on optimistic 2027 estimates. Even that free cash flow yield is theoretical, as we don’t think any of it will be returned to shareholders in the very best outcomes. Stay out of the Lumen Technologies common shares. Look at the bonds.

Read the full article here