Investment Thesis: While gross bookings for the Air Ticketing segment has continued to see growth into Q4, I take the view that earnings on a yearly basis would need to see a rebound to justify further upside.

In a previous article back in February, I made the argument that MakeMyTrip (NASDAQ:MMYT) could see further upside going forward, on the basis of strong revenue growth as well as earnings having rebounded into positive territory.

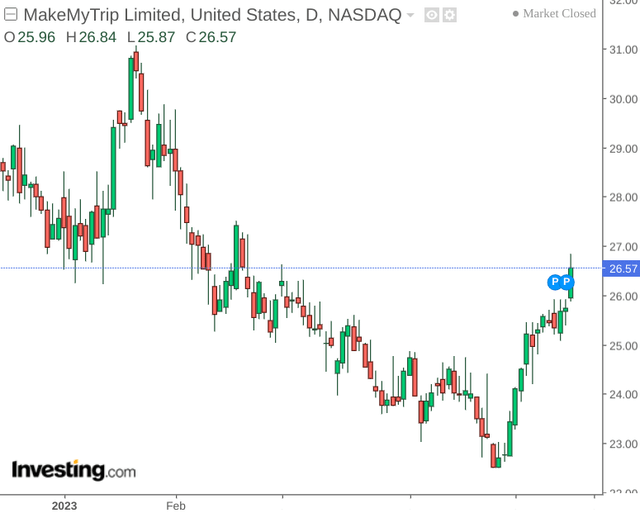

However, the stock has taken a fall of just over 5% since then – albeit having started to see a significant recovery in the past month:

investing.com

The purpose of this article is to reassess my prior reasons for taking a bullish view on the stock, and whether upside can still be expected going forward.

Performance

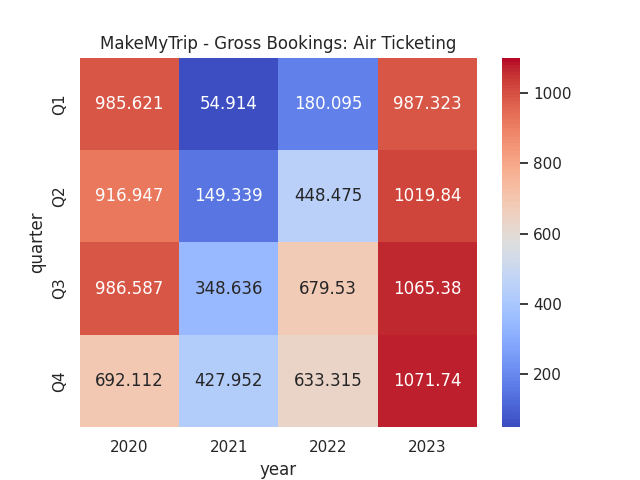

When looking at gross bookings across the Air Ticketing segment for MakeMyTrip, we can see that this has exceeded pre-pandemic levels once again (note that Q1 2020 to Q4 2020 covers quarters for the three months ended from June 2019 to March 2020 inclusive).

Figures sourced from previous MakeMyTrip Earnings Releases (Q1 2020 to Q4 2023). Figures provided in USD millions. Heatmap generated by author using Python’s seaborn visualisation library.

I had previously made the argument that with October to March representing the high season for travel in India – Q3 results (the three months ending December) would be expected to mark a key quarter for booking growth.

This has proven to be the case – with gross bookings across Air Ticketing (the company’s largest segment by bookings) having exceeded that of Q1 and Q2.

With that being said, the high season for travel in India is coming to a close and we can see that in previous years (the financial year of 2021 being an exception due to the COVID-19 pandemic) – gross bookings have seen a seasonal drop in Q4.

Taking recently released results into consideration, it is notable that gross bookings for Air Ticketing have actually held up in Q4 of this year – albeit having seen modest growth following that of Q3.

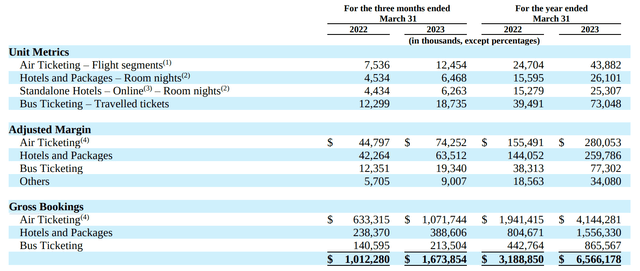

MakeMyTrip: Fiscal 2023 Fourth Quarter and Full Year Results

As such, the overall fall that we have been seeing in the stock may be a combination of a decline in the equity markets as a whole, as well as a reflection that gross bookings may start to be more modest until near the end of 2023 – as seasonal demand for travel in India starts to decline.

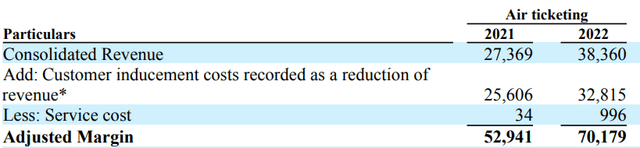

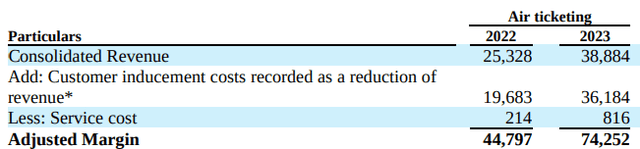

Moreover, it is also noteworthy that while gross bookings of Air Ticketing for the most recent quarter were on a similar level to that of Q3 – that of adjusted margin has grown from $70.179 million in Q3 2023 to $74.252 million in Q4 2023.

That said, adjusted margin also includes what MakeMyTrip terms as “customer inducement costs”, i.e. the cost of acquiring customers which includes factors such acquisition and loyalty program costs.

We can see that while consolidated revenue was slightly higher in the previous quarter – we can see that the higher adjusted margin is in large part reflecting higher customer inducement costs.

Q3 2023

MakeMyTrip Q3 2023 Earnings Release: For the three months ended December 31

We can see that consolidated revenue in Q3 was slightly lower at $38.36 million as compared to $38.88 million in Q4.

Q4 2023

MakeMyTrip Q4 2023 Earnings Release: For the three months ended March 31

While customer inducement costs can be expected to rise in line with revenue – the overall improvement in gross bookings and consolidated revenue from that of last year is encouraging.

Risks and Looking Forward

Going forward, it is possible that the stock could see further consolidation in the short to medium-term, with seasonal demand for travel in India set to decline as well as potentially bearish market sentiment affecting demand for stocks with emerging market exposure.

With that being said, I take the view that MakeMyTrip is still in a good position for longer-term growth. We have seen that gross bookings for Air Ticketing have exceeded that of pre-COVID levels, with inflationary pressures over the past year not having proven an impediment to booking demand.

As we have seen earnings rebound back into positive territory in the last quarter – the main challenge for MakeMyTrip is to be able to maintain positive earnings at this point. We can see that while earnings have rebounded to positive territory on a quarterly basis – it has yet to do so on a yearly basis.

| For the three months ended March 31 | For the year ended March 31 | |||

| 2022 | 2023 | 2022 | 2023 | |

| Diluted earnings per share in USD | -0.04 | 0.05 | -0.42 | -0.1 |

Source: Figures sourced from MakeMyTrip Fiscal 2023 Fourth Quarter and Full Year Results

Investors are likely to look for evidence that the company can contain its cost base while revenues are expected to take a seasonal dip. If MakeMyTrip is able to maintain positive earnings during a season with lower travel demand – then I take the view that investors will interpret this as a good sign and there is possibility of further upside going forward. However, rising costs and pressure on gross bookings as we approach the low season for travel demand in India is expected to make this challenging.

Given that earnings still remain in negative territory on a yearly basis, I do not see it prudent to attempt to value the stock on an earnings basis at this time.

The main risk for MakeMyTrip at this point is that the rebound in earnings that we have been seeing may prove to be temporary. Should we see a seasonal decline in revenues owing to lower travel demand coupled with a continued rise in customer inducement costs due to inflationary pressures – then this could lead to downward pressure on the stock.

Conclusion

To conclude, gross bookings across the Air Ticketing segment has continued to see growth – coinciding with the peak season for travel demand in India. Going forward, a seasonal decline in demand is expected up until October.

My overall view on MakeMyTrip is that while the rebound in gross bookings is encouraging – growth as compared to the last quarter was modest and we could see consolidation in the months ahead.

While I still take the view that the stock has longer-term potential for upside, my view in the short to medium-term is that earnings on a yearly basis need to show a rebound to positive territory before we might see meaningful upside in MMYT stock going forward.

Read the full article here