Manchester United plc (NYSE:MANU) and its stock has been much talked about lately amid a pending takeover. However, new tailwinds have emerged as the club has secured Champions League football for the new season, and talks of big-name signings have heated up.

Let’s traverse into a more detailed discussion about our latest findings.

On-field Improvements

Europe Secured & Carabao Cup Glory

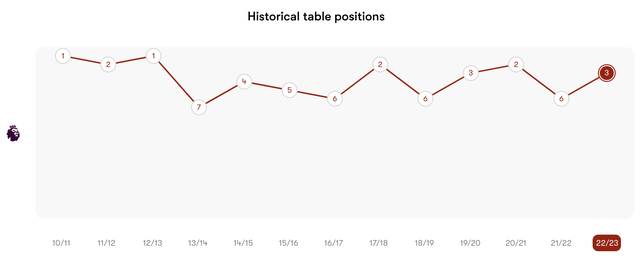

Manchester United’s 2022/23 season was a success on many fronts. The team jumped to third in the league from 6th in the previous season and won the Carabao Cup (a domestic cup championship).

MANU League Finish (FOTMOB)

Although quantitative measures show that Manchester United’s performance ticked up in 2022/23, a closer look is required to fully appreciate the team’s progress.

Here’s our take on Manchester United’s recent progress:

- Solved the Cristiano Ronaldo debacle and initiated a team-building process.

- Established a defense, illustrated by David De Gea’s golden glove award.

- Confidence build-up among some of the out-of-form players such as Marcus Rashford.

- Qualified for the Champions League in an ultra-competitive season.

- The club’s manager, Erik Ten Hag, has implemented sound short-term solutions while establishing a clear trajectory for longer-term success.

In essence, we think United’s dressing room is in better shape than before, and the club is establishing a clear identity. Furthermore, there has been a lot of spring cleaning while achieving domestic success and qualifying for the Champions League. In our view, Manchester United is well-placed to complete a few signings that could result in the club challenge for big trophies once more.

Transfer Plans: Harry Kane a Possibility?

As mentioned in the closing words of the previous section, Manchester United is probably a few transfers short from competing at the top level again. It is not a secret that the club is looking for a striker, and one of the names mentioned is Harry Kane.

Harry Kane is the second-highest goal scorer in the English Premier League’s history and has hinted at his desire to leave his current team, Tottenham Hotspur. According to numerous reports, Manchester United is a likely destination for Kane as it seems like a natural fit in today’s context.

Kane might add significant commercial value to the club and proliferate match-day sales. If Kane’s transfer does not realize, the club has the option of going for other top players as it has re-qualified for the UEFA Champions League.

A Pending Takeover

Manchester United’s potential takeover is old news by now. However, for those unaware, a majority stake in the club is up for sale after the Glazers (the current majority holders) have decided to listen to direct offers.

As things stand, it seems like United will either end up in the hands of engineer/investor Sir Jim Ratcliff or Sheikh Jassim of Qatar. Regardless of who assumes control, a bidding war is underway, which is generally a sign that shares will be bought at a premium, in turn raising the fair value of minority shareholders’ stakes.

Financial Performance

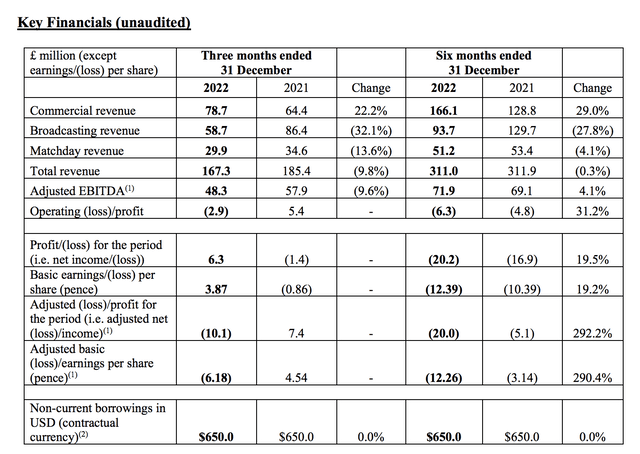

Manchester United last reported financial results in March 2023, which reflected its third quarter, ending on December 31, 2022. Firstly, the club’s commercial revenue grew strongly, surging by 22.2% year-over-year amid events like a sponsorship agreement with Tezos and sponsorship credits. The organic growth within United’s commercial segment tells us that the club’s brand remains strong and has a stronghold over sponsorship seekers.

Furthermore, the club’s broadcasting revenue suffered from a 32.1% year-over-year drawdown. However, United claims this is due to the impact of playing non-Champions League football. Thus, the segment’s revenue will probably recover over the next year as the team has re-qualified for the champions league.

Lastly, match-day revenue slumped by 13.6% in the same period. According to Manchester United, this is due to playing fewer home games. However, in our view, the club’s fanbase was deeply disgruntled with the team going into the 2022/23 season, likely resulting in lower attendance and spending. Nevertheless, performances have picked up, and additional factors, such as new ownership, European football, and a few new signings, might result in higher matchday revenue over the next year.

- Sidenote: Keep in mind that Man United is about to enter its off-season for a few months and that our forecasts are year-over-year, not quarter-over-quarter.

Financials (Manchester United)

Lastly, it is worth mentioning that United has not paid a dividend since March 2022. In our view, this is due to slower performance; however, comments cannot be made about the club’s future dividend policy, given that it is most likely about to enter a transition in ownership.

Valuation and Price Level

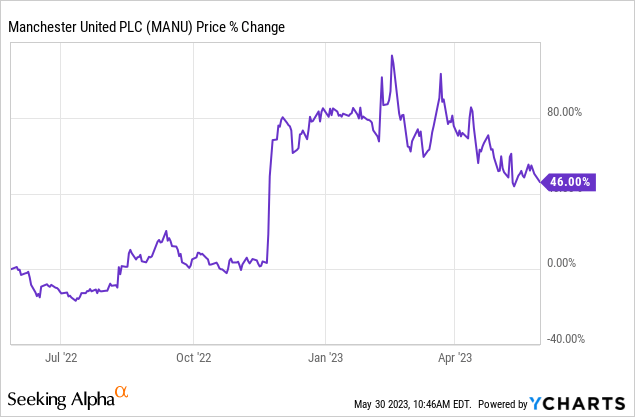

Manchester United’s stock has surged since the announcement of its potential takeover, which is conveyed by its stock’s approximate 47% year-over-year gain. As such, the security is trading at 4.39x its sales and 23.31 times its book value. Moreover, the stock has reached its long and medium-term moving averages, leaving little scope for a mean-reversion play.

However, despite its poor ratios, we think there is potential for untapped value. As mentioned before, factors like the club’s entry into the Champions League, a sustained bidding war, and the possibility of a few new signings might leave its stock’s valuation multiples in a much different position in a year’s time. Therefore, we would not discourage a bet on the firm’s stock.

Man U’s Stock Price (Seeking Alpha)

Risks

Apart from its valuation-based risks, Man United’s stock owns a few other concerns. Firstly, there is no guarantee that new ownership will realize, which leaves its stock open to tail risk. Additionally, new ownership does not guarantee better results; in fact, there is no consensus about the new owners’ shareholder policy.

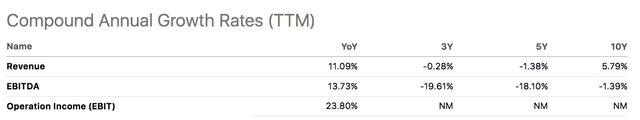

Furthermore, the club’s growth metrics are not overly welcoming. Contrary to many beliefs, football is a slow-growing business, meaning that United’s stock might crumble due to externalities.

Man U’s growth metrics (Seeking Alpha)

Final Word

Our analysis shows that Manchester United’s stock might be set for further gains as the team has secured Champions League Football for next season. Moreover, factors such as improved on-field performance, a newly established long-term vision, a pending takeover, and the possibility of big-name signings all provide tailwinds.

Although the stock owns valuation concerns, the club’s financial performance is set to skyrocket in the coming year, lending the argument that the stock remains underpriced unless the company’s pending takeover falls through.

Read the full article here