Investment Thesis

Match Group (NASDAQ:MTCH) reported Q1 2023 results that saw its share price jump after-hours. However, I argue that this is a relief rally and that investors should not chase MTCH stock.

In fact, I make the case that in the coming few days, once the dust settles, investors will return to reappraise Match’s prospects on more sober terms.

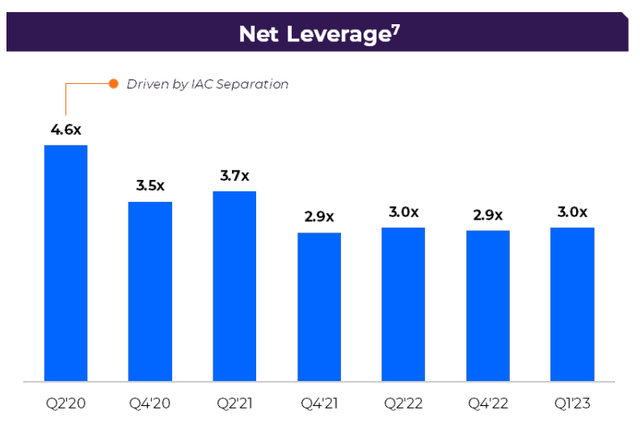

And at that point, investors will see a company that holds 3x net leverage and one that is unmistakably more cyclical than most would think.

I believe that Match should in the first instance work to stabilize its operations and improve its balance sheet, rather than resume its share repurchase trajectory.

Rapid Recap

As we headed into Q1 2023 I put forth 3 questions:

- Does Match have any pricing power?

- Is Match’s balance sheet starting to restrict its operations?

- Will Match resume buying back shares? (I hope not).

On the one hand, Match believes that its balance sheet is not restricting its operations, driving Match to continue buying back shares. But I maintain my key assertion that at this stage this is not its best use of capital.

Revenue Growth Rates Look Unappetizing

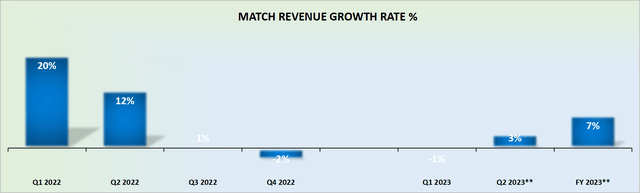

MTCH revenue growth rates, GAAP revenues

We are now 5 months into the year and Match has more visibility into 2023 than it did when it reported its Q4 results. Accordingly, Match now states that it guides for the full year 2023,

…Match Group total revenue and Tinder direct revenue growth rates closer to the low end of our previously communicated ranges of 5% to 10% Y/Y (emphasis added)

Even if we were to allow some room for Match to be conservative and positively surprise investors, I believe that we can largely take Match’s 7% CAGR for 2023 at face value.

Furthermore, keep in mind the following.

SA Premium

Match’s recent revenue beat history is patchy. In actuality, it appears that Match is more likely to miss estimates than beat estimates.

Even if in the past several years Match could be relied on to grow its revenues at double digits, presently this no longer appears to be the case.

Balance Sheet Decision

MTCH Q1 2023

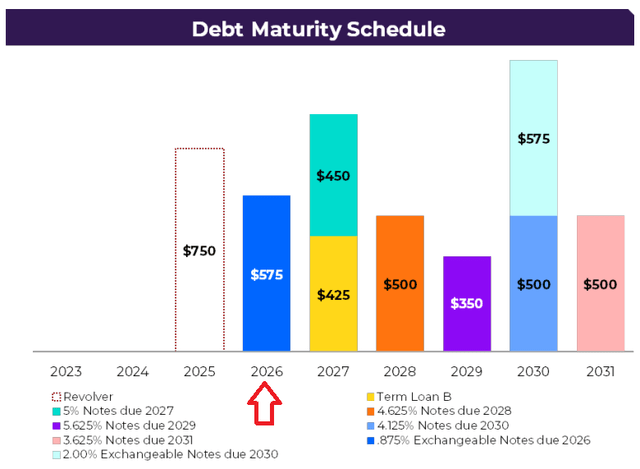

Match holds $575 million of convertible notes due in 3 years. Meanwhile, Match’s balance sheet holds very roughly speaking the same amount of cash and equivalents.

This means that within 3 years, a large proportion of the cash on its balance sheet will be needed to pay down these convertibles.

Even if Match were to refinance its convertibles, I strongly believe that interest on the convertibles will be substantially higher than 0.875%.

In fact, it’s not only that interest rates will be higher but also that Match’s revenue growth rates are slowing. Meaning that creditors will require a more alluring coupon to part with their capital.

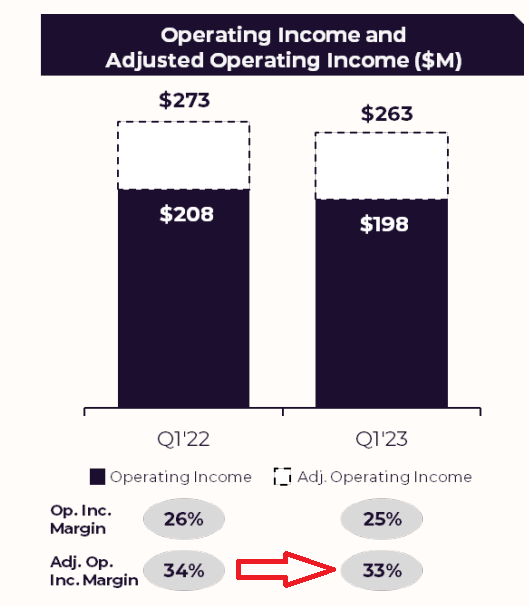

This leads me to note that Match’s profit margins are compressing, at the same time as Match’s growth rates are slowing down.

MTCH Q1 2023

It’s not a significant level of compression, only 100 basis points y/y, but when a company’s topline is slowing down, for investors to at the same time see Match’s operating margins compressing doesn’t leave a lot of room for optimism.

Given my portrayal of Match, why is the share price up post-earnings?

Capital Allocation Priorities

Investors have latched onto Match’s newly articulated capital allocation framework.

Match declares that it will return at least 50% of its free cash flow back to shareholders in the form of buybacks.

However, let’s get some context. Back in 2022, Match repurchased approximately $480 million worth of stock at $67 per share.

And in Q1, Match repurchases just over $110 million worth of shares at $43.

And yet, despite deploying these considerable sums to repurchase its shares, its share count is down approximately 3%.

And while that’s happening, with Match’s capital going out the door and allowing investors that want to exit their Match holding, Match’s net leverage remains stubbornly around 3x.

MTCH Q1 2023

I believe that Match should work harder to prioritize its debt profile and get its net leverage down to 2x to perhaps 2.5x net leverage. Particularly, as we’ve discussed, its revenue growth rates are becoming so cyclical.

The Bottom Line

The good news here is that Match doesn’t look that expensive, at 12x this year’s free cash flow.

But I would rapidly counter that by articulating the fact that Match’s adjusted operating margins today at 33% are towards the low end of the past several years, which again reinforces that its profitability profile does not appear to be moving in the right direction, which is made more acute considering its leveraged balance sheet.

Read the full article here