Investment action

I recommended a buy rating for Match Group, Inc. (NASDAQ:MTCH) when I wrote about it the last time, as I expected the business to grow as guided. Tinder’s Payer net-added performance should see improvement, and overall revenue should grow by double digits. Based on my current outlook and analysis of MTCH, I recommend a hold rating. I am downgrading my rating to a neutral view (hold rating) as I am disappointed by Tinder’s performance. There is a real risk of market saturation at stake here, which could limit MTCH’s near-term growth until Hinge becomes a larger part of the business.

Review

My buy rating turned out to be a complete disaster. I have given the new management too much credit for driving a return on Tinder’s growth, thinking that achieving double-digit growth was possible. However, with the 3Q23 performance, I am now withdrawing my buy rating and now think that it is better to wait for more concrete proof of improvements.

Author’s work

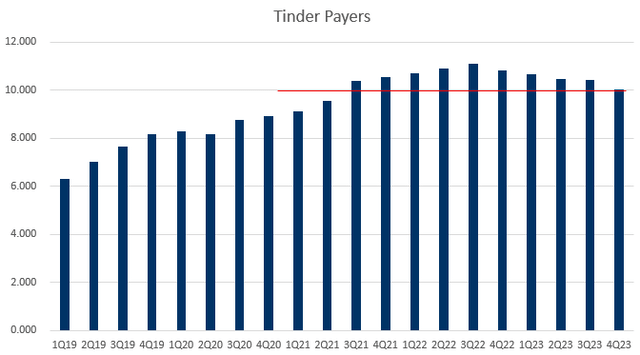

Contrary to my expectations for an acceleration, management is guiding Tinder’s payer to decline in 4Q, which is slightly worse than what was seen in 3Q23, which means an acceleration to the decline. In 3Q23, Tinder Payers fell by ~700k vs. 3Q22, which means 4Q22 is likely to see an 800k+ decline in payers. The argument could be made that some portion of that churn is due to the unwinding of weekly subscriptions, higher prices, and a lack of marketing. However, I think the fact is that the number of Tinder Payers is now going to be at the same level as in 3Q21. Factually, this is a major proof of saturation. The bad news did not end here. I would also point out that Tinder is going to face tough competition in 2H24 due to the US price increase. If payer growth does not recover and pricing growth gets impacted by a tough comp, the headline numbers will not be pretty. We have seen how important the Tinder payer number is to investors as MTCH stock gapped down by ~20% post-earnings.

Positively, management mentioned that weekly subscriptions are making it easier for younger users to become paying customers. Notably, the renewal and resubscription rates recently have exceeded management’s expectations, and the lifetime value of weekly subscribers is positive. They are also keeping to their previously announced Tinder product roadmap, which includes updates to Tinder Matchmaker and Tinder Select as well as the first stage of the new, improved Tinder core experience, which is expected to be released before the year ends. Again, all these are great to know, but I think the market is waiting for all of these to translate into actual payer growth.

Unlike Tinder, Hinge is performing very strongly (sadly, the market doesn’t seem to be focusing on this). Revenue growth year over year accelerated to 44% in the third quarter, up from 35% in the previous quarter, indicating that momentum is clearly building at Hinge. Overall usage and downloads both reached all-time highs, suggesting that the momentum will continue. With a download rank that has climbed into the top three across its English-speaking footprint and into the top five in most markets, Hinge is noticing a lot of success in Western European countries. Following the successful launch of weekly subscriptions in the US (as seen on Tinder), the next step for management is to optimise pricing across regions, which should lead to even more growth. Management has restated their expectation for $400 million in Hinge revenue for FY23, and they are predicting at least 35% growth for FY24, based on the current momentum. At this rate, reaching $1 billion in revenue (25+% of MTCH revenue) is only a matter of time.

While I am encouraged by Tinder’s ongoing product development momentum, I don’t see any path for the stock to rerate higher until the key concerns: (1) Tinder payer growth and (2) Tinder 2H24 revenue growth get addressed. Until there is more clarity on these, I expect stock performance to be range-bound. The only catalyst I see that will drive valuation upwards over the medium term is Hinge. Hinge is clearly on strong momentum and seemingly not impacted by the macro environment. Over time, as Hinge becomes a larger part of the business, the market might put less focus on Tinder, and Hinge’s value will be better reflected in the stock price. All in all, my previous buy rating was a bad call. I am downgrading my rating to a neutral [hold] rating for now.

(Note: I am skipping the valuation section as I have no confidence in the business growth cadence over the near term).

Risk and final thoughts

The upside risk present here is that Tinder Payer will accelerate in 1Q24, driven by the new product feature launches. That would immediately dispel the major concern about payer decline and market saturation. This could happen, but I am not going to bet ahead of this happening (this was a mistake previously).

In summary, I am downgrading my rating on MTCH from a previous buy to a neutral [hold] rating due to disappointing performance in Tinder, indicating potential market saturation. While weekly subscriptions show promise among younger users, translating these developments into tangible payer growth remains uncertain. Hinge, on the other hand, demonstrates strong performance and momentum, with robust revenue growth and expanding usage. That said, until Tinder’s issues regarding payer growth and revenue trajectory are resolved, stock performance may remain range-bound.

Read the full article here