Today, we are back to comment on Compagnie Générale des Établissements Michelin (OTCPK:MGDDF; OTCPK:MGDDY). There is some positive news to price in, and in addition, the company is advancing with a clear M&A strategy to become a group with 20/30% top-line sales Around & Beyond the tire segment. Our buy rating target was also supported by Michelin’s ability to offset raw material inflationary pressure, a solid balance sheet, sales diversification both in terms of geographies and products, Chinese tire recovery, and Nokian’s Russian exit implications.

One year after our release called “Looking At The Russia Exit Implications,” we positively view that Michelin announced its exit from Russia selling the division to Power International Tires LLC (a major tire distributor in the country). As reported, Michelin will save 250 jobs with no major cost implications. In addition, the company confirmed its 2023 guidance confirming a minor negative one-off charge due to currency translation (all expenses were already accrued in 2022 financials).

M&A Optionality Beyond Tire

Here at the Lab, we believe that Michelin is a great example of how a traditional company engaged in the auto sector is repositioning itself thanks to a digital transformation, and the Group is ready to gain market share, lowering its cost basis. Looking at the recent deals, last year, the company acquired RoadBotics. With this add-on which is an American start-up specializing in the analysis of road infrastructure images, Michelin strengthens its potential to provide solutions for the use of data on mobility and the improvement of traffic safety. Thanks to RoadBotics, the company can use Artificial Vision technology, which analyzes recorded images to transform them into information that helps detect priority areas for maintenance.

In early July, Michelin announced the Canopy Simulations deal. We have no details of the acquisition price; therefore, it is complicated to perform an EBIT growth scenario analysis. However, Canopy currently offers one of the most sophisticated simulation software on the market. Its system, hosted on a cloud platform, combines circuit, car, and tire models with a highly advanced ‘trajectory simulator,’ which virtually reproduces a driver behavior. A simulation is now an essential tool for tire development, both for racing in motorsport and as a standard for the automotive and mobility industries. This year, all the 24 Hours of Le Mans cars were equipped with tires developed with simulation software. This technology is also a cornerstone of traditional OEM. The canopy simulator identifies the most suitable dimensions and technologies for the new vehicle based on its characteristics and weight distribution. With this latest acquisition, Michelin (once again) is accelerating innovation for mobility.

In addition, the simulator will allow Michelin to support partners and manufacturers better, reduce the environmental impact of R&D and obtain substantial savings compared to longer and traditional tire cycle development. Even if the acquisition price was not disclosed, Michelin could enter (once again) into racing activities. Indeed, Canopy is a leading supplier of Formula 1 (and sub-categories such as F2 and F3), IndyCar, Formula E, and the World Endurance Championship (WEC). This simulation process is also vital for EV tire development. EV cars are usually heavier than traditional ICE units. We believe that Michelin tires are already ‘EV ready,’ and thanks to Canopy technology, this process is hypothetical scalable and applicable to 19-inch and 17-inch tires, providing a key value driver to offer Michelin products faster and cheaper versus its competitors. This is supported by lower R&D costs thanks to virtual simulation analysis and data power.

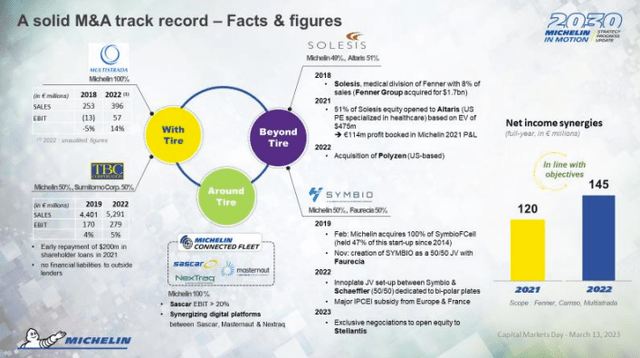

Michelin M&A track record

Source: Michelin Capital Market Day 2023

Again, it is important to comment on the latest Flex Composite Group acquisition (FCG). With this deal worth €700 million, the French tire manufacturer expects to increase the High-Tech Materials turnover business by around 20% and become a “leader in high-tech engineered fabrics and films“. This cornerstone deal positions the company as a key player in polymer solutions in line with the CMD strategy. According to the press release, this acquisition will enhance the division’s profitability and is already accretive with positive earnings per share impact.

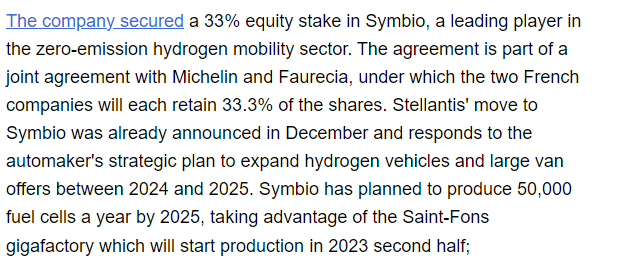

Still related to the strategy, we positively report a snap from our previous Stellantis publication. Following the Stellantis deal, Michelin retains a 33.3% equity stake in Symbio. We estimate a plus €150 million proceeds from this partial exit, while the cash outflow related to FCG is expected for H2 with a debt position change only in FY 2023 number release.

Mare past analysis

Conclusion and Valuation

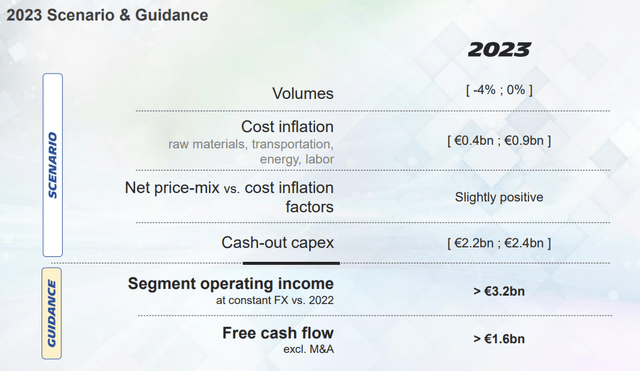

Ahead of the company’s results on 26 July, we forecast €13.7 billion in top-line sales with an operating profit of €1.65 billion. We anticipate a negative volume growth of 1.5% and unfavorable currency development for €50 million. While tire volume is expected to decline further in H2, we hope FX effects to offset over the year. In Q1, the company delivered solid results, and here at the Lab, we believe that the company has the right mix to enhance its earnings resilience in the medium-term horizon. This is well supported by brand power, price power, and a solid balance sheet. In addition, we should not forget its M&A optionality. This is likely the last semester of raw material inflationary pressure, and starting from H2, the company should leverage its capability to increase margin. CAPEX is under control, and we are forecasting an FCF of €550 million in H1. In addition, Michelin guidances were also confirmed.

Michelin 2023 outlook

Regarding the valuation, the stock is currently trading at a 9% FCF yield on our internal estimates. In addition, Michelin is at a 20% discount compared to its historical average at EV sales, EBITDA and P/E. Our internal team finds Michelin stock attractive in this current environment. Therefore, we expect the company’s valuation gap compared to its history to narrow and for the stock to progressively return to its long-term average multiples as a first step in the coming twelve-month basis. EV/Sales are at 0.83x vs the past at 0.95x, and EV/EBITDA is at 4.56x vs the past at 5.5x. Therefore, we confirmed our previous buy rating target of €33 per share (and $17.6 in ADR).

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here