Interlude

Microchip Technology Inc. (NASDAQ:MCHP) is a prominent semiconductor company that specializes in creating and producing integrated circuits for microcontrollers, analog, mixed-signal, and Flash-IP. Additionally, the company offers a wide range of development tools that cater to embedded systems, including compilers, programmers, debuggers, and other software and hardware tools.

This wide array of products and the market share the company has, which continues to grow, has netted them a very strong last quarterly result. With revenues increasing by 21%, it surpasses the industry’s growth and makes a strong case that MCHP is a play for the long term. To build upon this further, the company is also taking steps to appease the value investors as it both announced a dividend and increased the cash return to shareholders by 17.4% YoY. I think the strong outlook and room for growth with MCHP make them a buy, in combination with the shareholder-friendly mentality the management seems to have.

Company Brings Value For The Long-Term Investor

As mentioned at the beginning of the article, MCHP is taking steps to try and solidify its shareholder base and appease them. They have done so by returning record amounts in the shape of both dividends and buybacks.

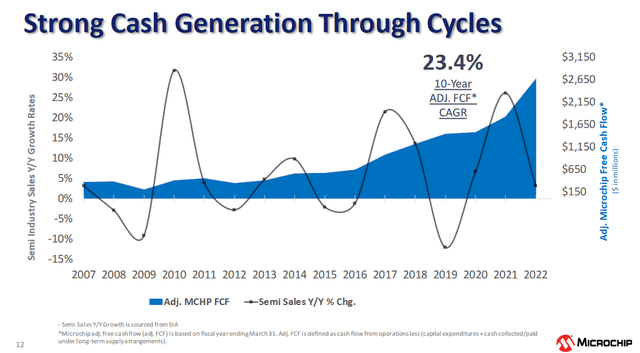

Company Cash Flows (Earnings Presentation)

They have been able to do this thanks to the strong cash flow growth the company has had over the years, even through tough times when sales and lower and demand decreasing. With a 23.4% 10-year CAGR, I think MCHP is set up to weather storms efficiently and keep increasing the dividend.

On top of this, they have the ability to not only increase the dividend, but also heavily invest to capitalize on the demand the semiconductor industry is experiencing. Investing $800 million into a factory is easy when you are generating over $2 billion in free cash flows the last 12 months and have a FCF margin of 26%. Currently, the company has a $4 billion active share repurchase program, which, if used right now, would be around 10% of the market cap.

The Financial State

Looking at the balance sheet, the company has significantly lower cash than it had a few years ago. From over $2 billion in 2018 to under $250 million. This seems to be in line with the company’s priority to return as much as possible to investors. I think in the long term, this can prove to be quite hurtful. It is vital to keep a strong cash position to help hedge against tough times in the economy and when sales a slower. I wouldn’t want to see the cash position being at risk of needing to be depleted to pay down debts. That would put the company in a risky situation and I can see the share price tanking if that were to happen.

With over $2 billion in free cash flows, I don’t think the long-term debts of $5 billion to be an issue.

Company Capital Strategy (Earnings Presentation)

Paying back $6.3 billion since 2019 is no joke, and I think that really puts into perspective the cash flow monster that is MCHP. The net debt/EBITDA ratio now sits around 1.5 though, which is a stable place to be. Generally, under 3 is ideal, and I don’t expect the margins of MCHP to take enough of a hit in a slowdown to put paying back debts at any risk. Going into the rest of the year, I would like to see a higher cash position from the company, which would put me more at ease with their balance sheet. Seeing it built up to around $2 billion at least would be ideal in my mind. That way they can pay down almost all current liabilities or all if they incorporate the cash flows. It might not ever be necessary, but having the opportunity means a long-term investment might be less at risk.

Valuation

Looking at the valuation of MCHP, they are trading significantly lower than the sector, at a forward p/e of just under 12 compared to 19 for the sector. I think that the sentiment around MCHP right now is that they are turning into a dividend company and away from the high-growth company they have been the last several years.

Company Projections (Earnings Presentation)

The company still has ambitious and realistic goals in my opinion. A CAGR of 10 – 15% between 2022 and 2026 seems very possible in terms of revenues and in my mind makes MCHP a growth company still. They hold around 6% of the market share and that seems to be increasing as well. One of the major companies in the industry is Intel Corporation (INTC) and they are losing market share and leaving the door open for companies like MCHP to fill that empty space. Looking at the estimates for MCHP, I think they should be higher based on the current margins they have and the opportunity to take more market share. A 10% EPS growth annually from $6.02 in 2023 would be around $8.01 in 2026. A fair multiple of 16 would put the share price around $128, indicating a potential upside of around 75% from the current share price. I think the risk/reward ratio here definitely is in favor of a buy case. The company remains solid and has proven to be able to face challenges and times of lower demand very efficiently by keeping strong margins and high cash flows.

Stock Chart (Seeking Alpha)

The main risk I see though is that the sentiment around the company will keep the valuation suppressed. A lot of cash is being returned to investors, and that doesn’t sound like a girth company to most people. But also the general sentiment around semiconductor-related companies is that the market has become saturated and that the next growth cycle is far out. I think this is false and MCHP is still seeing strong demand as seen in the last report when revenue grew 21.1% YoY.

Company Takeaway

Microchip Technology Incorporated has been able to capitalize and generate strong results, even though the semiconductor industry doesn’t have the same demand and love as a few years ago. It becomes clear that the market goes in cycles and with that, you want to be invested in a company that has a strong record of weathering the storm efficiently in those times. That company is MCHP, which has grown FCF margins by 23.4% CAGR over the last 10 years. This has meant the company is in a position where it can pass on a lot of value to shareholders through dividends, especially. Raising the dividend quite regularly. I think that the momentum the company still has paired with the strong balance sheet makes it a buy right now. It offers good exposure to broad market trends and puts little risk in the hands of the investors.

Read the full article here