Overview:

Micron Technology (NASDAQ:MU) released its 3rd-quarter earnings for FY 2023 on June 28, 2023. Those results were not pretty, as Micron reported a GAAP loss of $1.73 on revenue that was down a huge 56% from last year’s 3rd quarter.

In addition, Micron has had a big inventory build-up and sales restrictions imposed on it by China.

In spite of that, Micron’s price is up 9% over the last year.

Micron’s share price also compares poorly to both S&P 500 (SPY) and the tech-heavy Invesco QQQ Trust Series I (QQQ).

MU’s total return (including dividends) for the last 12 months is at 4% vs 15% for S&P 500 (SP500) and 24% for QQQ.

Seeking Alpha

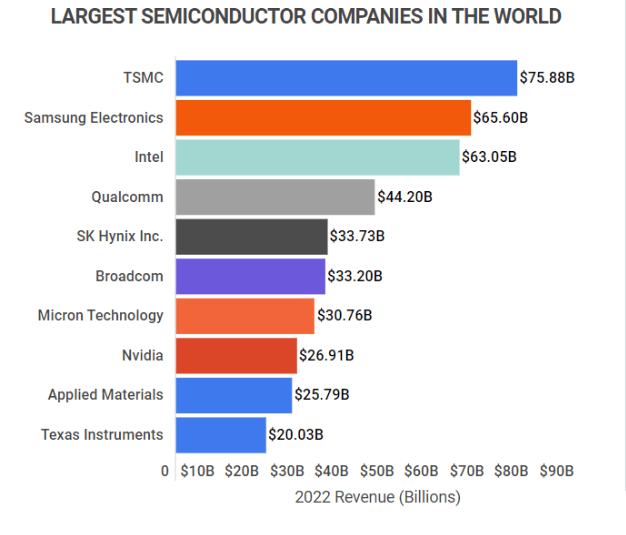

Micron is the 7th largest semiconductor company in the world by revenue, far behind leaders Taiwan Semiconductor Manufacturing Company Limited (TSM) and Samsung (OTCPK:SSNLF).

zippia.com

The question for investors at this point in time is whether Micron is a reasonable investment, or whether investors should be looking at other tech stocks.

In this article, we will look at 5 significant headwinds Micron faces which combined lead to a Sell recommendation.

1. Micron’s Key Stock Metrics Are Terrible

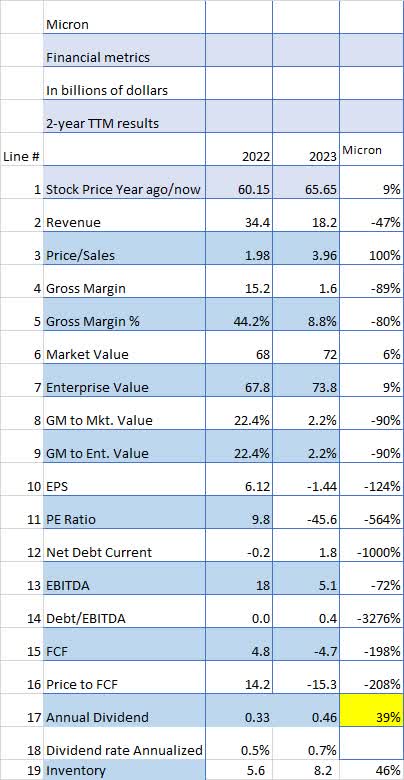

Let’s look at Micron’s financial metrics, comparing the latest TTM (Trailing Twelve Months) with the previous year.

I use the financial metrics to discover what I consider to be positive investment numbers (Yellow boxes) and compare them with any negative investment numbers (Orange). One quick look at the financial metrics table above comparing 2022 to 2023 shows what I consider to be serious problems in results for Micron over that time period. In fact, it is the worst year-over-year financial metrics comparison I have done yet.

It is so bad I have just ignored the orange negative numbers because except for the dividend, every item is much worse than the last year.

Seeking Alpha and author

The Stock Price (Line 1) is 9% higher even though Revenue (Line 2) is down a stunning 47% and the Gross Margin % (Line 5) is down 80%.

Gross Margin (Line 4) is significantly lower, down 89% since last year. This would imply serious revenue concerns and/or operational inefficiencies over that one-year time period.

EBITDA (Line 13) has dropped 72% or $13 billion.

Net Debt (Line 12) is up $2 billion, going from a net cash position to a $1.8 billion debt.

Also, free cash flow (“FCF”) (Line 15) went from a positive $4.8 billion to a negative $4.7 billion a drop of $9.5 billion in 12 months.

Perhaps the most worrisome indicator of all is outstanding Inventory (Line 19), which sits 46% higher than last year even after a decrease in revenue of 47%. I believe that could imply some serious management issues, to say the least. If the business doesn’t pick up significantly in the coming quarter or two, will there be some sort of significant inventory write-down?

The good news? The dividend was raised by 39% but still sits at a paltry 0.7%.

2. Analysts Are More Than Excited About Micron’s Investment Potential Than Quants Are

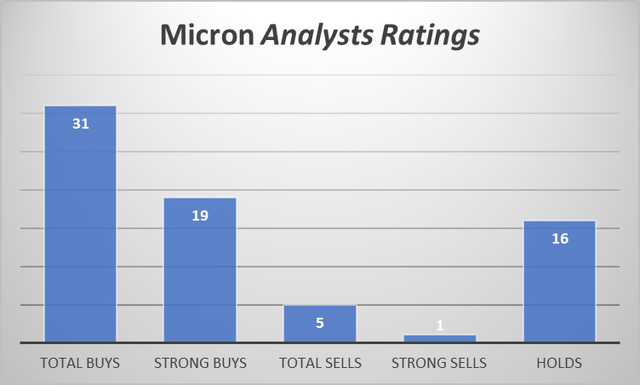

Wall Street and Seeking Alpha analysts have strong positive Micron ratings, with 31 Buys and only 5 Sells. Included in the Buy ratings are 19 Strong Buys.

Seeking Alpha and author

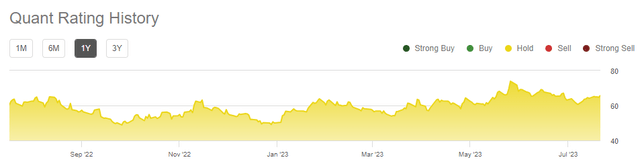

The quant rating is considerably less enthusiastic than the analysts – a Hold rating for the entire year.

Seeking Alpha

If there is very high enthusiasm for Micron from analysts and a blah Hold rating from quants should you invest?

3. Micron Has Underperformed Virtually Every Other Semi-conductor Stock

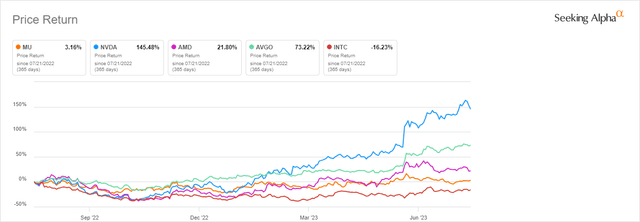

A legitimate question when looking at any stock is to compare its potential with other stocks in the same market sector. If we look at Micron’s performance over the last year and compare it to other large market-value stocks in the semiconductor sector, we can see Micron has performed poorly compared to the others, with a total return (including dividends) of minus 13%.

In the following chart, we compare Micron’s performance with Intel (INTC), Advanced Micro Devices, Inc. (AMD), Nvidia Corporation (NVDA), and Broadcom Inc. (AVGO). Except for Intel, Micron is the worst performer by far.

Seeking Alpha

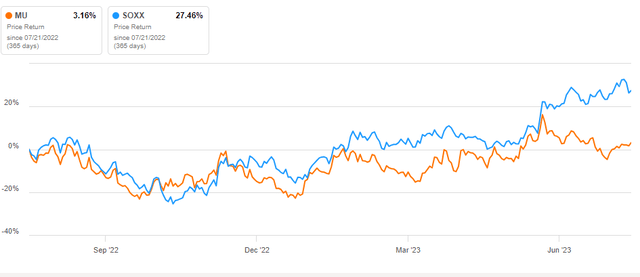

Another good comparison is with the iShares Semiconductor ETF (SOXX), which includes all the major semiconductor stocks in one ETF.

Seeking Alpha

In this case, SOXX has outperformed MU by 24% over the last year.

It is easy to see once again that Micron has not performed as well as the semiconductor sector in general over the last 12 months.

4. Experts Are Indicating The Slowdown In Chip Revenue Is Not Going Away Anytime Soon

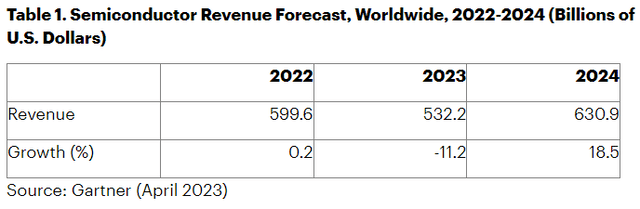

The other looming issue is whether semiconductor revenue, in general, is done falling yet. Gartner says no, there is more downside to come.

Gartner Group

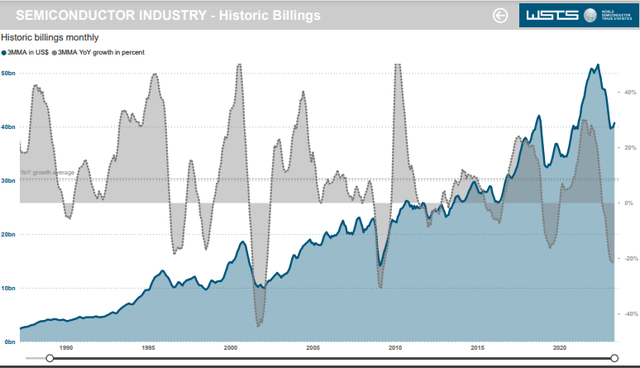

The WSTS (World Semiconductor Trade Statistics) also shows a slowdown.

WSTS

Note the growth rate for semiconductors is down 20%. Another indicator of a weak semiconductor market is Samsung’s recent announcement that it was cutting back on chip production.

Why invest now when indicators are clear that at least near-term and quite possibly longer, sales and shipments will be sluggish at best?

5. The ‘Chinese put’ Is In Place For Micron

Back in May, China announced that certain Chinese companies would no longer be able to buy chips from Micron because of security concerns. This is an example of what I call the ‘China put’ where I think China will attempt to strike fear and uncertainty into American companies of all sorts, but especially tech-related companies. Think for example what a China ‘put’ could do to Tesla (TSLA).

It could certainly be just a warning shot across the bow, but from an investment standpoint, that concern would always be lurking in the background and could affect the long-term price of Micron and other companies operating in China.

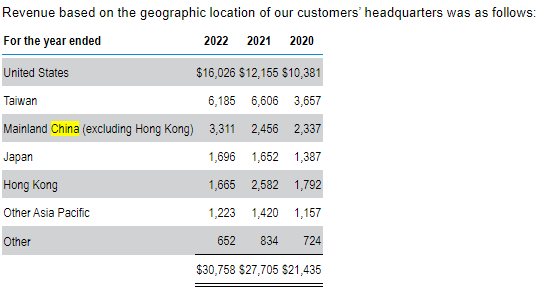

As for businesses in China and Hong Kong, Micron generated about 16% of its revenue from those sources in 2022.

Micron 10K

Is Micron Stock A Buy, Sell, Or Hold?

Obviously, there are risks with a Micron investment. For example, if semiconductor sales continue to be muted through the end of 2023, Micron shares will almost certainly go lower. Add to those risks the risk of Micron losing some significant revenue from China.

In addition, UBS reports weak IT spending may have impacted chips. Why would August or the rest of 2023 be any different?

Also, Micron’s big inventory overhang is a concern at least for the next quarter and maybe for the rest of the year. Is there an inventory write-off coming sometime this year?

Considering the possibility of a weak sales environment, the terrible financial metrics, and the potential loss of some unknown amount of revenue to China, I rate Micron Corporation stock a Sell.

Read the full article here