Global X MLP & Energy Infrastructure ETF (NYSEARCA:MLPX) focuses on the midstream energy sector by investing in MLPs, general partners of MLPs, and other energy infrastructure corporations. MLPX aims to offer a more tax-efficient way to get MLP exposure, but in its attempt, limits some key features of MLP ETFs like high yield and lower volatility. I think MLPX is a sound ETF with some benefits, I just don’t think now is the right time for it because of my outlook on oil prices. I rate MLPX a Hold.

Holdings

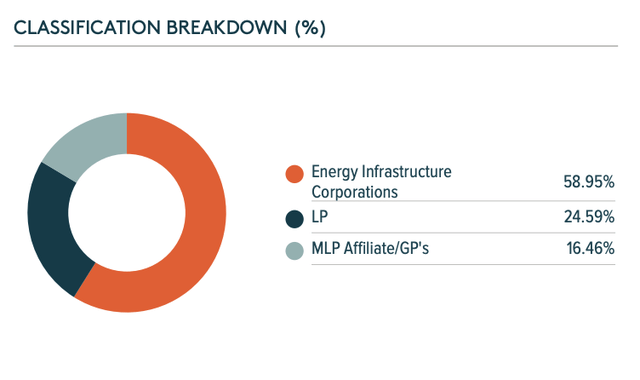

MLPX has pretty unique holdings for an MLP-focused ETF because of its attempt to be more tax efficient. MLPX only allocates at most 24% of its holdings to MLPs. This is so MLPX can qualify to be a Regulated Investment Company, also known as an RIC. To be an RIC, ETFs cannot have more than 24% of their holdings in MLPs at the time of rebalancing. MLPX wants to be an RIC because RICs are allowed to pass through taxes for capital gains, dividends, or interest earned to the individual investors, meaning that the income is only taxed once, rather than twice.

This is advantageous for MLPX, but it also means it has to fill the other 76% with non-MLP assets.

globalx.com

To offer a little more exposure to MLPs, MLPX holds MLP affiliates and general partners. These are very similar to MLPs but don’t count toward the MLP holding limit of 24%. MLPX only allocates about 16% of its AUM to these, causing the bulk of its holdings to be in energy infrastructure (midstream) corporations.

With almost 60% of MLPX’s holdings being in midstream corporations, the valuable benefits of MLPs are slightly diluted. Mainly, the dividend yield is lower and the volatility is higher than an ETF with 100% MLPs.

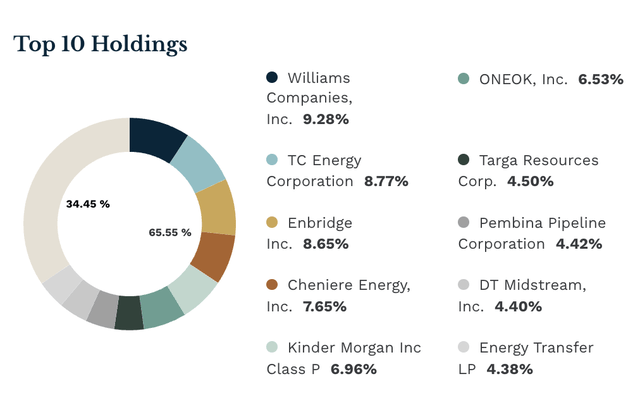

MLPX has 28 individual holdings. The top 10 make up about 65% of MLPX’s AUM.

MLPX top 10 holdings (ETF.com)

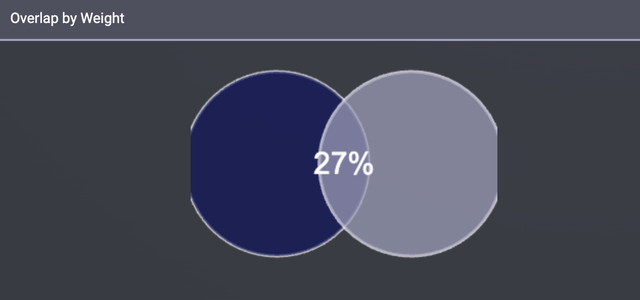

Although this is an MLP-focused ETF, because of MLPXs’ attempt to be tax efficient, it has very different holdings than a traditional MLP ETF such as Global X MLP ETF (MLPA). MLPX and MLPA only have a 27% overlap.

MLPX and MLPA Overlap (etfrc.com)

Dividends

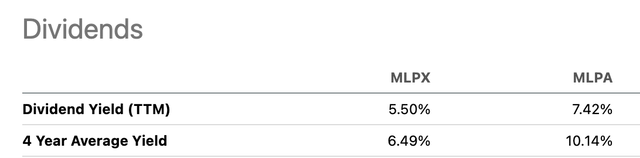

Probably the best part about owning an MLP ETF is its high dividend yield. However, because of MLPX’s diluted direct exposure to MLPs, it “only” has a yield (TTM) of 5.5%. By no means is this a low yield compared to the rest of the market, but MLPA and other popular MLP ETFs have a much higher yield of about 7.5%. This lower yield comes despite the fact that MLPX receives the tax benefits of being an RIC.

MLPX vs MLPA Dividend Yield (Seeking Alpha)

I think MLPX does a good job of filling the non-MLP holdings with high-yield assets. Midstream companies have a higher yield and more stable income stream than upstream and downstream companies. This lets MLPX have diluted MLP exposure for tax advantages, but still have a relatively high dividend yield.

Having a lower yield than MLP ETFs isn’t necessarily a bad thing. Because midstream corporations have more growth potential than MLPs, their yield is lower.

Why this trade-off isn’t worth it… at least not right now

As I said, this lower yield isn’t necessarily a bad thing, but I don’t think right now is a good time to take that trade. The right market conditions for MLPX would be rising oil prices and a growing economy. During times of rising oil and a growing economy, higher yields aren’t as important because MLPX would likely go up in price, causing investors’ unrealized gains to increase, until ideally they can be realized at long-term capital gain tax rates. But in times of falling oil and economic turmoil, having a higher yield from MLPA would add more comfort to a portfolio and provide the investor with income to ride out the rough times, even if it means your income is less tax efficient.

I believe we are headed to an economic downturn. To be more specific, I think we are being unavoidably pushed into a recession by the Fed’s fight against inflation. So far, the Fed hasn’t been able to get inflation under control, and more rate hikes are expected in 2023, likely pushing us past where rates peaked before both the burst of the dot-com bubble and the 2008 financial crisis. I see this causing a recession in the near future, making a higher-income asset such as MLPA more beneficial than MLPX.

Volatility

Another great aspect of MLPs is their low volatility. MLPs are usually in slow-growing industries; in this case, the midstream energy sector. Midstream energy MLPs usually have consistent cash flow from long-term contracts, This causes MLPs to provide consistent income, but slow growth, leading to low volatility.

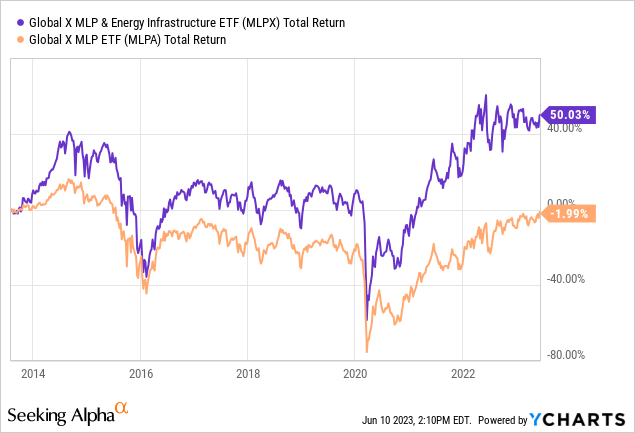

MLPX’s non-MLP holdings are more volatile than the MLPs. Midstream corporations are far less volatile than upstream and downstream energy companies, but more volatile than MLPs, meaning that MLPX has a higher volatility than a 100% MLP ETF. The 10-year chart of total returns depicts this well.

When MLPA goes up, MLPX goes up more. When MLPA goes down, MLPX goes down more. This means that if played correctly, MLPX can lead to bigger gains than MLPA. This time the trade-off is higher volatility for higher growth potential. But again, I don’t believe now is the time.

Why this trade-off isn’t worth it… at least not right now

Every investor knows that higher risk means higher reward. It goes without saying that higher risk can also lead to worse losses. As I stated above, I think we are headed to a recession. If I’m right and the Fed raises rates more aggressively to combat inflation, consumption will decrease. Consequently, oil prices will fall, causing midstream companies to also fall. The hope would be that we have a soft landing or a mild recession, but I think that it is too late for that. SPY has entered bull market territory from its low back in October, all the while the Feds have been raising rates in hopes to slow the economy. I believe this will cause the Fed to be even more aggressive with rates, causing a recession.

Why I’m watching MLPX closely

Once we enter a recession and oil, midstream companies, and most equities fall, we are presented with a great buying opportunity. The question is, when exactly does that shift from recession to recovery happen? This is where I think MLPX can play an important role in a portfolio. Once we enter a recession and MLPX drops in price, ideally 10-15%, it can be bought and provide lower volatility and higher yield compared to the rest of the market, but also provide more growth potential than a 100% MLP ETF like MLPA. This means that during a recession, the high yield and low volatility will help, and then once we enter a recovery phase and consumption goes up again, MLPX will deliver higher growth than its peers like MLPA.

Conclusion

MLPX is an MLP-focused ETF but holds many midstream corporations to offer tax advantages. MLPX has a lower yield, but higher growth potential than 100% MLP ETFs. Because of this, I don’t think it is an ideal time to buy, given an impending recession, but it should definitely be closely watched because it would be a great asset to buy during a recession. I rate MLPX a Hold.

Read the full article here