Morgan Stanley Headquarters in NYC

Summary

My investment thesis on Morgan Stanley (NYSE:MS) is bullish, giving it a buy rating this month due to the dividend yield and dividend growth, healthy capital ratios, a favorable rate environment for big banks, and its position as a leader in the wealth management segment.

A potential risk to my outlook is the firm’s continued weakness in its other business segments such as institutional securities and investment management.

I would argue that a buy strategy for this stock should focus on holding a long-term position.

The firm showed dividend growth and an attractive dividend yield

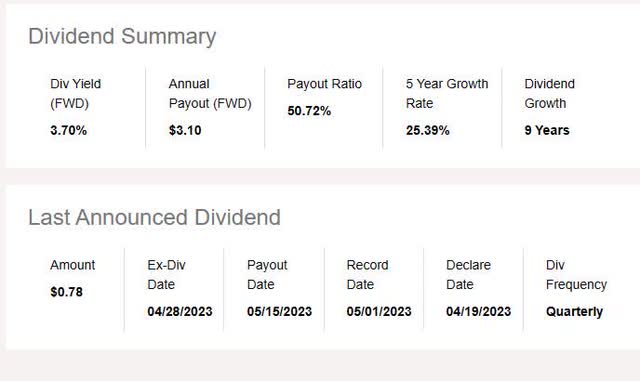

I like the dividend rate, and yield, that this stock offers, as shown in its dividend summary on Seeking Alpha.

As you can see from the screenshots, Morgan Stanley currently offers a $0.78 quarterly dividend, with a yield of 3.70%, however as of the writing of this article you missed out on the most recent ex-date to earn the May payout unless you are already a shareholder. But you may be able to snatch it up the next time around.

……………………………………………………………………………………………….

Morgan Stanley – dividends summary (Seeking Alpha)

……………………………………………………………………………………………….

As mentioned in other articles, in my opinion, dividend growth tells me a company is committed to returning capital back to shareholders and is in a healthy cash position to do so.

In this case, as you can see in the chart below, also from Seeking Alpha, since 2020 their dividend has grown from just $0.35 a share to now $0.78 a share. In fact, it went up 8 cents a share just in the last year alone.

……………………………………………………………………………………………….

Dividend growth history for Morgan Stanley (Seeking Alpha)

……………………………………………………………………………………………….

My sentiment on dividends was echoed in a February article by analyst Nick Ackerman and the Cash Builder Opportunities group on Seeking Alpha:

For investors, dividends can provide a steady stream of income and can also be a sign of a company’s financial health. Companies that pay dividends are often seen as more mature and stable than those that do not; they tend to be large-cap names.

It has solid capital ratios and benefits from current rate environment

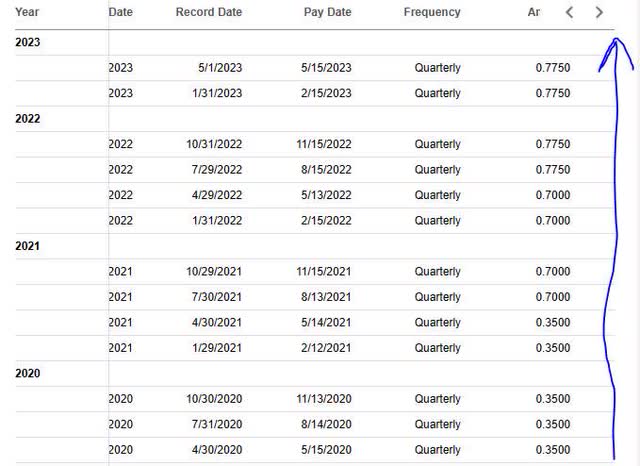

Because Morgan Stanley is on the Financial Stability Board’s list of global systematically critical banks, I would say that this puts even more eyes on this firm’s ability to maintain solid capital ratios.

As Morgan Stanley’s Q1 2023 earnings results show below, they have met this challenge and even increased both their CET1 and Tier 1 capital ratios vs the same quarter a year prior, now at 15.1% and 17%, respectively, as you can see:

……………………………………………………………………………………………….

Morgan Stanley – Q1 results – capital ratios (Morgan Stanley)

……………………………………………………………………………………………….

For those not familiar with the importance of capital ratios, a March article by Corporate Finance Institute explained the topic succinctly:

CET1 ratio compares a bank’s capital against its risk-weighted assets to determine its ability to withstand financial distress… The Basel III accord was introduced in 2009 as a response to the 2008 Global Financial Crisis and as part of continuous efforts to improve the banking regulatory framework.

Further, going beyond just discussing capital, let’s talk about the current interest rate environment, which I would argue favors large banking firms like Morgan Stanley, which in 2008 officially became a “financial holding company” under the Bank Holding Company Act, according to its official company history, a firm with roots on Wall Street that go back to 1935, in the 1960s developing the first computer model to deal with the increasing complexity of financial analysis, and acquiring retail brokerage firm E*TRADE in 2020 in a deal worth $13B.

In early May, the Fed raised rates again, and as mentioned in this CNBC article, ” The increase takes the fed funds rate to a target range of 5%-5.25%, the highest since August 2007.”

This can benefit large banks like Morgan Stanley because of the nature of its business model. Unlike a tech company like Dell Technologies (DELL), which sells a physical product (computers, servers) or a managed service for enterprises, the core business model of Morgan Stanley is essentially managing money for others, getting money from depositors and investors, trying to make a return on that money, while managing risk at the same time.

Sure, they also make money from advisory fees, trading, and other ways, but we are talking about what is the core of banking, and that is managing capital.

My point about banks is reiterated by Investopedia in an April 2023 article:

All have massive cash holdings… Some of it is invested in loans to businesses and consumers. Much of it is invested in short-term Treasury securities. This is the wave of cash that originates with the U.S. Treasury and flows constantly through the banking system. Even the very low interest rates that short-term Treasury notes yield are greater than the interest the banks pay to their customers.

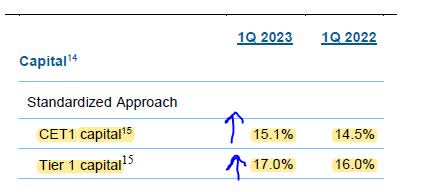

Since the Fed raised rates again in May, without specific indication of dropping them soon, my forward-looking sentiment is that this will continue to benefit Morgan Stanley for the rest of 2023, in terms of net interest income.

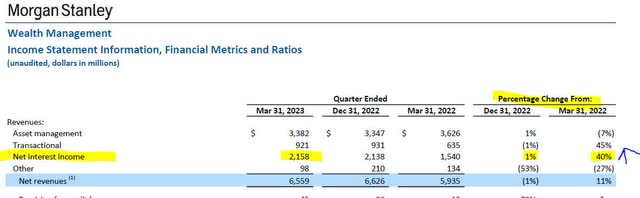

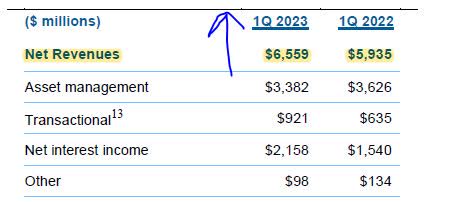

Case in point, as you can see from their wealth management business results in Q1 below, net interest income rose 40% year over year in this business segment:

…………………………………………………………………………………………..

Morgan Stanley – Q1 2023 earnings – net interest income (Morgan Stanley)

…………………………………………………………………………………………….

They are a major sector leader in the wealth management category

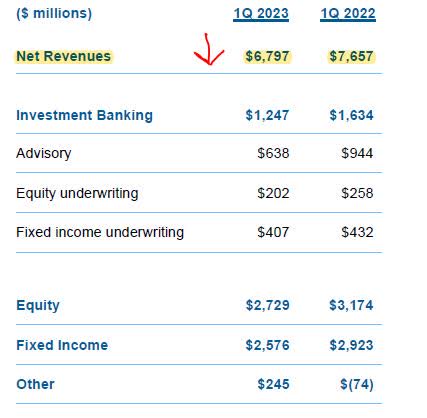

I would argue that Morgan Stanley is a leader in the specific banking segment of wealth management, and it has shown strong results in this business.

As is seen in its Q1 results, the net revenues increased in this business segment.

……………………………………………………………………………………………….

Morgan Stanley – Q1 results – Wealth Management unit (Morgan Stanley)

……………………………………………………………………………………………….

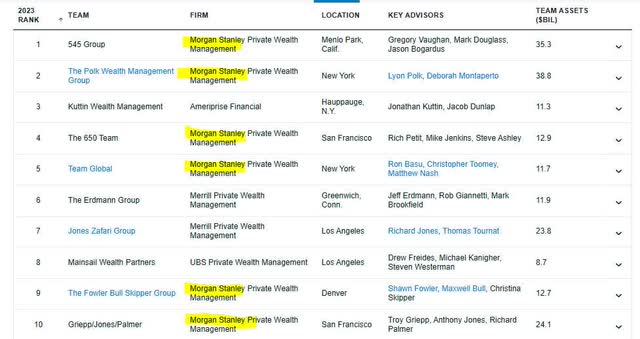

A key part of its wealth management business is the “private wealth management” component, which manages wealth for high-net-worth clients through a network of advisors that work as “teams”.

In the chart below, Barron’s ranked the top 10 wealth management teams in the US for 2023, and you can see that Morgan Stanley teams make up 6 out of the top 10, as well as clinching the top spot on the list.

……………………………………………………………………………………………….

Barron’s Top 10 Wealth Managers in US – 2023 (Barron’s)

……………………………………………………………………………………………….

One could argue, however, that artificial intelligence will deal a blow to the role of wealth managers. As both a tech and financial writer, I am tracking this trend of course.

However, much like I would not want an airplane 100% piloted by a computer without human pilot involvement, I would not want a $10MM portfolio completely managed by a robot.

This sentiment was also reflected in Morgan Stanley’s own survey, published May 10 in Berkshire Hathaway’s BusinessWire portal:

Over four out of five investors (82%) believe that artificial intelligence will never replace human guidance. And nearly nine out of ten (88%) agree that the human-to-human FA relationship is extremely important.

Risk includes continued weakness in its other business segments

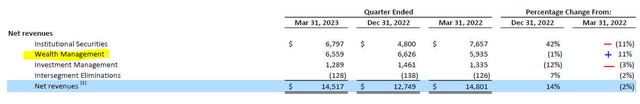

The risk I see in this firm is that its successful wealth management segment is dampened by negative results in its two other key segments: institutional securities and investment management, as seen in their consolidated net revenues for Q1:

……………………………………………………………………………………………….

Morgan Stanley – Q1 results – consolidated net revenues (Morgan Stanley)

……………………………………………………………………………………………….

As you can see in the consolidated results, its institutional securities group had an 11% drop in net revenues year over year, and the investment management segment had a year over year drop of 3%

The following is a closer look at the performance of the institutional securities segment:

……………………………………………………………………………………………….

Morgan Stanley – Q1 2023 results – institutional securities (Morgan Stanley)

……………………………………………………………………………………………….

According to the company’s official Q1 earnings press release, this segment’s decline was driven by “fewer completed Merger and Acquisition transactions, lower initial public offering volumes, declines in global equity markets.”

It also mentions an “increase in provisions for credit losses primarily related to commercial real estate.”

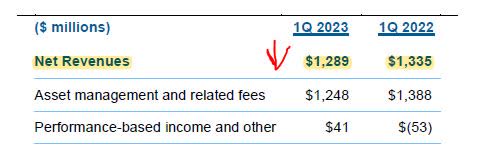

The following is a closer look at the performance of its other underperforming segment, the investment management segment:

……………………………………………………………………………………………….

Morgan Stanley – Q1 2023 results – Investment Management (Morgan Stanley)

……………………………………………………………………………………………….

The company’s commentary on this segment’s performance mentioned “decline in asset values and cumulative effect of outflows.”

The risk of continued headwinds for the institutional securities segment, I think, could be turned around if there is a surge in merger and acquisition activity and Morgan Stanley wrestles a lot of that advisory business away from competitors. This remains to be seen as of now.

From a forward looking perspective, however, Morgan Stanley’s own assessment from February expects an increase in Merger and Acquisition activity in the near future.

While the consensus view among economists and strategists calls for a mild recession in 2023, company balance sheets are relatively strong compared to previous recessionary periods, and that could help drive corporate acquisition activity despite an economic downturn. Morgan Stanley’s investment bankers anticipate large corporates to make additive acquisitions in their core businesses

A buy strategy should focus on long-term holding

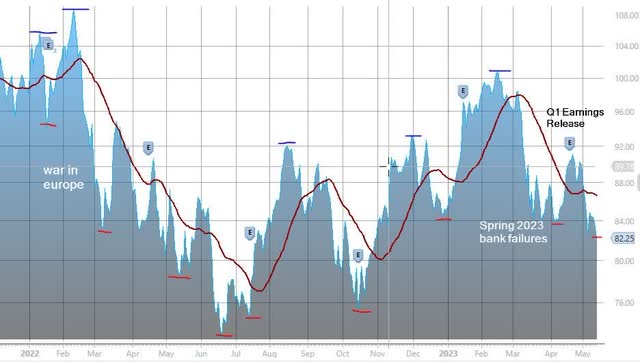

Below is a price chart for this stock since the start of 2022 until now, overlaid by the 30-day simple moving average in red, and several key events, as of May 11th.

Since I like dip-buying opportunities, this chart shows several dips over the last year, and even this month, that an investor could have taken advantage of to snatch up some shares of Morgan Stanley.

One of them, for example, was the March bank failures that led to a massive dip in overall banking sector stocks, followed by a brisk rebound.

……………………………………………………………………………………………….

Morgan Stanley price chart since 2022 (StreetSmart Edge trading platform)

……………………………………………………………………………………………….

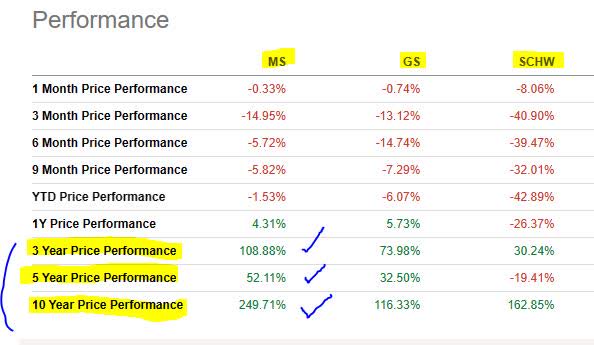

I would consider a valuable firm like this more of a long-term hold, and the chart below compares its previous longer term price performance vs two banking peers.

……………………………………………………………………………………………….

Morgan Stanley – Price Performance vs Peers (Seeking Alpha)

……………………………………………………………………………………………….

The above chart from Seeking Alpha shows the 3-year, 5-year, and 10-year price performance of Morgan Stanley vs its large banking peers, Goldman Sachs (GS) and Charles Schwab (SCHW).

Keep in mind that both Goldman and Schwab are also in the business of wealth management too, along with a portfolio of other business segments.

Although you can see short term price performance in the red for all three firms, Morgan Stanley comes out ahead of the others in the long term performance, particularly its 10 year price performance.

Though this past track record does not guarantee future performance, it does tell me that this firm’s stock price has more strongly weathered the market headwinds of the last decade, proving its resilience in a storm at sea.

Let’s also keep in mind that Morgan Stanley owns E*TRADE, a major retail brokerage and additional source of investor cash, adding to the diversification of the firm’s portfolio. It’s E*TRADE unit has already gone head-to-head with the likes of Schwab, TD Ameritrade, and Bank of America’s Merrill Edge, all of which offer $0 trading commissions for do-it-yourself online equity trades in most cases.

As someone who has used many of these platforms over the years, and have done home-based online trading during the work-from-home era of 2020 – 2021, I see value in Morgan owning a retail trading platform that has many of the same features its peers have, and I don’t believe home-based retail traders will go away any time soon, particularly since these platforms make it very nimble to buy and sell shares from your laptop or mobile device without ever calling a broker.

My long-term bullish sentiment was echoed by analyst Jishan Sidhu in a March rating on Morgan Stanley in Seeking Alpha:

In the long term, the company’s focus on synergetic growth driven by streamlined business practices and Merger and Acquisition promises high degrees of AUM growth alongside subsequent revenue and profit expansion in wealth and investment management.

Conclusion

In conclusion, I am reaffirming my buy rating for Morgan Stanley due to its dividend income potential, strong capital position and benefiting from the current interest rate environment as most large banks, and being a sector leader in wealth management.

A risk to my outlook is continuing weakness in its other sectors, which if not improved by 2024 could dampen investor sentiment in this stock. This risk could be alleviated if merger and acquisition volumes return.

A buying strategy could be to take advantage of volatility this quarter to snatch up dip-buying opportunities, then to hold on to this firm with the goal of longer-term investment.

Read the full article here