I recently covered MTU Aero Engines (OTCPK:MTUAF) stock and assigned it a strong buy rating and that has paid off so far. The stock is up 12.4% compared to 8.1% for the stock markets. In this report, I will be analyzing the most request quarterly earnings and I will attempt to put a price target on the stock.

The Buy Thesis For MTU Aero Engines

In the previous report, I already discussed why I like MTU Aero Engines stock, so I am not going to do an elaborate discussion of that. The short version is that the company generates its revenues from direct deliveries to original equipment manufacturers and aftermarket support with a customer base in defense and commercial aerospace allowing it to rely on the stability of defense and the growth prospect of air travel.

A Discussion Of The First Quarter Results

MTU Aero Engines

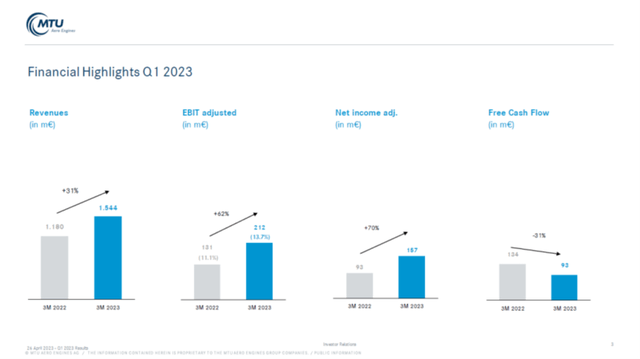

Except for free cash flow, MTU Aero Engines saw growth in all metrics. Due to continued supply chain challenge, free cash flow is also not guided on for 2023 other than the aim to have it at 2022 levels or better for the full year which would indicate a target of €326 million or better.

Revenues grew by 31%. Like we see with airlines, this was driven by an easy comp as the comparable period last year still was a period with lower demand for air travel. The revenue is composed of an OEM (Original Equipment Manufacturer) component which was up 42% and a Commercial MRO (Maintenance, Repair and Overhaul) which was up 25%. The OEM component is then split into Military, which saw 5% decline, and a Commercial component, which saw revenues increase by 60%. The military part saw revenues decline due to continued supply chain challenges. While supply chains are often seen as having a lot of overlap, they are distinctly different between defense and commercial and the pressures in the defense supply chain are bigger.

The year-over-year growth was driven by higher volume including spill-over from 2022 as well as forex tailwinds. The Commercial OEM segment also benefited from a favorable revenue mix with demand driven by older wide body turbofan platforms and industrial gas turbines for spares which saw 35% organic growth in dollar-terms and by higher geared turbofan and industrial gas turbine sales to OEMs. The MRO revenues grew by 19% in dollar values due to higher CF34, used on various Embraer (ERJ) and Bombardier (OTCQX:BDRAF) jets, related revenues, higher freighter airplane engine services and ramp up of maintenance on the geared turbofan used on the current generation Airbus (OTCPK:EADSF) single aisle jets.

At 13.7% EBIT margin, we saw margins grow which coupled with the higher revenues led to 62% in EBIT growth which was driven by lower costs adding 2.8 percentage points to the margin and forex tailwinds.

MTU Aero Engines Maintains Guidance For 2023

MTU Aero Engines

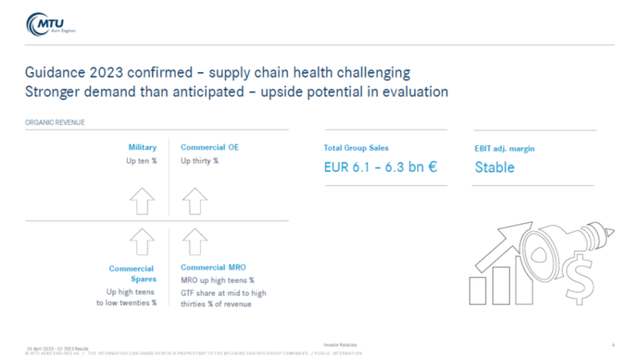

Despite higher margins in Q1, MTU Aero Engines has fully maintained its outlook issued during the fourth quarter earnings call and that is despite a 460 bps margin expansion in the OEM segment and a 40 bps margin expansion in the MRO segment. At the start of the year, the company had guided for lower margins in the MRO segment offset by higher growth in OEM. Despite margin expansion in the first quarter, the company decided to maintain the guidance as the supply chain remains challenging preventing the company from putting a goal on free cash flow and last year’s margins were driven by even stronger forex tailwinds which will abate this year and in the MRO segment last year had lower GTF related MRO which erodes margins.

On revenues level, military is expected to be up 10% for the year despite sales contracting in the first quarter. This is driven by higher revenue recognition on the net European fighter engine. Commercial OEM sales will be up 30% driven by growing geared turbofan deliveries driven by higher geared turbofan deliveries, strong growth in business jet engines and smaller but meaningful growth in GEnx engine production for widebodies as Boeing (BA) ramps up Boeing 787 production towards the end of this year and deliveries of Dreamliners has recommenced. MRO sales and spares are guided up high teens driven by high demand for cargo engine shop visits.

What should be kept in mind is that MRO growth is basically limited by the supply chain and the capacity that MTU Aero Engines has. To that end, supply chain issues easing in the second half of the year and there also is growth in the MRO capacity. For the geared turbofan the plants in Poland and China are ramping up and at the end of 2022, the new parts repair shop in Serbia was opened which is growth story for years to come.

What Is MTU Aero Engines Stock Worth?

|

Valuation MTU Aero Engines |

|||

|

Market Capitalization [$ bn] |

$ 14.09 |

||

|

Preferred stock [$ bn] |

$ – |

||

|

Total debt [$ bn] |

$ 1.79 |

||

|

Cash and equivalents [$ bn] |

$ 0.92 |

||

|

Minority and controlling interests [$ bn] |

$ – |

||

|

Total Enterprise Value [$ bn] |

$ 14.96 |

||

|

EBITDA 2023 [$ bn] |

$ 1.12 |

||

|

EV/EBITDA |

13.4x |

||

|

Current price |

$ 261.00 |

||

|

Median |

Current |

Industry |

|

|

EV/EBITDA |

10.45 |

17.32 |

15.03 |

|

Price target |

$ 204.17 |

$ 338.39 |

$ 293.65 |

|

Upside |

-22% |

30% |

13% |

Putting in the numbers for MTU Aero Engines, seemingly against its median, investors have already factored in earnings until 2025, which also leads to its current EV/EBITDA multiple to be at the high side. Nevertheless, when we apply the median EV/EBITDA for the industry, which I believe is fair, we still get 13% upside, which I believe combined with its dividend growth is attractive.

Conclusion: MTU Aero Engines Remains A Long-Term Growth Opportunity

The first-quarter results did benefit from improving supply chain health, increasing demand for air travel and higher airplane productions and going forward that will still be the case. MRO capacity is subject to a ramp up so the growth rate there depends on how fast MTU Aero Engines can increase the capacity, but for the long term, MTU Aero Engine’s business is solidly supported by increasing demand for air travel and thus airplane, higher military engine development sales and improving business jet deliveries. All of this comes on top of the final phase of recovery in air travel.

MTU Aero Engines stock might be overvalued based on its median and EV/EBITDA using the 2023 EBITDA and has a lot of forward earnings pulled into today’s stock price, but its 2023 EV/EBITDA of 13.4x remains below the industry mean and I believe with a strongly diversified business, expanding demand for air travel, capacity expansion at MTU Aero Engines, coupled with the prospect of increasing dividend payments, the company remains extremely attractive.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here