Introduction

Munich Re (OTCPK:MURGY) (OTCPK:MURGF) is a large Germany-based reinsurance company with a commitment to a low risk approach and an increasing dividend. This is backed by a currently relatively low payout ratio and the company’s commitment to continue to increase the dividend by approximately 5% per year.

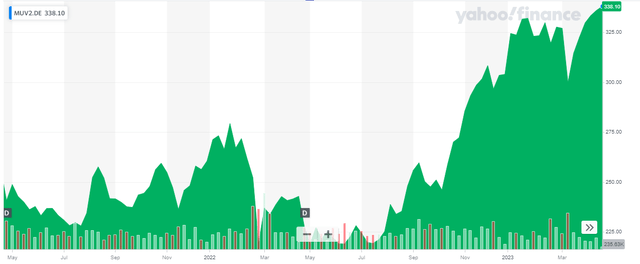

Yahoo Finance

Munich Re has its main listing in Germany where it is listed on the Deutsche Boerse with MUV2 as its ticker symbol. As the average daily volume exceeds 300,000 shares per day, it goes without saying investors should focus on the most liquid listing to trade in the company’s shares. All relevant presentations can be found here.

The targets for 2025 remain valid

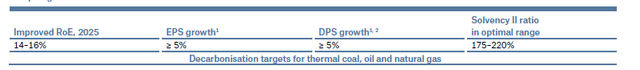

Munich Re doesn’t just provide a 2025 guidance, it made a ‘pledge to its shareholders’. As you can see below, the company plans to increase the EPS by about 5% per year and these profit increases should flow back towards the shareholders as the dividend is anticipated to increase at a similar rate. Meanwhile, the Return on Equity should come in at 14-16% while the optimal solvency ratio is 175-220%.

Munich Re Investor Relations

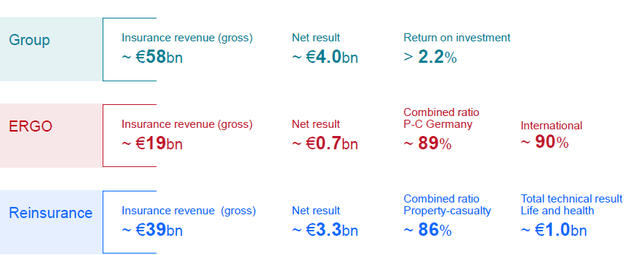

That’s interesting because this allows us to calculate an EPS expectation as we also already know Munich Re’s guidance for 2023 (below).

Munich Re Investor Relations

The company anticipates to generate a total insurance revenue of 58B EUR and expects to generate a net income of 4B EUR of which in excess of 80% will be contributed by the reinsurance activities. As there are currently 137.6M shares outstanding, the EPS could be expected to come in at approximately 29 EUR per share which would be a much higher result than the 24 EUR per share in 2022 and it would for sure exceed the anticipated average EPS growth of 5%.

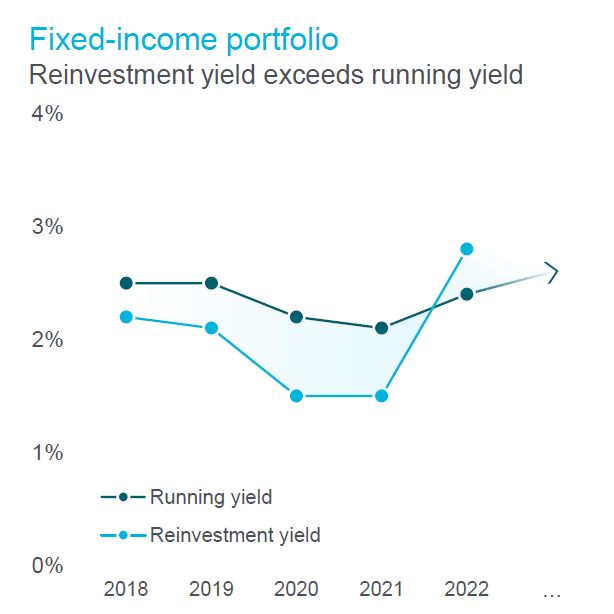

The reason for this is pretty straightforward: not only does Munich Re have one of the best in class underwriting teams and insurance losses remain limited, the higher interest rates will also firmly start to work in the company’s favor. Cash becoming available from fixed income investments reaching their maturity date can now easily be redeployed into higher yielding securities. The image below clearly shows the impact of the recent increase of the interest rates on the market: there will be a rather substantial increase in the ‘running yield’ and as long as the market rates remain relatively elevated, this running yield will continue to increase. And with an investment portfolio of almost 250B EUR, every 10 basis point increase adds 250M EUR to the pre-tax investment result.

Munich Re Investor Relations

Of course higher interest rates on the market also result in an unrealized loss on the bond portfolio. The reinsurance company does not have to let this flow through the normal income statement but the unrealized losses are included in the comprehensive income statement and are visible on the balance sheet as the total equity value decreases despite retaining 1.8B EUR in earnings.

As of the end of 2022, the balance sheet contained 21.2B EUR in equity (down by 9.7B EUR compared to the end of 2021) which resulted in a book value per share of 154 EUR (down from in excess of 200 EUR per share at the end of 2021). This is nothing to be too worried about although this does mean Munich is currently trading at approximately twice the book value. That’s relatively high but considering the company is expecting a 15% net income increase and considering it is likely about 2B EUR will be retained as equity on the balance sheet this year (excluding the impact of a share buyback program), it probably still is a fair price to pay for a leader in the reinsurance space.

If the total value of the bond portfolio doesn’t decrease any further, the 2B EUR in retained earnings this year will add about 15 EUR per share in book value.

Munich Re Investor Relations

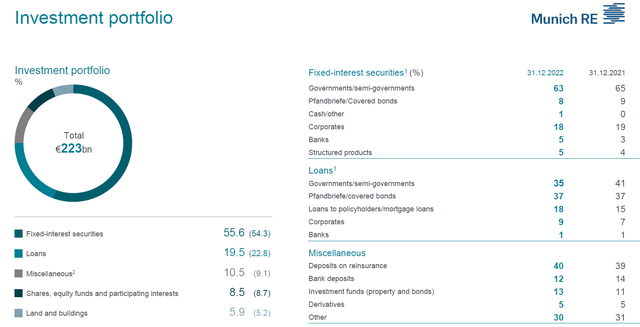

Looking at the breakdown of the investment portfolio, it is pretty obvious the majority of the insurance float is invested in fixed income securities and loans. And in excess of 60% of the 55.6% invested in fixed rate securities has been invested in government bonds.

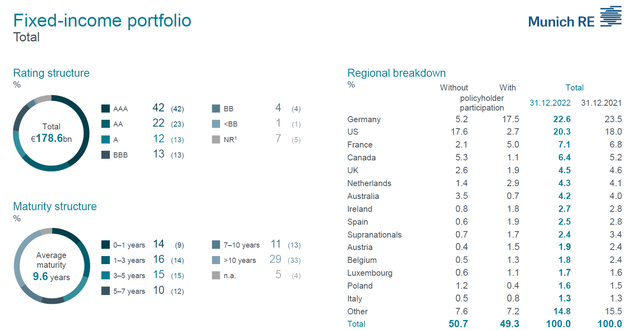

And of course, a very large portion of the fixed income portfolio has been invested in German and American assets which make up almost half of the total portfolio. And as you can see below, the total exposure to countries that are perceived as ‘weaker’ like Spain and Italy is very minimal (3.8% of the total fixed income portfolio on a combined basis).

Munich Re Investor Relations

Investment thesis

And this makes Munich Re an interesting long-term buy and hold. While it’s not easy to pay in excess of two times the book value, the stock is relatively cheap based on the earnings profile (trading at just 11 times earnings) while the relatively high earnings retention ratio will rapidly increase the book value again. If the bond portfolio does not deteriorate, Munich Re’s book value will likely hit 200 EUR per share again before the end of 2025 (excluding the impact of share repurchases).

Meanwhile, the dividend of 3.4% is pretty secure as this represents a payout ratio of less than 50% of the 2022 earnings while the reinsurance company will likely continue to increase its dividend at a pace in line with its earnings increase.

I currently have no position in Munich Re, but I am planning to pick up stock on the next weakness. I consider this to be a solid ‘buy and hold’ company as its management has definitely proven and shown its capabilities to navigate the company through choppy waters.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here