Commercial real estate services company Newmark Group, Inc. (NASDAQ:NMRK) enjoys a leading position and optimism from market forecasters, who believe that free cash flow will grow in 2024 and 2025. Considering potential business growth from technological innovation and further real estate database developments, I am not afraid of the 2023 guidance. In my view, further market efforts to create a stronger brand, internationalization, and more employees willing to work from offices would justify higher stock price marks.

Newmark

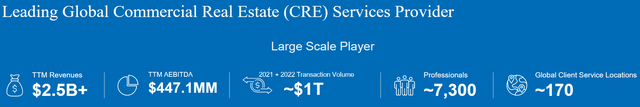

Newmark is a leading full-service commercial real estate services company offering a wide range of integrated services and products to meet all the needs of real estate investors/owners and occupants. Its services include capital markets, commercial mortgage brokerage, property management, valuation and advisory, loan services, and flexible workspace solutions. Considering the number of employees, transaction volume, global clients, and international exposure, the company is one of the largest players.

Source: Quarterly Presentation

Newmark also offers tenant representation services, global corporate services, corporate consulting, and flexible workspace solutions for occupants. Newmark focuses on improving these services and products through innovative real estate technology solutions and data analytics, enabling its clients to increase their efficiency and profits. With its exceptional team of strategists and advisors and strong revenue growth over the past decade, Newmark has become a leader in its industry.

Source: Quarterly Presentation

The type of clients is diversified. The firm’s clients include a wide range of homeowners, occupants, tenants, investors, lenders, small and medium-sized businesses, multinational corporations, and some of the world’s largest institutional real estate owners in numerous markets and around the globe. Besides, Newmark works with multiple property types, including office, retail, industrial, multi-family, student housing, hotel/lodging, data centers, healthcare, personal storage, land, condo conversions, subdivisions, and special use.

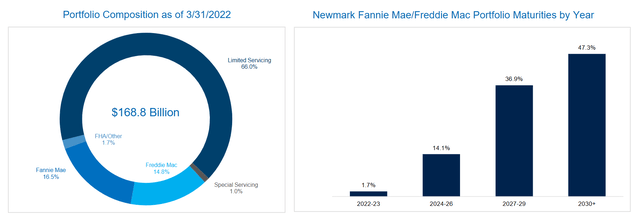

The company appears to have a portfolio with a significant number of maturities around 2027, 2028, 2029, and 2030. Hence, in my view, management will be able to sell loans and renegotiate service agreements in the coming years.

Source: Quarterly Presentation

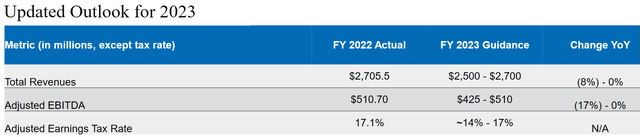

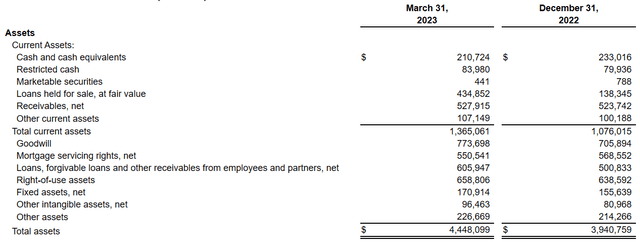

With that about the business model and leading position in the market, I believe that many investors would proceed with caution once they have a look at the outlook for 2023. Management expects a decline in revenue in 2023. Total revenue guidance would stand at $2.5-$2.7 billion with a decline in EBITDA of close to $425-$510 million. Having said this about the expectations for 2023, I believe that the numbers in 2024, 2025, and 2030 would justify a stock valuation higher than what the company reports today.

Source: Quarterly Presentation

High Competition, But Newmark Is A Leader

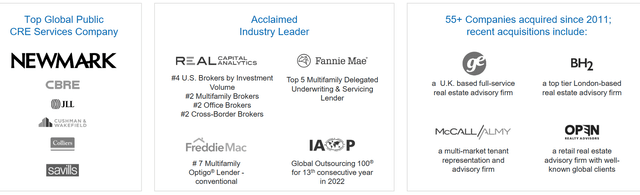

The firm competes in a wide variety of business disciplines within the commercial real estate industry, including commercial property and corporate facility management, property and landlord representation, property sales, valuation, capital markets solutions along with lending, maintenance, and development services.

Competition is very high at the local, regional, national, and global levels, and the company competes with other large multinational companies such as CBRE (CBRE), Jones Lang LaSalle (JLL), Cushman & Wakefield (CWK), Savills and Colliers International (OTCPK:SVLPF), and more specialized companies such as Marcus & Millichap (MMI), Eastdil Secured, and Walker & Dunlop (WD). It also competes with outsourcing companies and internal corporate real estate departments, institutional lenders, insurance companies, investment banking firms, and accounting and consulting firms in various parts of the business. Despite recent consolidation, the industry remains highly fragmented and highly competitive.

Expectations From Other Financial Analysts

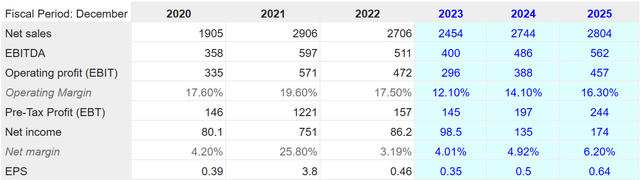

The estimates from other market analysts are optimistic. They include sales growth in 2024 and 2025, operating margin growth, and FCF growth. Newmark would deliver 2025 net sales of $2.804 billion, 2025 EBITDA of $562 million, EBIT close to $457 million, and net income of $174 million with 2025 EPS close to $0.64 per share.

Source: S&P

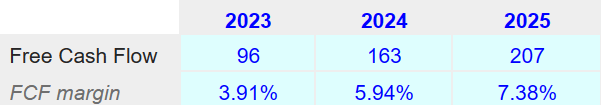

It is also worth noting that free cash flow is expected to double from 2023. FCF would go from $96 million in 2023 to around 207 million in 2025. It means that the FCF margin would be close to 7.3% in 2025. With these figures and also taking into account the current EV/Sales, EV/EBITDA, and EV/FCF ratio, I believe that Newmark is a stock to study carefully.

Source: S&P Source: S&P

Balance Sheet

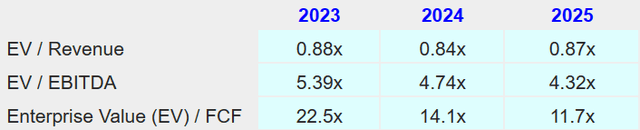

In the 10-Q, Newmark reported a significant increase in the total amount of assets driven by an increase in the total amount of loans held for sale. Cash in hand decreased, and management received some money for warehouse facilities collateralized by U.S. government sponsored enterprises.

As of March 31, 2022, cash stood at $210 million, with restricted cash worth $83 million and loans held for sale, at fair value close to $434 million. Also, with receivables of $527 million, total current assets stood at $1.3 billion. The total amount of current liabilities is larger than the total current amount of assets, which is not ideal.

Newmark also reported goodwill worth $705 million, mortgage servicing rights of $568 million, and loans, forgivable loans, and other receivables from employees and partners of $500 million. Finally, with right-of-use assets close to $658 million and fixed assets worth $170 million, total assets stood at $4.4 billion. The asset/liability ratio is equal to more than 1x, so I believe that Newmark reported a stable financial situation.

Source: Quarterly Report

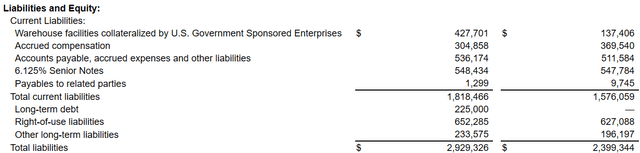

The list of liabilities reported included warehouse facilities collateralized by US government sponsored enterprises worth $427 million, accrued compensation of $304 million, and accounts payable, accrued expenses, and other liabilities of around $536 million. Also, with 6.125% senior notes worth $548 million and right-of-use liabilities worth $652 million, total liabilities stood at $2.9 billion.

Source: Quarterly Report

More Data Analytics, A Robust Database, And Further Marketing Efforts

Under my financial model, I assumed that technological innovation and data analytics will likely optimize efficiency, and may help management obtain more clients. In particular, I believe that a growing real estate database will bring cost savings, and may improve the FCF growth in the next ten years. In this regard, management offered the following comments.

Our multi-faceted real estate database continues to grow, as does our commitment to providing innovative, value-added technological solutions across our service lines, which enables our professionals to provide clients with data-driven advice and analytics with expediency. Our solutions are designed to increase operational efficiency, realize additional income, and/or generate cost savings for our professionals and clients. Source: 10-K

I also believe that it is very important for Newmark to hire the best professionals. Hence, under my financial model, I assumed that Newmark would successfully attract and retain the best professionals in the industry through partnerships and stock-based compensation structures.

I also assumed that management will continue to reinforce its position as a leading commercial real estate services company in the United States through national branding and corporate marketing, local marketing of specific lines of business, and professional brokerage marketing efforts. More visibility and brand equity will likely help Newmark retain more clients, and bring revenue growth.

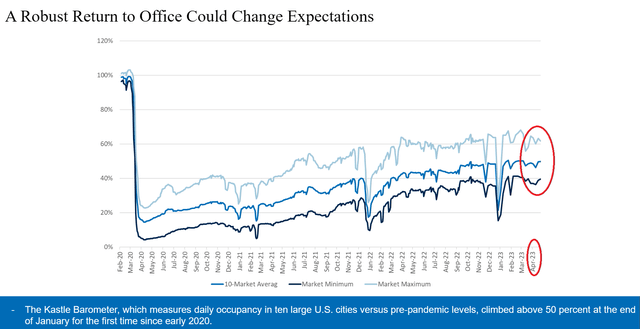

Finally, I also assumed that a robust return to the office could change expectations about the business model of Newmark. In this regard, management made a comment in a recent report. In my view, there are a lot of people that are still reluctant to work from offices. I do not expect that work will go back to 2019. However, if more and more employees decide to work from offices again, Newmark will likely enjoy further business growth.

Source: Quarterly Presentation

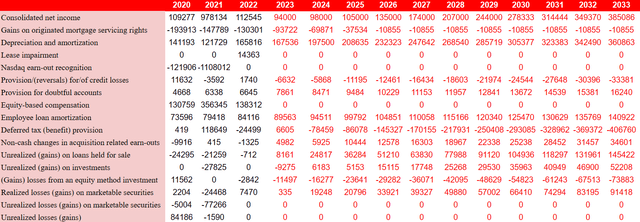

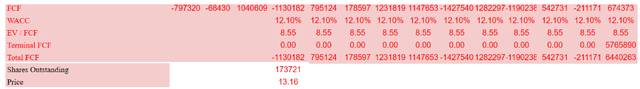

My financial model included net income growth and CFO growth from 2023 to 2033 driven by increases in accounts receivable, beneficial changes in loans for sale, receivables from related parties, and accounts payable. I also assumed that purchases of fixed assets will likely increase from 2023 to 2033.

My modeling of the cash flow statement included 2033 consolidated net income of $385 million, gains on originated mortgage servicing rights of -$11 million, and depreciation and amortization of $360 million. I also assumed provision for credit losses of -$34 million, provision for doubtful accounts of around $16 million, and a deferred tax provision of -$407 million.

Source: My DCF Model

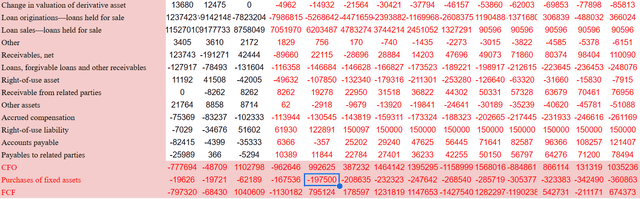

My cash flow statements also included 2033 changes in valuation of derivative asset of -$86 million, loans held for sale close to $366 million, loans, changes in forgivable loans, and other receivables close to -$249 million, and changes in accrued compensation of -$262 million.

Besides, with right-of-use liabilities close to $150 million, 2033 changes in accounts payable of $121 million, and changes in accounts payable to related parties close to $78 million, I obtained 2033 CFO of $1.035 billion, with purchases of fixed assets of -$361 million, which implied 2033 FCF close to $674 million.

Source: My DCF Model

With an EV/FCF ratio of 8.55x and a WACC of 12.1%, the equity valuation would stand at $2.285 billion, and the implied price would be close to $13 per share.

Source: My DCF Model

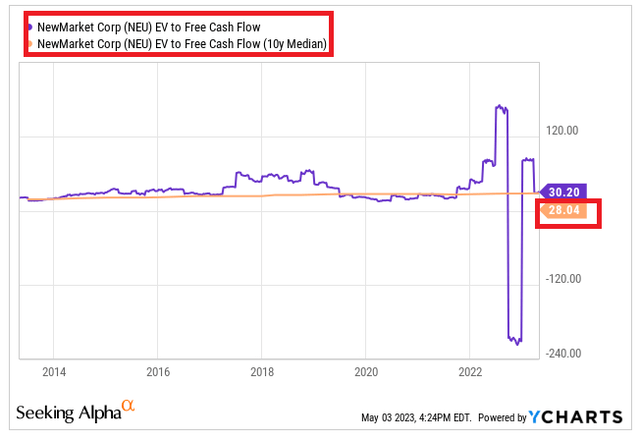

On a side note, in the last ten years, Newmark reported an EV/FCF close to 28x, and most investment advisors are currently using a WACC that is lower than 12%. In sum, I believe that my EV/FCF ratio is close to 8.55x, and a WACC of 12.1% is conservative.

Source: YCharts

Risk Factors

The company may suffer from various risks, including the general conditions of the economy, the commercial real estate market, and the banking sector. In addition, Newmark could be affected by the loss of key executives or a deterioration in the labor markets. If the company cannot find new employees, or has to pay too much, I believe that the FCF margins would decline.

Besides, non-compliance with laws in the United States or abroad or new emerging regulations with respect to data protection could also harm the business model of Newmark. If the company has to pay more to protect information about clients, I believe that the cash flow statement would deteriorate.

I also believe that failed inorganic activity could harm future revenue growth and FCF margins. If management fails to find adequate targets or reasonable transaction prices, the number of M&A deals will likely decrease. Besides, Newmark may also not find sufficient financing to acquire new competitors. In this regard, management offered the following explanation.

Any future growth will be partially dependent upon the continued availability of suitable transactional candidates at favorable prices and valuations and upon advantageous terms and conditions, which may not be available to us, as well as sufficient liquidity to fund these transactions. Future transactions and any necessary related financings also may involve significant transaction-related expenses, which include payment of break-up fees, assumption of liabilities, including compensation, severance, lease termination, and other restructuring costs, and transaction and deferred financing costs, among others. Source: 10-K

My Conclusion

Newmark enjoys beneficial expectations from market analysts that include FCF growth and sales growth in 2024 and 2025. The company already enjoys a leading position in the United States, and is working to operate in new jurisdictions. In my view, successful investment in technology innovation and data analytics and a larger real estate database will likely lead to FCF generation. Besides, further margin efforts and more employees willing to work in an office will likely improve the fees generated by Newmark. Even considering the guidance for 2023 and risks from deteriorating labor conditions, I believe that the stock is worth much more than what the market shows right now.

Read the full article here