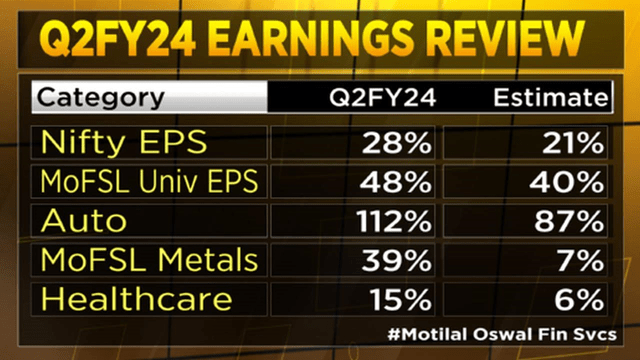

India just had a great corporate earnings season on the whole in Q2 fiscal 2024, with the country’s flagship Nifty 50 index outpacing expectations at +28% YoY net profit growth. Major Nifty conglomerate Reliance Industries tracked India’s resilient growth story yet again, though more cyclical names like Bharat Petroleum and Tata Motors also contributed to the outperformance. Continued IT services weakness (especially for Wipro (WIT), now the top Nifty laggard) was the key drag, with management teams now relying on more cost cuts to protect margins in the face of further top-line weakness. On balance, though, the major Nifty 50 earnings contributors are performing exceptionally well, supporting another quarter of overall positive revisions for India’s mega-caps.

CNBC TV-18

Beyond the near term, equities should receive plenty of support from India’s attractive macro outlook, backed by an investment upcycle and a structurally expanding middle class. While Indian stocks, not unlike other emerging markets, are prone to bouts of volatility amid cyclical shifts in oil prices (India is a net importer) and, more recently, weather-led disruptions, many of these headwinds have cleared.

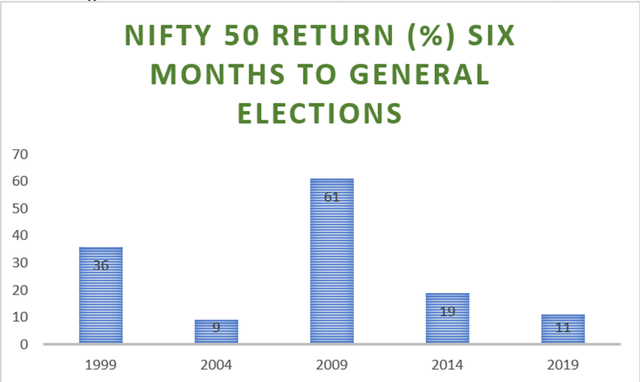

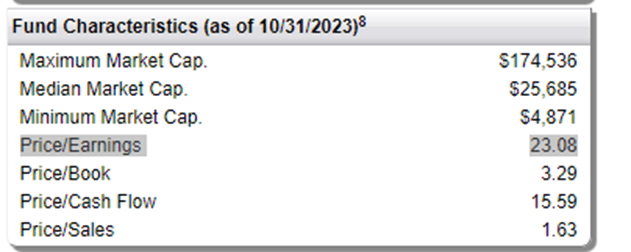

Instead, we are now entering election season, with policy continuity representing the highest probability outcome (per latest polling). Recent history also shows that the Nifty 50 tends to outperform broader emerging Asian indices in the lead-up to and through the election results period. Valuations aren’t stretched relative to historical levels either at ~24x earnings for the index, with the equal-weighted Nifty alternative, First Trust’s India NIFTY 50 Equal Weight ETF (NASDAQ:NFTY), offering a one-turn discount at ~23x P/E (~16x P/Cash flow). Net, I would use any pullbacks or volatility ahead of the elections as an opportunity to add to long positions.

Mint

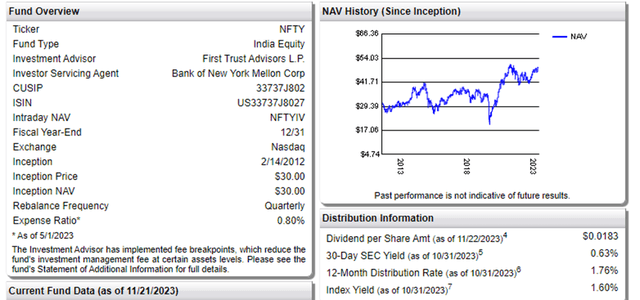

First Trust India NIFTY 50 Equal Weight ETF Overview – An Equal-Weighted Approach To Investing In India’s Mega-Caps

The First Trust India NIFTY 50 Equal Weight ETF tracks the NIFTY 50 Equal Weight Index, a basket of the fifty largest stocks listed on the National Stock Exchange of India, albeit with equalized weights (enforced via a quarterly rebalancing process). Unlike its closest US-listed comparable, the iShares India 50 ETF (INDY), which closely tracks the NIFTY 50 index composition, NFTY offers a more diversified option, with smaller and larger companies contributing equally to the overall fund performance. Despite seeing its net asset base rise to $111m over the last quarter, NFTY’s 0.8% expense ratio remains lower than INDY (0.9%), though its fee structure remains at the upper end of the US-listed Indian large-cap ETF universe.

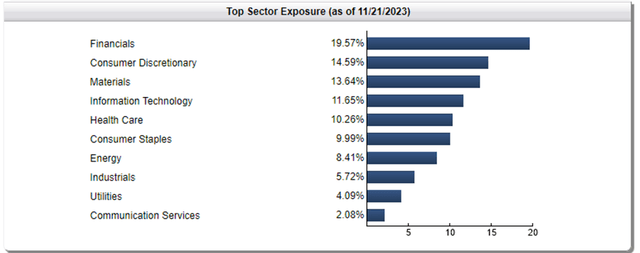

First Trust

The result of NFTY’s equal weight policy can be seen in its well-diversified sector breakdown. In line with other US-listed India funds, Financials remains the largest contributor, albeit at a relatively low 19.6% (vs INDY’s 35%). The most notable underweight relative to the Nifty 50 index is Information Technology (down to 11.7%), while Consumer Discretionary (up to 14.6%) and Materials (13.6%) are key overweights. Rounding up the NFTY top-five sector allocation is Health Care at 10.3%, also a big overweight – in contrast, INDY only allocates 4.2%.

First Trust

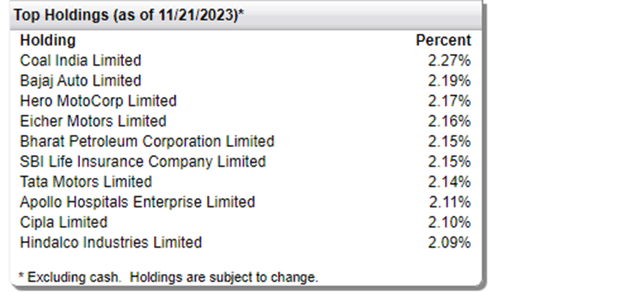

The single-stock allocation is evenly split across the 50-stock portfolio (excluding cash), with all its holdings generally around the 2% mark. Due to the lag in rebalancing, Coal India (2.3%), Bajaj Auto (2.2%), Hero MotoCorp (2.2%), Eicher Motors (2.2%), and Bharat Petroleum (2.2%) are currently the largest allocations, a result of their strong earnings results in fiscal Q2 2024. This stands in stark contrast to a more conventional Nifty 50 tracker like INDY, which features HDFC Bank (HDB), Reliance Industries (OTC:RLNIY), ICICI Bank (IBN), and Infosys (INFY) as its top holdings.

While the strict concentration limits mean NFTY might give up some momentum-driven performance, it also helps limit exposure to pitfalls, for instance, the recent HDFC Bank reset (discussed here). On the flip side, NFTY also retains slightly higher exposure (~2.5 percentage points more than INDY) to Adani-linked companies like Adani Enterprises (OTC:ANNRY) and Adani Ports and Special Economics Zone Limited (OTC:ANRTY), both of which carry considerable governance risks.

First Trust

First Trust India NIFTY 50 Equal Weight ETF Performance – Modest Near-Term Pullback But Track Record Remains Stellar

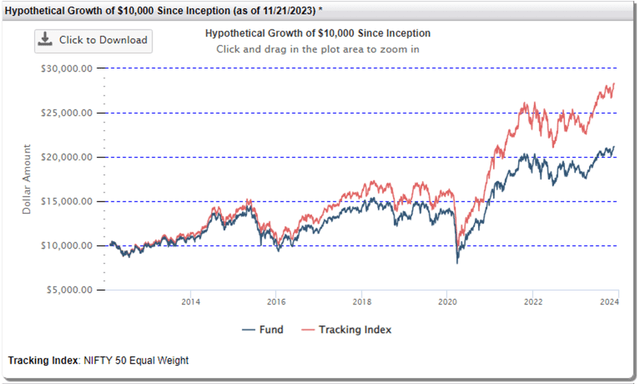

NFTY has generally tracked the broader Indian equity rally this year, with the ETF returning +9.1% annualized in NAV terms as of end-October. Of note, the equal-weighted approach has outperformed, with INDY pacing at a slower rate of +8.0% YTD. Over longer timelines as well, NFTY has compounded at an impressive +6.2% pace since its inception in 2012. Similarly, the fund boasts stellar three and five-year track records, with annualized figures of +17.5% and +10.1%, respectively, also outpacing INDY’s +13.3% and 8.3%.

First Trust

While the wide tracking error was one concern I had highlighted in my prior coverage, the good news is that there’s been some narrowing YTD. Relative to other India ETFs, the lower 2-3 percentage point delta remains wide, though. And while its higher distribution yield helps, this year’s rebalancing means the yield will probably end up well below 1.8% (on a trailing twelve-month basis). Hence, investors will need to weigh the benefits of capital growth from an equal-weighted approach with the additional costs. In the meantime, the NFTY portfolio is currently priced at ~23x earnings (one turn below INDY) relative to last quarter’s +28% earnings growth pace, so investors aren’t necessarily paying all that highly to underwrite the structural growth story.

First Trust

No Slowing The Indian Growth Engine

The latest Indian earnings season saw more beats than misses, supporting a +28% YoY bottom-line growth for Nifty 50 companies – by far the best in emerging Asia this year. While weakness in areas like IT services likely won’t be easing anytime soon, there’s more than enough offset elsewhere, even in traditionally cyclical sectors like automobiles, oil & gas, and cement, for more earnings beats and raises from here.

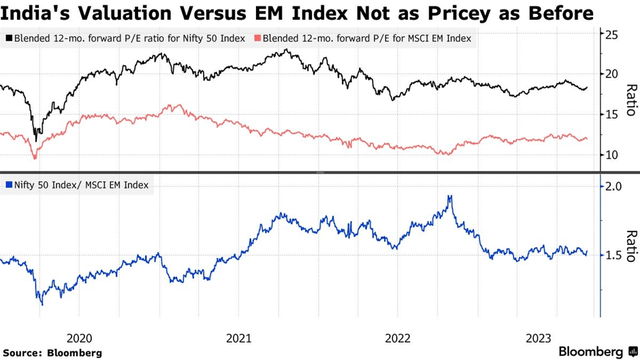

The macro backdrop also remains one of the most compelling in emerging Asia; in the likely event, we see more policy continuity at the upcoming elections, expect the impressive economic and earnings growth runway to extend into the coming years. Despite all the positives, Indian large-caps still aren’t too far off their historical premium vs other emerging markets (see chart below). In the meantime, investors looking to allocate to India via a more diversified, slightly lower-priced basket of mega-caps will find a lot to like in the equal-weighted NFTY fund.

Bloomberg

Read the full article here