Investment thesis

NIO (NYSE:NIO) was one of the hottest stocks during the EV frenzy of 2020-2021. The company’s market cap was close to $100 billion and is now traded much cheaper. My analysis suggests the selloff was fair because the company is losing the competition to its local rivals, not to mention other automotive giants entering the Chinese EV market. Moreover, NIO is highly likely to miss the aggressive growth profile consensus estimates expected from the company. Therefore, the stock is a strong sell.

Company information

NIO is a Chinese electric vehicle [EV] manufacturer incorporated in 2014. The company is headquartered in Shanghai. NIO designs, develops, jointly manufactures, and sells its vehicles in the premium EV market.

The company’s fiscal year ends on December 31 with a single reportable segment.

Financials

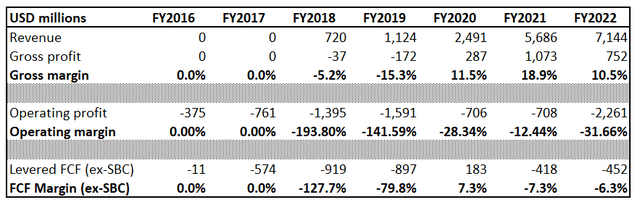

NIO went public in the U.S. in 2018. It means we have a relatively short horizon for financial analysis. Over the last five years, the company’s sales have increased by about ten-fold, and the company now generates positive gross profit but looks far from a breakeven from the operating profit perspective.

Author’s calculations

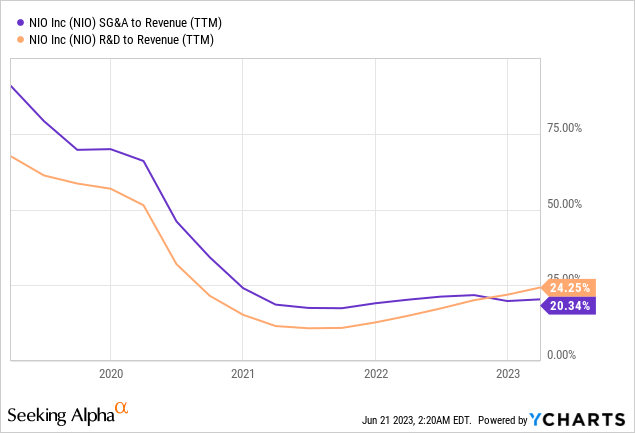

The company reinvests a substantial 20% of sales to R&D to improve its vehicles. SG&A to revenue ratio also looks high, though it has improved significantly in recent years, meaning the company is striving to expand its operating margin as the business scales up.

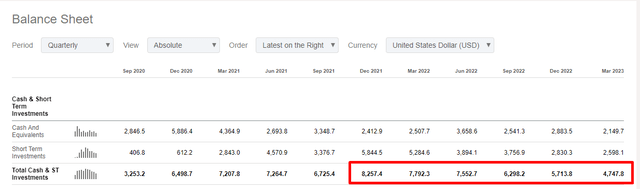

Looking at the latest quarterly dynamics, the company faces challenges because Q1 sales were flat while expenses snowballed. It means profitability metrics are shrinking, adding more uncertainty to the company’s break-even timing. NIO’s flat sales in Q1 are a huge red flag for me because the Chinese EV market grew 25% in Q1 2023 compared to the same period a year earlier. It means that NIO’s difficulties are not due to the overall weakness and cannot be explained by cyclicality. Weakness in NIO’s Q1 sales is highly likely related to the weak demand for the company’s vehicles due to the unattractiveness of the company’s offerings. This led to about $750 million operating loss for the quarter. It is crucial because the company is burning cash at a rapid pace. As you can see, the company’s cash balance almost halved in just six quarters.

Seeking Alpha

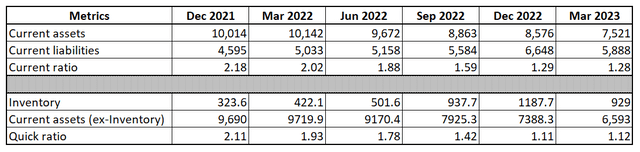

During Q1 of FY 2023, the company’s cash balance decreased by about a billion dollars. If NIO sustains this cash burn rate, the company will need to raise financing already in FY 2024. This is a red flag for investors as well. The company will raise debt finance, adversely affecting profitability and decreasing shareholders’ wealth. Or, the company might issue more shares, which is also bad for investors whose stakes will be diluted. There are no good options for a company rapidly running out of cash. You can also see below that NIO’s liquidity is rapidly melting and liquidity ratios are likely to fall below one in just a few quarters.

Author’s calculations

Valuation

NIO stock underperformed the broad U.S. market this year with about a 3% decline in the stock price. Overall, the stock now trades about six times cheaper than January 2021 peaks. Seeking Alpha Quant assigned the stock a low “D” valuation grade, meaning NIO is not attractively valued. This is due to the company’s high valuation ratios compared to the sector median.

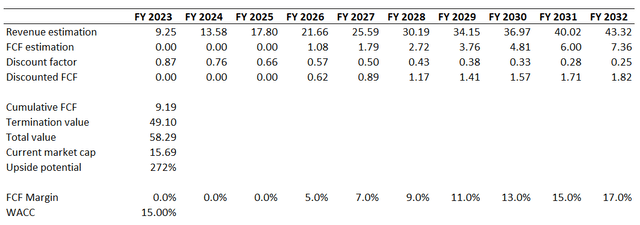

I want to cross-check the multiples analysis with a discounted cash flow [DCF] approach. Due to substantial political and country risks, I use a high 15% WACC for the valuation of Chinese companies. I have revenue consensus estimates for the next decade, though I consider them too optimistic, with about 17% CAGR. Therefore, I will simulate a more conservative scenario as well. Consensus estimates also forecast that adjusted EPS will break even after FY 2025. Therefore, I expect a positive FCF margin starting only from FY 2026. I project that the FCF margin will expand by two percentage points yearly.

Author’s calculations

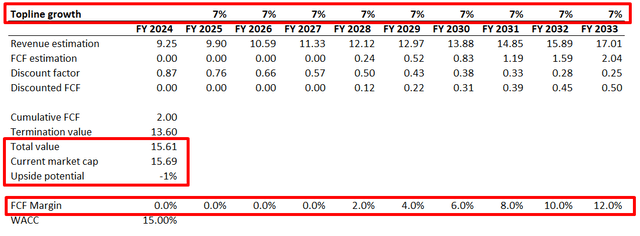

As you can see, the company’s fair business value is about $58 billion, meaning the stock is about four times undervalued. But 17% revenue CAGR is too optimistic. For example, according to statista.com, the Chinese EV market is expected to grow at a modest 6.4% CAGR over the next five years. To be not so pessimistic, I round up the revenue growth rate to 7% for my second scenario. Since the growth rate is more conservative for the second scenario, so are the FCF assumptions.

Author’s calculations

Based on more conservative assumptions, the stock now looks fairly valued with little upside potential. Overall, I believe the second scenario is more likely to unfold than the first one. In the “Risks to consider” section below, I explain why the company is unlikely to meet long-term consensus expectations.

Risks to consider

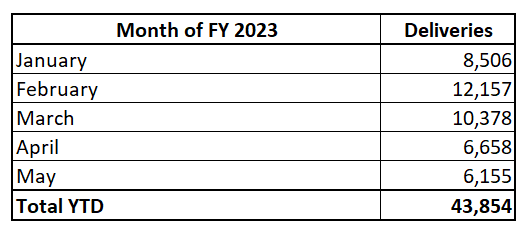

As we saw in my article’s “Valuation” section, consensus estimates forecast very aggressive revenue growth. Consensus estimates project FY 2023 revenue at $9.25 billion, meaning about 30% growth compared to the prior year. The correlation between income and the number of deliveries is not 100%, but extreme dependence exists. Therefore, for my analysis, I expect the company to deliver 30% more EVs this year than in FY 2022. FY 2023 deliveries should be about 160,000 to meet the projected consensus revenue. During the first five months of 2023, NIO delivered about 44,000 vehicles, meaning about 116,000 have to be delivered during the remaining seven months of the year. In other words, between June and December of 2023, the company has to deliver about 16.5 thousand vehicles per month on average. In the below table, you can see two significant trends. First, the number of deliveries has declined since February and almost halved. Second, the company was never even close to 16.5 thousand deliveries this year.

Compiled by the author

Therefore, the risk that the company will not be able to meet expected revenue growth is exceptionally high in the short- and long-term. If the company fails to achieve expected revenue this year, long-term earnings projections will likely be revised by analysts, which will directly adversely affect valuations.

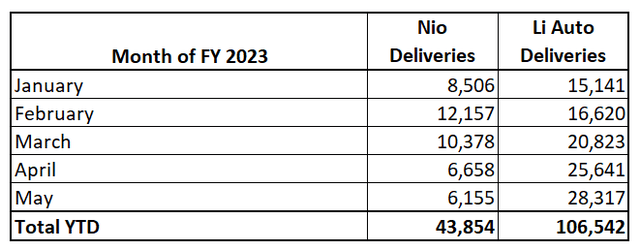

The company faces intense competition from local EV rivals like Li Auto (LI) and the undisputed global EV leader Tesla (TSLA). We should also not forget other established giant automakers like Toyota (TM) and Volkswagen (OTCPK:VWAGY). In my opinion, the Chinese EV market looks like a”red ocean”, and NIO does not look like a shark in this massacre. Global automotive giants possess more resources to invest in innovation and ramp production. NIO is definitely in a weaker position than TSLA of VWAGY. But the company looks much weaker compared to its Chinese rival, LI. Below is the dynamic of NIO and Li Auto deliveries this year.

Compiled by the author

We could have blamed possible weakness in the Chinese EV market overall, but we see that Li Auto improved its deliveries sequentially every month this year. After June deliveries are announced, Li Auto will likely surpass its full FY 2022 in the number of vehicles delivered. On the contrary, NIO is very far from surpassing last year’s deliveries. It is a huge red flag for me because the company is losing its market share in the domestic market, meaning NIO’s vehicles will not be competitive outside China as well.

Bottom line

To conclude, NIO stock is a strong sell. The company is losing market share in the domestic market. If the company is not competitive at home, the chances for a successful global expansion are very close to zero. NIO is highly likely to underperform the ambitious 17% long-term revenue CAGR expected by consensus estimates. Moreover, the company is still burning cash, and the balance sheet looks like the company will need to raise substantial amounts next year. A recent rally might be a good chance to sell the stock because the future does not look bright for NIO.

Read the full article here