As the US banking sector reels from a crisis of confidence following the recent spate of bank failures, investors in search of stable returns in the banking sector may want to look beyond US borders. One foreign bank that is particularly interesting given how its stock has performed YTD against the backdrop of dismal performance across the wider banking sector is Nu Holdings (NYSE:NU). Its Latin-American focused fintech banking unit, Nubank, reached a record 79.1 million customers in Q1 2023, up 33% in 12 months. The stock has rallied 64% YTD, a possible sign that the market is warming up to the bank amid strong growth in its customer base and improving profitability.

Interestingly, Warren Buffett is one of NU’s most notable investors. This is reassuring given his long-term orientation and knack for picking winners. Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) bought a $1 billion stake in NU in 2022, doubling down on its $500 million pre-IPO investment (NU went public in December 2021).

Strong competitive advantage

One of the qualities Buffett looks for in the companies he invests in is a strong competitive advantage, something I believe NU has by virtue of being the largest and most recognized digital bank in Brazil and Latin America. NU launched in 2013 in Brazil by offering credit cards to customers who couldn’t qualify for cards and other loan facilities from traditional banks. It has since evolved to become the 8th most valuable bank brand in Latin America in 2022, according to data from Statista, which notes that “out of all the listed banks, Nubank had the highest increase in its brand value between 2022 and 2023.” NU’s product portfolio has also expanded beyond credit cards to include personal loans, insurance, investments and SME loans, among others. The bank claims in investor presentations to have reached a penetration of 44% of the adult population of Brazil, cementing its status as a market leader by customers.

While no business is immune to the effects of competition, the odds of being displaced from market leadership greatly reduce when a dominant player is aggressively growing market share the way NU bank is. The 33% jump in its customer base from 59.6 million users in Q1 2022 to 79.1 million in Q12023 means that any challenger looking to gnaw into its market share has to work much harder now. It’s equally important to factor in its strong brand when assessing its competitive strengths. Many of its customers have a reason to be loyal to the brand given traditional banks had historically ignored them until NU disrupted the sector. NU also scores highly in areas like customer satisfaction, reliability, and customer service, according to annual rankings of Brazilian banks by Forbes.

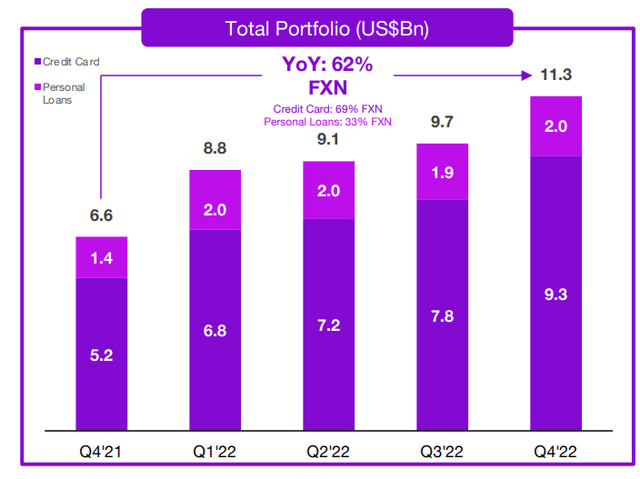

NU has been able to capitalize on its market leadership and strong brand in Brazil to deliver compelling commercial results, as measured by key metrics such as active customers (those that have generated revenue in the last 30 calendar days), average revenue per active user, purchase volumes on its credit and debit cards, and growth of its loan value and volume. All these are trending positively over the four quarters leading to Q4 2022, according to information published in NU’s Q4 2022 earnings presentation. Active customers, for example, were 41.1 million out of 53.9 million in Q4 2021 compared with 61.2 million out of 74.6 million in Q4 2022 – essentially leading to a higher activity rate on a bigger customer base. Tellingly, revenue over this period shot up from $636 million in Q4 2021 to $1.45 billion in Q4 2022. This was driven by a surge in its loan book, which grew close to 100% at a time when banks globally were generally reluctant to lend into the subprime category due to the rising interest rate environment. Below is a snapshot of how NU’s total loan portfolio grew in the past year.

NU continued lending despite restrictive interest rate environment (Nu Bank)

Because of its focus on the subprime category, the challenge for NU historically has been breaking even. Provisions for loan losses are typically higher when it comes to unsecured loans for borrowers with weak or nonexistent credit histories. Tellingly, NU’s income statement shows that it had provisions of $1.40 billion in 2022 vs revenue of $3.2 billion, which is significantly high if you were to compare with a traditional bank serving customers with higher credit quality, including established institutions and corporates. This situation has contributed to NU not achieving profitability on a GAAP basis.

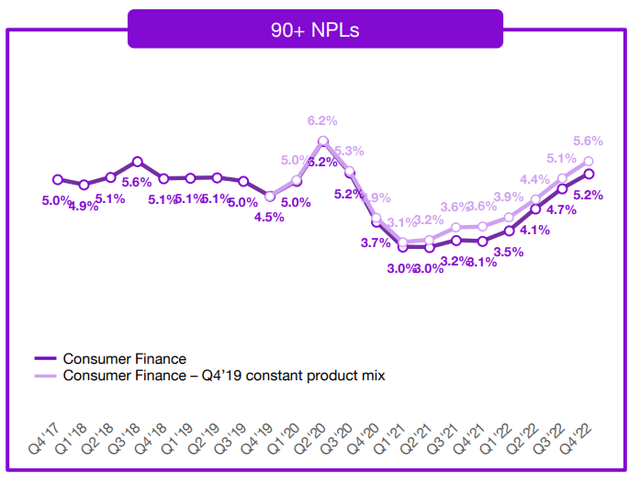

The other challenge with NU is the growing percentage of non performing loans from its consumer finance (loans to customers such as card holders) segment in recent quarters, which have crept up above 5% as at Q4 2022. The bank had reduced NPLS from 5.2% in Q2 2020 to 3.0% in Q1 2021, as per data in its presentations.

NU’s non performing loans have been increasing in recent quarters (Nubank)

The increase in NPLs in recent quarters likely reflects the challenging economic conditions brought about by the recent surge in global inflation. It is a risk investors need to monitor in the upcoming earnings, particularly if NPLs go beyond the historical high of 5.6% last seen in Q3 2018.

Scale accelerates move towards profitability

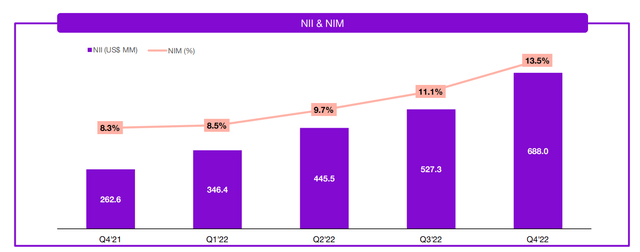

However, as NU increases its scale, it could be able to accelerate its move towards profitability as cost to serve remains stable and the bank gets access to cheaper deposits thanks to its diversification away from credit cards. Some of these economies of scale are already starting to show in historical results. As an example, NU’s net income margin steadily improved throughout 2022, with the management significantly talking up the move towards profitability in the Q4 earnings call in February.

NU’s efficiency is improving as it focuses on profitability (Nu Holdings)

The focus for investors as the bank reports Q1 2023 earnings in the next few days will be whether it has maintained this momentum in the journey towards profitability. While I’m confident that these trends could be sustained, I do not believe the bank will break even on a GAAP basis in the next few quarters. This, however, is not a concern for me as I believe investors understand that this is essentially a 10 year old company that has been public for barely two years. NU is still far off from reaching maturity, so it still has time to dig itself out of losses.

Valuation still makes sense

Because of the lack of historical GAAP profits, it’s problematic to use traditional metrics like P/E when valuing NU. However, looking at P/S shows that NU is priced at 4.17 sales (fwd).In comparison, PayPal (PYPL) has a P/S of 2.59x and Block (SQ) has a P/S of 1.84x. I’m comparing NU to these fintech players and not traditional banks as they are in my opinion more similar in their business models and investment profiles.

NU is not cheap but the valuation makes sense when you consider that the company is still far from reaching maturity and is still in the stage where the priority is driving growth while narrowing losses, having achieved adjusted net income of $113.8 million in Q4 2022 vs $3.2 million a year earlier.

Moreover, the company went public at a market cap of $45 billion vs the current $27 billion, meaning it is yet to trade above its IPO price. While IPOs are mostly about raising as much money as possible and stretching valuations to the limits of sanity (hence why many stocks underperform after going public), they can also be indicative of what investors believe a company should be worth in a best case scenario. Going by NU’s recent execution, particularly how it has been able to grow while narrowing losses, it’s safe to say that the best case scenario is playing out.

As far as long-term growth prospects are concerned, NU has also in recent years ventured into Columbia and Mexico, two other Latin American markets that are also attracting fintech investment. So far, a lot of the action as far as fintech investment in Latin America goes has been concentrated in Brazil, where NU is already one of the leading digital banks. Of the 2,482 fintech companies in Latin America observed in a 2021 study by the Inter-American Development Bank (IDB) and Finnovista, 80% are in Brazil, while Mexico has 21% of the share, Colombia and Argentina share 11%, and Chile has 7%. NU’s move to try its hand in the emerging Mexican and Columbian fintech markets could help unlock future long-term growth, assuming customers there are reception as Brazil.

Imminent earnings

The upcoming Q1 earnings, if positive, could be a powerful short-term catalyst for the bulls. From Q1 2022 to Q4 2022, NU has beaten analysts estimates on top line in every quarter. This strong growth remains firmly on the agenda of management, with executives noting in the Q4 earnings call in February that “as we go into 2023, we expect trends from Q4 to continue to gain traction.”

If this outlook means continued growth in loan volume as well as sustained improvements in net income margin, this is definitely bullish. However, continued growth in loans volume will also mean higher provisions and possibly higher NPLs due to the unsecured nature of the loans.

Therefore, what investors need to watch out for going into earnings is the update the bank gives on its plan to introduce secured lending in Brazil in 2023. Management noted in the last earnings call that it aims to launch secured personal loans, mostly public payroll loans, this year. If these plans are successful, NU could be able to grow its loan volume without necessarily growing provisions at a fast pace, as is presently the case with the unsecured business. This could help expand margins and accelerate the push to profitability. Investors should watch out for this in the earnings call.

Read the full article here