After rallying 172% this year on a wave of AI-related excitement, Nvidia Corporation (NASDAQ:NVDA) now knocks on the door of a trillion-dollar valuation. In this piece, I consider whether this valuation is justified. I do so by comparing Nvidia today versus other members of the trillion dollar club when they hit the trillion mark. I argue that Nvidia does merit a trillion dollar valuation given what we currently know (which, to be fair, is marred by some uncertainty). Nvidia may not live up to its valuation, but the valuation still makes sense at the moment. However, it is worth noting that Nvidia approaches the trillion dollar mark under unusual circumstances.

The Trillion Dollar Club

The trillion dollar club currently has four (non-state-owned) members: Apple Inc. ($2.76t), Microsoft Corporation ($2.48t), Alphabet Inc. ($1.59t), and Amazon.com, Inc. ($1.23t). The club also has two former members whose time was short-lived, Meta Platforms, Inc. ($671b) and Tesla, Inc. ($612b)-both around the 2021 market peak. Here, I will focus on the current members, since the goal is to see how Nvidia compares against the firms who have successfully managed to retain (and grow) their valuation past the trillion dollar mark.

Snapshots At The Trillion-Dollar Mark

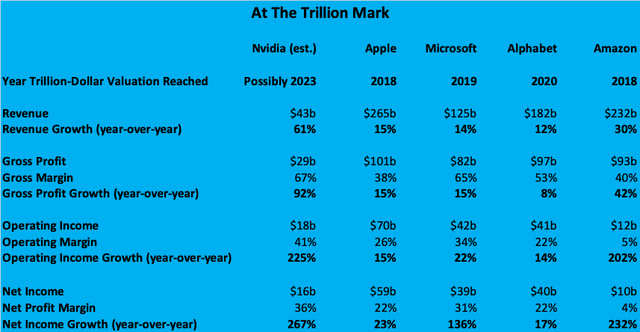

In this section, I present a snapshot comparison of Nvidia today against the existing members of the trillion-dollar club at the time they each reached this milestone. For example, Apple reached a trillion dollar valuation in 2018, so we will compare Nvidia’s anticipated figures for this year (fiscal 2024) against Apple’s 2018 figures (and similarly for the other companies).

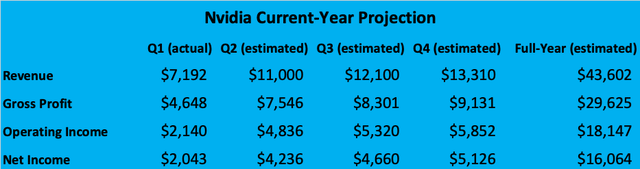

My projection for Nvidia is based on GAAP figures. The figures for Q1 are actual as recently reported. The Q2 figures are estimated from the midpoint of Nvidia’s guidance (for a more detailed analysis of the guidance, see here). Then, for Q3 and Q4, I assume the same margins as Q2 with 10% sequential top-line growth each quarter. Figure 1 below presents the full-year projection for Nvidia based on these assumptions.

Of course, there is considerable uncertainty about what Nvidia’s second-half numbers will look like. Management did not offer exact numbers, but did say that Nvidia is “substantially” increasing supply through the second half of the year, which suggests that some significant growth should be expected. I have conservatively predicted a 10% quarter-over-quarter growth (“conservative” considering the Q2 guidance anticipates sequential top line growth of 52%). While there may be room for more rapid growth, as well as for even higher margins as the production of new-generation chips ramps, I prefer to avoid overestimating the upside-since we are trying to figure out if Nvidia can more or less reasonably be valued at a trillion dollars without resorting to overly bullish projections.

Figure 1: Nvidia Current-Year-Projection (Nvidia CFO commentary Q1 2024 and author’s calculations)

In Figure 2 below, the projected figures for Nvidia are presented alongside figures for Apple, Microsoft, Alphabet, and Amazon for the years when they attained the trillion-dollar mark, allowing us to compare them at this milestone.

Figure 2: Snapshot Comparison (Financial Data from Seeking Alpha and author’s calculations)

How Does Nvidia Compare?

Before delving into the comparison, there are some caveats to bear in mind. First, Amazon’s history of heavy investments toward future growth tends to understate the profitability of its core businesses. It also inflates Amazon’s margin growth figures. Second, Microsoft’s net profit growth figure is distorted due to a large one-time tax expense in the comparison year. Without this anomaly, the net profit growth would be around 25% according to my calculations, which also aligns with Microsoft’s long term growth trajectory. Third, Nvidia’s growth figures are inflated due to a weak comparison year (fiscal 2023). However, Nvidia’s growth is still outstanding even when compared to the previous year (fiscal 2022), which was Nvidia’s most profitable year ever. In this comparison, revenue growth comes in at 62%, gross profit growth at 69%, operating income growth at 80%, and net income growth at 64%.

With these caveats understood, let’s compare. As we can see, Nvidia’s top line is vastly smaller compared to its peers when they hit the trillion-dollar mark. However, the difference in profitability is proportionally smaller due to Nvidia’s stronger margins-only Microsoft’s were comparable, and Nvidia currently even beats these. Moreover, Nvidia’s growth far outstrips the others, with the top line growing at 4-5x what Apple, Microsoft, and Alphabet were achieving and 2x what Amazon-the leader in this category-was achieving.

In addition, Nvidia’s growth can reasonably be expected to continue at a solid clip through this year and the next. Using my earlier projections for the rest of this year, we can also think about the following year. If Nvidia were to simply maintain its Q4 run rate into the next fiscal year without any revenue growth, it would still show substantial growth. This extremely conservative scenario is presented in Figure 3 below. Moreover, if Nvidia can exceed the Q4 run rate by, say, 20%, the outlook becomes even brighter, as shown in Figure 4 below. Predicting Nvidia’s growth figure for the next year is, of course, a challenging task at the moment, given how Nvidia just upended everyone’s financial models. But these figures seem like ones that Nvidia could realistically meet given how extraordinarily well things are going. And there could be further upside as well, depending on how much capacity Nvidia is able to secure and how well its new-generation Grace CPUs and Grace Hopper superchips are received.

It is, of course, understandable why Nvidia’s financial position may induce more investor unease than the other trillion-dollar firms did when they attained their milestone. Betting on future performance is always riskier than betting on current performance. There is also potential for Nvidia’s margins to contract from historic highs as supply expands and competing chips come to market. However, things could go the other way too. If Nvidia’s top line continues to grow rapidly, Nvidia’s high research and development and other fixed costs could be spread over a larger revenue base, further increasing Nvidia’s margins (as is the case with the Q2 guidance as well).

Different investors assign different weights to current profits versus future growth, and this is understandable. Still, given what we currently know, Nvidia’s valuation makes sense. Perhaps the expectations baked into the valuation will fail to materialize, but we do not know this yet-and the future could also materialize better than expected, as just happened this quarter. The situation thus presents both downside risk and upside potential to a greater extent than was the case for the other members of the trillion-dollar club. But just because Nvidia arrives at the trillion-dollar mark in a different fashion does not mean that the valuation is unjustified. Nvidia has some weaknesses compared to the others, but it also has some strengths. On balance, it is not evident whether the strengths outweigh the weakness or vice versa, making it reasonable to value Nvidia around a trillion, just as the others were.

The Unusual Circumstances

It is important to acknowledge, though, that Nvidia’s potential entry into the trillion dollar club comes under an unusual set of circumstances: Nvidia is riding a wave of excitement regarding a potentially transformative new technology-AI-whose full scope remains unknown. When other members of the trillion dollar club reached the milestone, they did so on the basis of well-established products with well-established demand. Although Nvidia’s chips are certainly well-established, there is uncertainty about the trajectory and sustainability of AI-related demand for Nvidia’s chips in coming years.

This uncertainty stems from multiple sources. First, we do not know how many products and services AI will support in the future, nor what the nature of these products and services will be. Second, we do not know what kinds and amounts of computing power these AI-enabled products and services will require. Third, we do not know to what extent AMD and Intel could capture market share with their enhanced AI offerings over the coming years. Fourth, we do not know the extent to which custom chips from players like Amazon may encroach upon Nvidia’s market share. Taken together, all these factors make it very difficult to forecast Nvidia’s long-term prospects with confidence.

However, uncertainty cuts both ways in Nvidia’s case. We have just witnessed how almost everyone had underestimated the speed and scope of AI-related demand for Nvidia chips. This could potentially continue-depending on how quickly and how significantly AI impacts the world, it is entirely possible that the ongoing AI revolution could prove to be even more significant than current high expectations suggest, further driving upside for Nvidia. In other words, circumstances are indeed unusual, but this comes with both risks and opportunities.

Conclusion

Nvidia Corporation approaches the trillion dollar mark under unique circumstances and a great deal of uncertainty. However, as I have argued, Nvidia’s current valuation still makes sense compared to the valuations of other trillion-dollar firms when they reached the milestone. And although the future could go many different ways, investors who believe in the staying power of AI, and in Nvidia’s ability to compete, should not be scared off by the trillion dollar mark. Given what we currently know, Nvidia Corporation does deserve to be in the trillion dollar club-for now.

Read the full article here