Earnings of OP Bancorp (NASDAQ:OPBK) will most probably decline this year because of pressure on the margin from unfavorable loan and deposit mix changes. However, improving loan growth will likely support earnings. Overall, I’m expecting OP Bancorp to report earnings of $1.71 per share for 2023, down 20%, and $1.79 per share for 2024, up 5% year-over-year. OP Bancorp is offering a moderate price upside and a high dividend yield. Therefore, I’m maintaining a buy rating on OP Bancorp.

Changes in Loan and Deposit Mixes to Pressurize the Margin this Year

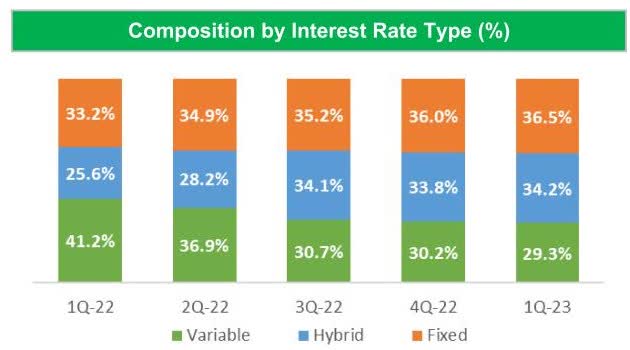

OP Bancorp’s margin declined by a hefty 52 basis points in the first quarter of 2023 following a 23-basis points reduction in the fourth quarter of 2022. Over the last twelve months, OP Bancorp has shifted its loan mix away from variable-rate loans towards fixed-rate loans, as shown in the chart below taken from the last presentation.

1Q 2023 Presentation

This migration will keep interest income high when rates start declining next year. However, OP Bancorp will miss out on some of the benefits from rate hikes this year due to this migration. I’m expecting the Fed funds rate to increase by 25-50 basis points in the second half of 2023. The larger proportion of fixed-rate loans will mean that the topline is less sensitive to rate hikes in upcoming quarters compared to previous quarters.

Apart from the loan mix shift, the deposit mix deterioration will also squeeze the margin in the remainder of 2023. Non-interest-bearing deposits dropped to 33.8% by the end of March 2023 from 37.2% at the end of December 2022.

Considering these factors, I’m expecting the margin to dip by 10 basis points in the last nine months of 2023 and then increase by five basis points in 2024.

Expecting Loan Growth to Improve

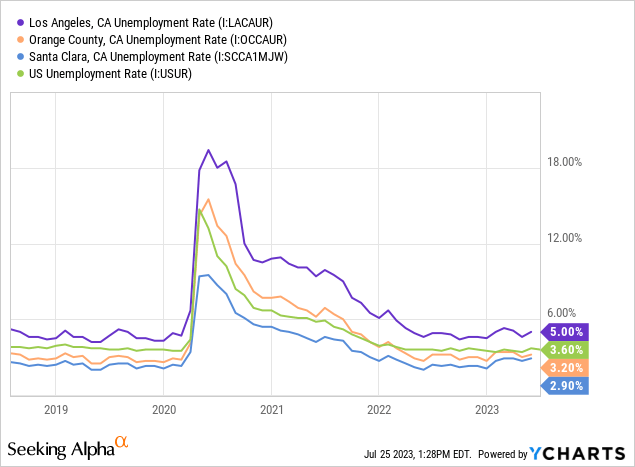

Although loan growth slowed down substantially in the first quarter of 2023, I continue to have a positive outlook on it because of local economic factors. OP Bancorp operates in the Los Angeles, Orange, and Santa Clara (including Silicon Valley) counties of California as well as Carrollton, Texas. As shown below, both Orange County and Santa Clara currently have lower unemployment rates than the national average.

However, the outlook for home mortgage loans, which make up about 30% of total loans, is murky for 2023 because of high-interest rates. OP Bancorp’s focus areas of commercial real estate are less affected by interest rate hikes as commercial borrowers can pass on the impact of higher borrowing costs to their customers.

Overall, I’m expecting the loan portfolio to have grown by 2.0% in the second quarter of 2023. Further, I’m expecting the portfolio to grow by 8% annualized in the second half of 2023. For 2024 I’m expecting the loan growth to improve to 12.6% as I’m expecting rate cuts next year. I’m also expecting other balance sheet items to grow more or less in line with loans. The following table shows my balance sheet estimates.

| Financial Position | FY19 | FY20 | FY21 | FY22 | FY23E | FY24E |

| Net Loans | 980 | 1,084 | 1,298 | 1,659 | 1,774 | 1,997 |

| Growth of Net Loans | 13.2% | 10.6% | 19.7% | 27.8% | 6.9% | 12.6% |

| Other Earning Assets | 68 | 129 | 251 | 266 | 247 | 267 |

| Deposits | 1,021 | 1,200 | 1,534 | 1,886 | 2,021 | 2,275 |

| Borrowings and Sub-Debt | 10 | 13 | 10 | 10 | 64 | 70 |

| Common equity | 141 | 143 | 165 | 177 | 197 | 211 |

| Tangible BVPS ($) | 8.8 | 9.4 | 10.9 | 11.6 | 12.9 | 13.8 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Earnings to Dip this Year Before Recovering

I’m expecting the earnings of OP Bancorp to dip this year mostly because of margin pressure. Meanwhile, loan growth will likely keep the earnings from falling too low. Overall, I’m expecting the company to report earnings of $1.71 per share for 2023, down 20% year-over-year. For 2024, I’m expecting earnings to improve by 5% to $1.79 per share on the back of loan growth. The following table shows my income statement estimates.

| Income Statement | FY19 | FY20 | FY21 | FY22 | FY23E | FY24E |

| Net interest income | 44 | 45 | 61 | 77 | 71 | 78 |

| Provision for loan losses | 1 | 6 | 1 | 3 | 2 | 3 |

| Non-interest income | 11 | 11 | 16 | 18 | 17 | 18 |

| Non-interest expense | 33 | 32 | 36 | 45 | 48 | 50 |

| Net income – Common Sh. | 16 | 13 | 29 | 33 | 26 | 27 |

| EPS – Diluted ($) | 1.03 | 0.85 | 1.88 | 2.14 | 1.71 | 1.79 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates(In USD million unless otherwise specified) | ||||||

SBA segment, Uninsured Deposits Create Risks

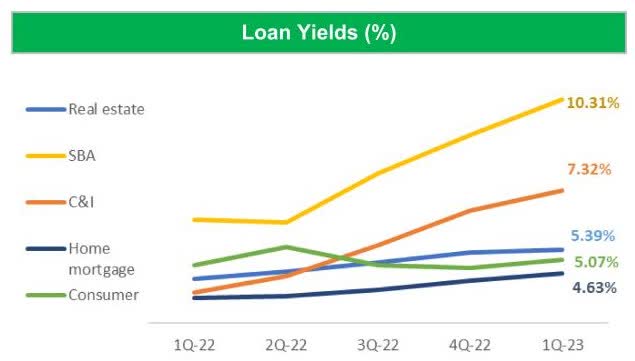

I expect the small business (“SBA”) segment to face some credit quality issues in upcoming quarters because OP Bancorp has issued loans at very high double-digit rates to borrowers in this segment. The rates are so high that they’ve raised the concern that even a bit of financial stress could send these borrowers into default.

1Q 2023 Presentation

The risks of deposit run-on-banks have subsided as there have been no new bank failures in recent months. Nevertheless, the risk still exists. The company had estimated uninsured deposits of $900.6 million, or 47.3% of total deposits, at the end of March 2023; therefore, it could face some problems in the unlikely event of a deposit run on the bank.

OP Bancorp is based in California; therefore, it shares some of the same markets as the banks that failed, namely SVB Financial (OTCPK:SIVBQ) and First Republic Bank (OTCPK:FRCB). Nevertheless, the market has so far treated OP Bancorp at par with other banks around the country. OP Bancorp’s stock price plunged by 31% from the start of the banking crisis on March 8, 2023, to the lowest year-to-date point on May 16, 2023. During the same time period, the Invesco KBW Regional Banking ETF (KBWR) dropped by 30%.

Considering these factors, I think OP Bancorp’s risk level is moderate.

Maintaining a Buy Rating

OP Bancorp is offering an attractive dividend yield of 5.0% at the current quarterly dividend rate of $0.12 per share. The earnings and dividend estimates suggest a payout ratio of 28% for 2023, which is close to the five-year average of 23%. Therefore, my earnings outlook does not present any risks to the dividend payout.

I’m using the peer average price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value OP Bancorp. Peers are trading at an average P/TB ratio of 0.8 and an average P/E ratio of 5.9, as shown below.

| OPBK | WNEB | EVBN | CALB | ISTR | FGBI | Peer Average | |

| P/E (“ttm”) | 4.6 | 5.5 | 6.5 | 6.3 | 5.4 | 5.9 | 5.9 |

| P/B (“ttm”) | 0.79 | 0.61 | 0.94 | 0.80 | 0.62 | 0.69 | 0.7 |

| P/TB (“ttm”) | 0.79 | 0.65 | 1.03 | 0.83 | 0.77 | 0.75 | 0.8 |

| Source: Seeking Alpha | |||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $12.9 gives a target price of $10.4 for the end of 2023. This price target implies a 9.0% upside from the July 25 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.61x | 0.71x | 0.81x | 0.91x | 1.01x |

| TBVPS – Dec 2023 ($) | 12.9 | 12.9 | 12.9 | 12.9 | 12.9 |

| Target Price ($) | 7.8 | 9.1 | 10.4 | 11.7 | 12.9 |

| Market Price ($) | 9.5 | 9.5 | 9.5 | 9.5 | 9.5 |

| Upside/(Downside) | (18.1)% | (4.6)% | 9.0% | 22.5% | 36.0% |

| Source: Author’s Estimates |

Multiplying the average P/E multiple with the forecast earnings per share of $1.71 gives a target price of $10.1 for the end of 2023. This price target implies a 6.3% upside from the July 25 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 3.9x | 4.9x | 5.9x | 6.9x | 7.9x |

| EPS 2023 ($) | 1.71 | 1.71 | 1.71 | 1.71 | 1.71 |

| Target Price ($) | 6.7 | 8.4 | 10.1 | 11.8 | 13.5 |

| Market Price ($) | 9.5 | 9.5 | 9.5 | 9.5 | 9.5 |

| Upside/(Downside) | (29.6)% | (11.7)% | 6.3% | 24.3% | 42.2% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $10.2, which implies a 7.6% upside from the current market price. Adding the forward dividend yield gives a total expected return of 12.7%. Hence, I’m maintaining a buy rating on OP Bancorp.

Read the full article here