Open Text Corp. (NASDAQ:OTEX) is recognized as a leader in enterprise information management (EIM) cloud software. These are the tools organizations use to store and manage documents which is critical for not only management-level decision-making but also for regulatory compliance and cyber security.

The attraction here is a highly profitable business with a long track record of growth, well positioned to build its market position. Indeed, the steps Open Text is taking to integrate artificial intelligence across its platform highlight new opportunities as a tailwind for the stock.

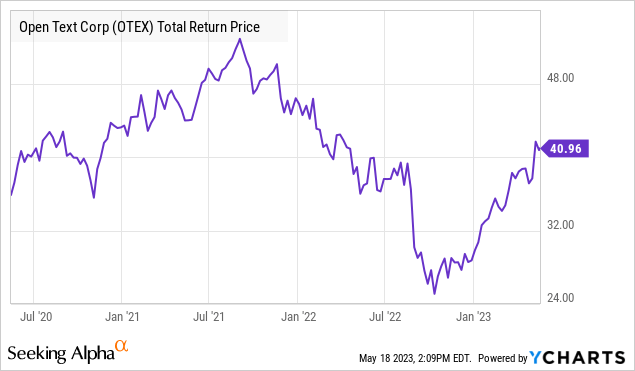

A takeaway from the company’s latest quarterly results was the strong outlook from management through next year with an expectation for firming margins and accelerating cash flow. Even with shares rallying sharply in recent months and trading at a near 52-week high, we are bullish on the stock and see room for more upside.

OTEX Earnings

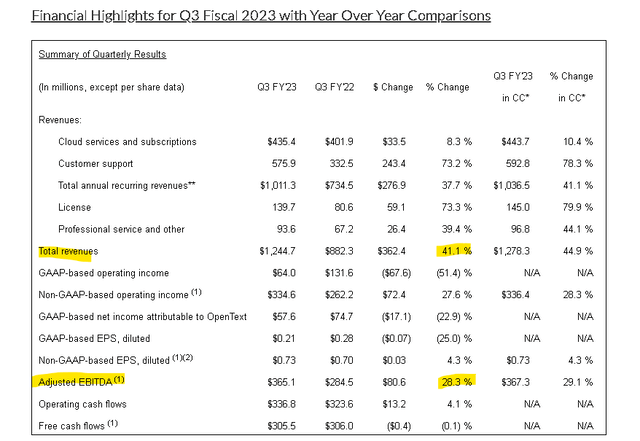

OTEX reported its fiscal Q3 earnings on May 4th with non-GAAP EPS of $0.73, up from $0.70 in the period last year, representing a big $0.27 beat ahead of expectations. Revenue of $1.24 billion was also ahead of the consensus estimate, climbing 40.5% year-over-year.

The context of that sales momentum is that it includes the $374 million sales contribution from Micro Focus International Plc, which closed in January. Nevertheless, organic growth was positive with gains across all major operating segments.

source: company IR

Management cited several key customers wins from solutions covering content management, customer experience, and cyber security solutions. In addition, bookings have been strong.

Annual recurring revenues reached the $1 billion milestone, up 37.7% y/y or up 41.1% in constant currency. Within that amount, Cloud revenues of $435 million, climbed by 8.3% y/y as a reflection of the core business strength.

Higher expenses and costs related to the Micro Focus deal ended up pressuring margins this quarter. Even as the adjusted EBITDA of $365 million this quarter climbed by 28.3% y/y, free cash flow was essentially flat at $306 million compared to last year.

That being said, the expectation is that the earnings will begin to benefit from both the continued top-line growth and the deal integration gains as a key theme extending through fiscal 2024. Favorably, the company is hiking its full-year 2023 guidance for growth and free cash flow.

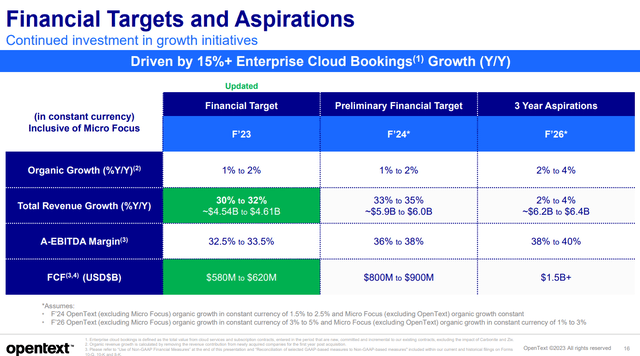

Including the year-to-be-reported current fiscal Q4, OTEX sees full-year revenue growth between 30% and 32%, which is a bump higher compared to the prior midpoint estimate of 29% issued last quarter. Similarly, Open Text now expects a full-year free cash flow of around $600 million, compared to the $550 million forecast announced last quarter.

source: company IR

Preliminary targets for 2024, see total revenue growth between 33% and 35%, while the adjusted EBITDA margin expands towards 36% to 38%. Looking even further ahead, the company’s “3-year aspirations” are to generate steady organic growth with a path for free cash flow to nearly triple above $1.5 billion from the current level by fiscal 2026.

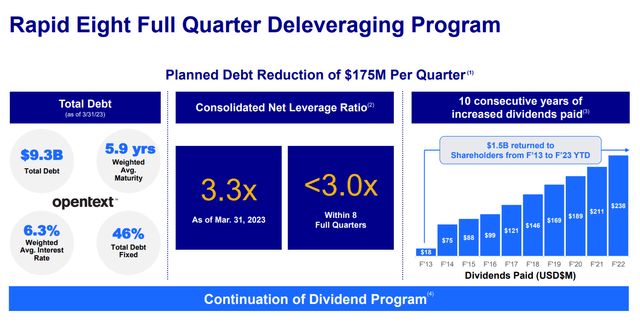

The trend here offers some confidence Open Text can continue its 10-year streak of annual dividend increases. The stock currently yields 2.4% through a $0.243 per share quarterly payout.

On this point, we expect a modest increase in announcements when Open Text declares its next distribution, likely in August considering the expected effort to deleverage in the near term following the Micro Focus deal. A net leverage ratio of 3.3x is stable and consistent well supported by underlying cash flows, in our opinion.

source: company IR

The AI Opportunity for OTEX

The reason we view OTEX as an AI stock is that its suite of EIM software represents a natural platform to deploy these emerging automation capabilities. Management has described the integration of language learning models (LLMs) including “ChatGPT” through secure data access at the customer level.

One example is AI being used to automatically classify documents by regulatory requirements. Utilities with the ability to connect the dots and interpret concepts beyond just keywords make the fields of document management ripe for AI-led efficiency.

Ultimately the tools are intended to add value to the customer while opening the door for new product opportunities. Management discussed these themes during the conference call:

Last week at OpenText World EMEA, we previewed Titanium X integration into two LLMs, T5 and ChatGPT. At the heart of LLM has to be trusted information management. LLM help enterprises upskill and reduce cost through text generation, information classification, knowledge answering and dialogue generation. LLMs also help companies find new paths for growth. AI is an additional path of value for OpenText, including the other things we’ve talked about cloud, climate trust and security.

We are committed to delivering large language models to OpenText customers in the OpenText cloud, trusted, secured based on their reliable information. OpenText is a unique position to help customers unlock the value of their information via LLMs and gain the information advantage. We are already working with strategic customers on specific LLM deployments.

Our analysis here is that Open Text has a strong selling point for new and existing customers thinking about how to implement AI in day-to-day operations. In our view, the company is well-positioned to be an early AI winner with plenty of low-hanging fruit that can add immediate value to the business from new AI drive solutions.

What’s Next For OTEX?

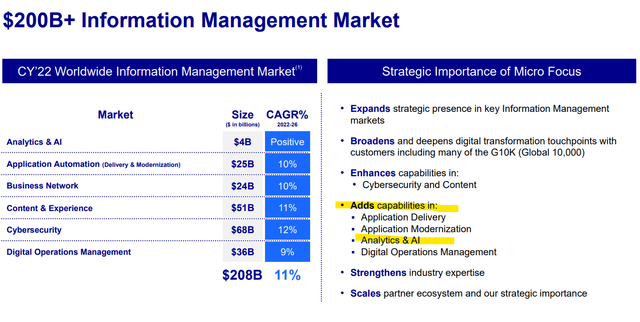

In terms of making a bullish case for OTEX, we can talk about AI, but there is also the major earnings momentum that is expected in the near term. In many ways, we can look back at the Micro Focus deal as something of a home run for the company because it further strengthens Open Text’s digital capabilities, precisely in these high-growth areas of the information management market.

source: company IR

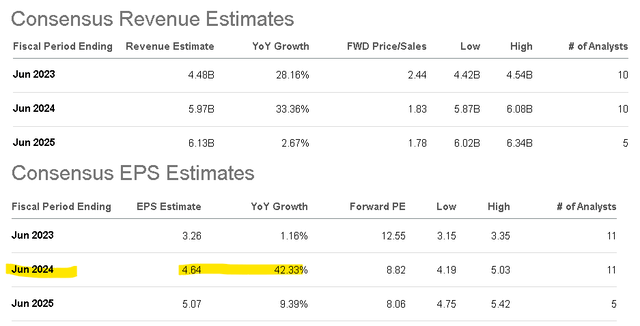

The impact here is evident when we look at the expected earnings jump for fiscal 2024, which starts this July. The consensus is for EPS to climb by 42% y/y leaving OTEX with a 1-year forward P/E ratio of just 9x.

Seeking Alpha

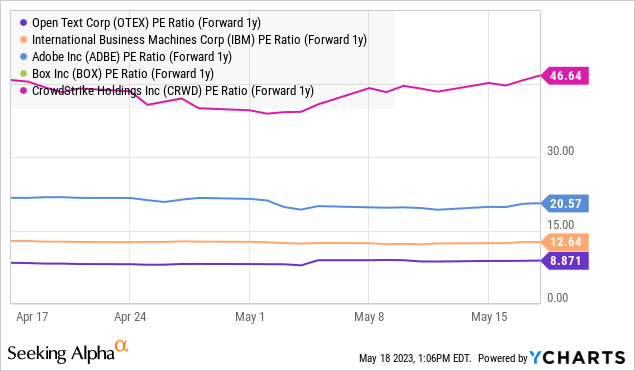

Those earnings multiples and even on a free cash flow basis are particularly attractive relative to some peers including companies like International Business Machines Corp. (IBM), Adobe Inc. (ADBE), Box Inn (BOX) and CrowdStrike Holdings Inc. (CRWD) which are all cited as competitors by Open Text. Focusing on IBM trading at 13x next year’s expected earnings, we make the case that OTEX has room to converge toward that level given its financial momentum.

OTEX Stock Price Forecast

We rate OTEX as a buy, with a price target for the year ahead at $55.00 representing a 12x multiple on the fiscal 2024 consensus EPS estimate of $4.64. In our view, the incremental boost from new AI initiatives will be enough for Open Text to outperform its baseline of expectations.

On the downside, the risk here is that the broader macro environment deteriorates. The possibility that the global economy sputters into a deeper recession would likely drive weaker demand and sales for OTEX, opening the door for the stock to reprice lower. Monitoring points over the next few quarters include the evolution of the adjusted EBITDA margin and the trends in the ARR.

Read the full article here