Introduction

Osisko Gold Royalties Ltd (OR) is a stock that I have wanted to own and have bid for it on a few occasions. But unfortunately I’ve never secured an acquisition as I low balled the offer and walked away empty handed. These days Osisko is a big player in the Royalty/Streamer space of the precious metal sector and deserves our consideration.

Today we will take a quick look to see how it is doing in order to establish if it’s a buy, sell or hold?

Osisko Gold Royalties Ltd: Brief Description

Osisko is a mid-cap precious metal royalty company formed June 2014. Osisko’s number one asset is a 5% net smelter return royalty in the largest gold mine in Canada, the Canadian Malartic mine. It should be noted that this star attraction is not alone as Osisko owns a portfolio of over 180 royalties and streams which adds diversity and the possibility of rich pickings as the precious metals Bull Market gathers speed.

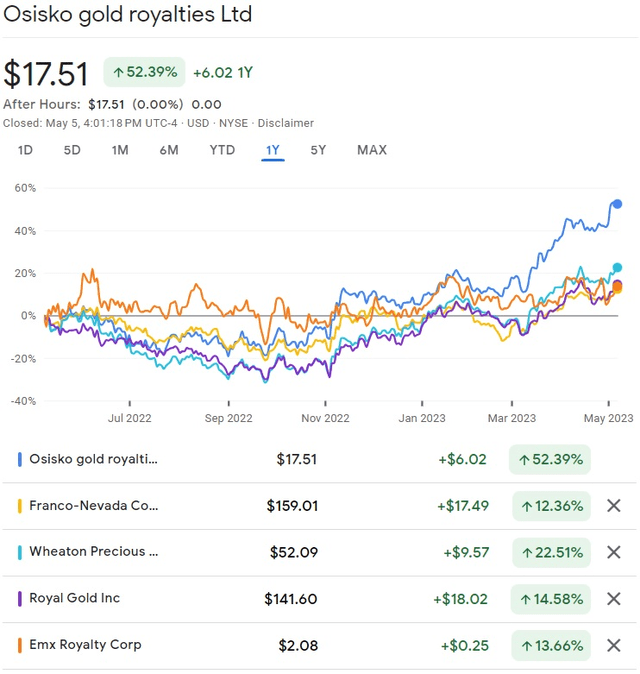

To get a feel for how they have performed over the last 12 months we can see from the chart below that they have done very well against their peers, outperforming most of them.

Osisko Gold Royalties Ltd Comparison Chart (Google Finance)

This is great news for those invested in Osisko Gold Royalties and not so good for someone like me, who hasn’t yet made an acquisition. However, this spectacular performance could entice investors to lock in their profits and sell this stock. On occasion we do get a certain amount of rotation whereby investors reallocate their investment funds to another company which they believe is lagging behind the front runners and therefore is overdue for a rally of their own. The entry point and the exit strategy are critical to maximizing the return on any trade which requires time and effort on your part as your requirements are unique.

Highlights Q1 2023 Financial Results

Results as released by Osisko on 10th May 2023:

23,111 GEOs1 earned, an increase of 27% over the first quarter of 2022 (Q1 2022 – 18,251);

Revenues from royalties and streams of $59.6 million (Q1 2022 – $50.7 million);

Cash flows generated by operating activities2 of $45.5 million (Q1 2022 – $40.5 million);

Cash margin3 of $55.5 million or 93% (Q1 2022 – $47.5 million or 94%)

Net earnings2 of $20.8 million, $0.11 per basic share (Q1 2022 – $16.8 million, $0.10 per basic share);

Adjusted earnings3 of $32.6 million, $0.18 per basic share (Q1 2022 – $24.8 million, $0.15 per basic share);

Repayment of $15.0 million under the revolving credit facility;

Increase in the cash balance to $119.1 million as at March 31, 2023; and

Declaration of a quarterly dividend of $0.055 per common share.

Overall their results read well, and good progress is being made as their appetite for deal making continues at a fair pace.

Osisko’s dividends history has been fairly steady over the last 12 months paying 0.055$/common share for each quarter. The recently published first quarter 2023 results have been good enough for the company to increase the quarterly dividend by 9.1% to $0.060 per common share for an annualized dividend of $0.24 per share payable on July 14, 2023.

It is always good to see a company increasing the dividend paid to shareholders however my interest is in the capital gain, which has also been excellent.

Osisko Gold Royalties Ltd has a market capitalization of $3.177B, an EPS of $0.35 and a P/E ratio of 49.23 and pays regular dividends. The average volume of shares traded on a daily basis is 1,001,309 so the liquidity is good for those traders wanting to trade in and out of this stock on a daily basis. The 52-week trading range has been from a low of $9.19 to a high of $17.96 so volatility in the stock price should be taken into consideration before making an acquisition.

Osisko Gold Royalties Ltd trades on the New York Stock Exchange under the symbol (NYSE:OR) and on the Toronto Stock Exchange under the symbol (TSX:OR:CA)

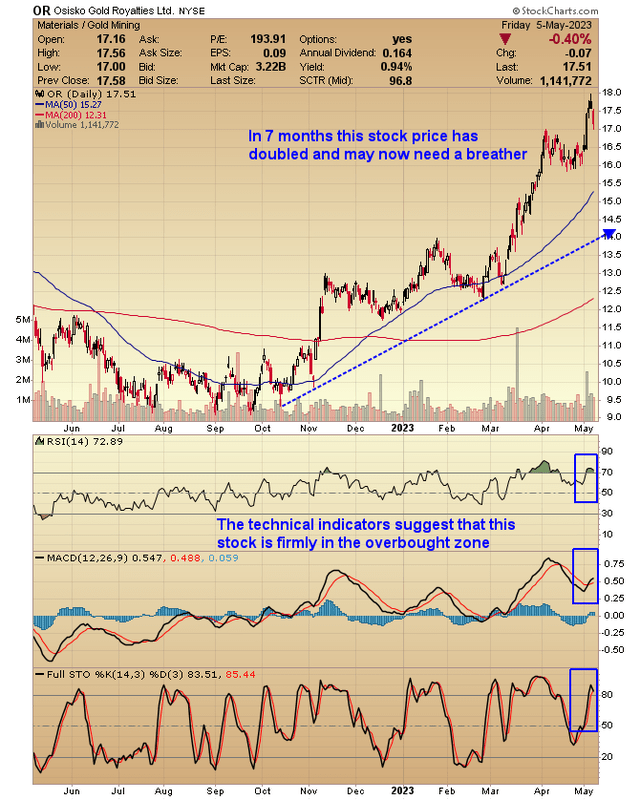

A Quick Look At The Chart Of Osisko Gold Royalties Ltd

I would like to draw your attention to a number of indicators on this chart that may influence your decision before making a trade.

Osisko Gold Royalties Ltd 12 Month Chart (Stockcharts)

In 7 months this stock price has doubled and may now need a breather in the near term, especially if the price of gold and silver drop significantly

The technical indicators suggest that this stock is firmly in the overbought zone so a near term bout of profit taking could be on the cards.

Both the 50dma and 200dma are heading north almost in parallel, which is a positive sign for the stock.

Technical analysis is not 100% accurate as we all know, but stocks do tend to revert to the mean sooner or later to take tea with the 200dma, so go gently with this one.

Conclusion

I am of the opinion that this stock will perform well as the precious metals Bull Market unfolds but a cheaper entry price may lie ahead.

The Streaming sector is expanding as the business model gains favour so the competition to secure income streams may become more intense than it already is.

At this point in time, Osisko remains on the Watch List and it is not a buy for me, however, my opinion is always open to persuasion.

The Seeking Alpha Quant rating is a ‘Hold’ and is ranked in sector as 74 out of 277 which is not too shabby.

Those who are looking for a near to mid-term capital gain may do better investing elsewhere for now. However, a week is a long time in this market and articles such as this one diminishes in value as time goes on.

For the record, I have been long physical gold and silver for a number of years and also own a portfolio of stocks in the precious metals sector including Sandstorm Gold Ltd (SAND), Wheaton Precious Metals Corp, Agnico Eagle Mines Limited (AEM) and SSR Mining Inc (SSRM).

You must have a comment so please add it to the commentary and I will do my best to address each and every one of them as the discussion is such a benefit for all concerned in these endeavors.

Read the full article here