Palantir Technologies Inc. (NYSE:PLTR) submitted its earnings card for the first-quarter yesterday, and the company’s stock price soared up to 25% in extended trading as the software analytics company reported yet another GAAP profit and raised its guidance for FY 2023. Palantir executed well in the first-quarter and also said that it expects GAAP profitability for every quarter in FY 2023. In my last work on Palantir — “Palantir Q1: All Eyes On GAAP Profitability” — I speculated that the reporting of a Q1’23 GAAP profit could be a catalyst for an upside revaluation. I continue to believe that Palantir hit an inflection point here and shares of the software analytics company continue to have upside potential, as well as a favorable risk profile, in my opinion.

Second consecutive GAAP profit

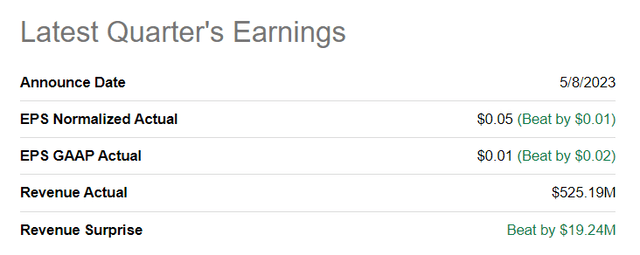

Palantir reported strong results for the first-quarter, with both the top line and the bottom line beating expectations. Palantir generated $525.2M in revenues in Q1’23, showing year-over-year growth of 18%. GAAP EPS came in positive at $0.01 per-share compared against a prediction of a $0.01 loss. This was the second GAAP profit for Palantir in a row and it attests to Palantir’s improving earnings picture.

Source: Seeking Alpha

GAAP profitability: the biggest take-away from Palantir’s Q1’23 earnings card

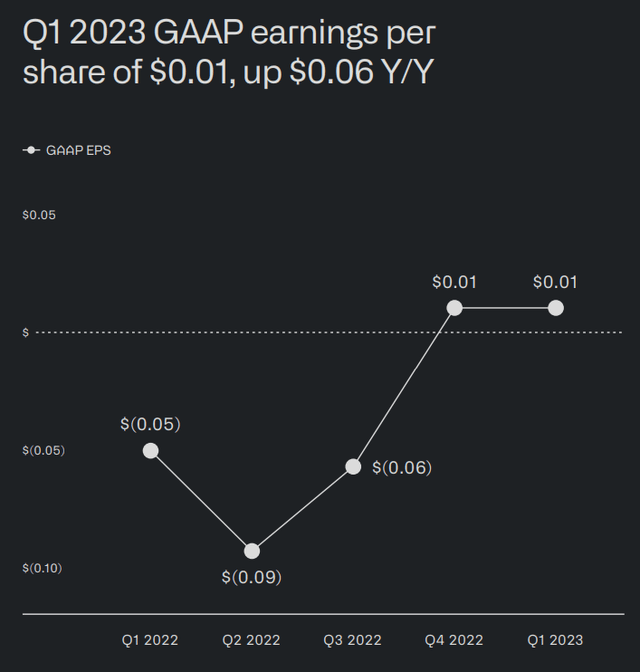

The biggest takeaway from Palantir’s first quarter earnings release was that the company truly hit an inflection point in the fourth-quarter of FY 2022, which was when the software company achieved its first-ever GAAP profit of $31M. Palantir’s Q1’23 GAAP profit was $17M.

Due to strong customer acquisition momentum and higher average revenue per customer, Palantir finally managed to reach critical scale with its customer base that indicates sustainable profitability.

Since investors have questioned Palantir’s ability to move towards GAAP profitability due to high operating costs and slowing top line growth, especially in the commercial segment, the achievement of Q1’23 GAAP profitability is a major win for the firm. It should convince more investors going forward that Palantir is running a growing and increasingly profitable — on both an earnings and free cash flow basis — software enterprise.

Source: Seeking Alpha

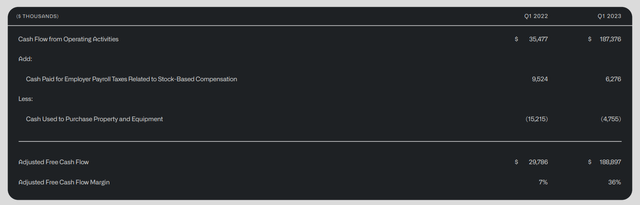

Soaring free cash flow is further evidence that PLTR has reached critical scale

Another sign that Palantir has finally reached an inflection point relates to the firm posting soaring free cash flow (“FCF”)… which is a key metric for software companies that make money on a recurring basis. The software analytics company reported Q1’23 free cash flow of $188.9M, showing a 534% increase in this important metric year-over-year. Additionally, FCF profitability also improved greatly, with free cash flow margins in Q1’23 coming at 36%, compared to just 7% in the year-earlier period. The ramp in free cash flow is one reason why I believe shares of Palantir can revalue higher: while management has not given free cash flow guidance, I believe the company could achieve $500-600M in FCF on $2.2B in revenues in FY 2023.

Source: Palantir

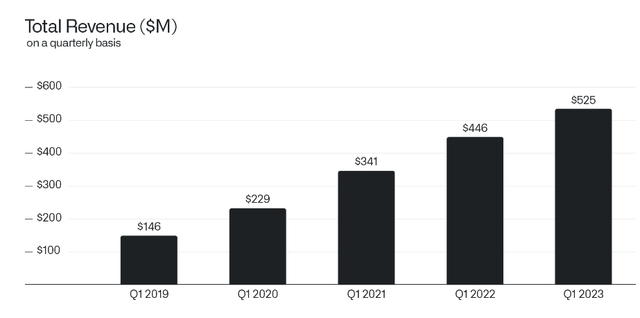

The improvement in GAAP profitability and free cash flow is due to Palantir signing on more customers to its Foundry platforms. The commercial business once again has been driving Palantir’s strong financial results in the U.S. commercial business in the first-quarter: revenues in this segment soared 26% year-over-year to $107M while U.S. government revenues increased 22% year-over-year. Total revenues of $525.2M showed 18% year-over-year growth.

Source: Palantir

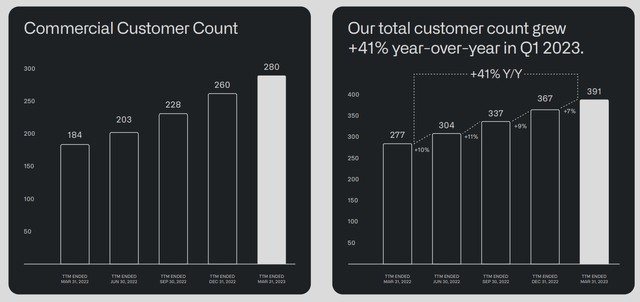

Key to Palantir’s growth is the acquisition of new commercial customers, and the software analytics company has had some decent success in signing on new clients in FY 2022 and also in the first-quarter of FY 2023. In Q1’23, the commercial customer count hit a new all-time high as Palantir added another 20 customers, on a net basis. Growth was especially pronounced in the U.S. commercial business (+50% Y/Y growth in customers), while total customer growth was up 41% year-over-year.

Source: Palantir

Palantir raises FY 2023 guidance

Palantir has said that it now expects revenues of between $2.185B and $2.235B in FY 2023 which compares against a previous guidance range of $2.180B and $2.230B. Palantir also raised its adjusted operating income guidance for FY 2023 from $481-531M to $506-$556M as the company continues to see momentum in customer sign-ups. Palantir also stated that it expects GAAP profitability in every quarter of FY 2023.

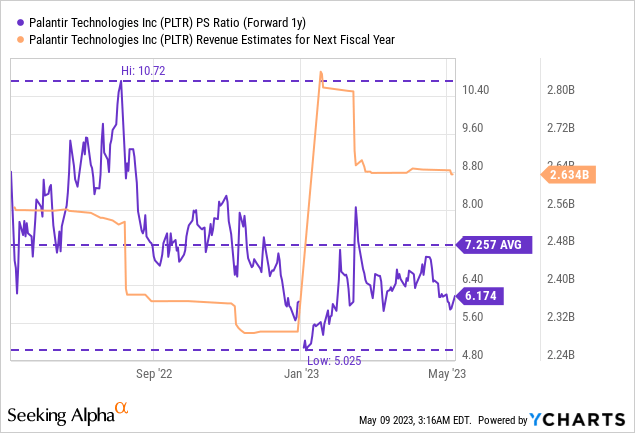

Palantir’s valuation

Palantir has a P/S ratio of 6.2X and is, therefore, still valued like a growth stock. The software company is now profitable on a GAAP basis which I believe is a game changer for Palantir. Therefore, the market may soon be able to value Palantir based on its earnings rather than just on its revenue potential. With $2.63B in revenues expected next year and Palantir already being profitable, I believe shares of Palantir are set to go into a new up-leg.

Palantir has enormous potential for growth, not only with its Foundry software platforms that help companies and government institutions aggregate, centralize, and analyze data, but also because of Palantir’s AI platform could benefit from increased corporate spending on AI. Palantir explicitly mentioned in its shareholder letter that demand for its AI tools was “without precedent,” without providing specific numbers. Artificial intelligence applications promise companies huge productivity gains which could be a key growth driver for Palantir in the next few years.

Risks with Palantir

I believe that Palantir’s risks have fundamentally decreased in the last quarter as the firm presented an impressive earnings scorecard for Q1’23. GAAP profitability and strong free cash flows should make Palantir more attractive as an investment for more investors now. If Palantir’s revenue growth slows down materially, however, investors may start to question the firm’s valuation multiplier.

Final thoughts

The moment of truth has finally arrived: Palantir Technologies Inc. is now profitable after years of posting losses. Palantir delivered a convincing earnings score card for Q1’23 that included a second consecutive GAAP profit, a raised guidance for FY 2023 regarding revenues and operating income, and continual momentum in customer acquisition.

Considering that Palantir is also guiding for GAAP profitability in every single quarter in FY 2023, I believe that the software analytics company has arrived at an inflection point: it finally achieved strong FCF growth and GAAP profitability… something many investors didn’t think Palantir Technologies Inc. could achieve. I believe after Palantir’s Q1’23 earnings report, shares of the software company have more upside potential and the risk profile remains skewed to the upside!

Read the full article here