Note:

I have covered Pangaea Logistics Solutions, Ltd. (NASDAQ:PANL) previously, so investors should view this as an update to my earlier articles on the company

Decent Third Quarter Results

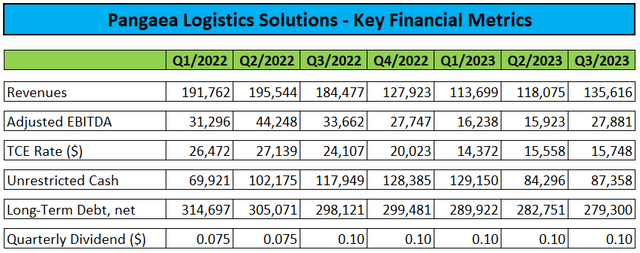

Earlier this month, leading dry bulk shipper Pangaea Logistics Solutions, Ltd. or “Pangaea” reported sequentially improved third quarter results with increased revenues and strong profitability:

Company Press Releases and Regulatory Filings

Adjusted EBITDA margin of 20.6% was up by more than 700 basis points from the second quarter due to lower charter hire expense and a reduction in general and administrative costs.

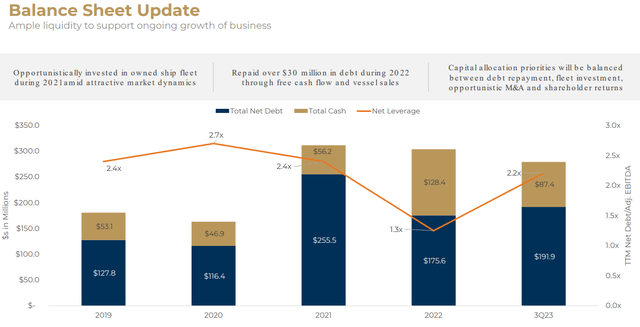

In addition, the company generated $16.3 million in cash flow from operating activities. Pangaea finished the quarter with unrestricted cash of $87.4 million and net debt of $191.9 million:

Company Presentation

The company also declared a quarterly cash dividend of $0.10 per share. On the conference call, management reiterated its commitment to stable payouts:

We remain committed to a consistent return of capital program and continue to view our quarterly cash dividend as an integral part of our investment thesis, one that emphasizes total shareholder returns.

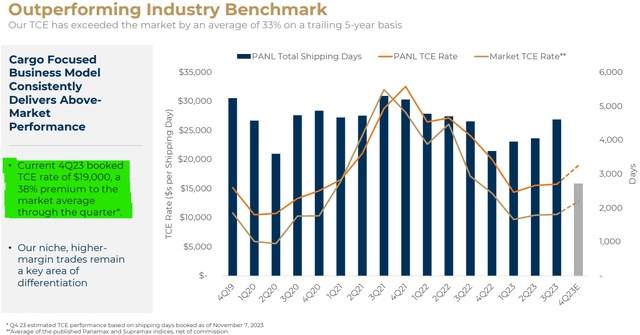

As usual, Pangaea’s focus on higher-margin offerings like ice-class trading and long-term contracts of affreightment (“COAs”) resulted in the company’s average daily time charter equivalent (“TCE”) rate outperforming market rates by a wide margin (emphasis added by author):

Our entire ice class 1A fleet was fully utilized under long-term contracts during the third quarter, resulting in a realized TCE rate that was nearly 50% above prevailing market indices. Our other contract positions and our strategic focus on commercial growth across new and existing trades, together with a continued focus on disciplined expense management, positioned us to produce good margin realization, Adjusted EBITDA and free cash flow in a low market environment.”

Strong Fourth Quarter Outlook

Moreover, with the majority of available days booked at an average TCE of $19,000 as of November 7, Pangea’s fourth quarter results should come in well ahead of current consensus estimates.

Company Presentation

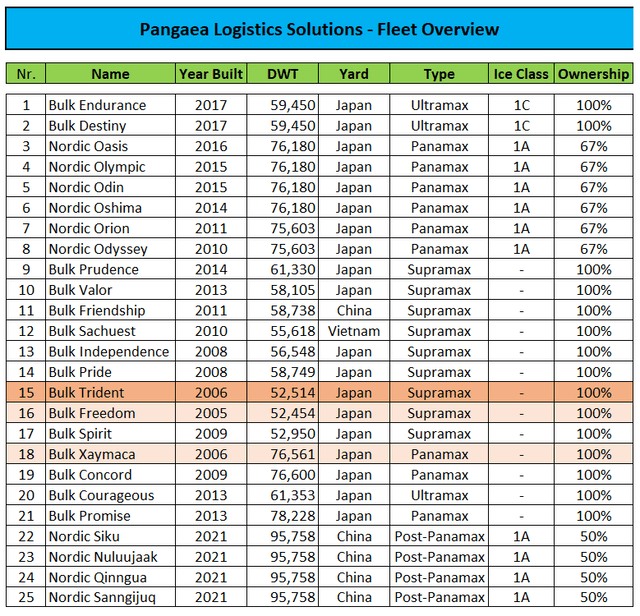

Fleet Renewal Efforts To Continue

Subsequent to quarter-end, Pangaea agreed to sell the 2006-built Supramax carrier Bulk Trident for $9.8 million as the company continues its multi-year fleet renewal effort with the acquisition of younger vessels targeted for next year.

Company Presentation

Accordingly, I would expect the 2005-built Supramax vessel Bulk Freedom and the 2006-built Panamax carrier Bulk Xaymaca to be replaced with younger tonnage in the not-too-distant future.

Regulatory Filings

Valuation

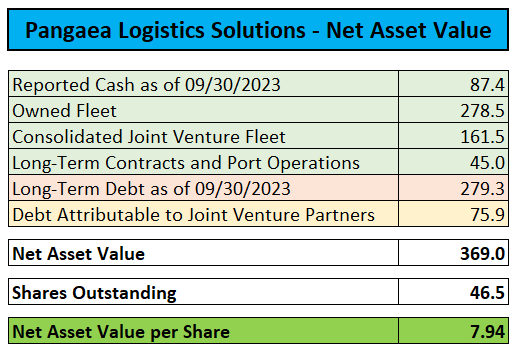

Considering the apparent benefits from the company’s long-term contracts of affreightment and the recent expansion of Pangaea’s North American port terminal network, I have assigned some meaningful value to these assets for the first time. In combination with the strong Q3 performance, estimated net asset value (“NAV”) per share is approaching $8:

Regulatory Filings / MarineTraffic.com

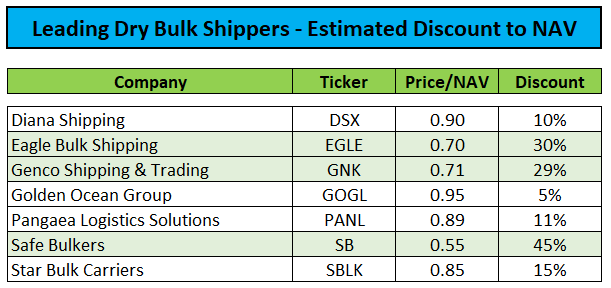

That said, an approximately 11% discount to NAV doesn’t exactly qualify as a bargain in the current dry bulk shipping environment with peers like Safe Bulkers (SB), Eagle Bulk Shipping (EGLE) and Genco Shipping & Trading (GNK) offering much better value at prevailing prices:

Regulatory Filings / MarineTraffic.com

However, Pangaea’s valuation apparently hasn’t deterred competitor SwissMarine Pte. Ltd. (“SwissMarine”) from accumulating a 5.3% stake in recent months without publicly stating its intentions regarding the company.

Please note that leading dry bulk shipper Golden Ocean Group (GOGL) remains one of SwissMarine’s largest shareholders.

Looking forward, management expects geopolitical tensions to weigh on near-term market sentiment with elevated volatility in charter rates likely to continue.

Company Presentation

Bottom Line

Pangaea Logistics Solutions reported decent third quarter results and, based on the company’s preliminary TCE guidance, should finish the year on an even stronger note.

While Pangaea Logistics Solutions’ strategy of focusing on higher-yielding market niches and commitment to a fixed quarterly dividend certainly resonates with investors, the company’s valuation is keeping me from getting more constructive on the stock at this point.

With a number of competitors changing hands at much larger discounts to NAV, I am reiterating my “Hold” rating on the shares.

Read the full article here