Park Aerospace (NYSE:PKE) is one of the small aerospace suppliers that I am following and is a buy in my book. Since my last report covering the stock, Park Aerospace has gained 7.8%, outperforming the broader market, and since my first buy rating for Park Aerospace stock, the stock gained 21.7% compared to the 13.6% for the broader market, which I believe demonstrates the appeal of the aerospace industry even though capacity constraints continue to exist.

In this report, I will be discussing the Q1 2024 results for Park Aerospace. I follow many aerospace companies and the earnings calls and presentations from Park Aerospace are among the most tricky ones to analyze because they are incredibly lengthy and the CEO tends to spend way too much time discussing items that are not quite interesting to investors or are simply repetitive. So, investors can benefit from this condensed analysis which looks at the most important items for investors as well as a price target assessment.

Park Aerospace Results Exceed Expectations

Park Aerospace

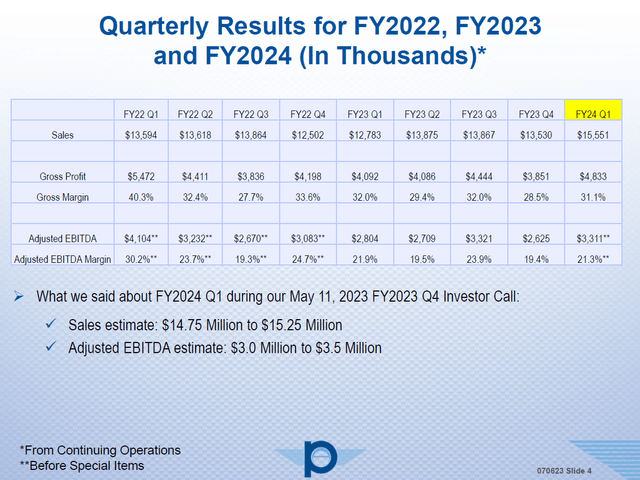

While the previous quarter was marked by an uptick in missed shipments which was particularly notable on the bottom line, the Q1 results were good and exceeded expectations. Sales of $15.55 million exceeded the $14.75 million to $15.25 million guidance. One thing I have continuously pointed out is that the company lacked the presentation of a mitigation plan. It is something that the CEO of Park Aerospace pointed out, whether that was directed to my coverage is something I don’t know but we are seeing more presentation of mitigation efforts being presented now. Last quarter, the company pointed out that it would build inventory which reduces the risk on late shipments from suppliers and in the most recent presentation the CEO pointed out that suppliers are given longer lead times.

What I did miss from the discussion was drove sales beyond the guided range. I could think of two specific items. The first is that the $1.4 million in missed shipments propped up sales in Q1 and the second item is that missed shipments during the quarter were $0.4 million whereas the normal range in previous quarters was $0.6 million to $0.8 million. I would think that the easing in missed shipments led to better than expected results. The adjusted EBITDA margins of 21.3% fell in the EBITDA range of 20 to 23 percent that could be derived from the sales and EBITDA guidance and also market a sequential improvement. Supply chain issues, increased labor and raw material costs and logistical challenges are still pressuring the efficiency of the company, but supply chain issues for Park Aerospace have started to ease which is a good thing and in some contracts higher cost basis are also passed on which is another positive. The challenges faced by the industry are not going to dissolve from one day to the other, but having Park Aerospace seeing positive developments is good and also suggests that we could be seeing higher margins in the future again which could be in the 25 to 30 percent range.

The Negative Park Aerospace Surprise

What I found disheartening during the first quarter earnings call was the fact that the company has removed the guidance for the quarter ahead. I would have assumed that with supply chain challenges easing for Park Aerospace, there would be more confidence to provide a guidance, yet the company chose to remove it. That is something I don’t understand but likely is driven by the stock price reaction or lack thereof after providing a long-term outlook.

When Park Aerospace announced its dividend increase in February this year, the stock climbed only to see the gains vanish as the stock was removed from the S&P Small Cap Index. Seemingly, in response to that the company issued a long-term forecast which it expects would have appealed to investors but the company to its own surprise saw no meaningful recovery in its stock price. Following the lack of movement in the stock price, the company bought shares itself which it previously labeled as a task of the investor. I would say that with the long-term objectives in mind that might have been a great buy. However, it also seems that that might have triggered the company to not provide a Q2 guidance which I frankly do not understand as the company should have better insights in its results going forward.

What Will Be The Growth Drivers For Park Aerospace?

Park Aerospace

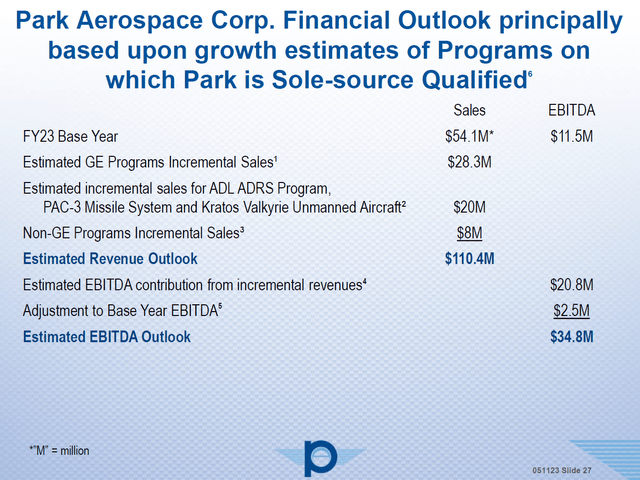

While the market might not have appreciated the forward look from Park Aerospace as much as the company would have liked, I certainly did like it as it provides a clear or clearer path towards future growth. While management doesn’t seem to understand why the stock reaction was not stronger, I could think of two reasons why. The first is that many of the future sales growth are based on a ramp up profile of production rates, most notably in the single aisle space and that growth trajectory remains one that is unclear as industry wide supply chain challenges continue to be prominent.

Furthermore, incremental sales on the ADL ADRS program and PAC-3 Missile Systems are lower than what I would have expected and perhaps lower than what the market would have expected. It should be noted that sales could grow further as more orders come in but the incremental add from these programs in the outlook was underwhelming. With an installed base of thousands of Boeing 737 NG airplanes, I would have expected significantly more growth than what Park Aerospace has modelled.

Is Park Aerospace A Buy?

The Aerospace Forum

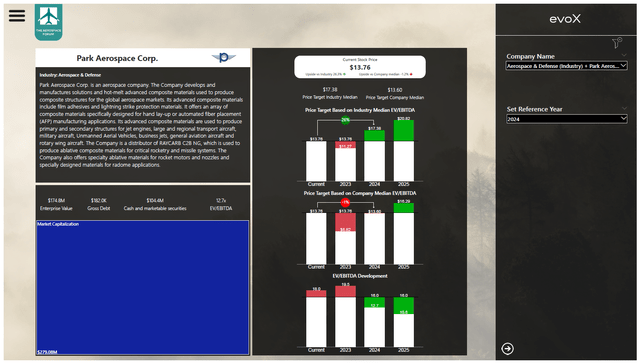

Share prices of Park Aerospace hit $15.79 earlier in the year and from there the stock sold off. Management signaled that it did not quite understand this price move. However, a fundamental approach towards the numbers in our evoX Financial Analytics model shows that realistically with the 2023 earnings in mind the stock price had grown beyond what could be seen as a decent valuation. So, even with the special dividend and the dividend increase, it should not quite come to a surprise that some profit taking would occur at some point. The stock price simply had grown beyond what its FY2023 fundamentals would justify. With the FY2024 fundamentals in mind as projected, the stock is actually fairly valued when considering the median EV/EBITDA multiple for Park Aerospace. However, compared to the industry Park Aerospace stock remains undervalued which I think is not quite justified given the long-term growth prospects that Park Aerospace has in common with the industry and its differentiating zero-debt balance sheet. Valuing the stock according to the industry multiple would indicate around 26% upside to $17.38, so I have no issue putting a buy rating on the stock.

Conclusion: Park Aerospace Stock Remains A Buy

Park Aerospace has a bright future if we look at the growth trajectory ahead. However, we do not quite know when those projections will materialize given the uncertainty on the ramp up profiles for single aisle jet production for Airbus (OTCPK:EADSF) which is the growth driver via the CFM LEAP-1A exposure that Park Aerospace has. While the company expected a big surge in stock prices, I can somewhat understand why this did not happen based on the long-term projection as there is uncertainty on the timeline and realistically the stock price had increased quite a bit and perhaps to levels that could not be justified based on the 2023 earnings levels. However, as the market should be forward looking I believe with FY2024 projections in mind, Park Aerospace has around 25% upside and some appreciable growth prospects this year and into the coming years while it is in a net cash position. As a result, I continue to maintain my buy rating on the stock as I believe EV/EBITDA multiple expansion towards industry levels is more than justified.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here