Investment thesis

Peloton Interactive (NASDAQ:PTON) became one of the major beneficiaries of COVID-related restrictions, especially lockdowns. Demand for the company’s equipment for working out at home surged multiple times. But the pandemic is over, and we all hope that new lockdowns are highly unlikely. Therefore, the most robust possible momentum for the company’s growth is in the rearview mirror and is not expected again in the foreseeable future. PTON’s financial performance over a couple of past years suggests the company could not take advantage of such a “gift”. The company could not generate positive free cash flow (FCF) even when its revenues peaked in FY 2021. The company’s subscription segments demonstrate impressive profitability and growth, but the level of uncertainty is very high and significantly outweighs the upside potential. Thus, I assign PTON a “Hold” rating.

Company information

According to the company’s latest 10-K report, Peloton is the largest interactive fitness platform in the world. The company seeks to mix the physical and digital worlds to create an immersive and connected fitness experience. Peloton stock generates sales from fitness equipment and subscription services related to the equipment.

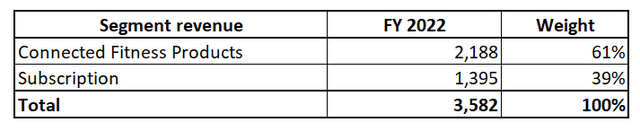

The company’s fiscal year ends June 30. PTON has two reportable segments: Connected Fitness Products and Subscription. The first one is the largest with above 60% weight, but in FY 2022, the segment generated a gross loss.

Author’s calculations

Financials

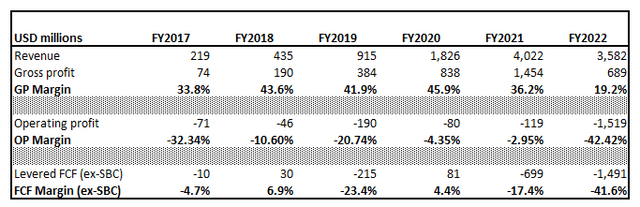

If we look at PTON’s financial performance over the last six years, we can see that the company enjoyed rapid revenue growth during the pandemic years 2020-2021. People were not allowed to go to gyms during peak levels of COVID contagion, and those who worked out did not have options other than to exercise at home. The company could absorb growing demand, and revenue increased more than four-fold over just a few years. But, the worst part is that the company’s cost of revenue increased even more rapidly between 2019 and 2021, which made the gross margin shrink. For me, as a potential investor, it is a huge red flag when the company’s profitability deteriorates as the business scales up. Because it should be the other way around. Otherwise, there is not much point in scaling up the business.

Author’s calculations

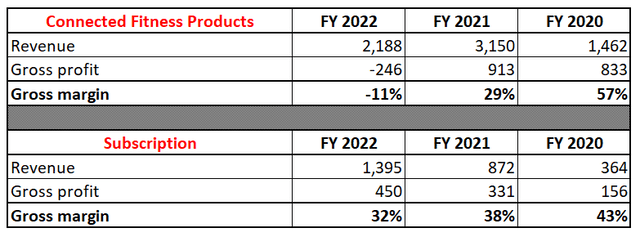

As you can see, the company was far from generating positive levered free cash flow (FCF) with stock-based compensation (SBC) deducted even during its peak year in terms of sales. Consensus estimates forecast PTON’s revenue to return to $4 billion again only in FY 2029. This indicates a minimal probability that the company will generate positive FCF in the next 2-3 years. What is also important to mention is that both segments’ gross margin has been deteriorating three years in a row.

Author’s calculations

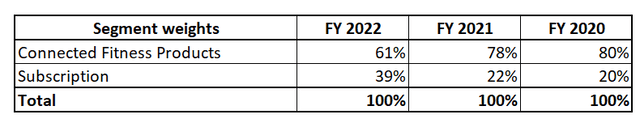

The company is striving to rebalance its revenue mix to increase the share of the Subscription segment, which is more profitable. The trend has been positive during the last three years because the percentage of the Subscription segment almost doubled over the period.

Author’s calculations

However, this does not help in the short term. The company’s revenues are rapidly decreasing from pandemic highs at a double-digit pace. Consensus estimates expect revenue to plummet about 22% this year, and the rebound is expected to be slow.

Seeking Alpha

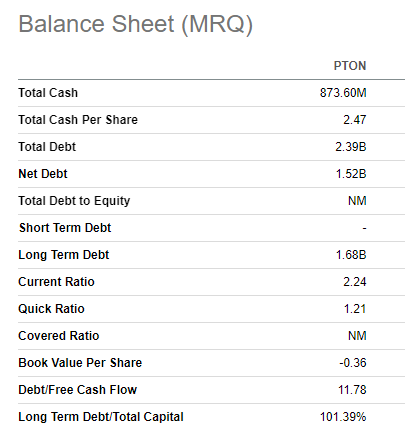

The company’s balance sheet is moderate, with solid liquidity metrics. But the leverage is high, especially given the negative operating cash flow. The last time quarterly operating cash flow was positive was December quarter of 2020. Given the consistently negative operating cash flow, I cannot say that the company’s financial position is strong. For sure, the company is unlikely to go bankrupt, but the trend is warning.

Valuation

The stock gained 1.2% year-to-date and significantly underperformed the broad market. PTON experienced a massive selloff in 2022 and trades 95% lower than its all-time highs of early 2021. Seeking Alpha Quant assigns a “D” valuation grade to the stock.

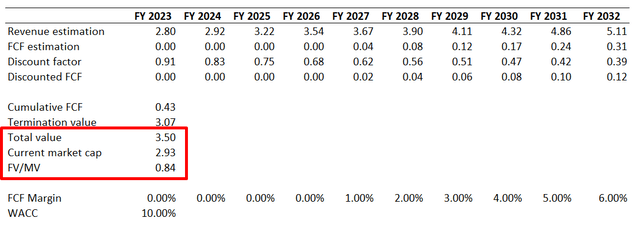

I use discounted cash flow (DCF) for PTON valuation. Valueinvesting.io suggests that PTON’s WACC is about 10%, which I consider reasonable. Revenue consensus estimates project revenue to compound at about 7% CAGR over the next decade. This also looks reasonable to me. The company is far from generating positive FCF. To be conservative, I expect positive FCF to start in FY 2027 and to expand by one percentage point per year.

Author’s calculations

According to the above calculations, the stock trades about 15% lower than its fair value. On the other hand, cumulative discounted FCF for the next nine years represents a mere $430 million. In all my valuation analyses for growth stocks, it is common when terminal value represents a significant part of the fair value. But, PTON is one of the few companies demonstrating deteriorating profitability as revenue grows. Most other businesses enjoy the economies of scale effect, but not PTON. Therefore, there is no certainty regarding the timing of positive FCFs.

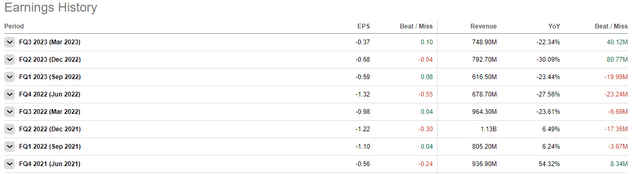

The fact that the company frequently misses consensus estimates is a fair reason for a massive stock selloff from all-time highs. Out of 8 last quarter, there was only one when the company delivered above-consensus figures relating to revenue and EPS.

Seeking Alpha

Volatile margins, together with poor earnings history, make it very difficult to build a DCF model which can be reliable. The stock might look undervalued from discounted FCFs perspective, but the uncertainty is vast. PTON has no track record of sustainable success and profitability growth.

Risks to consider

Apart from uncertainties related to underlying assumptions for stock valuation, several other risks are inherent to investing in PTON.

As COVID-related restrictions eased worldwide and the U.S. in particular, competition increased massively due to gyms reopening. Gyms offer a variety of equipment, classes, and social interactions that Peloton may not be able to replicate fully. Besides, gyms have an unmatched advantage over working out at home. It is all about real social interaction. The social aspect is inspiring and motivating for many people. As a result, Peloton’s user base could experience a decline, impacting its revenue growth and profitability. I see this as the biggest threat to the company in the nearest future.

As seen in the “Financials” section, PTON’s revenue surged during the pandemic due to strict lockdowns when people could not work out somewhere other than their homes. Pandemics and lockdowns, as we saw in 2020-2021, occur once in a century, and strong momentum for PTON’s equipment sales growth is in the past and unlikely to happen soon. Moreover, fitness equipment is durable with a long useful life, and people usually do not change it frequently. Therefore, the company’s primary driver of revenue growth should be subscriber growth. Peloton’s “All-access membership” costs $44 per month, which is more expensive than many gyms. There is a high risk that the company will struggle to drive sales from subscriptions.

Bottom line

Overall, the potential benefits do not outweigh the risks and threats the business faces due to the reopening of gyms. The company’s subscription segment might be hidden, but I see too many risks and uncertainties. Also, the fitness equipment business drags down the profitability substantially. And without PTON’s equipment, their subscription segment does not make much sense. My valuation analysis suggests there is a double-digit upside potential for the stock. Still, it does not outweigh the risks.

Read the full article here