One of the better bullish calls that I have made in recent months involves none other than Penske Automotive Group (NYSE:PAG). Shares of the company have skyrocketed since January of this year, driven in part by strong revenue growth and in spite of weakening bottom line results. Management’s propensity for increasing the dividend, as well as engaging in significant stock buybacks, likely helped on this front. But it was also helpful that shares of the company were attractively priced at that time. The big question many investors are likely asking now, however, is whether the upside that was on the table has already been captured in its entirety, or if there is room for further upside from here. Based on my own assessment of the company, I would say that it is still worthy of serious consideration from investors. Although, I would preface that by saying that the easy money has certainly been made.

Great upside so far

Back in the middle of January of this year, I found myself taking a bullish stance on Penske Automotive Group. In that article, I talked about how attractive revenue growth for the company had been. But I also acknowledged that profits and cash flows were weakening. Apparently, the strong sales figures, combined with management’s willingness to buy back large amounts of stock and to engage in share buybacks helped to push shares up considerably. In fact, from the time that I had first written about the company in October of 2021 until the time said article was published, shares had seen upside of 20.1% at a time when the S&P 500 dropped by 7.4%. Since then, the picture has been even better. Shares of the company are up a whopping 56% compared to where they were in January of this year. By comparison, the S&P 500 has increased a more modest but still impressive 13.9%.

Author – SEC EDGAR Data

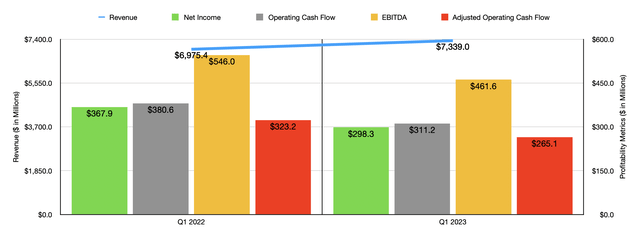

As I mentioned, a good part of this upside can be attributed to the revenue growth of the company. During the first quarter of 2023, sales came in at $7.34 billion. That’s 5.2% above the nearly $6.98 billion the company reported one year earlier. This move higher in sales has been driven by multiple factors. For instance, the number of new retail vehicles that the company sold increased 4.7% year over year, climbing from 45,528 to 47,667. The company also saw 6,933 new agency retail sales during the first quarter compared to none the year prior. On the used side of the equation, the firm suffered from a decline of 0.6%, with a 4.6% drop and used retail sales revenue per vehicle adding insult to injury. At least with the new vehicle sales, the company benefited from a 5.8% increase in average sales revenue per unit.

There were other contributors to the company’s top line growth as well. For instance, service and parts revenue jumped 16.5% from $586.2 million to $683 million. This was largely driven by a 24.2% surge in international revenue. But a lot of that increase was the result of foreign currency fluctuations. In total though, management said that the growth in revenue for this part of the company was really the result of vehicles remaining on the road longer because of limited supply and considerations centered around affordability. Higher pricing was also a component of this as the company sought to increase wages and push costs onto its customers. Another growth area for the company involved its retail commercial truck dealerships. Revenue for this part of the company jumped 27.2% from $471.7 million to $600.2 million. That came largely as a result of a 17.2% rise in new retail unit sales from 3,855 to 4,517, with higher revenue per unit sold helping out in the amount of 8.6%.

Unfortunately, not everything from the company has been great. During the first quarter of the year, net profits totaled $298.3 million. That represents a decline of 18.9% compared to the $367.9 million in net income generated one year earlier. Profit margins for the company have been severely negatively affected by a rise in the cost of acquiring used vehicles for resale and, to a lesser extent, a rise in the supply of certain premium new vehicle brands that are available for sale. Unfortunately, other profitability metrics have followed suit. Operating cash flow dropped from $380.6 million to $311.2 million. If we adjust for changes in working capital, we would get a decline from $323.2 million to $265.1 million. And finally, EBITDA for the firm dropped from $546 million to $461.6 million.

Author – SEC EDGAR Data

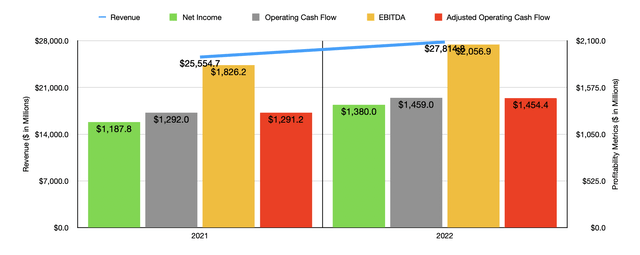

As you can see in the chart above, the results experienced during the first quarter of 2023 were not at all similar to what the company saw in 2022 compared to 2021. From 2021 to 2022, higher unit sales and higher pricing helped push revenue higher. Profits and cash flows also, without exception, increased year over year. Now unfortunately, we don’t know what the rest of the current fiscal year holds. Management has not provided any detailed guidance on that front. But if we annualize the results experienced so far, we would expect net income of $1.12 billion, adjusted operating cash flow of $1.19 billion, and EBITDA of $1.74 billion.

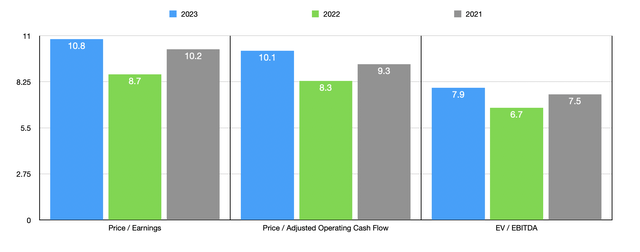

Author – SEC EDGAR Data

Based on these figures, it’s pretty easy to value the company. In the chart above, you can see how shares are priced using results from 2021 and 2022, as well as the estimates I provided for 2023. As part of my analysis, I also compared the company to five similar firms shown in the table below. When it comes to the price to earnings approach, four of the five companies ended up being cheaper than Penske Automotive Group. That number drops to two out of five if we use the price to operating cash flow approach and it becomes three out of five if we use the EV to EBITDA approach.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Penske Automotive Group | 8.7 | 8.3 | 6.7 |

| AutoNation (AN) | 7.2 | 6.1 | 6.7 |

| Lithia Motors (LAD) | 7.6 | 24.4 | 8.2 |

| Sonic Automotive (SAH) | 80.4 | 16.6 | 12.2 |

| Asbury Automotive Group (ABG) | 5.7 | 11.8 | 5.6 |

| Group 1 Automotive (GPI) | 5.6 | 7.7 | 6.0 |

Keep an eye on results

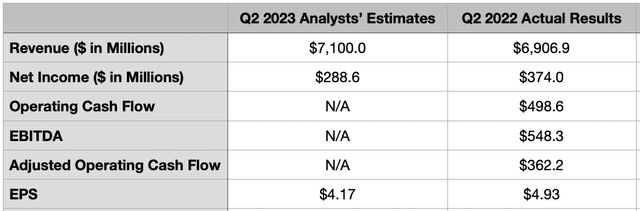

Before the market opens on July 26th, the management team at Penske Automotive Group is expected to announce financial results covering the second quarter of the company’s 2023 fiscal year. Given the recent weakness that we have seen and considering how much shares have appreciated in recent months, it would be wise for investors to pay attention to what the company reports on that day. The current expectation is for revenue to continue to climb, with sales forecasted to be $7.10 billion. That would be a fairly decent increase over the $6.91 billion in revenue generated the same time one year earlier.

Author – SEC EDGAR Data

Earnings per share, meanwhile, should be around $4.17. That would represent a decline compared to the $4.93 reported at the same time last year. Matching analysts’ expectations would result in net profits of about $288.6 million if the company has not bought back any stock versus the $374 million bought back during the second quarter of 2022. In all likelihood, however, the firm will have bought back some additional shares. I say this because, in 2022 as a whole, management acquired 8.2 million shares for $886.5 million. And from the beginning of 2023 through part of May when the company announced that it was adding another $250 million share buyback program on top of the $135.8 million existing program that was left at that time, they said that they had acquired 1.45 million units for a combined $188.4 million. That translates to about 2.1% of the company’s outstanding shares for that window of time alone.

Other profitability metrics should also be on the minds of investors during this time. Operating cash flow, for context, totaled $498.6 million in the second quarter of 2022. On an adjusted basis, it was a bit lower at $362.2 million. Meanwhile, EBITDA came in at $548.3 million. It is highly probable that all of these will show year over year declines. But so long as the stock remains cheap on a forward basis, additional upside is likely to exist.

The last thing that investors should be paying attention to would also be any discussion regarding acquisition activities. The most recent purchase the company made was on June 5th of this year when it announced its purchase of a commercial truck dealership enterprise in Canada. Terms were not disclosed. But management did say that the deal will bring on about $180 million of additional revenue to the company on an annualized basis. Management is very transparent about purchases that it makes. So it’s unlikely that any new deals that would have been agreed upon in the second quarter will be announced on that day. But given the tightening budget the company has and its continued commitment to share buybacks, it is possible management might discuss the strategy for acquisitions moving forward.

Takeaway

Operationally speaking, I understand that the picture for Penske Automotive Group is not quite as positive as it was previously. But this doesn’t mean that the company is a bad prospect. I definitely believe that the easy money has been made at this point. But even with that factored in, shares are attractively priced at the moment. Because of this, I do believe that a ‘buy’ rating is still appropriate. But if we see upside of another 10% or so, I likely will downgrade the company to a ‘hold’.

Read the full article here