Brazil is South America’s leading economy and most populous country and is a commodity-rich nation. Brazil has the world’s seventh-largest population and is the fifth largest by land area.

Brazil supplies the world with iron ore, soybeans, sugar, coffee, oranges, meats, and other commodities. It’s also the world’s eighth leading oil producer.

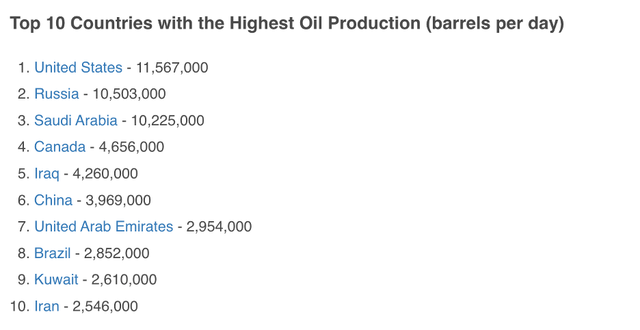

The World’s Leading Oil-Producing Countries (worldpopulationreview.com)

As the chart highlights, Brazil’s crude oil output of 2.852 million barrels per day is sandwiched between the United Arab Emirates and Kuwait, two OPEC members. Brazil is not a cartel member. In 2019, former President Jair Bolsonaro expressed interest in joining OPEC, but the membership never materialized. Meanwhile, Petroleo Brasileiro S.A. – Petrobras (NYSE:PBR) is a Brazilian oil company.

PBR Company Profile (Seeking Alpha)

PBR’s company profile highlights its activities in the oil and gas markets. At around $11 per share, PBR was the world’s sixteenth leading oil company by market cap, worth approximately $71.66 billion.

An upside earnings surprise

PBR reported its latest earnings of $1.25 per share, beating consensus estimates of $1.10 and significantly above the prior year’s 65 cents profit. Higher oil prices accounted for the better-than-expected earnings.

Meanwhile, revenues of$30.171 billion were 25.6% higher than the year-earlier sales of $24.031 billion. However, they were lower than the estimated consensus $30.691 billion level because of lower oil and gas production.

While PBR’s upstream production decreased by 2% from the same time in the previous year, downstream revenues increased by 30.9%. General and administrative expenses moved 19.4% higher over the period, pushing production costs higher.

PBR has outperformed the XLE since the end of 2022

PBR shares closed at $10.97 on May 9, up 11 cents or just over 1% after the earnings release.

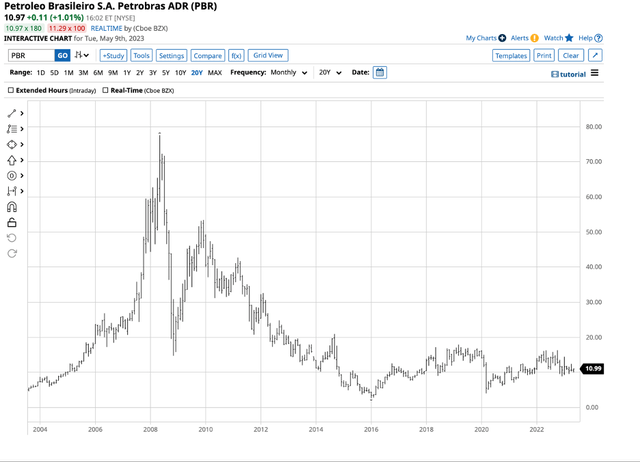

Monthly Chart of PBR shares (Barchart)

The chart shows that PBR was 3% higher than the Dec. 30, 2022, $10.65 per share closing level on May 9. In 2022, PBR shares fell 3.1%.

The XLE holds shares of the leading U.S. oil companies and is a benchmark for the traditional energy sector.

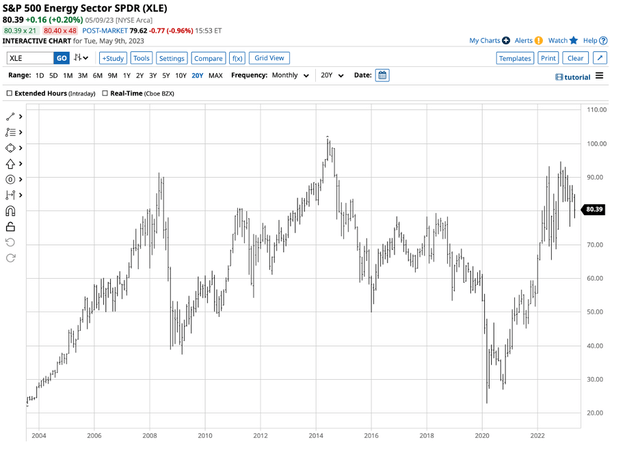

Monthly Chart of the XLE ETF Product (Barchart)

The chart highlights that PBR has outperformed the XLE in 2023, as the ETF declined 8.1% since the end of 2022. However, PBR is only playing catch-up after the XLE rose a whopping 57.6% in 2022. PBR has a long way to go to achieve the XLE’s performance since the end of 2021.

Brazilian political issues face the company

In a Jan. 5, 2023, Seeking Alpha article on PBR, I highlighted the significant political change in Brazil that impacts the leadership’s traditional energy company. In that piece, I wrote:

President Lula, a former trade unionist, supports higher wages and a greener path for Brazil’s energy policy. He appointed Jean Paul Prates, a senator, former Petrobras official, and critic of the company, as PBR’s CEO. At a recent press conference, Prates said, “All oil companies are turning into energy companies, and it isn’t just talk. None of this is happening at the right scale at Petrobras.

I concluded the piece with the following:

PBR has been around for seven decades, and the state oil company will continue to operate in South America’s most populous country with the continent’s top economy.

Over the past few months, the bifurcation of the world’s nuclear power placed Brazil at the center of global tensions. With China’s lead, BRICS countries, including Brazil under President Lula, are considering a BRICS currency that could “shake the dollar’s dominance.”

A bullish trend and volatile dividends

PBR underperformed the XLE since the 2020 low as the stock has moved over 170% higher since the March 2020 $4.01 low. Over the same period, XLE gained more than 250%.

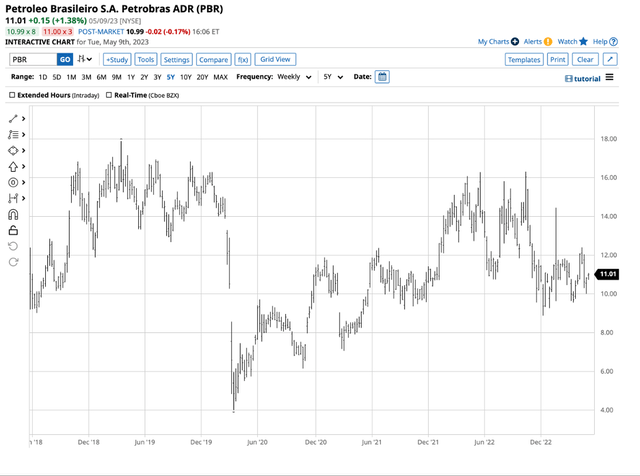

Five-Year Chart of PBR Shares (Barchart)

The chart shows a pattern of higher lows and higher highs since early 2020. However, unlike many other traditional oil and gas companies, PBR’s gains have not been stellar.

Meanwhile, PBR will pay a full-year dividend for 2022, “rewarding investors who stuck with the company despite worries over political intervention under Brazil’s new leftist President.” The $6.9 billion in dividends is “largely in line with its existing shareholder remuneration policy.”

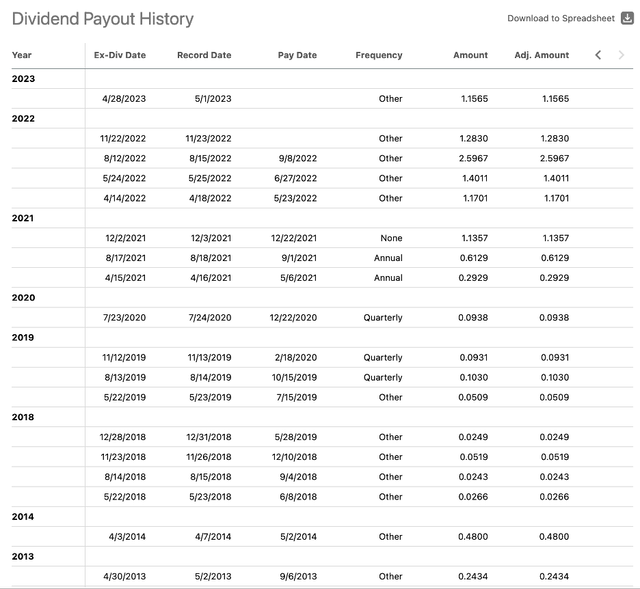

PBR has a choppy dividend history.

PBR Dividend History (Seeking Alpha)

PBR is a hold

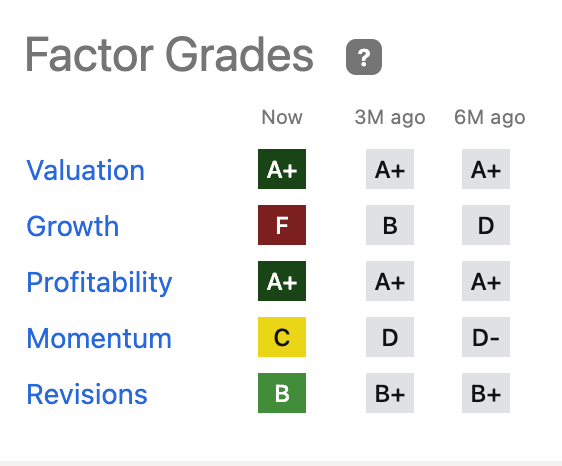

Seeking Alpha’s factor grades for the company reveal a significant decline in growth potential.

PBR Factor Grades (Seeking Alpha)

The failing grade for growth is a function of the political environment under the Lula administration. Meanwhile, A+ grades in valuation and profitability are reasons to hold PBR shares, and the latest earnings support the profitability grade.

PBR delivered a pleasant surprise for shareholders as the worst case based on the political change has yet to materialize. Production could continue to slip as the Lula administration focuses on the climate impact of oil and gas production. However, the 16th leading oil company by market cap is the Brazilian state-run energy giant for the eighth top oil producer worldwide, and will continue to deliver positive results for shareholders with crude oil prices at the current level or higher.

Read the full article here