Introduction

As a dividend growth investor, I seek new investment opportunities in income-producing assets. I often add to my existing positions when I find them attractive. I also use market volatility to my advantage by starting new positions to diversify my holdings and increase my dividend income for less capital.

The consumer staples sector is attractive during times of uncertainty as it consists of companies that tend to be recession-resilient. People consume daily products, from food, drinks, toothpaste, and cigarettes. Therefore, we see investors flocking to these stocks when the business environment is challenging. One stock that I find interesting is Philip Morris (NYSE:PM).

I will analyze Philip Morris using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Philip Morris International operates as a tobacco company working to deliver a smoke-free future and evolving its portfolio for the long term to include products outside of the tobacco and nicotine sector. The company’s product portfolio primarily consists of cigarettes and smoke-free products, including heat-not-burn, vapor, and oral nicotine products that are sold in markets outside the United States.

Fundamentals

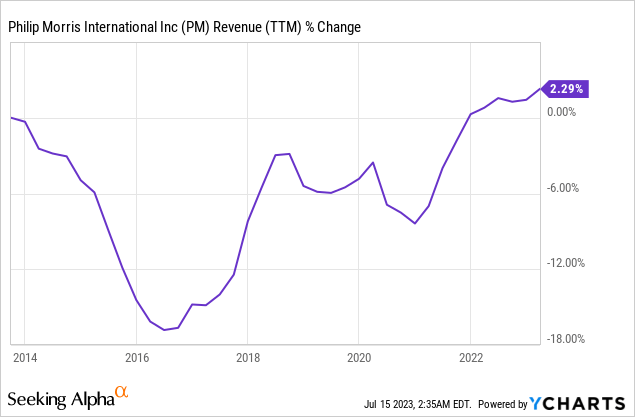

Philip Morris’s revenues have been flat over the last decade, with a tiny increase of 2.3% in 10 years. The company underwent a significant transformation during that decade as it shifted its focus from traditional cigarettes to smoke-free products. The transformation changed the revenue streams of the company during the reconstruction. In addition, the company was also involved in the M&A realm, most notably with the $16B acquisition of Swedish Match. In the future, as seen on Seeking Alpha, the analyst consensus expects Philip Morris to keep growing sales at an annual rate of ~8.5% in the medium term.

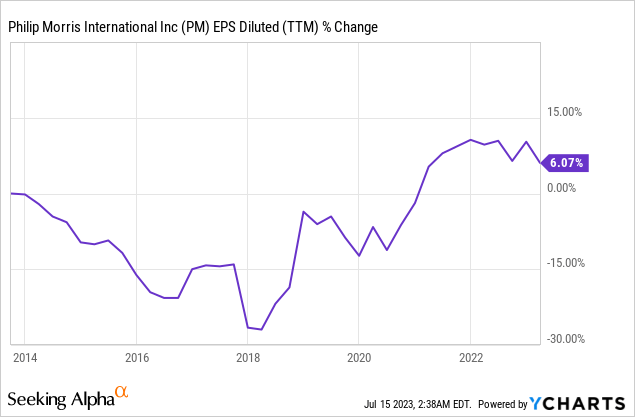

The EPS (earnings per share) of Philip Morris also didn’t increase significantly during that decade. The transformation required prominent investments in the new products and their marketing. Since 2018 though, we have seen a significant 34% increase in the company’s EPS as it started harvesting the fruits of its labor. In the future, as seen on Seeking Alpha, the analyst consensus expects Philip Morris to keep growing EPS at an annual rate of ~8% in the medium term.

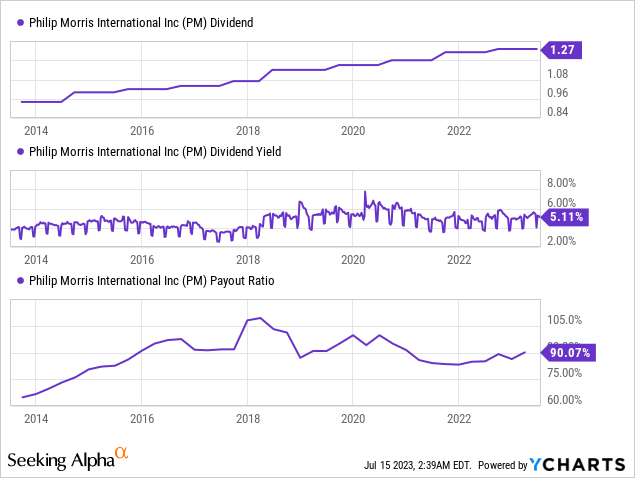

The company has been paying and increasing its dividend yearly since its spin-off from Altria (MO) fourteen years ago. The current dividend yield stands at 5.1%, which is a very attractive yield, in my opinion. The long-term treasuries yield less than 4%, and they don’t grow their payout. The downside here is the current payout ratio which stands at 90%. The company has enough flexibility to maintain the dividend, and with the transformation complete, it will enjoy faster EPS growth. Right now, investors should expect a low to mid-single digits growth rate as the company strives to lower the payout ratio.

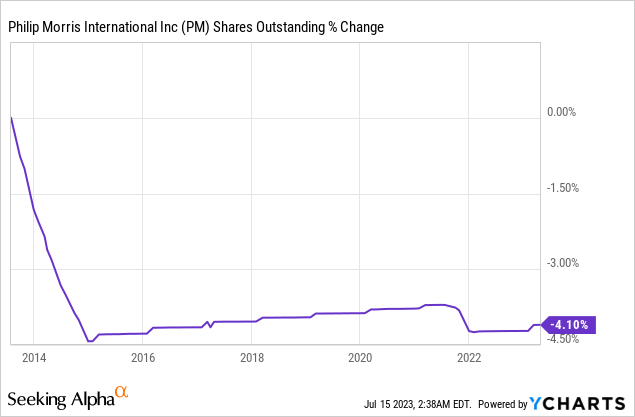

In addition to dividends, companies, including Philip Morris, return capital to shareholders via buybacks. These share repurchase plans support EPS growth by lowering the number of outstanding shares. Over the last decade, the number of shares decreased by 4%, which is a highly modest amount. It resulted from a high payout ratio that left limited room for buybacks. As the company grows its EPS and lowers its payout ratio, there will be more room for buybacks.

Valuation

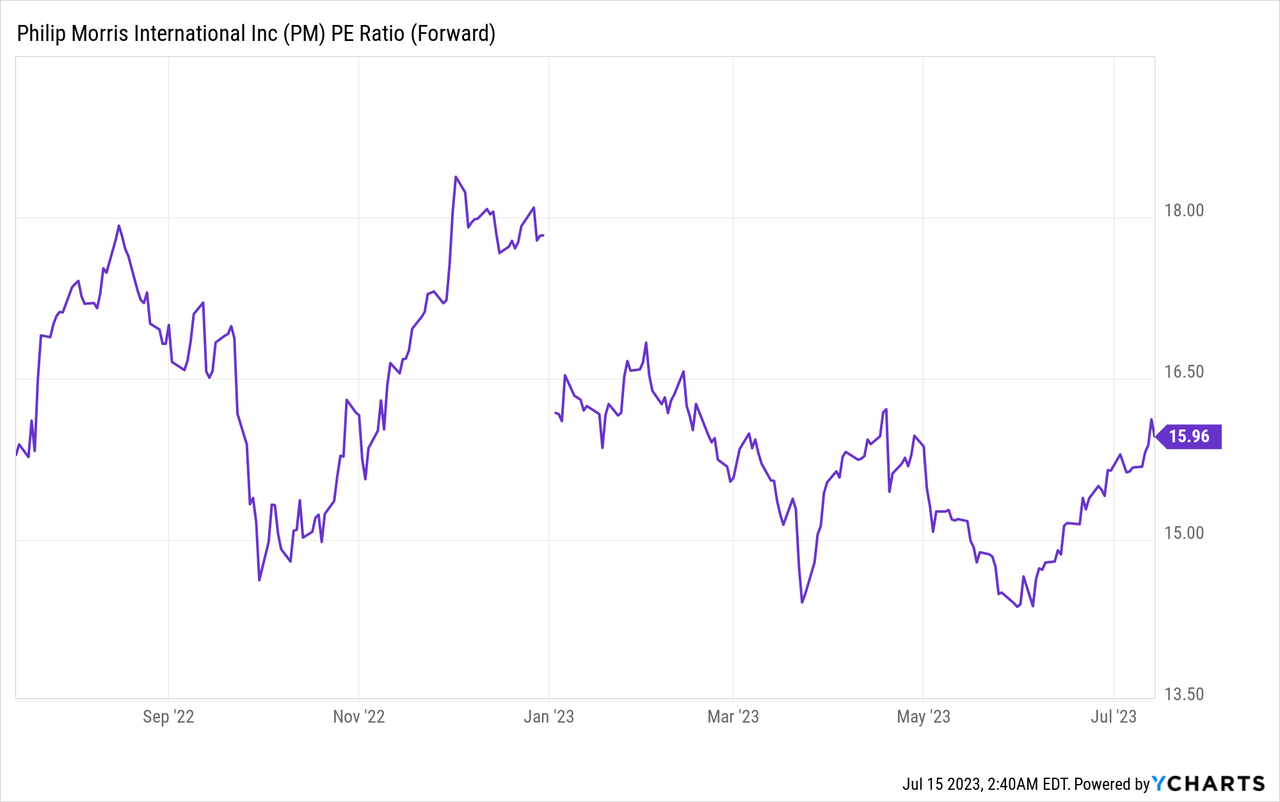

The P/E (price to earnings) ratio when using the 2023 EPS estimates stands at 16. It is fair to pay 16 times for a company that grows its EPS at 8% annually and rewards shareholders well. The current valuation is about average when looking at the last twelve months. Therefore, it seems that investors who buy shares in Philip Morris get a decent and fair entry point, even if there is no significant discount.

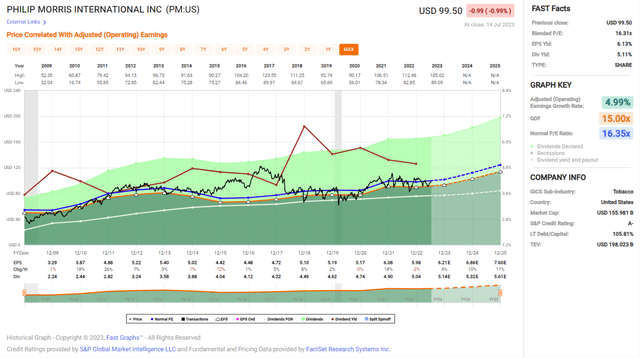

The graph below from Fast Graphs also emphasizes that shares are fairly valued at the moment. The average P/E ratio of the company since its spin-off was 16.35, and the current one is 16. Moreover, the company expects to grow its bottom line at 8% annually, faster than the historical 5% annual growth rate. Therefore, I believe the shares are fairly valued at the current price of $100.

Fast Graphs

Opportunities

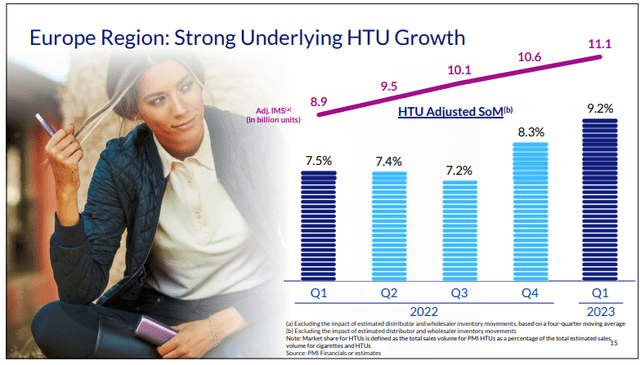

Smoke-free products are the primary growth driver for Philip Morris. The company must have a leading portfolio of smoke-free products to compete in developed markets where smoking is less prevalent. The company is growing its heated tobacco business successfully, and the graph below shows how the number of units sold increased by almost 25% in the past year in Europe. This is a key growth driver, and as long as the company keeps executing that well, it will keep growing fast.

Philip Morris

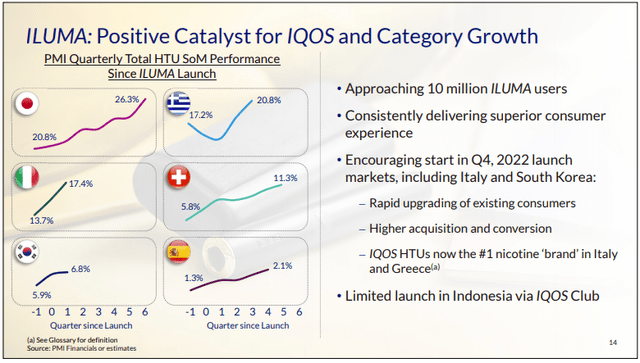

The company is selling its product and ensuring that it is the leading one in the category. It keeps improving the technological aspect of its products so they are less harmful and more convenient. ILUMA is the latest development by Philip Morris, as it uses induction technology to heat the tobacco. ILUMA has dramatically affected the adoption of smoke-free products by Philip Morris, and its rollout will continue in the coming year.

Philip Morris

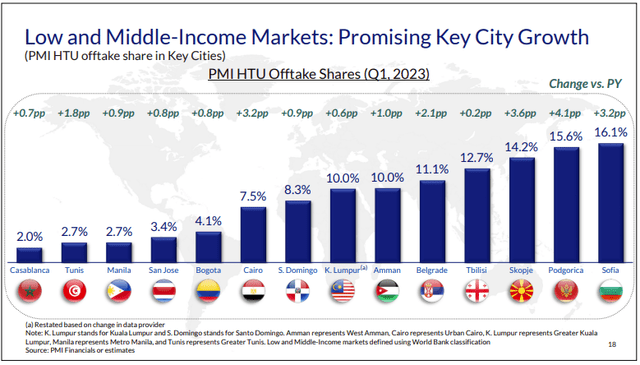

Diversification in terms of products and markets also allows Philip Morris to grow in different environments. The company sells cigarettes and smoke-free products across the globe. It will enable it to focus on smoke-free products in more developed countries and on cigarettes in countries where they are still popular. Thus, Philip Morris has an offering for middle-income markets until it shifts them to the smoke-free offering.

Philip Morris

Risks

The regulation is the most prominent risk for Philip Morris today. The company sells tobacco products, which are tightly regulated by countries worldwide. Smoking is an unhealthy habit that causes significant health issues. Therefore, any intervention in tobacco companies’ marketing and sales procedures may lower and even stop the growth rate. Investors should be most concerned about regulations in the European Union, a massive body encompassing over 500 million people with very tight regulation on various products.

Health consciousness towards the risks of smoking is another significant risk. Smoke-free products, while less risky than cigarettes, are still unhealthy for the users. Even under the assumption of no effective limiting regulation, as people are more aware of the risks, the percentage of smokers among the general population will decrease. Therefore, Philip Morris must keep investing in its safer products and consider expanding into other products.

Competition is another risk for Philip Morris. In the past, the company had control of the smoking market. Regarding cigarettes, its brands led by Marlboro had over 50% market share in key markets in Europe and North America. Regarding the new era of smoke-free products, the field is much more competitive, and the company controls less than 20% of the market. It means that the competition is harsher and will need significant marketing investments.

Conclusions

To conclude, Philip Morris is a solid blue chip company that has been independent over the last fourteen years but has a decade-long track record as part of other entities. The company has completed a transformation and is now growing its top and bottom line again. Investors are rewarded with a hefty dividend payment, and the company is working on increasing its business even more, mainly around smoke-free products.

There are some risks to the investment thesis, mainly revolving around competition, regulation, and the declining number of smokers. However, the company has proved that it knows how to deal with such challenges. Therefore, with the current fair valuation, I believe that the shares of Philip Morris are a BUY. Long-term dividend growth investors should build their position gradually in this blue chip titan.

Read the full article here